industryview/iStock via Getty Images

Investment Summary

Here at HBI, we are uniquely positioned at various points along the healthcare value chain in our broad healthcare exposure. Specifically, we are long healthcare stocks all the way from services, product sales, manufacturing, and even supply chain. With respect to the latter, we’re here today to discuss our latest findings on Premier, Inc. (NASDAQ:PINC), a stock that benefitted tremendously from the effects of Covid-19 on healthcare supply chains.

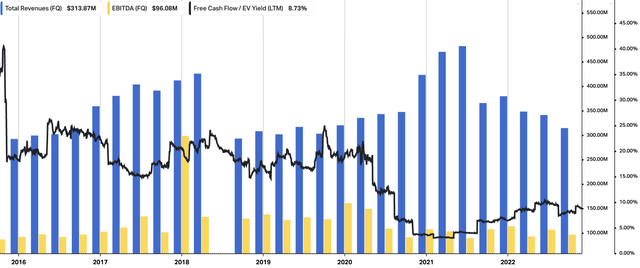

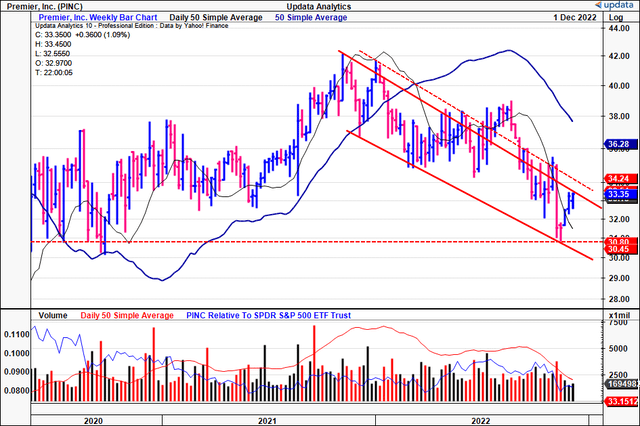

We’d first note that PINC has re-rated heavily to the downside in FY22 [see chart below], and the question now turns to whether this is an exciting time for entry or not. We can now buy PINC at 13.7x trailing adjusted EPS and a 8.75% trailing free cash flow (“FCF”) yield, whilst our calculations suggest further EPS upside ahead. Net-net, we rate PINC a buy on valuation and forward earnings growth, seeking a price objective of ~$40.

PINC 24-month price evolution [weekly bars, log scale]

Q1 FY23 financials: PPE price reversion impacted top-bottom line result

Turning first to the latest quarter, we noted a reversion of PINC’s P&L back towards longer-term averages. Note, PINC is currently in its Q2 of FY23′, with its annual report completed on June 30, 2022.

Total revenue of $313.9mm came in 14% lower YoY on adjusted EBITDA of $104.1mm, down 10%. It brought this down to net earnings of $43mm, or $0.36 per share, down from $0.99 per share a year ago.

The decrease was driven primarily by a 21% decrease in turnover from its supply chain services division, as both demand and pricing for personal protective equipment (“PPE”). Moreover, we noted higher logistics costs and a $mm YoY increase at the SG&A line eroded margins vertically down the P&L.

A comprehensive look-back at PINC’s operating performance is observed in Exhibit 1. Note, whilst numbers have tightened, investors can still buy PINC at a c.8.75% trailing FCF yield. This represents strong value in our estimation.

Exhibit 1. PINC Quarterly operating walk through, FY17–date. Investors can still buy PINC at a ~8.75% trailing FCF yield.

Note: FCF yield is calculated as [FCF TTM / rolling enterprise value]. (Data: HBI, Refinitiv Eikon, Koyfin)

It’s also worth noting the company settled its transaction in purchasing “key assets” from TPRN Direct Pay and Devon Health (“TPRN”) in October. It acquired these assets through its Contigo Health (“Contigo”) arm on a $177.5mm valuation. We should note the acquisition includes contracts involving >900,000 providers across 4.1mm locations in the US, per the company.

This earmarks PINC’s mobilization into adjacent markets, will build on Contigo’s growth route, and is expected to generate $40–$60mm in incremental revenue on an annual basis. Management also reckon it will bulk roughly 40–50% to the company’s adjusted EBITDA margin once at scale. Moreover, it is expected to be accretive of $0.01–$0.02 of EPS in FY23.

We should also advise PINC is pushing ahead on its new out-of-network wrap offering through Contigo, known as ConfigureNet. Per CEO Mie Alkire on the earnings call:

“[ConfigureNet] is expected to help improve access to health care and reduce the cost to patients as it will provide health plan payers and their health plan members medical claim savings through pre-negotiated discounts with the network providers.

In addition, through this asset acquisition, Contigo Health will expand its customer base to include national health plans, specialized insurance providers and other network companies.”

Turning to the divisional and operational highlights, there were mixed results throughout the P&L across PINC’s core offerings. To list a few:

- Supply chain services revenue decreased $21mm YoY to $219.7mm on adjusted EBITDA of $121.2mm, underscored by a normalization across several categories. This included pharmacy, and impact from members who did not renew their group purchasing organization (“GPO”) agreements with the company over these past 2 years.

- Switching to the performance services segment, we saw PINC recognized a 700bps YoY growth schedule compared to this time last year. This was underpinned by growth in its adjacent markets discussed earlier, along with revenue timing effects.

- Net-net, we noted PINC’s adjacent markets business was the standout in the performance services division, securing a 40% YoY growth. This was from upsides in its PINC AI and applied sciences portfolio[s], along with expansion of Contigo and Remitra. Management forecast 30–40% growth in turnover in this segment, calling for $112mm in contribution for FY23.

- It’s worth highlighting that PINC also recognized $35.5% YoY growth in CFFO, thanks to growth in primary services revenue, but also thanks to a cash dividend received from its minority investments. We’d note this is a factor for consideration going forward, and perhaps a sound deployment of capital in light of the macro landscape, as it reduces the execution risk associated with cash flows.

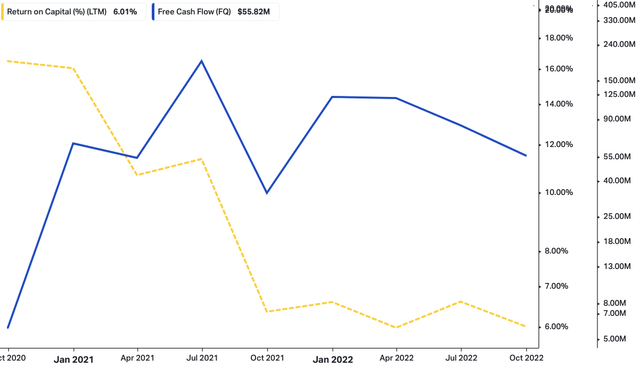

- As such, PINC realized a $31.5mm free cash inflow [$55.82mm on TTM basis], well above the $10.3mm secured last year. This was driven by the dividend mentioned above, along with higher net working capital. Management project FY23 FCF at 45–55% of adjusted EBITDA from the call. You can see the company’s TTM free cash flows below, and the corresponding TTM return on capital below. Note, whilst return on capital has tightened to ~600bps, we’d note PINC’s WACC hurdle is also c.6% at present. Hence, it will need to grow this return on capital number above the WACC hurdle in order to create future economic value in our opinion.

Exhibit 2. PINC return on capital currently in-line with WACC hurdle, whilst FCF continues to lift sequentially.

Data: HBI, Refinitiv Eikon, Koyfin

Guidance reaffirmed, points to EPS upside downstream

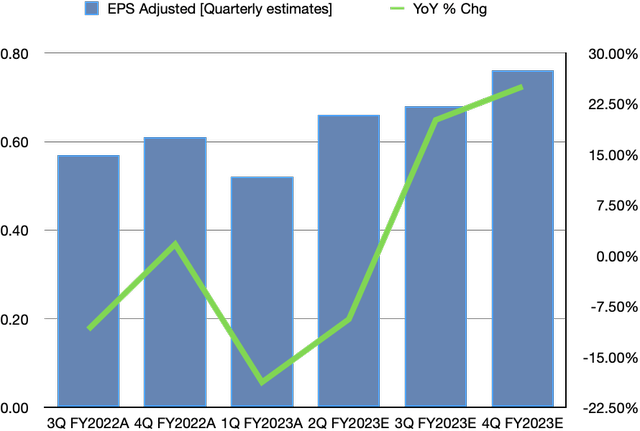

Management reaffirmed its FY23 guidance ranges on the earnings call. It continues to project net revenue in a range of $1.38–$1.45Bn, on adjusted EBITDA of $510–$530mm, a 36.5% margin at the upper bound. We should note it expects EPS of $2.63–$2.75 on this number, calling for 24.4% upside at the upper range.

We are aligned with managements forecasts and see the company growing EPS sequentially into the end of calendar year 2023 [Exhibit 3]. Note, this corresponds to PINC’s H2 FY24.

In that vein, we remain constructive on the stock, given the propensity of this EPS upside downstream.

Exhibit 3. PINC FY22–24′ EPS assumptions [quarterly, internal estimates].

Note: Data is presented in calendar year format. Hence, Q3 FY2022E corresponds to the 3 months ending December 30, 2022, and so on.

Valuation and conclusion

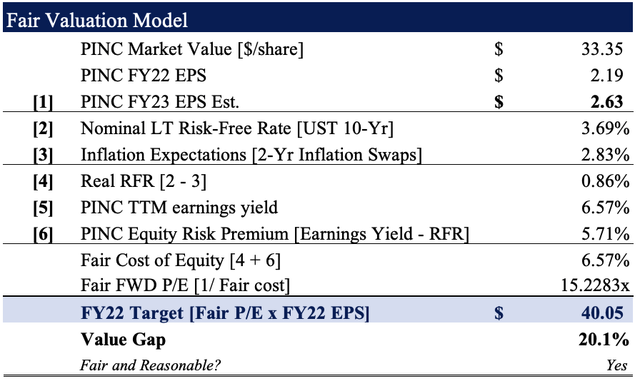

With these growth percentages in mind, we believe the stock has potential to re-rate to the upside. We should first advise that consensus values PINC at 12.7–16.7x forward earnings [non-GAAP–GAAP respectively]. This appears to be an appropriate range based on our calculations of a 15.2x fair forward P/E [Exhibit 4]. The stock also trades at 1.75x book value and 8.5x trailing CFFO.

Rolling our FY23 EPS assumptions forward and applying the 15.2x multiple derives a price target of $40.05, or ~20% return potential. This confirms our bullish thesis.

Exhibit 4. FY22 EPS est $2.63 x 15.22 = $40.05.

Net-net, we rate Premier, Inc. a buy on valuation and forward earnings growth. Whilst the company missed consensus estimates last quarter, we’d note these estimates were incredibly bullish and perhaps didn’t factor in known market data such as reduced demand for PPE and pricing reductions associated with the same. Nevertheless, we see upside value for Premier, Inc. to a price objective of $40.05, hoping to capture ~20% upside before re-evaluating the position.

Be the first to comment