porcorex

High yielding stocks are attractive for retirees for obvious reasons, but I don’t think they should be limited to just seniors. A common refrain for young working adults is to invest in growth stocks, because they have a longer investment window. However, what happens when growth stocks that were way overvalued precipitously fall?

The recent crash in tech stocks is reminiscent of the dot com bust, after which many names never recovered and investors had permanent losses. That’s why it may be better to pay at or close to fair value for companies in the BDC sector, all while being compensated a decent cash return for holding on, no matter what the price does in the near term.

This brings me to the quality BDC, Golub Capital (NASDAQ:GBDC), which current sports a 9% dividend yield that could help to satisfy the income needs of many. This article highlights why GBDC remains attractively valued for income seekers, so let’s get started.

Why GBDC?

Golub Capital is an externally-managed BDC that’s been publicly traded since 2010. At present, it has a $5.6 billion investment portfolio that’s well-diversified across 328 investments in 40 different industries.

It maintains a conservative investment profile, with 94% exposure to first lien debt. Most of this (84%) is in the form of first lien one stop, which is another word for unitranche debt. In these instances, GBDC is the sole lender for the borrower, thereby giving BDC a closer relationship and more say in material finance decisions of the companies.

This is reflected by the fact that 90% of GBDC’s loan originations during Q2 was with a repeat sponsor and over 50% was with repeat borrowers. Junior debt comprises just 1% of GBDC’s portfolio, and the remaining 5% is comprised of equity, giving more upside potential to GBDC’s net asset value.

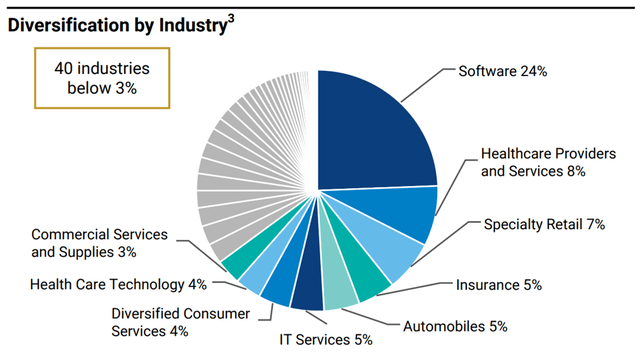

GBDC also maintains adequate diversification, with the average investment representing just 0.3% of the portfolio average, and top 10 investments represent just 15% of portfolio total. As shown below, growth and defensive sectors including technology (software), healthcare, specialty retail, and insurance make up nearly half of GBDC’s investment industries.

GBDC Diversification (Investor Presentation)

Meanwhile, GBDC is set to continue benefiting from rising rates, as 100% of its debt investments are floating rate, while only a quarter of its funding sources are floating rate, enabling GBDC to take advantage of rising investment spread. Management remarked on the benefit from rising rates in the recent conference call:

Short-term interest rates increased meaningfully during the quarter as the US Federal Reserve looked to address high inflation. GBDC will be able to take advantage of the higher interest rate environment and got some benefit in the quarter. Nearly all of GBDC’s investments are floating rate, while only about 25% of its funding sources are floating rate. Bear in mind that base rates for different loans reset with a lag, so we haven’t yet seen the full benefit of higher base rates across the portfolio. We believe GBDC will continue to benefit as higher base rates are fully realized in future quarters.

Plus, GBDC generated adjusted net investment income of $0.34 per share in the quarter ended June 30th, a $0.07 improvement over the prior year period, and more than covers the $0.30 quarterly dividend rate. While NAV per share did decline by $0.21 to $15.14 in last reported quarter, this was almost entirely driven by mark to market adjustments (unrealized losses) amidst a challenging environment for public and private market valuations.

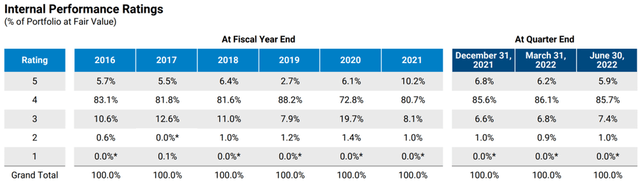

I don’t see reasons to be concerned, as investments on non-accrual remain low, at just 1.1%, just 10 basis points higher from the prior year period. As shown below, GBDC’s portfolio companies’ performance ratings are currently high compared to historical norms, with a score of 5 being the highest quality.

GBDC Portfolio Ratings (Investor Presentation)

Lastly, I see value in GBDC as its current price of $13.21, equating to a price to NAV ratio of just 0.87. As shown below, this sits at the low end of GBDC’s trading range over the past 5 years, and the stock traded at a premium to in the years prior to 2020.

GBDC Price to Book (Seeking Alpha)

Investor Takeaway

Income investors looking for a high yield and exposure to the middle market lending space could do a lot worse than GBDC, which trades at a healthy discount to NAV. GBDC offers a good mix of diversification, with solid portfolio fundamentals and an attractive and well-covered dividend. Given that many BDCs have reported positive earnings results for the quarter ended September 30th, it may be a good move to layer into GBDC before it reports earnings on November 22nd.

Be the first to comment