David Tran

Adobe (NASDAQ:ADBE) is a market leader in the creative software space as corporations increasingly deliver their content through digital platforms. Despite macro concerns, the company reported FQ3 results with revenue up 12% YoY (missed consensus by $10 million) and non-GAAP EPS of $3.40 that beat estimates by $0.06. Looking to FQ4, management expects revenue of $4.5 billion vs. $4.6 billion consensus and non-GAAP EPS of $3.50 vs. $3.47 consensus. All told, these numbers aren’t exactly terrifying considering many tech companies saw their growth rates virtually fell off a cliff in 2022. While Adobe’s business seems robust in a post-COVID environment, markets were not particularly impressed with the company’s new acquisition: Figma.

What is Figma?

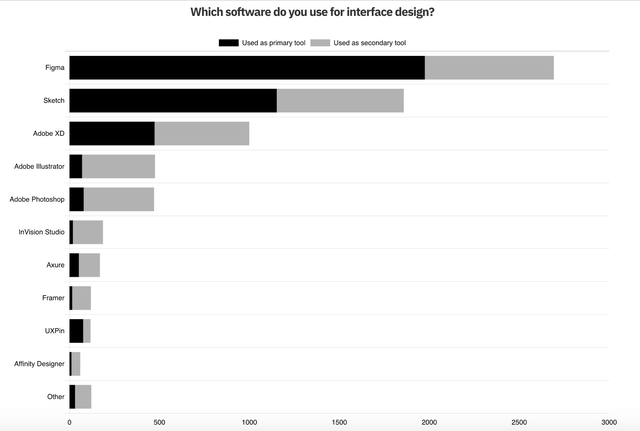

Figma is a private company that provides a web-native collaborative software for UI/UX and product design. Per a survey conducted in 2020, 66% of designers said they used Figma for UI design, an increase from 37% in 2019. The software competes with the likes of Adobe XD and Sketch in the UI/UX market. Figma is priced lower than Adobe (there’s also a free tier) and is highly popular amongst younger professionals who find it easier to use.

Adobe just announced the purchase of Figma for approximately $20 billion with half cash and half stock. This is the largest acquisition in the company’s 40-year history. Around 6 million of RSUs will be granted to Figma’s 850 employees with a 4-year vesting period after deal closure. Cash will be paid using the company’s cash on hand and a term loan if needed. The acquisition is expected to close in 2023 subject to regulatory approval and agreement by Figma shareholders.

Is $20 billion too high of a price tag?

From a strategic perspective, acquiring a fast-growing competitor like Figma makes sense as the deal will enhance Adobe’s product portfolio and help compete in the UX/UI design market. The problem, however, is the price tag and the shareholder dilution that comes with issuing more stock. Figma is expected to double its ARR to $400 million in 2022. For a $20 billion purchase price, this comes down to 50x forward sales, which is extraordinarily rich by any measure. Suppose ARR is to double again in 2023 to reach $800 million, the 2023 P/S multiple still compares lavishly to Snowflake (SNOW) – one of the most overvalued company with a 2023 P/S of 20x. Granted, the market isn’t expecting Snowflake to double its revenue in 2023 (+54%), but I find it very concerning that Adobe management would accept such an expensive deal given today’s market environment.

Adobe has made a series of acquisitions and it’s understandable that inorganic growth is necessary given the size of the company. However, the Figma deal is more than 4x larger than Adobe’s last major deal to acquire Marketo for $4.75 billion. Considering the deal size, the lofty valuation implied by the price tag, and the current macro backdrop, I believe Adobe made this move out of desperation which could raise the following concerns amongst investors:

- Is Adobe’s long-term competitive advantage is question? Are younger professionals increasingly turning to competing products that may be easier to use?

- Are acquisitions really a viable answer to addressing competition?

- Given the still intense competition from Canva and other smaller companies. What is the appetite for future acquisitions?

Further, management expects 1-2% operating margin dilution in the next 1-2 years, implying a 2-4% impact on EPS. In other words, while Figma is expected to add to Adobe’s top-line right away (+$200 million ARR in 2022), the bottom line will not be accretive until 3 years later. In a world where investors are focused more on earnings growth than ever before, I expect shares of Adobe to remain challenged without any near-term catalysts.

Thoughts on the stock

From a valuation standpoint, Adobe’s stock currently trades at ~23x forward earnings which may seem relatively attractive against its 48x peak in 4Q21 and 33x of a similar-size peer like Salesforce (CRM). While the much lower multiple today may attract some buyers to this 12-15% growth story, I believe valuation itself does not provide enough justification to own the stock as the luxurious purchase of Figma raises a number of questions around the company’s competitive position and growth outlook.

Be the first to comment