Charlie Parker/iStock via Getty Images

Published on the Value Lab 12/9/22

Matthews International (NASDAQ:MATW) is our next high conviction idea. While not completely immune on the downside due to some interest rate risk and some demonstrated inflation exposure, it is a rare issue that can offer long-term, all but guaranteed secular growth despite a very uncertain environment. They are going to be beneficiaries of the electrification push on one hand, and their casket and crematorium business on the other is exposed to positive US demographics and extraordinarily resilient demand. The only weak point on the demand side is the packaging and branding segment, SGK, which is more exposed to economic decline. Nonetheless, the electrification exposed businesses of industrial technology, which also has warehouse automation and disruptive marking equipment to boot, will come to offset SGK’s declines in the profit mix very shortly due to its substantial growth. Trading at a very compressed multiple under 6x EV/EBITDA, the stock is a clear buy thanks to resilience in memorialization and compounding growth in the industrial technologies business as energy solutions applications ramp in demand, and the upside can be demonstrated in a sum-of-the-parts (SoTP) analysis.

Business Run-down

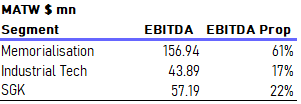

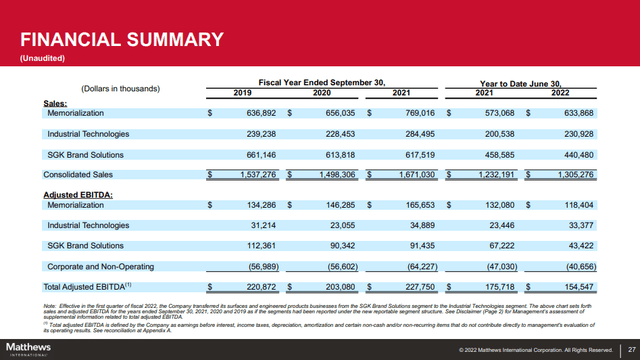

Let’s begin with the EBITDA split:

EBITDA Split (Q3 2022 Pres)

Memorialization drives profits right now, but a growing industrial technology segment is soon to overtake SGK which is the most exposed business. Industrial tech has seen 50% EBITDA growth YoY based on YTD figures, while SGK has declined a little less than 5%.

Memorialization Primer

Memorialization declined about 10% in EBITDA primarily due to gross profit contractions that occurred as a consequence of input cost inflation, mainly steel and lumber, and this totally offset a pretty meaningful 15% increase in the memorialization topline, which was driven entirely by pricing as volumes were flat. The reason there was such a big EBITDA hit despite pricing efforts is apparently due to troubled municipal waste to energy incineration contracts that hope to be partially recovered over the next quarters. Unfortunately this headwind is not very temporary and the current margin will persist for a bit. Also pricing was limited in the fact that some of the sales were preneed (in anticipation of death) and therefore not pricing in commodity inflation.

The memorialization segment is the selling of caskets, urns, plaques and cremation equipment. The segment isn’t a full-service funeral company that offers interment rights and owns cemetery properties, or organizes the services themselves. The MATW business is more upstream from the end-customer. This period saw cemetery products and not funeral home products driving topline and sustaining volumes, as pull-forward effects from COVID-19 mortality affected the funeral home business more than cemetery.

From a commodity perspective steel prices are calming down as China deals with its housing and other economic woes, and likewise lumber prices have also come down as the building cycle moves from the early/mid stage to the later stages where construction is less lumber intensive. Housing slowdowns are likely to limit excitement in the next period for these products as well.

Lumber Prices (tradingeconomics.com)

Steel Prices (tradingeconomics.com)

Starting in May, which is towards the end of the current June-ended results, is when the prices of these key commodities started to really turn around. These prices only really started to rise in the latter half of the 2021 FY, so they haven’t helped ease the comps yet. In addition to deflation in the current period which will help EBITDA comps, a tough commodity environment in H2 2022 will also make an easier comp, and will show that run-rate results are not dire relative to the new normal in commodities, and are likely to improve. It should be noted that steel will take longer to digest due to the nature of supply contracts, and the deflation effects there won’t be seen next quarter either. Copper is another important input for memorialization products and the story there is the same as for steel and lumber.

Copper Prices (tradingeconomics.com)

There is also wage inflation. That is less transient and continues to persist. However, besides digestion times, we feel that inflation of all kinds are fairly irrelevant for the businesses. The reality of the funeral industry is that people don’t bargain-hunt for funeral services, and people want to honor their dead, and ultimately the industry sets the prices. You have to do something with the dead anyway, so you can’t exactly opt out of being a customer.

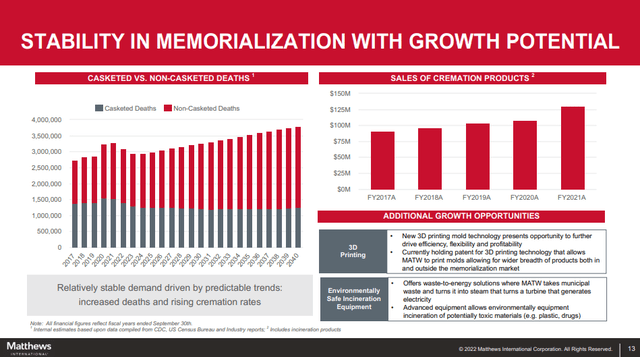

Also, the number of dead that are casketed is falling. This simply means that the rates at which people choose to cremate rather than bury the dead are rising. This is a trend across the industry, and is a bit of a mix pressure for downstream funeral homes. For MATW it doesn’t matter too much. They sell products both for the cremated as well as the buried dead, and they even sell crematorium equipment, like incinerators, which is a secularly growing market. They also sell these incinerators to municipalities in Europe for waste-to-energy purposes and the incineration of trash, so there’s a waste management angle there as well.

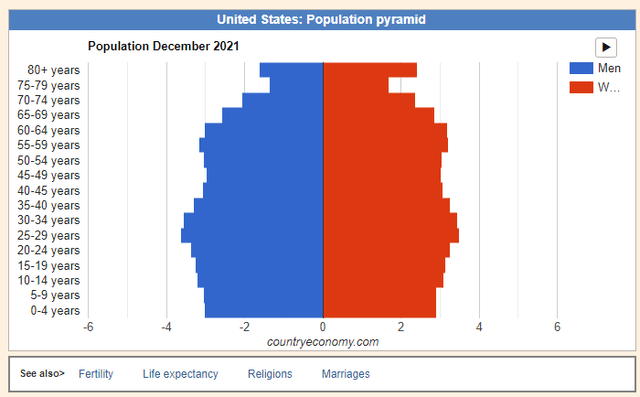

A final tidbit on the memorialization side is that not only are US demographics going to create a very long-burning market for memorialization products, as baby boomers graduate into a higher mortality bracket, and Gen X bloats the center of the population pyramid to guarantee another 30 years of guaranteed mortality, but pet ownership has grown massively since 2020, by 28% actually. Pet demographics will support the urn and incineration equipment markets as well, as they sell to veterinary clinics pet crematoriums. So both US demographics, which is one of the most favorable in the western world and like a loaded syringe for the death care industry, and pet ownership support these memorialization markets for decades. It is a tank of a business.

US Benefits from low dependency ratios (countryeconomy.com)

Industrial Technology Primer

Battery and Hydrogen Fuel Cell Production

The next segment to discuss is industrial technology. There are a couple of major trends to discuss. The first is that this segment produces calendering machines, which are used to flatten plates. These surface technologies can be used on plastics and metal and have applications in the automotive, decor and leather industries, but they are also necessary for the production of plates in Li-ion batteries and for hydrogen fuel cells. The earmarked funds for the renewable energy transition are mostly (60%) allocated to production equipment for batteries, so calendering machines, and also the equipment that is produced by the newly acquired Olbrich and R+S, will ride the wave of this electrification investment. Olbrich produces equipment for manufacturing essential electrodes for both hydrogen fuel cells and Li-ion batteries, so no matter which direction the renewable transition goes MATW will benefit. These products are also high margin, and expand the margin substantially of the industrial technology segment. Where topline growth was a little over 10%, EBITDA growth was around 50% for the IT segment. That these energy solution products will grow in the mix will be a boon to the segment’s EBITDA contribution. Olbrich and R+S will contribute about $100 million to the industrial technologies EBITDA annually (25% of current IT revenue, 5% of overall), and $43 million was paid for those companies.

The energy businesses are primarily Europe based and therefore FX has limited sales growth this quarter despite the emerging energy solutions area. The contracts are large and measured on a completion milestone basis, and have been slowed down by logistics and supply chain. Growth here should accelerate once the gas is more off the goods pedal in markets.

Warehouse Automation

Another nice area in the IT segment is the warehouse automation segment which sells machines that help fulfilment for ecommerce and other logistics activities. Management had the following promising comments to say about this segment.

Certainly, in our Product Identification and our Warehouse Automation business, we continue to see revenue and profit growth while order intake remained strong. Hardware delivery delays at several client warehouse site slowed the installation of our automation systems, thus preventing us from having an even stronger quarter. We expect these businesses to finish the year strong as well since much of the work we perform has to be delivered by the beginning of our next quarter.

Therefore we may experience some timing effects to the benefit of next quarter results as clients get conveyors, sorters etc. installed and ready for MATW’s equipment. As of now, these segments are driving the majority of growth. The energy solutions business is more of a future growth area. The headline declines in sales for this quarter alone were caused by dollar strength, while there was over 10% growth for the YTD figures as mentioned before. The R+S acquisition brings automation expertise for this business within industrial technologies, and it’s supposed to be a platform for European expansion of this business. Currently, almost all clients are in the US and relate to ecommerce.

Industrial Printing

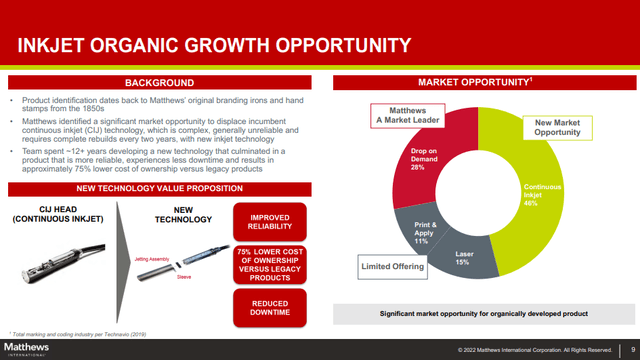

Finally, there is another emerging opportunity that while not as aggressively secular as the electrification push, which is firing on both private and public cylinders, represents an attractive market area with great recurring revenue economics. Currently MATW produces equipment for drop-on-demand marking of porous and non-porous materials for logistical and tracking purposes but also retail purposes like barcoding. They can print directly on all sorts of materials, and there is overall secular growth here on account of greater product traceability requirements related to ESG but also health and ISO standards that support DoD printing markets for marking and coding purposes. The market structure is shown below.

Drop-on-demand Opportunity (Q3 2022 Pres)

They have developed a new product that should win share against the continuous inkjet technology which apparently is unwieldy and famously requires total rebuilds every so often, but is useful because of its print velocity and simpler solvents, even if it lacks in resolution and other characteristics where DoD printing wins out. Their new technology, which they decline to comment on in depth, will enter the market at the end of the calendar year and will apparently address these major issues for CIJ owners and put some of that market in MATW’s pocket.

SGK

The last broad segment is SGK, which does branding and marketing advice combined with the technical expertise to prepare print bands for the packaging print process. They depend a fair bit on retail traffic, and a bit on FX outside of the dollar, so there’s been a bit of pressure on both those bases. Supply chain issues have also slowed down the need for new packaging and branding initiatives, and there’s been less investment in in-store branding and prints as consumer facing businesses start seeing the pressures of reduced consumer confidence, as well as it being difficult to fully staff and open locations by retailers. Sales declined by 10% or so but the EBITDA declines were around 33%. SG&A related to this segment grew too, with labor pressure affecting the business as well as a resumption in travel and entertainment expenses as the segment leaders try to build business again the old-fashioned way. But the big killer here was a shortfall in the in-store marketing business.

This quarter is simply the least exciting and the most exposed to the turning of the cycle. We consider this EBITDA at risk at the moment, and are beginning to see the effect not only of a stronger dollar but a weaker macro environment in Europe. There are no signs of incremental improvement into this next quarter according to management, but there isn’t a strong expectation for it to get worse as the problems are on supply chain issues and staffing problems.

Conclusions

Overall, we have a resilient memorialization business on the topline. The bottom line should improve as further pricing efforts set in, and hopefully as unprofitable waste to energy contracts are worked through. For industrial technology, FX headwinds are affecting the surface businesses, which includes the applications for energy. That is limiting the show of topline growth. Furthermore, the Olbrich acquisition should help in meeting market demand for energy solutions. The company is struggling to keep up with requests, and projects are large and daunting. The backlog is swollen, and overall the company sits on 6-8 months of business in backlog. The industrial technologies segment is an important margin contributor, and once the emerging energy solutions offering takes off, the company should see major EBITDA increases. Finally, the marking and coding and automation business should see organic growth as supply chain issues unwind for the former, and the next technologies are launched against CIJ technologies to win share in the latter. SGK remains a more vulnerable point relative to the economic cycle as proven in its Europe exposure, but extraordinary shortfalls in labor as well as consumer confidence issues in Europe are putting a lot of pressure on the business, and things can’t get too much worse.

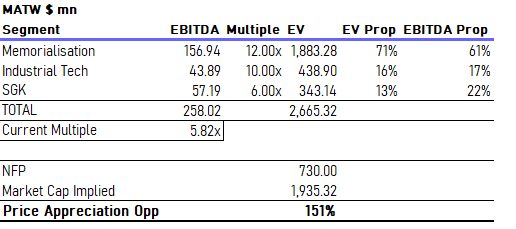

On a SoTP basis we can value the business. Assuming no incremental growth as scaling up YTD Q3 figures to an annual basis we get the following EBITDAs.

Valuation (VTS)

A 12x multiple on Memorialization is coming from a more vertically integrated peer, Service Corporation (SCI). While the economics are not quite the same due to the more downstream stuff SCI does, and more upfronting of cash through cemetery and preneed sales, it is somewhat close in terms of resilience, and ability to determine solid horizon values. A 10x multiple for industrial tech is just a standard 10x multiple for equipment suppliers in Europe’s industrial world. SGK is valued at Omnicom’s (OMC) multiple on the basis that it similarly depends on advertising spending, and retail activity to incentivize advertising investments by customers.

Memorialization is the most long-term and therefore drives most of the value, but industrial tech gets a pretty modest multiple, and its scope for growth isn’t being reflected yet in our valuation either on the energy nor on the warehouse side, which remains a hot area in real estate and for operators for good reason. Its importance will grow from its currently marginal positions, similar to SGK, which will remain less exciting, and dwindle in importance compared to industrial tech.

According to our multiples, the upside would be really large, but even just looking at the current sub 6x EV/EBITDA multiple despite substantial memorialization exposure, where death care is one of the few businesses that can justify perpetual growth assumptions (especially with US demographics), as well as the growth area and exposure to EV and electrification, you can see that this company is cheaper than its growth prospects would be able to justify. Overall, this is a business that is rare. It has catalysts in the current environment, and a low multiple at the same time.

Finally, about 50% of its debt is from a revolving credit facility, priced with LIBOR, while the rest is fixed debt with 2.5 years till maturity. So the exposure to rate hikes is rather limited, especially since the rates are around 6% on the fixed debt and 3% on the variable, so most of the current interest expense (66%) is coming from fixed debt.

Overall, a clear buy.

Be the first to comment