MicroStockHub/iStock via Getty Images

Investment Thesis

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) has continued to deliver on its promises, despite the management’s lofty guidance during its recent Investor Briefing. Though slowing enterprise spending could be a temporary headwind, we are not concerned about its prospects in the long-term, given that the global cloud computing market is expected to grow from $445.3B in 2021 to $947.3B in 2026, at a CAGR of 16.3%.

Nonetheless, we may expect more volatility ahead as Mr. Market continues to worry about the Fed’s hike in interest rates and the potential recession. Given the drastic market correction since November 2021, CRWD has lost half of its pandemic gains. If the bearish market sentiments continue for the next few months, we may expect another retracement, which would provide interested investors with a safer entry point to this winning stock.

CRWD Has Showed Exemplary Execution Thus Far

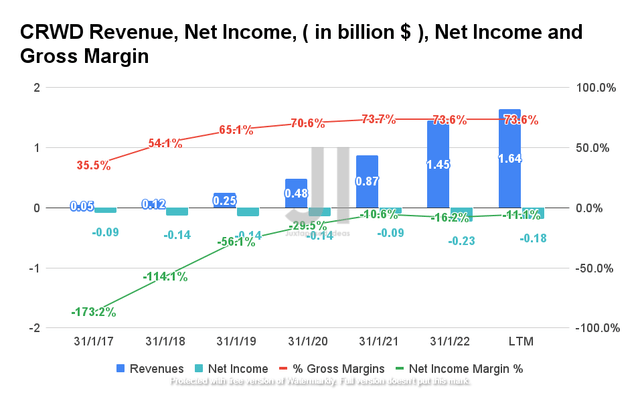

CRWD Revenue, Net Income, Net Income Margin, and Gross Income

CRWD reported revenues of $1.64B and gross margins of 73.6% in the LTM, representing impressive revenue growth of 88.5% YoY. Nonetheless, it is also evident that the company has yet to report net income profitability, with a net income of -$0.18B and a net income margin of -11.1% in the LTM.

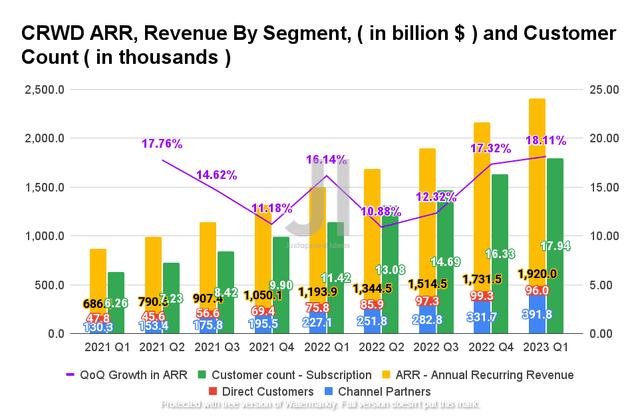

CRWD ARR, Revenue By Segment, and Customer Count

As seen from the chart, it is evident that CRWD has been on a successful mission in acquiring customers and growing its Annual Recurring Revenue (ARR). By the FQ1’23, the company reported an impressive ARR of $1.92B, with an excellent 18.11% growth QoQ and 43.2% YoY, while also recording a total of 17.94K of customers, with 57% of YoY growth. In addition, CRWD’s investment in its channel partners has also been paying off, with the segment now accounting for 80.3% of its revenues, as opposed to 74.9% in FQ1’22.

Nonetheless, we believe the analysts’ concerns on the “slowing ARR growth” is valid, given the potential recession slowing enterprise investment moving forward. Nevertheless, we are optimistic about its long-term prospects, since the headwinds are temporary at best

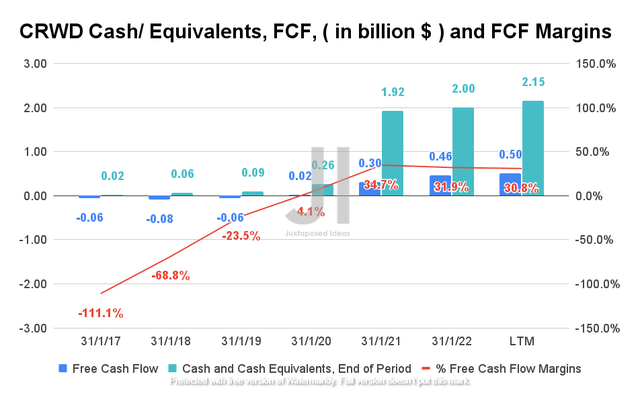

CRWD Cash/ Equivalents, FCF, and FCF Margins

CRWD has also been reporting positive Free Cash Flow (FCF) since FQ3’20. The company recorded FCF of $0.5B in the LTM, while also growing its cash and equivalents to $2.15B simultaneously. Given the massive YoY improvement in its levered FCF yield from 0.5% in FQ1’22 to 1.7% in FQ1’23, it is not hard to assume that CRWD may easily double its yield by FY2024, once the company reports sustained net income profitability. We shall see.

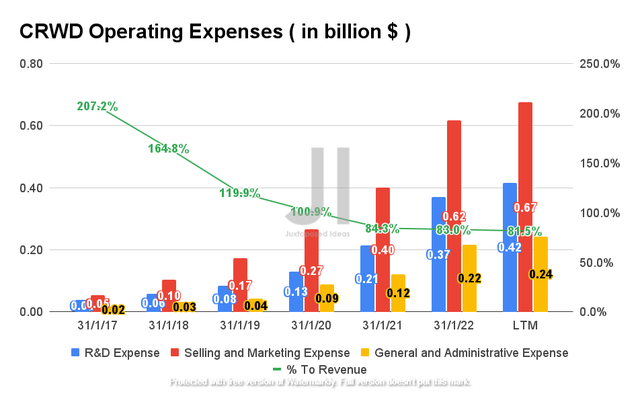

CRWD Operating Expense

Despite the COVID-19 pandemic, CRWD has been aggressively growing its operational expenses in the past two years, with $1.33B of expenses in the LTM. However, it is evident that the company has been prudent in its capital management as well, given the moderated percentage of its growing revenue at 81.5% in the LTM, compared to 100.9% in FY2020 and 119.9% in FY2019.

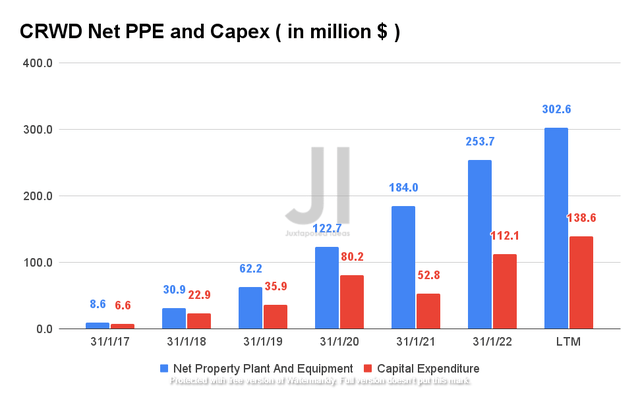

CRWD Net PPE and Capex

In the meantime, CRWD has also been increasing its Capex investments over time, with a total Capex of $138.6M and net PPE assets of $302.6M in the LTM. Nonetheless, these growing investments in its capabilities are essential for the company’s growth, since they would directly contribute to its top and bottom lines moving forward. In addition, we are not overly concerned, given its positive FCF generation, strong cash and equivalents on its balance sheet, and the projected net income profitability by FY2023.

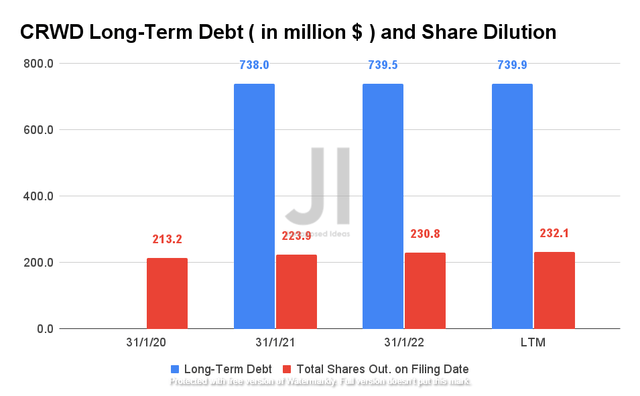

CRWD Long-Term Debt and Share Dilution

CRWD has also been evidently careful in its capital management, despite the lack of net income profitability thus far. The company had refrained from massive debt leveraging and share dilution in the past two years, despite the exponentially growing operational expenses and capital expenditures. CRWD also reported a relatively modest share-based compensation (SBC) of $309.9M in FY2022, representing an increase of 207.1% YoY. Assuming a similar rate, the company would report a total of SBC expenses at $409.6M for FY2023, based on $102.4M of expenses in FQ1’23. It would represent an apparent deceleration in SBC expenses of 32.1% YoY.

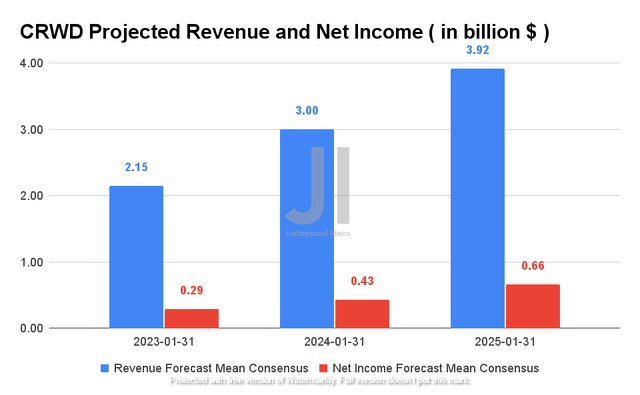

CRWD Projected Revenue and Net Income

Over the next three years, CRWD is expected to report revenue growth at a CAGR of 39.31% and net income at a CAGR of 50.86%. For FY2023, the company guided revenues in the range of $2.19B to $2.205B against consensus estimates of $2.15B and net income profitability at $0.29B. Its FQ2’23 guidance looks excellent as well, with revenues in the range of $512.7M to $516.8M against consensus estimates of $509.9M. Its net income profitability is also expected to improve over time, with a projected net income margin of $13.1% in FY2023 to 16.8% in FY2025.

In the meantime, we encourage you to read our previous article on CRWD, which would help you better understand the company’s updates from its previous investor briefing.

- CrowdStrike: What You Need To Know From Its Investor Briefing

So, Is CRWD Stock A Buy, Sell, or Hold?

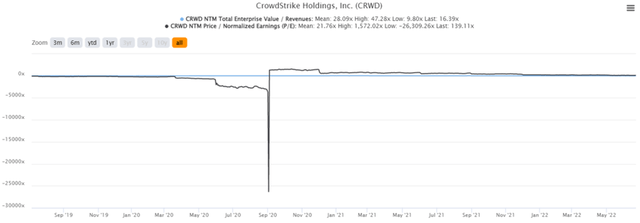

CRWD 3Y EV/Revenue and P/E Valuations

CRWD is currently trading at an EV/NTM Revenue of 16.39x and NTM P/E of 139.11x, lower than its 3Y EV/Revenue mean of 28.09x though massively elevated from its 3Y P/E mean of 21.76x. The stock is also trading at $175.90, down 41.4% from its 52 weeks high of $298.48, though at a premium of 34.5% from its 52 weeks low of $130. Despite its excellent FQ1’23 earnings call on 02 June 2022, CRWD had also traded mostly sideways in the past three weeks. Gone were the days of the stock rallies post-earnings calls with excellent performance and guidance.

CRWD 3Y Stock Price

Though consensus estimates still rate CRWD as an attractive buy with a price target of $238, with a 36.08% upside, we recommend patience for now. Given the bearish market sentiments, there is a strong likelihood of a moderate stock retracement in the next few months as its fundamentals are uncoupled from the stock performance. As a result, we encourage patience before adding more exposure.

Therefore, we reiterate our Hold rating on CRWD stock now.

Be the first to comment