JimVallee

Co-produced with Treading Softly

With Powell and crew continuing to push the economy towards a recession, the level to which rates will be hiked continues to be nebulous. Other central banks have hiked rates at a slower rate than the United States, possibly signaling a desire to have the U.S. follow suit.

However, the ever-late-to-the-game Federal Reserve seems to be set on its path of “higher for longer”. This is the game crew who claimed inflation was just transitory while it skyrocketed to record levels and the economy worked itself into being overheated on cheap liquidity fueled by Government stimulus and Federal Reserve quantitative easing.

To tackle this oversupply of liquidity, the Federal Reserve is not draining the excess from the economy by selling off its holdings. It is taking the slowest route possible – interest rate hikes. The idea is if it’s costlier to spend money, you’ll be incentivized to save it. Thus, less money is flowing from A to B, and liquidity dries up. This process takes time, and in the meantime, inflation continues to get more ingrained.

We aim to have an agnostic portfolio. This doesn’t mean it’s unsure if a higher deity exists or not – our Model Portfolio isn’t sentient after all! We aim to have a rate-agnostic portfolio. This means if rates go up – great! If rates go down – great! To achieve this, we hold various investments that benefit from rates moving in either direction and provide ample income and possibly income hikes of their own as rates climb higher.

Let’s dive into two investments that reported earnings last week!

Pick #1: CSWC – Yield 10.7%

It is a huge year for Business Development Corporations. BDCs have an ideal business plan for a rising interest rate environment. They lend at floating rates and borrow at fixed rates.

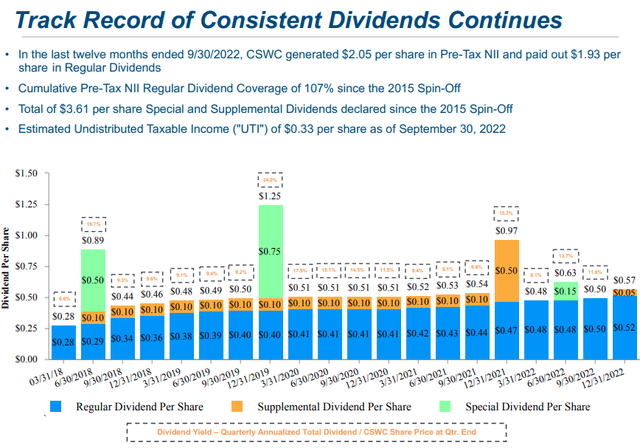

Capital Southwest Corp. (CSWC) has benefited from this and reported a record $0.54 in pre-tax NII (net investment income) last quarter. CSWC is sharing the wealth with investors hiking the dividend to $0.52 and paying a supplemental of $0.05 for the December dividend. Management stated that they expect the supplement dividends will continue being declared as interest rates remain high.

CSWC has proven to be a very shareholder-friendly company by paying out a growing regular dividend every quarter and frequently paying out supplemental and special dividends as they realize investment gains.

There is no doubt about it, CSWC’s history is that of a dividend-generating machine!

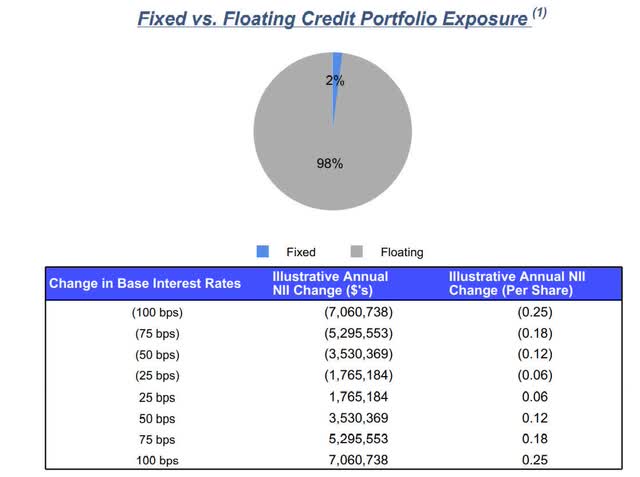

The best part is that interest rates will continue to be a tailwind. The following chart shows the impact of rate changes for CSWC, starting with 3-month LIBOR being 3.75%:

As of now, 3-month LIBOR is 4.55% – already up 80 bps after the Fed’s widely expected rate hike last week. Based on this chart, we can expect that CSWC is on track to see an additional $0.045+/share each quarter.

BDCs lend money to privately owned businesses, and like all lending, the risk is that the borrower might be unable to repay the loan. CSWC’s niche is with small businesses that have annual EBITDA averaging around $20 million. When investing in such small companies, credit quality is paramount.

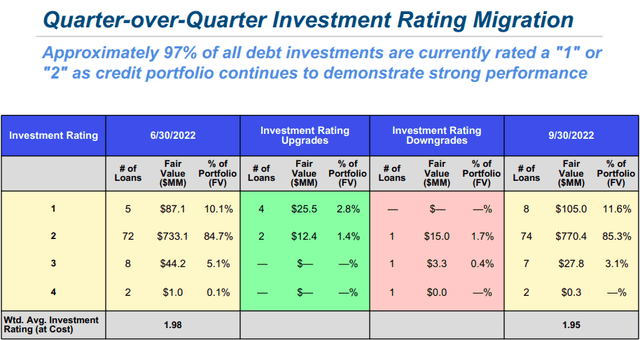

CSWC rates its investments on a 1-4 scale. 1 meaning that the company is exceeding expectations set at underwriting. 2 meaning the company is meeting expectations. 3 meaning the company is underperforming expectations. 4 meaning that the company has defaulted or CSWC otherwise expects that it will not fully recover its investment.

Last quarter was a bit of a mixed bag, with some upgrades and some downgrades.

This is not a complete surprise, as some companies will deal with an inflationary environment better than others. However, CSWC’s overall credit quality remains strong. For the last quarter, the upgrades outweighed the downgrades.

This is similar to what we’ve seen throughout the BDC sector so far this earnings cycle. Earnings are shooting up thanks to rising interest rates, while credit quality is showing some stress for select businesses but overall remains high.

BDCs continue to be an opportunity for income investors to benefit from the Fed hiking rates. The higher rates go, the higher profits go, and BDCs will pass that along to us as higher dividends.

Pick #2: OXLC – Yield 16.5%

Oxford Lane Capital (OXLC) continues to significantly outearn its dividend with $0.33 Core Net Investment Income. That is 146% dividend coverage last quarter. Over the past 12 months, OXLC’s dividend coverage was 200%.

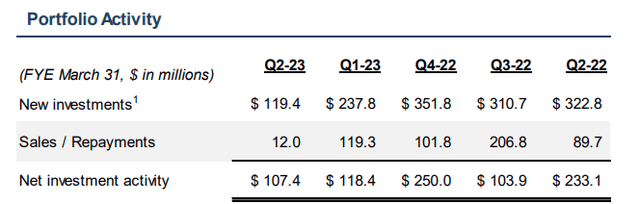

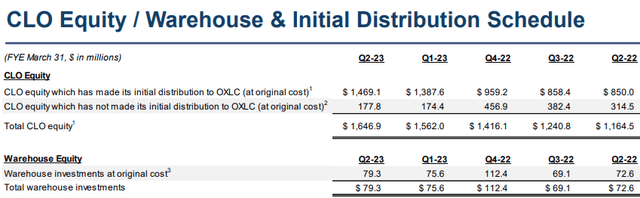

Net asset value has continued to decline, as the price of leveraged loans has declined to the low $90s. As prices have declined, OXLC has continued to be a net buyer – adding $107 million in net new investments. (Source: OXLC Presentation)

I’ve said it before, and I’ll say it again: Low prices benefit those who are buying.

OXLC has aggressively increased its assets since the COVID fall and the last few years of CLO equity prices being below long-term averages. Over the past year alone, OXLC has increased the size of its portfolio by 40%.

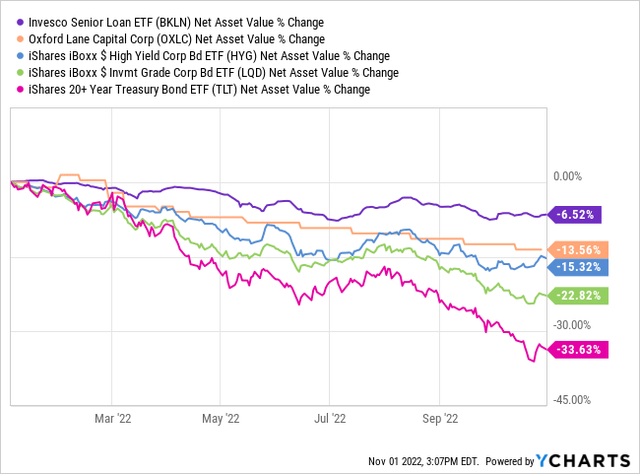

Loan prices are down primarily due to the Federal Reserve hiking rates quickly. We’ve seen pressure on all loan investments. Here is a look at OXLC’s NAV vs various debt ETFs:

Note that none of these debt ETFs use leverage, while OXLC does. There is no question about it, 2022 has been a rough year for the valuation of debt.

But what does it mean when a loan is trading at $91? It means that investors can buy $100 in debt for $91. It does not mean that the borrower can pay off their debt for $91! When borrowers repay, they are still paying $100.

OXLC does not make money by flipping positions. It has a buy-and-hold investment strategy. So for OXLC, its profits are not determined by whether or not it can sell the CLO at a higher price later. OXLC’s profits are determined by whether or not borrowers pay as agreed.

Default rates remain extremely low. While we’ve seen some news articles hyperventilating about defaults “tripling”, they are tripling from near 0%. Default rates remain below 1%. They need to triple again just to be average. The bulk of the defaults is with two large bankruptcies this year, Revlon and Cineworld.

The bottom line is that the majority of companies have very healthy balance sheets today relative to historical periods. Cash flow is high and borrowers spent the past two years refinancing their fixed-rate debt at historically low rates. We expect that default rates will remain below historical averages, and OXLC is one of the best ways to convert that prediction into dividends.

Dreamstime

Conclusion

With CSWC and OXLC, we can invest in floating-rate debt, so the Fed’s hikes do not negatively impact our investments. This allows us to shrug off rate hikes or even benefit from them in this part of our portfolio. The market has been a whip-saw of fear and panic, and I do not expect anything different as the year continues to march to a close.

As an income investor, this is an excellent time to see my income growing more rapidly than when prices are skyrocketing, and reinvested dividends lock in a lower yield than previously offered. Time is my ally and friend. In time, I get regular income from my holdings while others pray for prices to increase.

So what do I do with all this time? Whatever I want to do! You see, I don’t need to micromanage my portfolio. I can travel whenever I want. Jump on a sailboat and visit islands around the Great Lakes. I can hop on a plane and visit remote locations in New Zealand where the Lord of the Rings was filmed. I can do all this, without ever having to check on my portfolio – the income just keeps landing in my account continuously.

There’s a famous line from the Tinkerbell movies, they describe how a little bit of blue pixie dust turns a trickle of yellow pixie dust into a roaring stream of it. They say “from a trickle to a roar”. That’s what just a few income-producing investments in your portfolio can do to your personal income stream.

Toss in a little blue pixie dust and be ready to stand amazed.

Be the first to comment