mladenbalinovac

What Is Med-X?

Canoga Park, California based Med-X (MXRX) was founded to grow and sell cannabis, develop and sell natural pesticides and commercial medicinal supplements based on compounds extracted from cannabis.

Management is headed by Chairman and CEO, Matthew A. Mills, who has been with the firm since inception in February 2014 and was previously Chief Operating Officer of Bidz.com.

The company’s primary offerings include:

-

Nature-Cide – natural pest control products

-

Thermal-Aid – heating/cooling packs

-

Malibu Brands – Topical homeopathic pain cream

As of June 30, 2022, Med-X has booked fair market value investment of approximately $23 million as of June 30, 2022 from investors.

According to a 2018 market research report by Allied Market Research, the global organic pesticide market was an estimated $99.2 billion in 2016 and is forecast to reach $279 billion by 2023.

This represents a forecast CAGR of 14.0% from 2017 to 2023.

The main drivers for this expected growth are a desire by consumers for fewer toxic sources of chemicals in their food and personal products.

Also, while North America has historically represented the highest market share, the Asia Pacific region is expected to “dominate the market by the end of 2023.”

Major competitive or other industry participants include:

-

Bayer

-

Ecolabs

-

Envincio

-

Essentra

-

Monsanto

-

DuPont

-

DOW AgroSciences

-

Certis USA

-

Others

Med-X also sells to consumers in the personal pain control market via its cooling/heating packs and pain cream.

Med-X’s IPO Date and Details

The initial public offering, or IPO, date for Med-X has not yet been disclosed by the company.

(Warning: Compared to stocks with more history, IPOs typically have less information for investors to review and analyze. For this reason, investors should use caution when thinking about investing in an IPO, or immediately post-IPO. Also, investors should keep in mind that many IPOs are heavily marketed, past company performance is not a guarantee of future results and potential risks may be understated.)

Med-X intends to raise $7 million in gross proceeds from an IPO of its common stock, offering approximately 1.7 million shares at a proposed midpoint price of $4.15.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Post-IPO, Chairman and CEO Mills will have voting control of the company.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $75.2 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 8.6%. A figure under 10% is generally considered a ‘low float’ stock, which can be subject to significant price volatility.

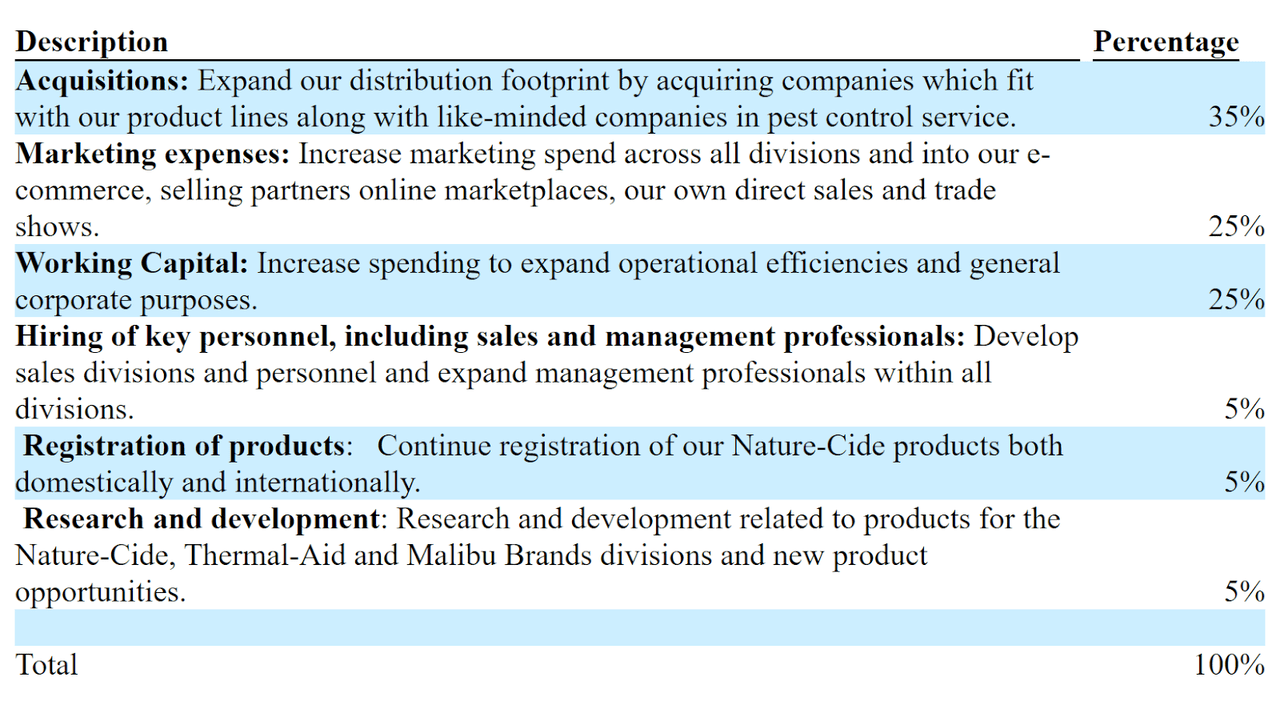

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of IPO Proceeds (SEC EDGAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm “is not involved in any legal proceeding, claims and litigation arising in the ordinary course of business.”

The company has entered into a $100 million Share Purchase Agreement with Gem Global Yield and may choose to sell stock at any time. If management chooses to sell shares to Gem Global Yield, this will have the effect of diluting existing shareholders accordingly.

The sole listed bookrunner of the IPO is EF Hutton.

How To Invest In The Company’s Stock: 7 Steps

Investors can buy shares of the stock in the same way they may buy stocks of other publicly traded companies, or as part of the pre-IPO allocation.

Note: This report is not a recommendation to purchase stock or any other security. For investors who are interested in pursuing a potential investment after the IPO is complete, the following steps for buying stocks will be helpful.

Step 1: Understand The Company’s Financial History

Although there is not much public financial information available about the company, investors can look at the company’s financial history on their form S-1 or F-1 SEC filing (Source).

Step 2: Assess The Company’s Financial Reports

The primary financial statements available for publicly-traded companies include the income statement, balance sheet, and statement of cash flows. These financial statements can help investors learn about a company’s cash capitalization structure, cash flow trends and financial position.

My summary of the firm’s recent financial results is below:

The company’s financials have produced variable topline revenue growth from a tiny base, uneven gross profit and fluctuating gross margin, higher operating losses and increasing cash used in operations.

Free cash flow for the twelve months ended June 30, 2022, was negative ($5.5 million).

Selling and Marketing expenses as a percentage of total revenue have trended higher as revenue has fluctuated; its Selling and Marketing efficiency multiple rose to 0.4x in the most recent reporting period.

The firm currently plans to pay no dividends and to reinvest any future earnings back into the form’s growth and operational initiatives.

Step 3: Evaluate The Company’s Potential Compared To Your Investment Horizon

When investors evaluate potential stocks to buy, it’s important to consider their time horizon and risk tolerance before buying shares. For example, a swing-trader may be interested in short-term growth potential, whereas a long-term investor may prioritize strong financials ahead of short-term price movements.

Step 4: Select A Brokerage

Investors who do not already have a trading account will begin with the selection of a brokerage firm. The account types commonly used for trading stocks include a standard brokerage account or a retirement account like an IRA.

Investors who prefer advice for a fee can open a trading account with a full-service broker or an independent investment advisor, and those who want to manage their portfolio for a reduced cost may choose a discount brokerage company.

Step 5: Choose An Investment Size And Strategy

Investors who have decided to buy shares of company stock should consider how many shares to purchase and what investment strategy to adopt for their new position. The investment strategy will guide an investor’s holding period and exit strategy.

Many investors choose to buy and hold stocks for lengthy periods. Examples of basic investing strategies include swing trading, short-term trading or investing over a long-term holding period.

For investors wishing to gain a pre-IPO allocation of shares at the IPO price, they would “indicate interest” with their broker in advance of the IPO. Indicating an interest is not a guarantee that the investor will receive an allocation of pre-IPO shares.

Step 6: Choose An Order Type

Investors have many choices for placing orders to purchase stocks, including market orders, limit orders and stop orders.

-

Market order: This is the most common type of order made by retail traders. A market order executes a trade immediately at the best available transaction price.

-

Limit order: When an investor places a buy limit order, they specify a maximum price to be paid for the shares.

-

Stop order: A buy-stop order is an order to buy at a specified price, known as the stop price, which will be higher than the current market price. In the case of buy-stop, the stop price will be lower than the current market price.

Step 7: Submit The Trade

After investors have funded their account with cash, they may decide on an investment size and order type, then submit the trade to place an order. If the trade is a market order, it will be filled immediately at the best available market price.

However, if investors submit a limit order or stop order, the investor may have to wait until the stock reaches their target price or stop-loss price for the trade to be completed.

The Bottom Line

MXRX is seeking U.S. public capital market funding for acquisitions and general corporate working capital needs.

The market opportunity for organic pesticides is large and expected to grow at a strong rate of growth over the coming years, so the firm enjoys positive industry dynamics in its favor.

EF Hutton is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (65.9%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risks to the company’s outlook are its unfocused business approach and tiny revenue history.

As for valuation, management is asking investors to pay an EV/Revenue multiple of nearly 54x, which is extremely high despite little revenue, heavy operating losses and high cash use.

While the IPO’s low nominal share price may attract day traders seeking volatility, it is highly speculative, so I’m on Hold for the MXRX IPO.

Be the first to comment