Klaus Vedfelt

Hanesbrands Inc. (NYSE:HBI) is a global company that specializes in the manufacture and distribution of everyday basic innerwear and active apparel. The company is still facing problems managing its margins, mainly because of higher input costs on top of the necessary expenses needed for its Full Potential Plan. HBI’s FY2022 will remain weak with negative projected growth on its top line; however, it will remain liquid to support its dividend. Today, most of the negative catalysts, such as unfavorable currency fluctuations and its complete exit of its European innerwear business, appear to have been priced in. As the global economy continues to recover from the pandemic, I believe demand for HBI will come back to life. HBI is approaching a strong support area at around $7 and is currently providing a 6.97% dividend yield, providing investors a good long opportunity.

Company Overview

After years of significantly underperforming the S&P 500, Hanesbrands initiated its Full Potential Plan in Q4 2020, and according to management, this will simplify their business operation and focus on margin expansion. From 2020 up to date, HBI recognized impairment charges mostly due to SKU rationalization and successfully exited its non-profitable European innerwear business. In fact, it recognized a net loss from discontinued operations of -$443.7 million in FY2021 and -$43.9 million in FY2020. HBI’s top line suffered in Q2 2022, falling to $1513.5 million from $1,751.3 million in the same quarter last year, due to a combination of slowing demand and, unfortunately, some ransomware attacks. According to the management, an unusual cyber event impacted their sales by $100 million negatively, which snowballed into a $35 million operating loss and -$0.08 earnings per share.

This resulted in a lower gross profit this quarter, amounting to $572.6 million, down from $683.5 million in Q2 2021. This snowballed to a lower bottom line amounting to $92.1 million, down from $128.7 million in the same quarter last year. This negative catalyst is worsened by a negative top line growth outlook from the management of a 4% decline. According to the management, this outlook already reflects unfavorable changes in foreign currency exchange rates, impairment on inventory, and a challenging retail environment.

On the brighter side, there is a bit of an improvement with its projected operating profit from continuing operations (GAAP) for FY2022 ranging from $570 to $620 million, compared to $581.07 million in FY 2021. The management reassured their investors that they will earn enough this year to sustain dividend payments and fund future investments, as quoted below.

…we expect to generate approximately $400 million in cash flow from operations in the second half, which is more than sufficient to support our full potential investments and our dividend. Source: Q2 2022 Earnings Call Transcript

On top of this catalyst, HBI announced the authorization of the $600 million share repurchase plan in FY2021. They have already utilized $25 million of the said amount, and if the upcoming holiday season goes well for HBI, they may have additional funds for additional buybacks.

New Partnerships And Trademark

HBI is well on track to capitalize their new partnership with University of Southern California (USC), University of Tennessee, and extension of another 10 year partnership with University of Michigan. In addition, HBI acquired Champion trademarks for footwear in the United States and Canada, giving customers more options to match their vibe.

According to the management, they are seeing success in their international operation with their innovative innerwear products such as total support pouch with cooling fabric X-TEMP and with their comfy Retro Rib product. In fact, operating margin of its international operation is gaining some improvement this quarter with 13.2%, up from 12.9% in the same quarter last year.

People are spending more time outside as the global economy continues to recover from the pandemic. HBI’s plan to expand globally, as outlined below, will aid in improving its top line projection.

We see significant growth opportunities through the expansion of our women’s and kids businesses. The expansion in new markets such as China, as well as into adjacent product categories, including footwear.

…

We’re also on track to go live this month with our new West Coast DC to support our direct-to-consumer business. Plus, we began adding additional automation to several DCs. This includes the addition of robots and sortation systems, which will help improve picking and sorting speeds, while also lowering costs. Source: Q2 2022 Earnings Call Transcript

With their full potential growth strategy, which will support top line and margin boosts and improvements on their pipeline suggests that HBI may be capable of meeting their 2024 targets of $8 billion in revenue, 14.4% operating margin, and $1.6 billion in FCF.

Getting Cheaper And Cheaper

HBI is currently trading at a trailing P/S of 0.46x and, considering its top line target of $8 billion by 2024 or a forward P/S of ~0.30x, I believe it is currently cheap as of this writing. This is especially true when factoring in its 5-year average price to sales ratio of 0.88x. I believe the street’s average target price of $12.08 is a good benchmark to set an initial reward limit.

At Support Levels

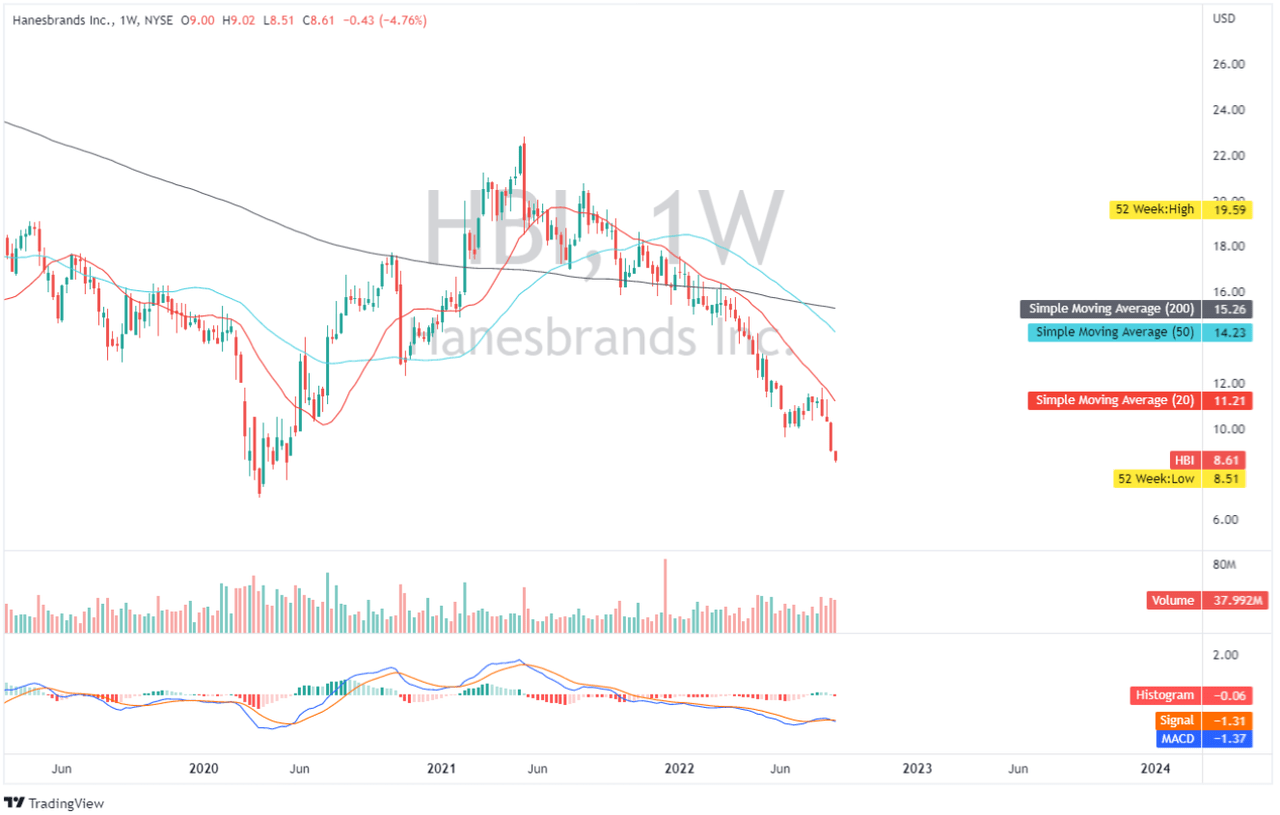

ACI: Weekly Chart (TradingView.com)

HBI still has room to fall, of course, especially given the fear caused by the negative sentiment mentioned earlier. This is especially true when looking at its indicator, as shown above, where its simple moving averages printed in a strong bearish manner and its MACD crossed over below zero. If the bearish pressure remains strong, I believe around $7-$8 will be a strong support zone to monitor. However, a potential consolidation in the said zone may imply an exhausted bearish move and may force its price to challenge its ~$10 level.

Final Key Takeaways

Upon investigating its long-term debt schedule, HBI’s next material obligations will be due in FY2024, aggregating to $1,468.63 million. According to the management, the company has $1 billion in liquidity this quarter. If they reach their 2024 target, I believe it can easily fund this obligation. However, a continued mismanagement of its current inventory level may induce unexpected impairment charges in the future. If this happens, I believe HBI can reshuffle their debt, or, in a worst-case scenario, we might see a follow-on offering, which may further dilute its current shareholder value.

Although FY2022 will be tough and risky, I believe HBI is still liquid with potential easing of its operating environment and the successful implementation of its Full Potential Plan may help the company achieve sustainable growth in its margin. Any further drop, I believe, will unlock the opportunity to get HBI at a better price with a bonus of a higher dividend yield, making this stock a good long candidate.

Thank you for reading and good luck!

Be the first to comment