SDI Productions

Investment Thesis

Medical Properties Trust (NYSE:MPW) focuses on acquiring and developing net-leased healthcare facilities across various countries. The company has recently agreed to sell three Connecticut Hospitals, which I believe can expand the company’s profit margins and improve its liquidity. It also has an attractive dividend payout, making it a good investment opportunity for risk-averse and retired investors.

About MPW

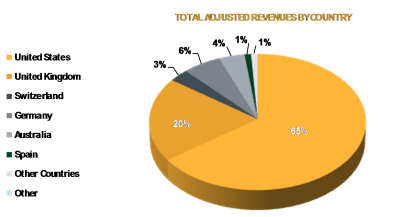

MPW is a real estate investment trust that acquires and develops net-leased healthcare facilities. The company’s current portfolio consists of investments in 437 facilities and approximately 46,000 beds. These investments are made across 32 states in the USA, six countries in Europe, Australia, and certain parts of South America. It also provides mortgage loans to healthcare operators by collateralizing their real estate assets. It also grants loans to certain operators through taxable REIT subsidiaries, and proceeds from such loans are utilized for acquisition, working capital, and other activities. The company’s business plan mainly focuses on the diversification of its portfolio in several ways, including a concentration in any one facility, improving tenant relationships, and expanding geographic areas in which it operates. The company’s growth highly depends on the healthcare sector. The global Covid-19 pandemic has driven the demand for healthcare facilities over the past two years and created investment opportunities in the real estate business. The USA currently incurs the highest healthcare expenditure in the world – $4.1 trillion ($12,530 per person) in 2020. The country’s health spending experienced a growth of 9.7% in 2020. The USA’s health spending is expected to reach $6.2 trillion by 2028. This growth has also been observed in other countries where the company operates, such as the UK, Switzerland, Germany, Australia, Spain, Italy, Portugal, and Colombia.

Revenue by Country (10-K of Medical Properties Trust)

Sale of Connecticut Hospitals

The company currently has a long-term debt of $10.13 billion, which ultimately increases the interest expenses for the company and contracts the profit margins to some extent. To reduce such costs, generating additional cash flows becomes necessary. For this purpose, the company has recently announced that it has entered into an agreement to sell three Connecticut Hospitals to Prospect Medical Holdings, the property’s current lessee. Separately, the hospital operations will be acquired by Yale New Haven in a contemporaneous transaction. As per the agreement terms, the selling price of hospitals is approximately $457 million. The company is planning to use the proceeds of this transaction to reduce debt. I believe this sale transaction can act as a primary catalyst to expand the company’s profit margins as it can reduce debt and cut down the interest cost, which affects the bottom line profit margins. It is also planning to use the proceeds to make acquisitions and other investments that can generate revenues from rent and other incomes and further help the company increases its profit margin by diversifying its investment portfolio. This cash flow can also help the company to sustain its attractive cash dividends for the long term, which I will discuss in the next section.

High Dividend Yield

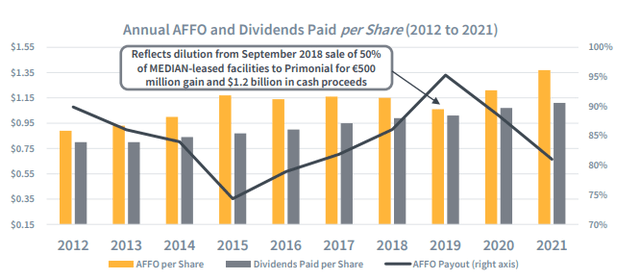

The company has paid attractive cash dividends over the years, which signals its good position in the market. It has consistently paid a quarterly cash dividend of $0.29 per share in the current year. I believe this dividend will remain constant for the last quarter as the company has recently agreed to sell Connecticut Hospitals, which can generate additional cash flows. I estimate the company’s yearly dividend to be $1.16 per share, representing an annual dividend yield of 10.55%. I believe the significant decrease in the share price has resulted in a solid dividend yield as the company’s share price has decreased by 53.13% year to date. I think the reason behind this decrease is rising uncertainty regarding Steward Healthcare and the bankruptcy of tenant Pipeline healthcare. However, Steward Healthcare has shown dramatic improvements in the last quarterly result compared to FY2020. Unadjusted EBITDA for Steward was about $209 million in FY2020. According to the most recent unaudited financial data, Steward produced an unadjusted EBITDAR of more than $450 million in 2021. This represents an improvement of more than $240 million. The management has confidence that Steward Healthcare can generate sustainable positive FCF from the end of this year. After that, I think the share price might increase. Hence, I believe this is the perfect opportunity to create a new position in MPW, as it can help the investors to earn a strong dividend yield at the current share price. The company has shown stable growth in AFFO and dividend payment since FY2012, which gives assurance about dividend payment in the coming years. According to Seeking Alpha, the company has an ‘A+’ and ‘A’ grade in yield and consistency of the dividend payment.

MPW recently announced the authorization to repurchase $500 million worth of stock, which is 7.6% of the company’s current market capitalization. The company has decided to complete the buyback before October 2023. After considering all these factors, I think this makes the company an attractive investment opportunity for risk-averse and retired investors as they expect to earn a regular fixed income.

AFFO and Dividend Trend (Investor Presentation: Slide No: 5)

What is the Main Risk Faced by MPW?

Intense Competition

The company competes for development opportunities and chances to buy healthcare facilities with, among others: private investors, including big private equity funds, healthcare providers like doctors, other REITs, real estate developers, government-sponsored, and financial institutions. Competition for healthcare facilities could have a negative impact on MPW’s capacity to build or acquire healthcare facilities, as well as the costs the company incurs in doing so. MPW’s revenue, profit growth, and financial return could be severely negatively impacted if it cannot purchase or build facilities or if the business overpays for facilities. Some of MPW’s facilities might face competition from other nearby facilities that offer services similar to those provided at the company’s facilities. Some of such facilities are owned by governmental organizations and supported by tax money, while others are owned by corporations exempt from paying taxes and may receive a significant portion of their funding through endowments and charity donations. Some of the company’s competitors are backed by private financial institutions. However, MPW’s facilities do not typically have access to that kind of support or fund. Additionally, rival medical facilities in the regions covered by MPW’s facilities might offer medical treatments that are not offered at the company’s facilities. Referral sources, such as doctors and managed care companies, occasionally change the hospitals to which they refer patients. This could adversely affect MPW’s tenants and the company’s operations, finances, and capacity to service debt and pay dividends.

Valuation

The company has recently entered into an agreement to sell three Connecticut Hospitals, which I believe can significantly help the company to reduce debt and interest costs and expand its profit margins. Recently, Steward Healthcare has shown dramatic improvements in the last quarterly result compared to FY2020. After considering all the above factors, I am estimating an FFO per share of $1.85 for FY2023, which gives the forward P/FFO ratio of 5.94x. After comparing the forward P/FFO ratio of 5.94x with the sector median of 12.77x, I think the company is undervalued. The company does not have access to external funds like some of its competitors, and rising demand can attract new entrants. Hence, I believe the company might trade below its sector median in the coming years. After considering these factors, I estimate the company might trade at a P/FFO ratio of 10.5x, giving the target price of $19.425, which is a 76.7% upside compared to the current share price of $10.99.

Conclusion

MPW has recently agreed to sell three Connecticut Hospitals, which can help the company to pay off its debt and reduce its interest expenses by further expanding its profit margins. The company is paying an attractive dividend yield of 10.55%, which I expect to remain sustainable as a result of the recent sale agreement and rising demand in the industry, which can generate additional cash flows. MPW has also announced the authorization to repurchase $500 million worth of stocks, which is 7.6% of the company’s current market capitalization. The company does not have access to external funds like some competitors, and rising demand can attract new entrants. After comparing the forward P/FFO ratio of 5.94x with the sector median of 12.77x, I think the company is undervalued. After considering all the above factors, I assign a buy rating to MPW.

Be the first to comment