Dilok Klaisataporn

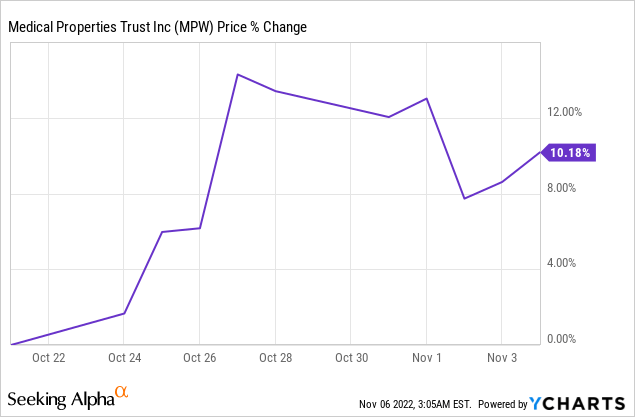

Medical Properties Trust (NYSE:MPW) recently reported its quarterly results and the market reacted very positively to them:

Typically, we don’t post updates on the public site of Seeking Alpha so shortly after the earnings report comes out because we give priority to the members of our marketplace service – High Yield Landlord. Besides, we like to take some time to digest the results and compare them to those of close peers.

But MPW has been a hotly debated company as of late and I know that many of you wanted to know my latest thoughts as soon as possible, so I am writing this quick update for you.

Before that, I want to remind everyone that MPW is a hospital REIT that we hold in our Core Portfolio. It is a higher risk/higher (potential) reward type investment that pays a 10% dividend yield and has 100%+ upside potential if our thesis plays out. Naturally, with such high return potential also comes higher risk, which we discussed in a recent update that you can read by clicking here. In case you aren’t familiar with the company, you can also read our full investment thesis by clicking here.

With that out of the way, here are my latest thoughts. I just finished listening to the MPW’s conference call for a second time and digging into the supplements. Here are my main takeaways:

- They met expectations despite selling some properties and paying off some debt. Typically, REITs miss expectations under such circumstances, particularly when their sentiment is so low. Not only that, they actually also slightly hiked their full-year guidance for FFO per share.

- They guided for abnormally rapid organic rent growth in 2023. This is largely because most of their leases have CPI adjustments, which should result in ~4-5% rent growth in 2023. This is better than any other triple-net lease REIT (NETL). Even better than W.P Carey (WPC), which is commonly seen as the net lease REIT with the fastest organic growth in rents.

- The financial condition of MPW’s biggest tenant, Steward, has significantly improved. They are now managing to cut down costs even as volumes are improving and reimbursement rates will soon be increased. As a result, Steward is now forecasting unadjusted EBITDA of more than $350 million for 2023 and is expected to be “strongly” free cash flow positive going forward. Steward also completed the accelerated repayment of amounts due related to $450 million in COVID-related advances. Shorts believed that Steward wouldn’t be able to repay this, but they were wrong.

- MPW spent some time explaining why the market is overreacting to fears related to its Steward properties. I copy pasted below the most important section for you to read:

I’ll call out a few additional indicators of Steward’s long-term capacity, which we hope will make even more clear why our second quarter loan to Steward was a prudent and profitable investment.

Remember that HCA valued Steward’s Utah operations and solely the Utah operations at $850 million. This transaction ultimately did not occur but only because of the antitrust position of the FTC. But the value of Steward’s Utah operations did not suddenly go away just because one particular operator faced antitrust issues.

Steward, of course, still owns these valuable assets and has the option to continue to operate Utah on its own and generate strong after-rent cash flow as it is doing now or to explore monetization of the Utah operations by selling to other prospective purchasers who would not face the level of antitrust scrutiny that HCA (HCA) often attracts.

Under either scenario and whoever is the operator in Utah, the community infrastructure-like characteristics of MPT’s Utah real estate assets should result in profitability and cash flow to pay MPT’s rent at attractive coverage levels.

Similarly, earlier this year, MPT sold a 50% joint venture interest in our Massachusetts real estate that is leased to Steward. The JV simultaneously placed secured debt on that real estate and MPT recognized an approximate $600 million gain on the sale and received an aggregate of $1.3 billion in cash.

The self-evident point to be made is that two very sophisticated institutional investors, the infrastructure funds and the lender, did substantial diligence on the operations cash flow and value of Steward’s Massachusetts operations and concluded that MPT’s contractual rents on its real estate were well supported. Again, the value of those operations has not suddenly gone away.

MPT also owns nine hospitals in Florida that are leased to Steward where operations since last year, when Steward acquired five of these hospitals from Tenet, have continued to improve. And by the way performance was very attractive even from the time of acquisition. These three markets Utah, Massachusetts, and Florida comprise nearly 75% of Steward’s total annualized rental obligations.

On a weighted average basis, Steward’s EBITDARM coverage in these markets has ranged from 2.7 times for the trailing 12 months ended June 30, 2022, to in excess of three times preliminarily for a stand-alone August. With these coverages Steward appears well able to continue paying MPT rent.

And that of course is the cornerstone principle behind MPT’s very long-term track record of buying hospital real estate that needs to be — needs to continue operating in order to serve the critical health care needs of people in its community. It is by identifying those physical and market characteristics in the real estate we invest in that has led to MPT avoiding renegotiation of rents or other impairments over our almost 19-year history.

- MPW confirmed that Pipeline is expected to keep paying its rent in full and on time despite filing for bankruptcy protection. This is what we expected since its MPW properties are highly profitable. It shows once again that just because a tenant is filing for bankruptcy does not mean that the rent payment will end. The profitability of the properties matters.

- MPW sold some of its worst assets leased that had negative rent coverage without suffering a loss. In fact, they earned significant rental income and earn a good return, all during the worst economic and health crisis in over a century, which is really a testament to the good underwriting of the company.

- I think that something that a lot of investors misunderstand about the healthcare space is that some occasional tenant issues are inevitable. This is partly because their businesses rely heavily on reimbursement systems and reimbursement rates take time to adjust. When operators suffer temporary pain, it is in the best interest of the tenant and landlord to figure out a solution to get through the temporary crisis. You don’t want to ruin a potential multi-decade relationship that’s mutually beneficial just because the operator is having some temporary difficulties and this is why it may occasionally make sense for the landlord to support the tenant by granting it a loan or a rent deferral. A loan is of course better if you are confident that the tenant will recover because it also allows you to earn interest. Short sellers are heavily focused on why MPW occasionally lends money to its tenants, but it makes sense when you think about it, especially since we just went through the pandemic, which was a severe, but temporary crisis. To give you an example: in earlier quarters of 2022, MPW allowed one of its tenants to defer $7 million of rent over four months. That tenant is now back to paying 100% of the rent and will repay the amounts deferred over 12 months starting in January. This is a better outcome than forcing the tenant into bankruptcy since the issues were only temporary.

- MPW is focused on realizing some value in its portfolio in order to prove to the market that it is undervalued, but also to pay off debt and buy back shares. Acquisitions are put on pause for now unless something spectacular comes along. The proceeds coming from recent disposition went towards the repayment of near-term debt.

Bottom Line

What could MPW really have done better?

They slightly hiked their midpoint guidance for NFFO per share, guided for unusually strong organic rent growth in 2023, paid off a bunch of near-term debt, and Steward is expected to be FCF positive going forward.

I think that as I have said before: the stock price performance of the past year simply hasn’t been reflective of the company’s fundamental performance. The market has been punishing us, but based on all the information that we have, our thesis is actually playing out quite nicely.

If Steward is really going to be strongly FCF-positive going forward, what are the shorts going to say next? Right now, it appears that they have been reduced to saying that the management is fraudulent and lying to us. Well, if that’s the case, then we will be proven wrong of course, but you could say that about any company and we have no reason to believe that this is the case.

The company has a near two-decade track record of excellent performance. They have underwritten tens of billions of dollars of acquisitions and only had very few tenants go through the bankruptcy process. And in almost every case, the hospital kept being operated, there was no interruption, and rents kept getting paid and MPW figured out a transition to a new tenant with the same lease in place.

I continue to think that the market is misinterpreting MPW’s risk as that of a hospital operator when in reality, it is a landlord, which greatly mitigates its risks. We expect 100%+ upside and earn a 10% dividend yield while we wait.

Be the first to comment