takasuu/iStock via Getty Images

Investment thesis

Medical Properties Trust (NYSE:MPW) has returned 20% profit since my last call on November 3, 2022. The stock has reached my target much faster than what I initially expected, leading me to assess the situation anew, and give an update on my strategy. In this article, I will discuss two positive and one negative scenarios, as I also increase my trailing stop-loss to secure my profit, while allowing the stock to have enough margin to form the likely outcomes and profit from an eventual further extension of its recent upward trend.

A quick look at the big picture

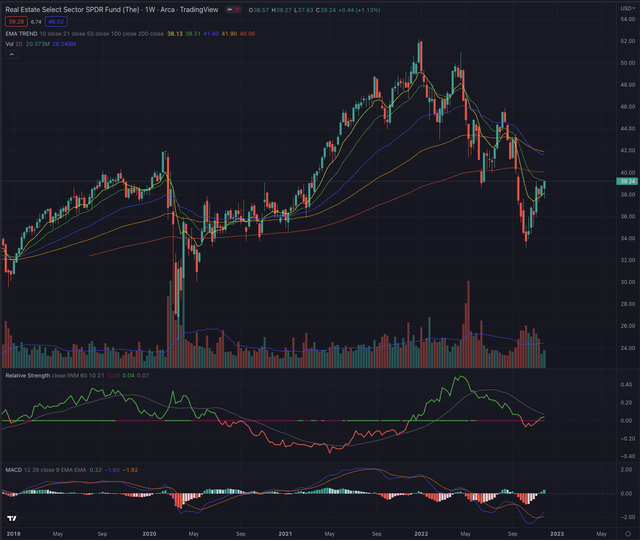

Although having been relatively lagging during the past year, the real estate sector in the US has recently performed better, retracing partially its loss while still not showing significant relative strength when compared to other sectors. The sector is led by companies in the diversified real estate industry, real estate developers, and REITs in the healthcare facilities industry, the latter has been more resilient than other industry groups in the past year and could be set for further strength.

Considering more specific groups of the industry, the Real Estate Select Sector SPDR ETF (XLRE) which seemingly bottomed on October 13, 2022, has since returned over 18%, and could soon test its EMA200, which the industry reference broke earlier during September, marking its drop into a long-term downtrend on its weekly chart. XLRE is building up some relative strength on a reversing positive momentum when compared to the broader iShares Russell 2000 ETF (IWM), which confirms the positive development of the entire sector.

Where are we now?

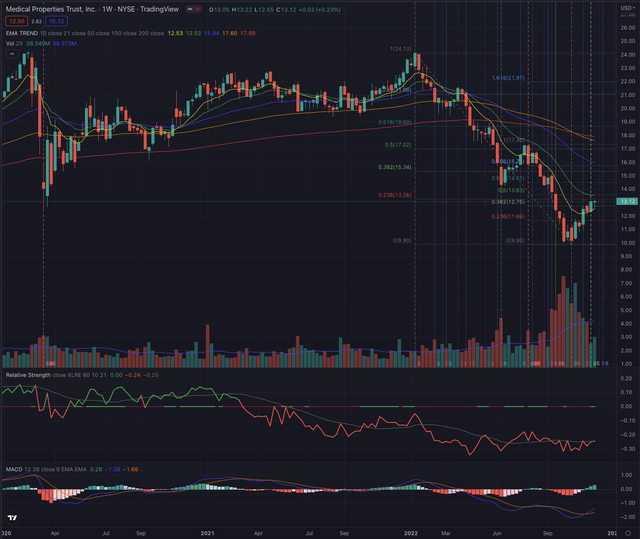

In my most recent article “Medical Properties Trust: May Be Set For A Massive Opportunity” published on November 3, I discussed an investment opportunity, basing my thesis on the exhaustion of the sell-side and relatively extreme negative extension of the stock, which has been suffering from a prolonged and severe sell-off. Despite this, I was expecting a likely short-term consolidation before the stock would continue its upward movement, but the stock consolidated much less and faster than expected and has since reached my target, reporting over 20% performance in a little less than one month.

MPW has successfully overcome its EMA10 on a weekly time frame, and its EMA50 on its daily chart, retracing approximately 23% of its losses since the beginning of the decline, and 38% from its last leg of the decline, which I identified as wave 5 in my former article. Despite this recent rebound, the stock is still negatively extended, and given the actual setup, I estimate further gains as likely.

What is coming next?

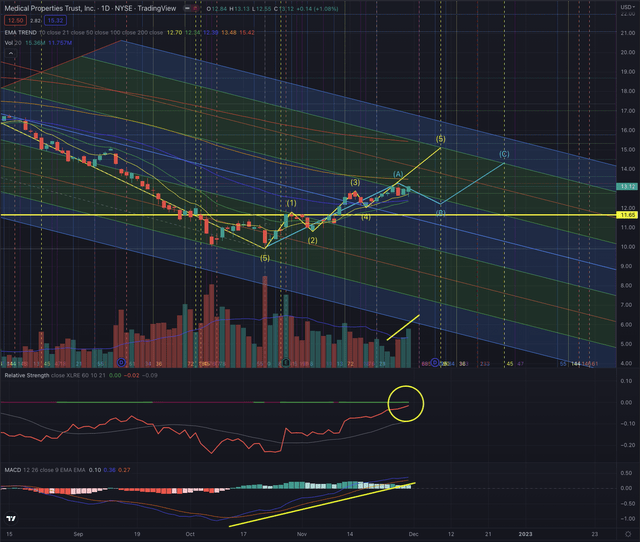

I consider MPW’s daily chart to illustrate the most likely outcomes I see possibly forming in the coming weeks. If the recent price action is forming a new Elliott impulse sequence, the stock could be in its wave 5 and extend as much as reaching $15.10. In this case, I would expect the stock to accelerate over the next few market sessions, possibly testing its EMA200 on its daily chart, before possibly consolidating.

Another possibility I consider would instead see the stock forming its Elliott corrective wave sequence. Here MPW could approach the top of wave A, we could then observe the stock forming a short-term correction before the last leg of the wave sequence would project the stock to likely around $14.30.

It is therefore essential to set up appropriate risk management. Investors who followed my last call, are now holding on to a nice profit of 20% performance, which I would not give back, at least not entirely. I, therefore, raise my former stop-loss from $9.60 to around $11.65, which would give the stock enough space to form both discussed likely outcomes, and would grant a sure profit of at least 7%, even in the event of an extended downward movement.

The stock is showing positive momentum and is increasingly building up strength, under my initial thesis of an extended retracement of its sell-off. MPW’s short interest has again increased, now standing at 13.45%, while its short interest ratio has doubled to above 8 days, which could add fuel to the stock’s uptrend in case of significant upward momentum.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories.

While it is early to determine which of the discussed scenarios is more likely to form, I would certainly continue to closely observe the price action and follow my contingency plan, as the higher volatility in the markets is hinting at an elevated risk of possible further losses. MPW has an interesting technical setup and offers significant opportunities to investors who recognize the potential of the discussed likely outcomes. The discussed strategy is leading me to continue to rank MPW as a buy position. As my former call already returned 20% in profits, I want to secure this trade at least partially, allowing me to make a sure profit of at least 7% even in the eventuality of a worst-case scenario.

Be the first to comment