PM Images

Stocks continue to defy the bearish narrative, grinding higher yesterday on the tailcoats of better-than-expected earnings from retail heavyweights Walmart (WMT) and Home Depot (HD). The consensus on Wall Street has been forecasting a recession this year on the basis that the rise in inflation to a 40-year high would crush the consumer. Clearly, it did not consider the strength of the labor market, wage growth, or the excess savings built up during the pandemic as effective offsets to higher prices, but they have been.

Finviz

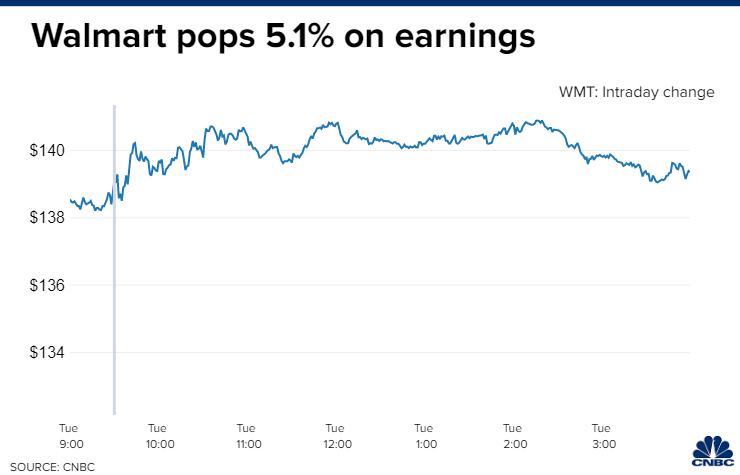

Less than a month ago, Walmart’s stock tumbled when the company lowered earnings guidance for the second quarter, as well as the rest of this year. Management blamed waning sales on inflation in a “gotcha” moment for the bears, but I asserted at that time that the shortfall was more likely a function of poor inventory management. The stronger-than-expected finish to the quarter and boost to the second-half outlook suggests my intuition was correct, as sales from Home Depot were also a homerun with investors. Consumers may be more selective in how they are spending their money, but they are still spending it, and in a turn of events the wealthy are not the only engine of growth.

CNBC

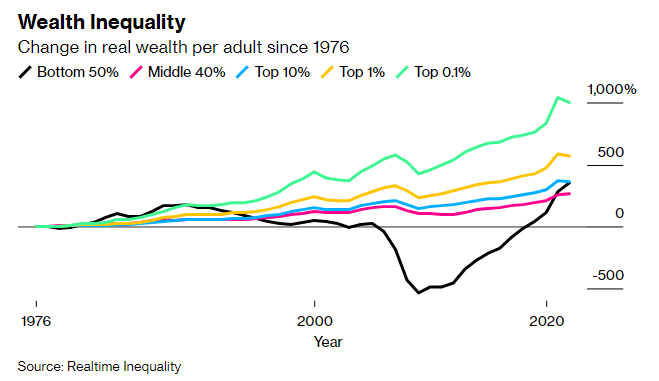

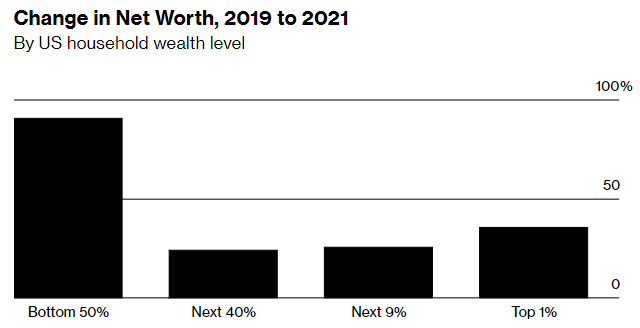

One significantly underappreciated fact about the lower-to-middle income consumer is how well they have fared during the recent inflationary environment. According to a tool developed by a trio of economists at UC Berkeley called Realtime Inequality, which analyzes more than a dozen inputs to show how growth is being distributed in the economy, the working class have seen their wealth increase over the past year, while the wealthiest households have been the losers. This is a tremendous reversal from decades past and largely the result of declining financial asset prices. The bottom 50% don’t own a lot of financial assets, so they did not suffer from the market decline. Instead, they have benefited from the strong labor market and a surge in wage growth that saw real incomes rise 5.1% through the first quarter or this year and 11% in 2021.

Bloomberg

The increase in inflation-adjusted income for lower-income workers that followed the pandemic-induced recession came from a combination of robust wage growth with several aid packages, including the Child Tax Credit, that distributed trillions of dollars to the lower and middle classes. This resulted in a much different recovery than we saw following the 2007-2009 recession, which took 10 years for this demographic to recover their pre-tax income.

This unprecedented increase in income and wealth for the working class has been the foundation for my bullish outlook for the economy, which has also strengthened my resolve that the bear market would be more shallow and shorter than most. It is also the main reason I still see a soft landing for the economy, as the Fed tightens monetary policy, as the highest probability. I think it completely undermines the bearish narrative.

NY Fed

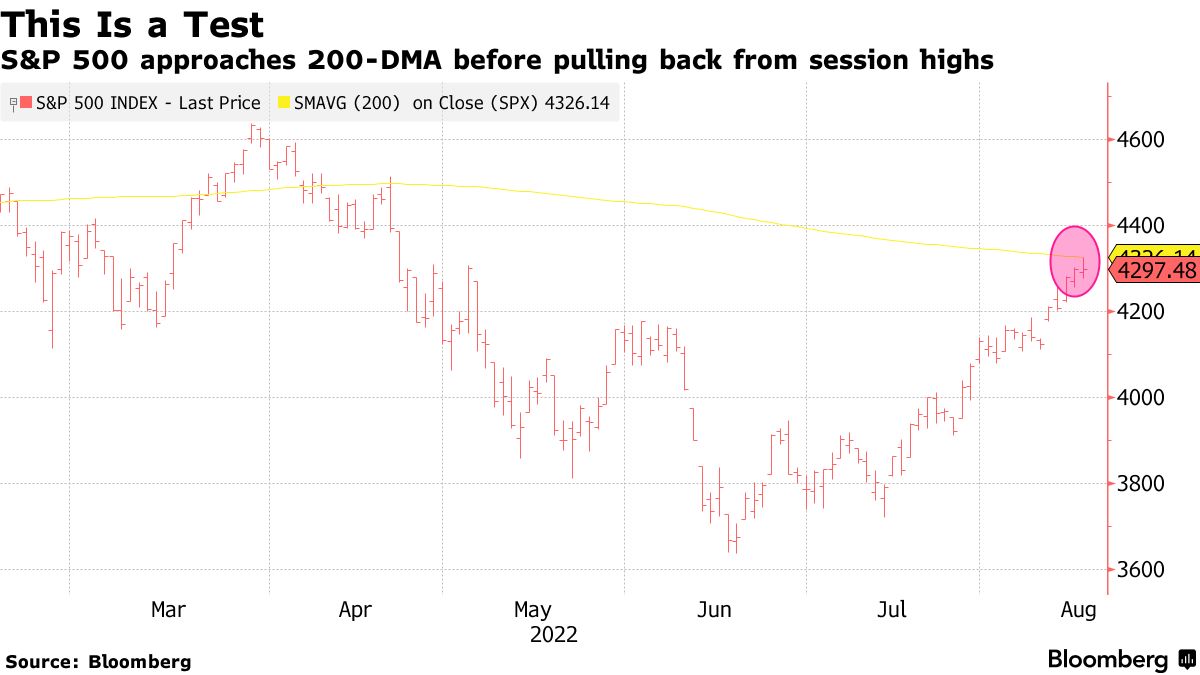

While I am optimistic about the economic outlook and confident that the bear market is behind us, I think we still need to be mindful of the headwinds intended to tame inflation. On that front, the speed and strength of the market recovery are a concern, as we have now reached the 200-day moving average for the S&P 500. The index climbed within one point of its 200-day yesterday before reversing course. This should present some overhead resistance, especially as the uncertainty surrounding the Fed’s next rate decision looms next month. At this level it may not take much in terms of an unfavorable economic datapoint or event to instigate profit taking and send stocks south. This is a good time to weed the garden for underperforming names and build some cash reserves that can be deployed into stronger ones on the next pullback.

Bloomberg

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment