Pgiam/iStock via Getty Images

*** This report was published to members of Yield Hunting on June 12th. All data herein is from that date.***

Macro Picture

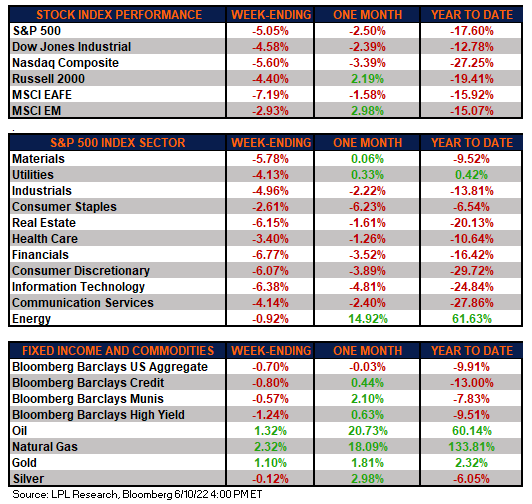

Another hotter than expected inflation report was released on Friday and it sent stocks spiraling lower. For the week, the S&P 500 fell over 5%, in line with the other averages. The MSCI EAFE fell the most dropping -7.2%. EM stocks fared the best at -2.9%. Recession risk is clearly on the rise. What was once a 1-in-4 chance of happening looks better than 1-in-2 at the moment.

All sectors were in the red with energy doing the best only falling 0.9% while technology and financials were the worst with declines of -6.4% and -6.7%, respectively. Oil prices climbed for most of the week before dropping on Friday.

The week started out on the weak side after Target (TGT) guided profit estimates lower for the second time in three weeks. The company said inventory was building up in many categories due to a ‘falling out of favor’ with consumers. The retailer is now forced to discount them reducing revenue. They are also cited higher transportation and energy costs as a driver for the reduced outlook.

The much-hyped CPI report for May didn’t disappoint. The headline number (which includes food & energy) showed prices moved up 1.0% m/m or +8.6% compared to the prior year. That topped the estimates which were looking for +8.3%. Excluding food & energy inflation was +6.0%, also higher than expected.

At the same time we are starting to see jobless claims tick higher in what may be a precursor to indicators showing a recession as started.

Meanwhile, over at the Fed, we saw rate expectations (Fed Funds expectations) move significantly higher. We also saw the 2-year yield rise significantly indicating a higher expected movement by the Fed vis a vis’ rates.

lpl

CEF Market Review

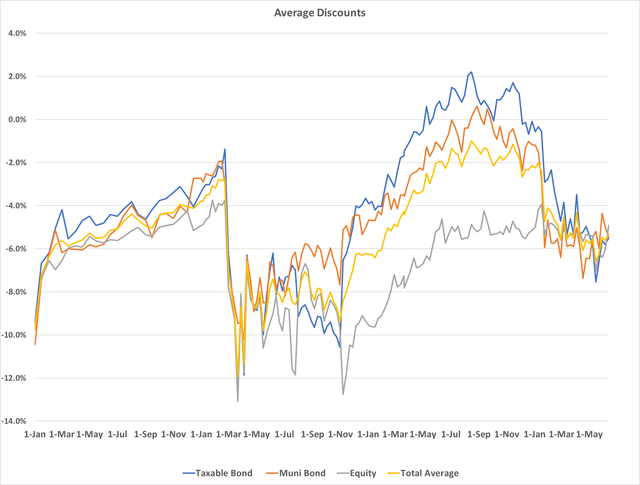

CEF discounts continue to meander without direction for most of the last few months (outside of the mid-May one-week swoon). Taxable bond discounts at -5.5% are no different then where they were back in mid-April with little variation outside of that one week. Muni bond discounts widened a bit in the last two weeks (which is not surprising given what rate expectations did this past week) but are still well off their lows at -5.5%.

Between NAVs and prices, we are heading back to the mid May lows and have retraced about half of the gains realized since then. We called it a dead-cat bounce or a bear market rally then and it appears to be turning out to be one.

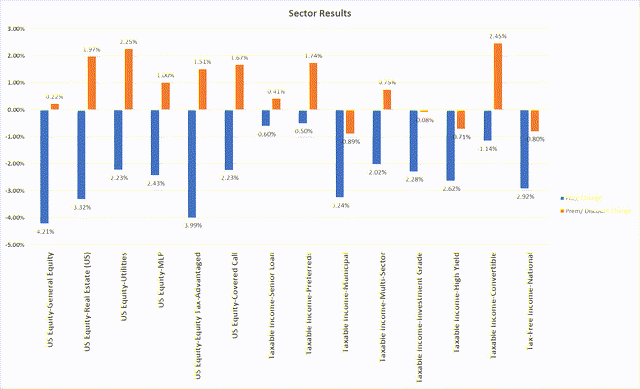

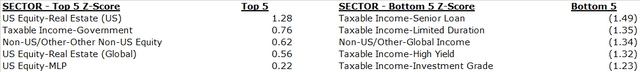

The below chart shows sector results for the week which were dismal for the income category. The best performing categories on NAV was the senior loan category, limited duration, mortgages, and energy but they were still down on the week. The worst categories were real estate (I would sell everything I owned in this sector [already did]), utilities, and dividend equity.

A few sectors saw discounts close ‘the bad way’ with price not falling as much as NAV. Those included convertibles, utilities, and real estate.

In terms of valuations, senior loans are the cheapest followed by Limited Duration and Global Income. High yield and Investment grade round out the top 5 cheapest sectors.

On the most expensive side: real estate, non-US equity, real estate, and MLPs are at the top of the list.

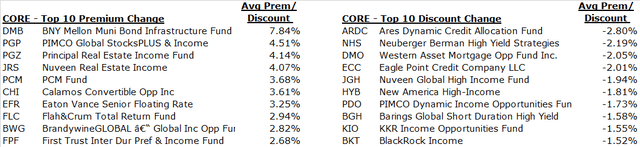

In Core funds, we saw some decent movement to the upside last week (i.e. some funds really closing discounts) but the discount change to the downside was quite muted.

Ares Dynamic Credit Allocation (ARDC) tops the list of “Core” funds that saw the most widening at -2.8% on the week. The fund had been closing its discount over the prior few weeks but reversed that last week and ended at a -10.3% spread with a 8.93% yield. The fund is ok here if you think we’re not going into recession.

Another was Western Asset Mortgage Opp (DMO) which is now at a -12.4% discount and 10.6% yield (not covered). The NAV trend on this fund looks good compared to most of the fixed income CEF market. The discount is extremely compelling.

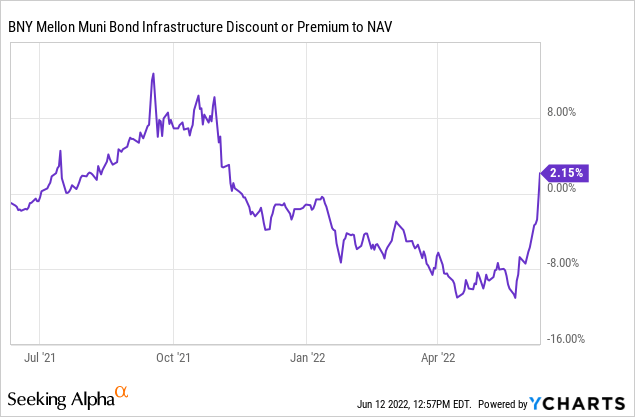

On the opposite end, BNY Mellon Muni Bond Infra (DMB) saw its valuation rise by 7.84% in the week! That’s an incredible move for a muni CEF. More below.

We haven’t mentioned Principal Real Estate Income (PGZ) in some time. This is a real estate-focused fund that invests mostly in cMBS and some REITs. The discount is typically in the double-digits but has since improved to -9.4% on a bit of a rally that last couple of weeks. I unloaded a small position I had in it as I continue to dislike the real estate sector.

In the last week, we saw Nuveen Municipal Credit Income (NZF) absorb the much smaller, Nuveen Municipal Value (NEV). NZF is currently a buy on the muni core tab at a -9.6% discount and a 5.43% yield. There’s an error in CEFConnect that shows the yield lower than it really is, which could be causing some of the selling pressure. As CommishJW put it, “You were a NEV shareholder and then you see this new fund in your account, NZF. You look it up in CEFConnect and it shows a much lower yield so you go and sell it.”

But the yield is solid.

I continue to make rotational trades in my muni portfolio to take advantage of the valuation differentials. In the past week, I sold out of Invesco Muni Income Opp (OIA) because the sell flag was triggered having reached a +6.8% premium. I rotated that capital into NZF.

BNY Mellon Muni Bond Infra (DMB) was another fund we discussed recently in our Muni Update as one of the best buys out there. It has since run up going from a more than -8% discount to a +2.1% premium.

ycharts

I also sold and rotated that capital, mostly to NZF, and the rest to MVF, a high quality Blackrock fund that yields 5.35% and trades at a -9.1% discount.

One of our “go to” funds, Mainstay MacKay Shield DefTerm Muni (MMD) did what we all expected them to do, file papers in order to switch from a term fund to a perpetual. The fund is slated to liquidate on December 31, 2024 but the fund filed an amendment to the trust declaration to move to a perpetual fund. The release also has a tender offer for up to 100% of the shares at NAV.

But the filing is a bit tricky as it includes a provision to liquidate should the tender be successful enough that the fund is left with less than $200m in total assets. Following the tender, the fund would switch to a perpetual fund.

With the shares typically trading at a premium to NAV, or a very small discount, the chances of shareholders tendering at this point is low. Mainstay knows this which is why this sweetener to convert to a perpetual fund is not really that sweet. The only chance it has of liquidating would be if the muni CEF market blew out and the fund moved to a decent discount. Mainstay is taking that risk.

In some respects, it is a put for the MMD shareholder at this point. If the muni CEF market remains “ok” then they won’t tender and the fund simply changes to a perpetual. Nothing really happens for the shareholder. If the market blows up and the fund is at something like a -6% or greater, then the chances are that shareholders would vote to tender to capture that 6%. Under that scenario, the fund could see assets fall below $200m and the fund would have to liquidate.

We also have hedge fund and CEF activist firm, Saba, starting to make some moves. They’ve been accumulating shares of several funds and created some fairly large stakes but haven’t taken any actions to date.

In the Templeton Global Income Fund (GIM) they hold over 32.3m shares out of a possible 102.8m (31.4%) outstanding. They then pushed for their trustees to be on the board nominating four new members. Preliminary results were released last week showing those four new members won their elections and they now have a majority of the seats (8 of 11).

The question is, what happens next?

The best outcome would be a total liquidation of the fund but I put a low probability on that result. The most likely outcome would be a large tender offer of more than 30% of the outstanding shares.

That would mean you would capture an 8%+ cap gain on about 40% of your position. The question then becomes what happens to the remainder. The discount would likely widen out to double-digits at that point. The upside is A) how much does it widen out, and B) does it tighten enough to make a 3-4% gain in short-order on the entire position whereby you could just sell out?

I’ll be watching the shares and may initiate a buy if I can get them at a near double-digit discount.

We also had the Cornerstone funds’ (CLM) rights offering expire on Friday. No preliminary results have been released yet. We should get them some time this week.

Next Week:

Commentary

With short-term rates rising sharply this past week due to the inflation report and other factors, we once again highlight the risks in this market for CEF investors.

Federated Premier Municipal Income (FMN) reduced its distribution by a massive 24%. Prior to the reduction, the fund had coverage of 94% and UNII was at +5.0c. If you were to just look there you would say that this fund had little chance of cutting the distribution.

However, that underscores the environment we are currently facing. In the release, they stated:

The reasons for this change include but are not limited to the maturities of higher income-earning holdings, reinvestment at the lower yields, an upward shift in portfolio credit quality, the anticipated increase in leverage costs linked to rapid tightening by the Federal Reserve and the fund’s reduction in its outstanding leverage.

The fund reduced its preferred shares by $25 million, lowering the fund’s effective leverage from approximately 42.8% to approximately 36.8%. This reduction in leverage is intended to decrease volatility of the fund’s net asset value as market interest rates fluctuate. This reduction in leverage also contributes to the decline in the fund’s dividend to common shareholders.

So FMN decided to take mostly proactive actions to reduce the distribution due to the impending higher leverage costs that are starting to affect all leveraged funds. Not only are they seeing higher costs associated with their leverage but they reduced their leverage at the same time compounding the issue.

What that means if that if they have $25m less in muni bonds in the portfolio, that is approximately $1m in less net investment income or earnings that the fund generates to support the distribution.

We have been telling members that large reductions in muni CEF distributions were coming. This is an example of that. We expect to see many more of these down the road.

But in these actions comes opportunity. Investors are likely to continue to sell off FMN given the large reduction in income they are facing. So far, the fund has seen its discount widen by just over 1% since June 9th. I would expect the discount to continue to widen over the next couple of weeks, especially since the new yield of 4.1% is so low.

If the yield rises from discount widening to approximately 4.5%, then the fund would be relatively attractive. Another cut at this point in 2022 would be unlikely unless drastic events took place. You would have a bit of distribution safety not present in most other funds and that is worth something.

We continue to favor higher quality, defensive positioning in our income portfolios as credit spreads remain fairly tight. If we see a recession, those credit spreads are highly likely to blow out dealing significant damage to credit NAVs like high yield, loans, and multisector portfolios. This market is simply not priced for one happening though those risks continue to rise.

The most likely outcome over the next year is that the Fed overtightens because they were caught behind the 8-ball, and this causes a recession. This is our base case at the moment although the market isn’t currently priced for this.

If we do see this kind of outcome, we would stay very high quality, longer-duration. That would mean high-quality investment grade corporates, agency MBS, investment grade munis, and perhaps high-quality preferreds.

If we don’t enter a recession but continue to see high inflation and low-growth, we would look to be in higher-quality floating rate securities. That can be in the form of senior loans but we would stay away from CLOs and other lower-quality assets. Instead, be in BBB and BB loans with low leverage.

In other words: low duration, higher-quality.

If the Fed is able to thread the needle and guide the economy in for a soft landing, then the investment outlook would change dramatically. Here it would be safe for investors to own junkier assets as the economy would continue to grow and financial conditions would remain fairly loose since the Fed would not have to tighten as much as projected. Inflation would have to come down to a manageable level so that the Fed would feel comfortable not continuing to raise rates.

Here, we would want to invest in mostly high yield bonds, CLOs, and perhaps some senior loans as well. But in a soft landing type of environment, it is likely that short-term rates wouldn’t rise as much as projected which would mean loans wouldn’t see the types of coupon resets predicted in a higher persistent inflation scenario.

We continue to favor/lean towards the ‘harder landing’ outcome which means keeping some dry powder and staying higher quality, likely outside of the CEF structure whenever possible to avoid leverage and further discount risks.

CEF News And Corporate Actions

Distribution Increase

Blackstone Long-Short Credit Income (BGX): The fund increased the distribution by 8.22% to $0.079

Blackstone Sr Floating Rate (BSL): The fund increased the distribution by 4.2% to $0.074

Blackstone Strategic Credit (BGB): The fund increased the distribution by 3.1% to $0.067

Distribution Decrease

Federated Premium Muni Inc. (FMN): The fund decreased the distribution by a whopping 24% to $0.041

Liquidating Distribution

Nuveen Muni Credit Inc. (NZF): Distribution amount of $0.0549

Merger Completed

Nuveen Muni Credit Inc. (NZF) completed the merger with Nuveen Muni Value (NEV) on June 6th. The exchange ratio was 0.93046184.

Tender Offer

MS China Fund A (CAF): The fund announced that the board approved a conditional tender offer for up to 25% of the outstanding shares at a -1.5% discount to NAV.

-

The fund announced today that its Board of Directors has approved a performance-related conditional tender offer to acquire in exchange for cash up to 25 percent of the Fund’s then issued and outstanding shares at a price equal to 98.5 percent of the Fund’s net asset value per share (“NAV”) (minus the costs and expenses related to the tender offer) as of the close of regular trading on the New York Stock Exchange (“NYSE”) on the business day the offer expires (a “Tender Offer”). The Fund will conduct such a Tender Offer only if both (1) the Fund’s total return investment performance measured on a NAV basis does not equal or exceed the total return investment performance of the Fund’s benchmark index, the MSCI China A Onshore Index, during the three-year period commencing on July 1, 2022 and ending on June 30, 2025 (and for the term of successive five-year periods thereafter commencing July 1, 2025), and (2) the Fund’s shares are trading at or below NAV at the conclusion of the applicable measurement period, with such Tender Offer occurring on or before September 30, 2025, and thereafter on each five-year anniversary of September 30, 2025. If the Fund’s performance described above equals or exceeds that of the MSCI China A Onshore Index during any such period or if the Fund’s shares are trading at a premium to NAV at the conclusion of the applicable measurement period, no Tender Offer will be conducted for that period.

Mainstay Mackay Shield DefTerm Muni (MMD): The fund announced a tender for up to 100% of shares at NAV. Further details to be released. Within the release was an amendment to change the fund structure from a term set to liquidate in December 2024 to a perpetual fund that does not liquidate. The tender will allow shareholders to sell all of their shares at NAV and if the fund is less than $200m in assets following the tender, the tender will be canceled and the fund liquidated.

Be the first to comment