ajr_images/iStock via Getty Images

This article was coproduced with Nicholas Ward.

Anyone who follows my work knows that I love a good game of Monopoly.

This board game helped to inspire my love of real estate investing…and yet, anyone who knows about Monopoly knows that real estate isn’t the only asset class you can own in the game.

The Monopoly board has squares for utilities and railroads, which both happen to be attractive assets for investors to own in the real world as well.

Every quarter, I like to provide updates on the largest U.S. railroad stocks, and being that Union Pacific Corporation (NYSE:UNP) reported earnings this week, I wanted to take some time to put together an update for investors on what is widely considered to be the best-in-breed player in the class-1 railroad space.

Class-1 Rails

One of my favorite things about the railroads is that they offer nice supply/demand metrics.

Simply put, it’s incredibly difficult to build major railway projects these days.

Rising costs of materials makes them very expensive, and environmental regulation makes it nearly impossible to embark upon large scale projects in this industry.

Furthermore, the industry has consolidated over time and, therefore, there are incredibly high barriers to entry and defensive moats in this industry.

Therefore, the bullish supply-side argument for the rails is an easy one to make.

Yes, demand is more fickle. Shipments in this industry are largely dependent on economic health/growth. However, the U.S. economy has grown at a strong pace, and while there will surely continue to be bumps in the road along the way, I don’t expect to see this upward macro trajectory change moving forward over the long-term.

But, at the end of the day, railroads continue to be one of the cheapest and most efficient ways to transport goods/materials and, once again, that isn’t likely to change anytime soon either.

When looking at the class-1 rails, you’ll see that UNP has the largest market cap of the pure play railroads.

Even after its 25% year-to-date sell-off, Union Pacific’s market capitalization is still approximately $125 billion, which dwarfs its peers, whose market caps are largely in the $60-$75 billion range.

I will quickly note that Berkshire Hathaway (BRK.A, BRK.B), which owns BNSF Railway, has a much larger market cap of $615 billion; however, Berkshire is obviously not a pure play in the railway space. BSNF is one of many impressive assets under that company’s broader umbrella.

Furthermore, when looking at the pure play railways, it’s important to note that UNP has one of the strongest balance sheets in the railroad industry…it is one of only two players in the industry with an A-rated balance sheet.

- Union Pacific currently carries a Standard & Poor’s credit rating of A-.

- Norfolk Southern (NSC) currently carries an Standard & Poor’s credit rating of BBB+.

- CSX Corp. (CSX) currently carries a Standard & Poor’s credit rating of BBB+.

- Canadian National Railway (CNI) currently carries a Standard & Poor’s credit rating of A.

- And, Canadian Pacific (CP) currently carries a Standard & Poor’s credit rating of BBB+.

One of the primary reasons that investors own the railroads is because of their safe and secure dividend yields.

Therefore, I wanted to take the time to highlight UNP’s attractive dividend yield, dividend growth, and dividend safety metrics, relative to its peers.

- Union Pacific shares currently yield 2.79%. The company is currently on a 16-year dividend growth streak. UNP’s 5 and 10-year dividend growth rates are 13.7% and 16.1%, respectively. The company’s most recent dividend increase came in at 10.2%. And, looking at expected 2022 earnings, UNP’s forward dividend payout ratio is 45.0%.

- Norfolk Southern shares currently yield 2.42%. The company is currently on a 6-year dividend growth streak. NSC’s 5 and 10-year dividend growth rates are 12.0% and 9.6%, respectively. The company’s most recent dividend increase came in at 13.8%. And, looking at expected 2022 earnings, NSC’s forward dividend payout ratio is 36.6%.

- CSX Corp shares currently yield 1.48%. The company is currently on an 18-year dividend growth streak. CSX’s 5 and 10-year dividend growth rates are 9.2% and 9.6%, respectively. The company’s most recent dividend increase came in at 7.5%. And, looking at expected 2022 earnings, CSX’s forward dividend payout ratio is 21.0%.

- Canadian National Railway shares currently yield 2.00%. The company is currently on a 27-year dividend growth streak. CNI’s 5 and 10-year dividend growth rates are 11.6% and 11.6%, respectively. The company’s most recent dividend increase came in at 19.1%. And, looking at expected 2022 earnings, CNI’s forward dividend payout ratio is 41.7%.

- Canadian Pacific shares yield just 0.8% and the company froze its dividend for several years not all that long ago, so from an income-oriented standpoint, I believe it’s clear that there are other, more attractive options in the industry.

As you can see, none of the blue-chip railroads has a clean sweep of the dividend related metrics…

UNP has the highest yield and highest long-term dividend growth rates. CSX has the lowest payout ratio, and CNI has the largest 2022 dividend increase.

But, overall, I really like the metrics that UNP shares have to offer – admittedly, up until this point of the comparative analysis, UNP and CNI are neck and neck in terms of their quality ratings.

However, something that clearly sets the two companies apart are their historical total returns.

Sure, the past doesn’t predict the future, but I do sleep well at night knowing that the companies that I’m bullish on have clearly demonstrated their ability to generate outsized wealth for shareholders, and when you look at trailing 5 and 10-year total returns across the railroad industry, UNP shares really start to stand out.

Looking at trailing price returns, you’ll see that…

- Over the last 5 and 10-year periods, UNP’s share prices have appreciated by 65.7% and 203.4%, respectively.

- Over the last 5 and 10-year periods, CNI’s share prices have appreciated by 33.5% and 156.0%, respectively.

- During these same periods of time, the S&P 500’s price returns are 44.0% and 161.5%, respectively.

Therefore, not only has UNP outperformed its highest quality peer, but also, the broader market at large.

Union Pacific’s Q3 Earnings Results

At this point it, should be clear why I like Union Pacific so much. And, the bullish thesis gets even stronger when I factor in the stock’s recent sell-off and its historically attractive valuation figures.

But, before I get into the valuation metrics, let’s take a look at UNP’s recent quarterly data, because this is what inspired the stock’s -5.6% performance this week.

When Union Pacific reported Q3 data on Thursday, the company beat Wall Street’s expectations on both the top and bottom lines.

UNP’s Q3 sales totaled $6.57 billion, beating estimates by $160 million, and representing 18.0% year-over-year growth.

UNP’s Q3 non-GAAP EPS came in at $3.19, beating Wall Street’s estimates by $0.13/share, and representing 24.1% year-over-year growth.

Those headline growth figures were fantastic.

However, UNP’s efficiency ratings did fall a bit during the quarter, and while management tried to maintain an upbeat tone throughout the report and the ensuing conference call, they did lower expectations for forward-looking efficiency ratings in light of inflationary pressures.

During the earnings release, Lance Fritz, Union Pacific chairman, president, and chief executive officer, said (emphasis added):

“We made positive strides in the third quarter to increase network fluidity and better meet customer demand. Inflationary pressures and operational inefficiencies continued to challenge us. We reported strong revenue and operating income growth in the quarter through increased fuel surcharge revenue, volume gains, and solid core pricing. As we close out 2022, we will maintain strong price discipline while improving efficiency and service to capitalize on the available demand.”

UNP noted that volumes were up 3% on a y/y basis during Q3, and they guided for the full-year car load y/y growth to be in that 3% area as well.

With regard to its operating metrics, UNP highlighted Q3 data, stating:

- Quarterly freight car velocity was 191 daily miles per car, a 2% decline.

- Quarterly locomotive productivity was 124 gross ton-miles (GTMs) per horsepower day, a 2% decline.

- Average maximum train length increased 1% to 9,483 feet.

- Quarterly workforce productivity of 1,045 car miles per employee was flat.

- Fuel consumption rate of 1.056, measured in gallons of fuel per thousand GTMs, improved 1%.

- Union Pacific’s year-to-date reportable personal injury rate improved 20% to 0.80 per 200,000 employee-hours compared to 1.00 for year-to-date 2021.

However, while it’s great to see that growth, management also guided towards a “full year reported operating ratio around 60%,” which is above the 58.5% consensus estimate coming into the report.

This hurt the sentiment surrounding shares, causing the ~5% sell-off after the top and bottom-line beat.

But, looking through the report, I was pleased to see that management guided towards $6.5 billion in total share repurchases during 2022…and specifically mentioned that they plan to continue to buy back shares at a “strong pace” throughout Q4.

This is one of the benefits of owning blue chip, cash cow-type companies with generous shareholder return programs…

When UNP’s share price falls, it increases the effectiveness of the company’s buyback, bolstering EPS growth moving forward.

UNP also stated that it plans to continue to pay out roughly 45% of its earnings to shareholders in the form of a dividend.

Therefore, looking at current consensus EPS estimates for 2023 in the $5.80 area, investors should expect to see another reliable dividend increase next year ($5.80×0.45=$5.38, which is 3.5% higher than the stock’s present annual dividend).

Admittedly, a 3.5% increase would be well below UNP’s historical dividend growth CAGR; however, being that we’re potentially headed into a recession, I’m pleased to see just about any increase in today’s market environment, especially from economically sensitive companies like this one.

UNP Stock Valuation

I certainly wouldn’t be surprised to see UNP’s growth slow down over the coming year or so as we work through the tough economic conditions that the U.S. and the world are facing at the moment; however, looking at UNP’s current share price and valuation metrics, I also believe that these threats have already been priced into the stock.

Simply put, UNP shares are historically cheap at the moment, and looking at the stock’s 2022 selloff, I believe that irrational fear has pushed share prices down here down below fair value.

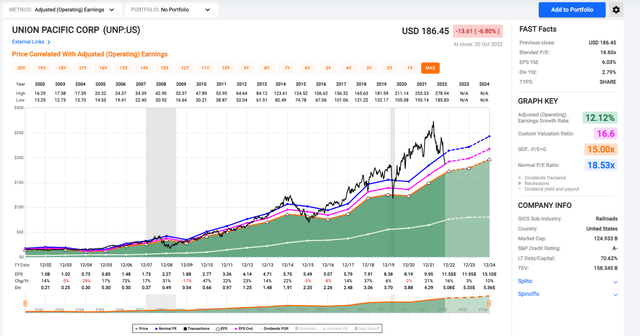

Looking at the chart above, you’ll see that the black line (representing share price) has fallen well below its long-term average P/E ratio (represented by the blue line).

I’ve also added in the pink line, showing the present valuation level.

As you can see, UNP’s current 16.6x P/E ratio isn’t the lowest that we’ve seen attached to these shares during the last couple of decades; however, since 2012 you’ll clearly see that the black line has largely remained above the pink line…meaning that shares have rarely been this cheap during the last decade.

During the last 10 years, UNP has only been cheaper than this during the COVID-19 sell-off in March of 2020 and during a brief period from late 2014 to mid-2015 when the stock experienced a growth scare.

Today’s 16.6x P/E multiple represents a 10% discount to UNP’s long-term average P/E ratio of approximately 18.5x.

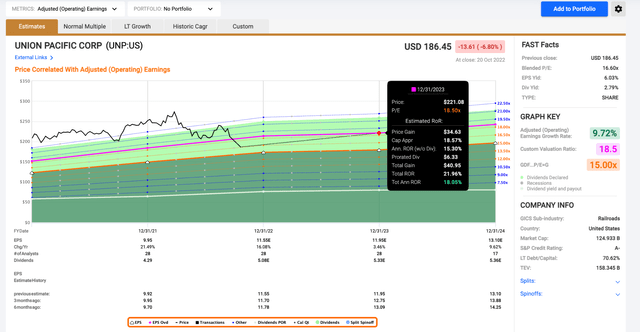

In the event of mean reversion back to this 18.5x level…even with the relatively low 3.5% EPS growth rate for 2023 factored in, investors buying shares at today’s valuation level would be looking at annualized returns north of 18% over the next 14 months.

And, even if it takes a bit longer for sentiment to shift from bearish to bullish, looking out 2 years to the end of 2024, assuming that UNP hits consensus EPS estimates for 2023 and 2024, investors buying shares today would see an annualized rate of return of approximately 15% over the next 26 months.

The way I see it, there’s absolutely nothing wrong with compounding wealth at a 15% clip with a mature blue chip like Union Pacific.

And, being that UNP’s expected growth during the next couple of years is below its long-term average growth rates, I think that the consensus analyst estimates are fairly conservative.

Therefore, these strong double-digit return projections don’t seem outlandish to me.

Conclusion

One should expect to generate strong returns when they buy blue chips like UNP at a discount to fair value because mean reversion combined with fundamental growth and dividend income is a sure-fire recipe for success for patient investors over the long-term.

Obviously, I’d love to see UNP’s operation ratios continue to fall; however, we’re seeing blue chips across the industrial space highlighting inflationary headwinds these days, and, therefore, I wasn’t surprised to see poor guidance from management.

But, I also don’t expect this to be a permanent change for the company.

Historically, UNP has found ways to survive…and thrive, throughout a myriad of tough macro environments. I don’t think that today’s high inflation is going to present a hurdle that they cannot successfully clear.

I believe that UNP can maintain its leadership in the industry, and even if we do hit a recession in the near future, this is the type of company that will roar higher once the economy rebounds.

In the meantime, I believe that investors can count on UNP’s dividend yield, making this blue chip a quintessential SWAN stock within the industrial sector.

It’s impossible to time a bottom on a cyclical stock like this as the broader economy slows down. And it’s true that, during past recessions, UNP shares got much cheaper than they are today.

However, over the long-term, the upward trajectory that UNP shares have been on is clear and, therefore, now that the valuation represents a double-digit discount to historical averages, I believe that this is a great time to consider starting to build a long-term position in this beaten down blue chip.

Be the first to comment