All_About_Najmi/iStock via Getty Images

Here goes another reader-inspired article and another reminder of why I love my job so much. Somehow, someway, you guys consistently keep me coming back with great material.

This time, that’s thanks to 50ofDiamonds, who posted on my recent piece “I’m Rooting for a Recession”:

“Personally, I am not rooting for a recession, because we are already in one. 🙂

“Gas prices fell under $5 today. Retail malls are empty, while airports are full. Experience vs. luxury goods.

“I hope [the] Fed finds a way to land softly (i.e. control inflation with little or no impact to unemployment rate…

“My 1c.”

To which I replied:

“I put $100 in my wife’s car last night… painful at the pump… cost of living at an all-time high… but I know that the biggest lesson learned from all previous recessions is…

“Cash Is King! (The title to my next article.)”

That was the original inspiration for this latest writeup. Though I also have to give credit to cowen54 for remarking:

“Rooting for a recession and preparing for and taking advantage of a recession are two different things. Remember that not everyone is an investor, and those that are not are the ones most often hurt by a recession.”

It inspired me to add:

“I will include some lessons learned from ‘the great one’… Plenty of battle scars to prove my point ;)”

Those battle scars are mine, in case you didn’t know.

Building Better Out of the Ashes

I wanted to include cowen54’s criticism because, yes, it’s very important to recognize the human cost of a recession. It’s not easy to handle for most people, and I don’t say that lightly.

My regular readers know that I lost almost everything in the housing crash of 2008. I was a commercial real estate developer, owner, and landlord at that point. So you’d better believe I paid dearly for that occupation.

I paid even more dearly for my bad positioning with my focus on fast gains instead of sustainability. That and too little savings paired with too much spending.

But guess what?

I ultimately took advantage of my severely depleted situation to build myself back up with a more secure blueprint…

A stronger foundation…

And better materials…

Rooted in intellectual property, instead of real property.

The results have been exceptional, as my multiple iREIT on Alpha portfolios continue to showcase year in and year out. So, with the power of hindsight, I very much appreciate the last intense recession we had.

It’s that experience and the lessons I learned from it that made me craft that recession title.

With that said, “Rooting for a Recession” was also a bit tongue in cheek. If it was actually up to me, I wouldn’t cause a downturn.

But if one is inevitable – and there is always one around the corner. It’s just a matter of how soon – then I aim to make the most of it.

“Cash Is King” Is More Than Two Years Old Now!

The last recession, caused by the Covid-19 shutdowns, was brutal. To quote CNBC:

“The Covid-19 recession is in the books as one of the deepest – but also the shortest – in U.S. history, the official documenter of economic cycles said Monday.

“According to the National Bureau of Economic Research, the contraction lasted just two months, from February 2020 to the following April.

“Though the drop featured a staggering 31.4% GDP plunge in the second quarter of the pandemic-scarred year, it also saw a massive snapback the following period, with previously unheard-of policy stimulus boosting output by 33.4%.”

Of course, that recovery was very dependent on who you were and what you did. As cowen54 noted, it’s the less privileged who tend to suffer the most in such downturns.

That’s why we had repeated rounds of stimulus sent out and why so many small businesses shut down anyway.

You probably also remember how poorly commercial real estate did. While the housing market boomed, offices and malls were shuttered. And every single hotel real estate investment trust (REIT) in the U.S. had to suspend its dividend.

Because you can’t pay anything out when you’re not taking anything in.

But it was in the midst of that mess – on March 19, 2020 – that I wrote:

“Bad times should always be at least somewhat expected. That’s part of the reason why REITs are generally such good holdings. They go up slowly but steadily over time, a track record that makes them safe havens during most market downturns.

“Admittedly, they’re still suffering in most of the market-wide selloffs we’re seeing now. But that doesn’t mean they won’t fully recover, just as long as they have enough cash on hand.

“The more, the better.”

And that’s how The Durable Income Portfolio was born.

Cash Is King Pick #1 – Prologis

When it comes to REITs flush with cash and strong cash flows, you have to mention Prologis, Inc. (PLD). It’s the premier industrial REIT on the market today, with one of the largest market caps as well.

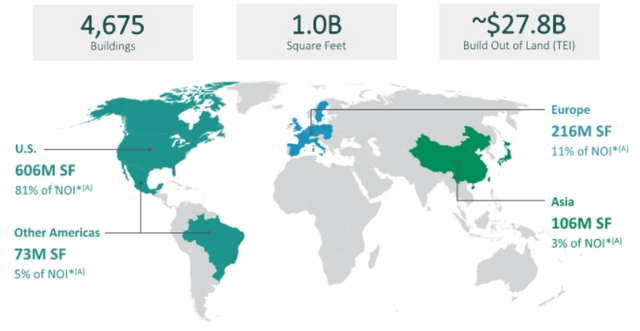

Prologis has a portfolio of 4,675 buildings consisting of 1 billion square feet of leasable space. They’re leased out to roughly 5,800 customers across the globe.

The majority of PLD’s portfolio is located in North America, amounting to 81% of net operating income. But it also has a strong footprint in Europe as well, which made up 11% of NOI.

(PLD Q1 Investor Presentation)

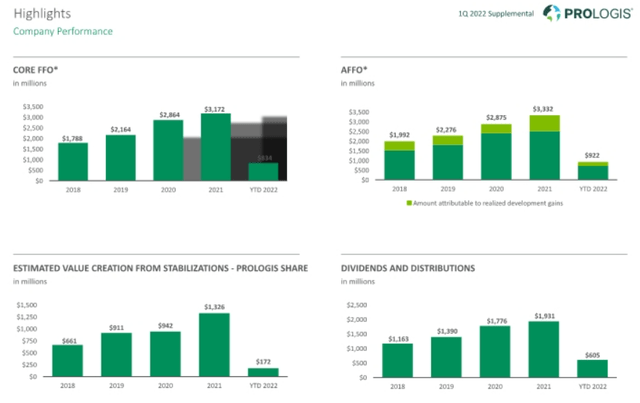

Either way, PLD continues to create value for its shareholders as it continues to expand and become more efficient. This shows through its core funds from operations (FFO) and adjusted FFO (AFFO). They’ve led to larger and more consistent dividend increases over the years.

Look at the progress PLD has made over the past few years:

(PLD Q1 Investor Presentation)

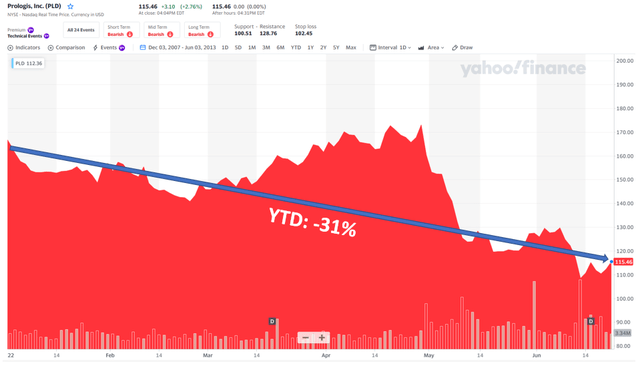

Through the end of April, PLD shares had been on a roll. Quite frankly, it was trading at an extremely rich valuation.

iREIT on Alpha mentioned this a number of items, cautioning members that the valuation was just too rich at the time.

Since then, however:

- The market as a whole has slipped into a bear market.

- Amazon (AMZN) made a few comments about having too much industrial space.

- The company entered into an agreement to buy Duke Realty (DRE).

That put tons of pressure on PLD, providing investors a much more intriguing entry point. Shares are down over 30% on the year and nearly 35% from their 52-week high.

(Yahoo Finance)

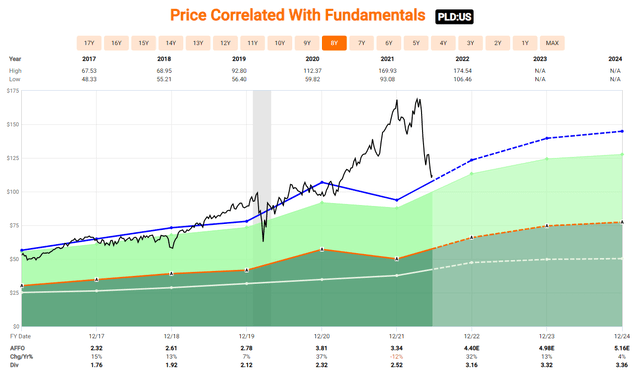

PLD currently trades at a forward price-to-AFFO of 23.2x 2023 projected earnings. Over the past five years, shares have traded at an average 28.1x, suggesting they’re very undervalued.

The company maintains an A- rated balance sheet, which should further provide investors with comfort if we do fall into a recession.

PLD yields a 2.81% dividend with a five-year dividend growth rate of 10.5%.

(Fast Graphs)

Cash Is King Pick #2 – Digital Realty Trust

Our next cash-flowing REIT comes from a subsector with a long demand runway. Digital Realty Trust, Inc. (DLR) is one of the largest data-center REITs on the market today, providing cloud and carrier-neutral data center, and interconnection solutions.

The company has 291 data-center facilities across 25 countries on six continents, making it a global giant in the space.

The portfolio consists of 35.8 million square feet and has 8.1 million square feet under development. Another 2.6 million square feet is being held for future development.

Even before the shutdowns, companies were more and more looking to have data readily accessible. Add in today’s work-from-home trend, and there’s even more pressure on companies to digital.

Which means more demand for data centers.

DLR’s top tenants include technology giants like:

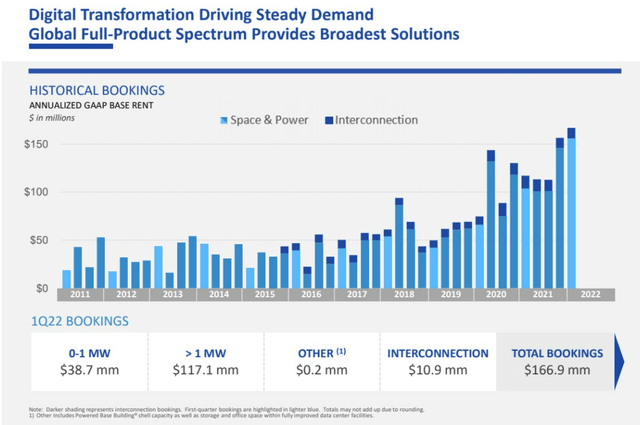

As such, last full quarter’s revenue grew 3.4% year-over-year to $1.1 billion. And sales growth is expected to move higher from there due in part to PLD’s record Q1 bookings.

Its backlog grew from $346 million in Q4-21 to $395 million in Q1-22, a 14% increase.

(DLR Q1 Investor Presentation)

Regardless of whether the U.S. falls into a recession, the demand and the need for data centers will remain. And DLR’s specific BBB balance sheet hardly hurts either.

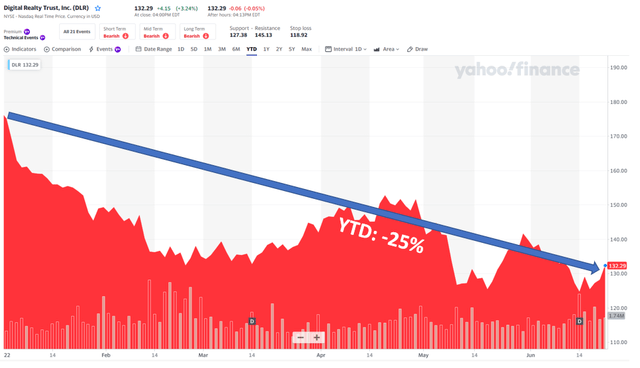

(Yahoo Finance)

Yet year-to-date, shares are down 25% after hitting a 52-week high at 2021’s close.

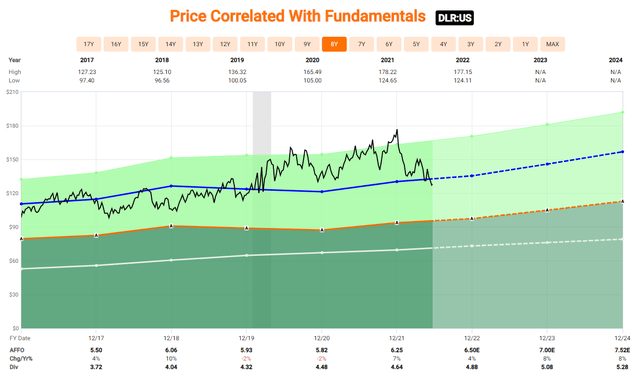

Analysts expect DLR to deliver AFFO of $7 in 2023. That means it’s trading at a forward p/AFFO multiple of 18.9x.

Over the past five years, shares have traded at an average 20.9x… suggesting this blue-chip REIT is discounted.

(FAST Graphs)

DLR yields 3.8% and has been increasing its dividend for 17 consecutive years now. Over the past five, the dividend has grown at an average annual rate of 5.6%.

Cash Is King Pick #3 – Realty Income

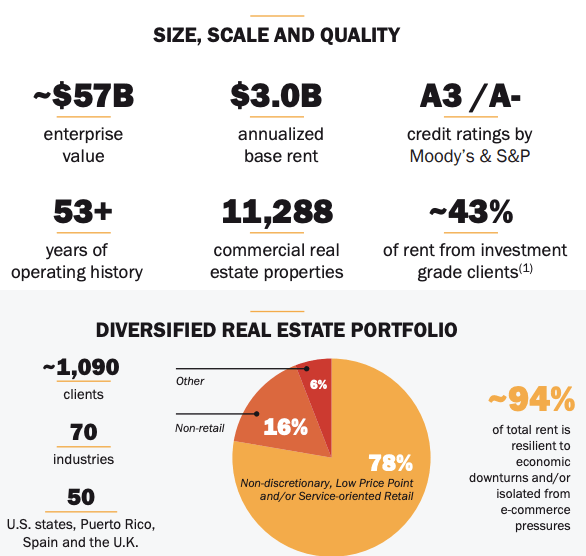

If cash is king, then crown Realty Income Corporation (O), which was founded in 1969 and went public in 1994. Its strong cash flows help fuel the monthly dividend investors enjoy.

Just check out these stats:

- Over 11,200 properties

- 1,090 different clients within 70 different industries

- Global portfolio with properties in the U.S., U.K., and Europe

There’s a reason why the self-branded “Monthly Dividend Company” is so attractive. Plenty of them, in fact.

(Realty Income Investor Presentation)

Realty Income has a strong reputation within the REIT community. It’s one of the most well-known around, but arguably one of the greatest as well.

Led by a strong management team, with CEO Sumit Roy at the helm since October of 2018, it’s maintained a fortress balance sheet backed by an impressive A- credit rating. That allows for very favorable debt whenever the company acquires a new property.

And, boy, but has it been acquiring with that extremely low cost of capital.

A common thing I hear come up when investors discuss REITs is how they’re a “poor investment during periods of rising interest rates.”

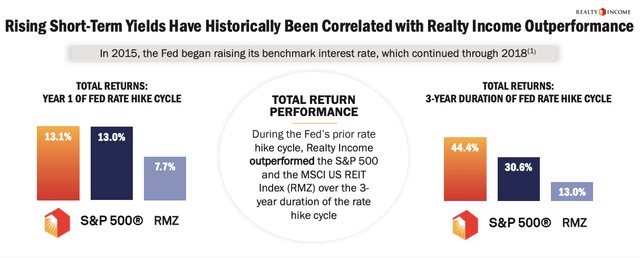

Well, this REIT exists to debunk that myth. In 2015, the last time the Federal Reserve entered a period of rising rates – which lasted for three years – Realty Income shares went toe-to-toe with the S&P 500 in the first year.

Fast-forward to the third year, and you can see how O handily outperformed the S&P 500 by 14 percentage points.

(Realty Income Investor Presentation)

Realty Income Continued…

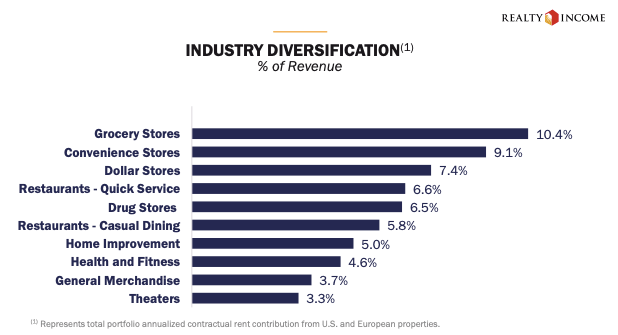

Investors are also concerned about a slowing economy that could dip into a recession. In which case, I have to point out Realty Income again.

Looking at its portfolio diversification by industry, you can see that its highest exposure is to necessity-based businesses.

(Realty Income Investor Presentation)

And Realty Income’s top three tenants based on annualized base rent are as following:

- Walgreens (WBA) – 4.0%

- 7-Eleven (OTCPK:SVNDY) – 3.9%

- Dollar General (DG) – 3.9%.

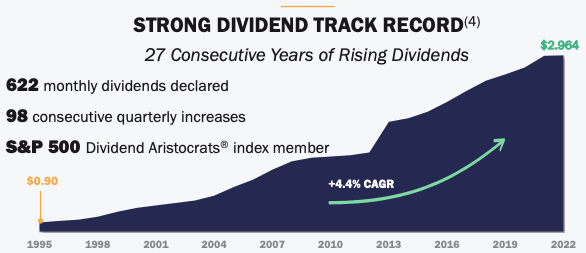

All around, it’s a very diversified REIT built to withstand any economic backdrop. This has been tested over its 50+ year existence… which includes a 25-year dividend-growing streak.

And counting, making Realty Income a dividend aristocrat.

About a week ago, the company announced its 624th consecutive monthly dividend at $0.2475 per share. Plus, it’s increased that payout 115 times since listing in 1994.

Here’s a look at the company’s strong track record over the years:

(Realty Income Investor Presentation)

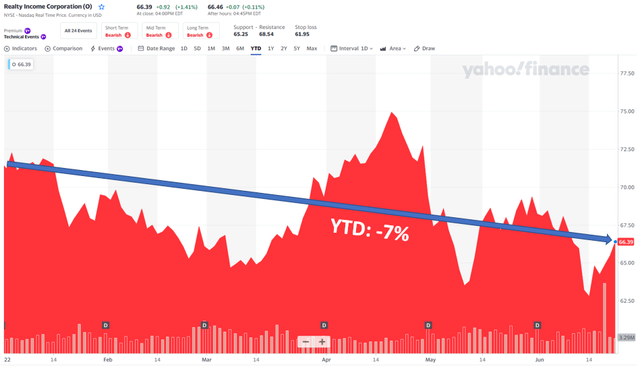

Year-to-date, shares of O are down only 7%. Compare that to the S&P 500 and Vanguard Real Estate Index Fund (VNQ), which are both down 22%.

(Yahoo Finance)

O currently trades at a forward (2023) p/AFFO multiple of 16.4x. This is well below its five-year average of 20x, once again suggesting shares are undervalued.

Realty Income is about as consistent as they come. Investing in it means investing in a total return machine backed by a strong portfolio of properties leased out to investment-grade tenants.

And on top of all that, you get one of the best REIT management teams around.

In Conclusion…

In case you missed it, I wrote a controversial article recently titled, “Warning: Do Not Chase Yield.” In it, I said to ask yourself, “Is the thrill of victory worth the agony of defeat?”

Remember that a REIT that yields 10% almost always means investors expect very low growth, or – even worse – a potential dividend cut. So we tend to avoid those suckers at all costs.

At iREIT on Alpha, we’re able to forecast quarterly results within one or two cents. That’s because of the stability and predictability of REIT’s operating cash flows, rents, built-in-increases, and real estate operating costs.

We also recognizing that high-quality REITs – like the ones referenced in this article – can expect to have good access to capital during most market cycles. REITs thrive when they create real economic value for shareholders. And that value is created when they invest capital at rates of return that exceed their costs of capital.

After all, as the title to this article suggests, “Cash Is King.”

Be the first to comment