Justin Sullivan/Getty Images News

The 40,000-foot view

I don’t need to rehash the obvious qualities of McDonald’s business model in great detail. Every business analyst knows them. It is a capital light franchisor, prodigiously cash generative, and extremely resistant to economic downturns. These attributes have made it a darling of quality-first investors everywhere.

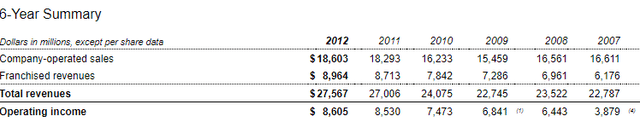

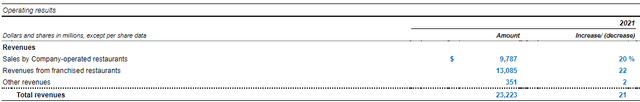

Indeed, the refranchising strategy in the last ten years has been well-executed and only served to increase the solidify those qualities, as you can see from two snips from the 2012 and 2022 10-Ks below:

Let me now veer off from the consensus narrative, though. I don’t want to pretend we are experts on the minutiae of McDonald’s operating trends, or good predictors of short-term earnings. I do think we are reasoned long-term investors with an appropriately high return hurdle in an increasingly uncertain environment.

And in absolute terms, one has to acknowledge that McDonald’s is a slow growth business. 2012 operating income – from that same 10-K – was $8.6bn. 2022’s forecast operating income, a decade later, is $9.9bn. That’s 15% growth over the decade, and substantially less than inflation over that same period.

Net income has grown faster, sure: but it has been powered by a reducing tax rate – a one off and non-recurring gain, if ever there was one – and EPS has been helped by consistent share buybacks, which have also seen the balance sheet flip from $16bn of tangible equity to $9bn of negative equity. I am not worried about the balance sheet, to be clear: but I do note that they have been optimizing. McDonald’s balance sheet is no longer lazy. Likewise, payout ratios have increased, propelling the dividend ahead of earnings growth. This is not a trend that can be sustained indefinitely, although they still have a little powder in the barrel on that front.

The vast majority of that growth was also driven by higher check sizes, a trend which has continued aggressively in the current inflationary environment. Recent systemwide sales figures are strong, up 10% in constant currencies in the latest quarter. They’re likely to remain strong in the upcoming Q3 results. But they also sit against ‘high single digit’ menu price growth, and expected inflation for the full year of double digits. Guest count growth most years is in the very low single digits, and that is predominantly driven by international markets where the chain is still expanding and population growth is more noticeable.

Is the last ten years a fair or unfair period to judge them by?

Well, my view is that this relatively modest growth rate was produced in a decade where the business has executed well. It has digitalized, producing $6bn of quarterly system sales (growing by 40% annually) from the app, delivery and kiosks. 85% of restaurants now offer delivery. Product development and loyalty programs have been effective. I think management have done a good job with the hand they have been dealt.

All of this sweat and effort has served, effectively, only to offset the ongoing consumer trends in the other direction: toward healthier eating, more varied cuisines, and toward fast-casual and higher quality food. Unfortunately for McDonald’s, I don’t see those trends abating.

McDonald’s is late in its corporate lifecycle, and it has its foot on the gas to stay still.

Where does this leave equity investors?

Buffett would tell us that there are three ways you can make money investing in common stocks:

– You can grow your net distributable cash flow

– You can distribute cash flow through dividends and share buybacks

– And you can have a change in the trading multiple of your stock

As just described, I think we can’t hold too much hope out for the first indicator. This is not a preview of Q3 earnings, to be announced next week, which strike us as unusually difficult to predict thanks to the high degree of geographic volatility, issues in Europe, exchange rate movements, and the lumpy impact of inflationary pressures.

But I would be very surprised if, in 5 years’ time, we look back and see much more than 3% p.a. EBIT growth, with a commensurate change in distributable cash flow.

That distributable cash flow is likely to produce another ~4% of annual return for investors at the current share price, roughly the inverse of the 25x FCF multiple at which McDonald’s trades.

This gives us ‘ex-multiple’ prospective shareholder returns of around 7% per annum. I consider this to be effectively the base case for McDonald’s. As I said, management have executed well in a difficult environment. I think risks in the future are skewed to the downside, particularly overseas, and currency translation effects are likely in any case to present a big headwind in the next couple of years.

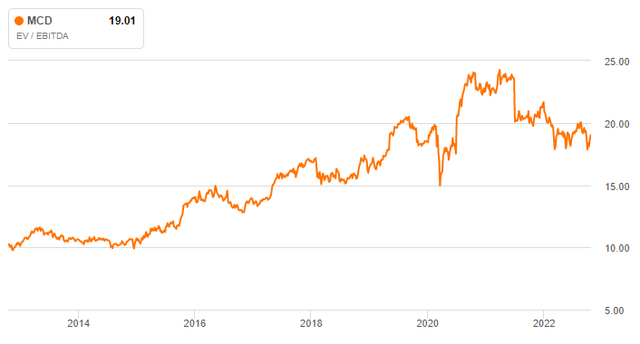

Finally, on the multiple expansion point, I present simply the following graph from Seeking Alpha’s Charting tab, which shows McDonald’s EV/EBITDA over the prior decade:

The only period with a higher valuation than today is the pandemic period, when EBITDA was artificially suppressed by store closures globally and incredibly choppy consumer demand.

In a ‘normal’ environment, this is the most expensive the stock has ever been: and by quite some margin. Note that 10 years ago the multiple was effectively half of today.

This tells us one thing: there is a lot more downside risk to valuation multiples than upside risk, particularly as risk-free rates increase. For much of the last decade, that extreme valuation level could be justified by US government bond yields at historically low levels. Now, though, we are back to rates on a par with 2008, and higher than at any point since then. The justification for paying a 4% free cash flow yield for an equity is a lot trickier when government bonds themselves yield more than that.

Looking up the cap structure

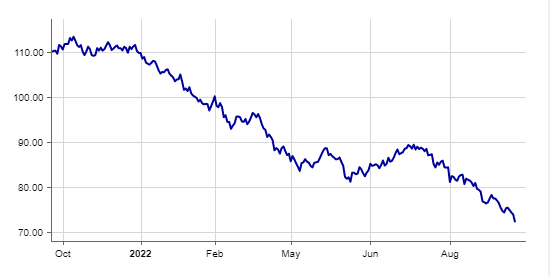

Given McDonald’s low leverage level and cash flow characteristics, I see essentially no risk to their bonds, which have been crushed year-to-date by yield compression, driven by that risk-free dynamic mentioned above.

I know many investors do not have a fixed income element to their portfolios, but as yields start to increase, we have a preference for moving the ‘lower risk’ portion of the book into fixed income securities. In our view, there is little justification to holding slow growth stocks at over 20x FCF multiples when rates are where they are.

The 2042 3.7% issue, for instance, is down 35% year-to-date, against the equity which is broadly flat:

Boerse Frankfurt

As a consequence, you can now get a 6.3% contractual yield-to-maturity on some of the safest paper you will find on the market. If 2042 sounds like a lot of duration, remember that the stock is trading at 26x FCF.

Compare that to my expected 7% return on the equity, with a huge amount of downside risk from potential multiple contraction. There’s just not enough meat on the bone.

Even much shorter duration paper – like the 2026 bond – yields 5.4%, for corporate bonds almost as close to risk free as you’ll find.

Conclusion

The market is gifting us an opportunity to shift out of lower growth, high quality names, at exceptionally high multiples. The fixed income markets have got the message. The equity markets have not, yet.

McDonald’s will likely remain a brilliant business: but there is a price for everything, and a risk-reward balance in every security. As things stand today, we much prefer the bonds.

Be the first to comment