Sjo/iStock Unreleased via Getty Images

Overview

Deere & Company’s (NYSE:DE) announcement of an autonomous self-driving tractor at the Consumer Electronics Show (CES) earlier this year has turned heads, generated a lot of media publicity and excitement, and earned Deere the “Tesla of farming” nickname. As the self-driving feature will be available as an add-on attachment to existing GPS-equipped Deere tractors as well as on its new tractors, the adoption of this self-driving capability could be reasonably rapid.

I decided to examine the implications for the agriculture industry and Deere shareholders.

Thesis

My investment thesis for Deere is centered around the secular increase in demand for food that is driven by: (1) the growing global population, and (2) the rising middle class’s consumption of more animal protein from livestock that feed on grain.

Deere is a leading agricultural equipment provider that has a long history of driving productivity improvements — its recent attention-catching announcement of self-driving tractors will be followed by more technological innovations that will leverage data, artificial intelligence, and machine learning that enable farmers to produce more output with less inputs and increase their profits.

While the impact on near-term profitability may be more muted, Deere will create significant value for society, farmers, and shareholders if it achieves the holy grail of creating the source of truth for the agricultural industry.

More food production is needed to feed more people around the world

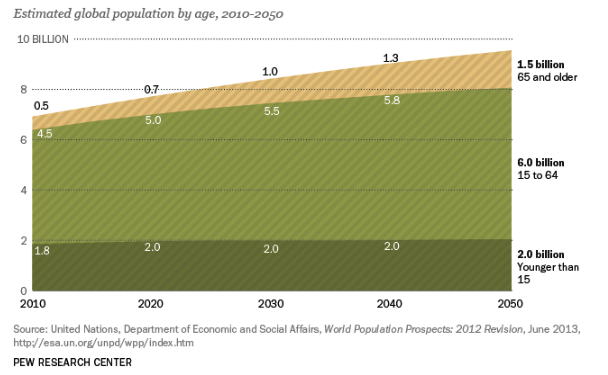

The global population continues to increase and is expected to reach almost 10 billion by 2050, up from under 8 billion today (figure 1).

Figure 1: Projected global population from Pew Research

Pew Research Center

Rise of the global middle class

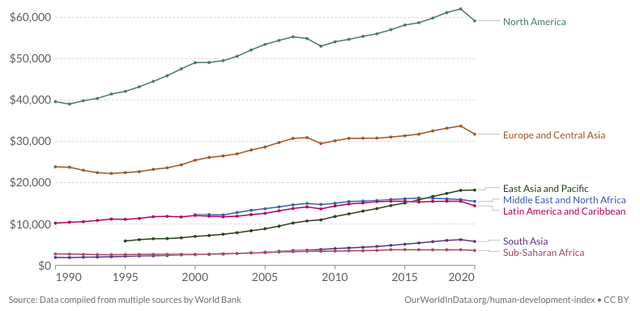

Rise of per-capita income of the middle class around the world also increases demand for animal-based protein, which requires grain to feed the livestock that provide the protein (figure 2).

Figure 2: Per capita income

The World Bank

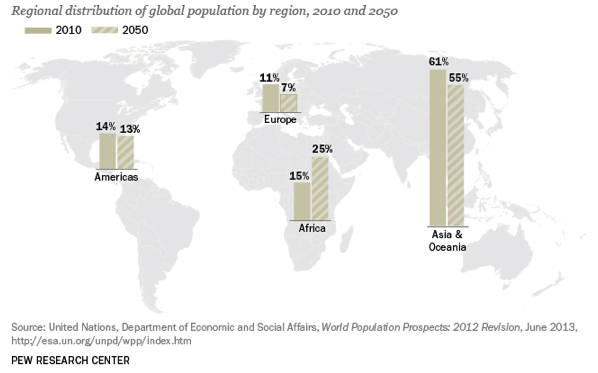

Furthermore, the high growth in population in Africa, which is expected to account for 25% of global population by 2050 (up from 15% in 2010), will need additional agricultural equipment to farm arable land in the region (figure 3).

Figure 3: Re-distribution of global population towards Africa by 2050

Pew Research Center

Agricultural productivity improvements needed to feed to world

Deere Senior Principal Software Engineer Greg Finch noted in a presentation earlier this year that farming faces similar problems as manufacturing–the industry needs to do more with less, eliminate waste, avoid excess inventory, have the right amounts of resources available when and where they are needed, and ensure the distribution logistics need to be available at harvest time.

There is ongoing pressure to get more output from each seed and every acre of land while reducing the amount of labor and inputs such as fertilizer and herbicides. However, unlike manufacturers which can control the production environment within their factories, farmers are at the mercy of uncontrollable exogenous factors such as weather, which determines the window for planting and harvesting. Unfavorable and extreme weather during the planting and harvesting seasons can greatly narrow the work window, making it difficult for farmers to procure the labor required to get the work done within the timeframe. Pests and crop diseases can also cause yields to plummet.

Agricultural equipment has gone a long way since the days farmers used human labor and horses to work the land. Companies like Deere have developed the modern tractor and implements that help farmers till, seed, irrigate, apply fertilizer & herbicide, harvest, and bale more efficiently with less labor. Over the last 20 years, precision agriculture has incorporated the use of computers and GPS navigation systems to help farmers make better decisions in crop planning, field mapping, soil sampling, tractor guidance, crop scouting, pesticide applications, and yield mapping. GPS guidance technology also allows farmers to work at night and in low visibility field conditions such as rain, dust, and fog.

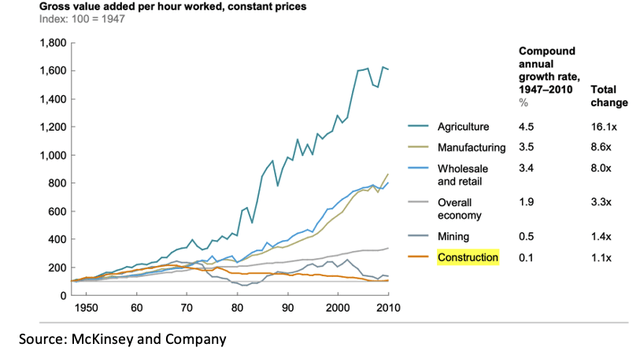

Mechanization, together with advances in seed technology, has raised the output per unit labor by 16-fold since World War II (figure 4).

Figure 4: Agriculture productivity has soared since World War II

McKinsey and Company

Labor and wages in agriculture

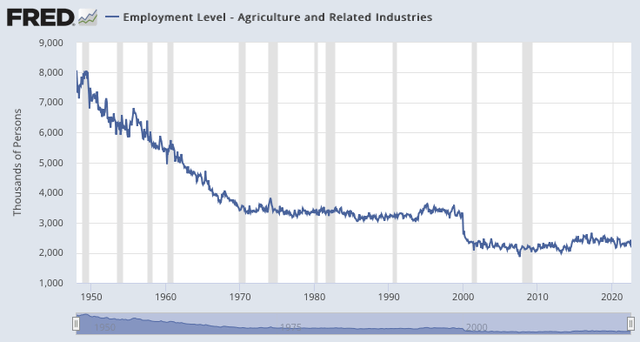

I have been under the mistaken impression that population migration away from rural farming areas to urban cities has caused a downward trend in agriculture employment. This was certainly true from 1950 through 1980 when agricultural employment more than halved from 5.8 million to 2.4 million as mechanization contributed to rising agricultural productivity and reduced the need for labor. However, employment levels have stabilized since 1990 and began ticking up since 2015 (figure 5).

(I note the sharp one-time drop in agricultural employment around 2000–the one explanation I can find is that the USDA’s Farm Labor Survey stopped estimating the number of family farmworkers around that time)

Figure 5: Employment in agriculture

St. Louis Federal Reserve FRED (LFEAAGTTUSM647S)

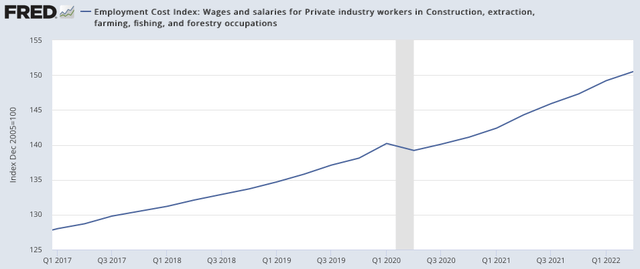

Labor cost has increased by about 20% over the last five years (figure 6) and is difficult to procure during peak planting and harvesting seasons, particularly when unfavorable weather narrows the work window.

Figure 6: Employment cost index

St. Louis Federal Reserve FRED (CIS2020000405000I)

Deere, self-driving tractors, and digital twins

Deere is a leading heavy equipment manufacturer with a 53 percent share of the U.S. market for large tractors, 60 percent of the U.S. market for farm combines, and 18 percent share of the overall farming equipment market. It has the largest share in an oligopolistic market where the four largest manufacturers control 45 percent of all sales.

Earlier this year at the CES Show, Deere announced a fully autonomous self-driving tractor which will be available by the end of 2022 and won the company the “best of innovation” honoree award in the Robotics category. This self-driving tractor is designed to be controlled with the farmer’s smartphone, does not require a driver in the cab, and can operate in low visibility conditions at all hours around the clock. This not only frees the farmer to focus on other tasks, but lessens the farmer’s dependence on available labor, which can be scarce when bad weather requires tilling, planting, or harvesting be completed within a tight time window. At the show, Deere also shared that its existing tractors equipped with GPS guidance systems can be easily upgraded to a self-driving tractor with the purchase of camera and sensor hardware and a software subscription.

Much of the technology is developed internally by the company’s R&D team of over 5,000 employees. However, the company has also acquired external technology, including Bear Flag Robotics for its autonomous tractor capabilities; Blue River Technology and GUSS Automation, which enables Deere’s See & Spray technology to spray herbicides directly on weeds, cutting herbicide use by 77% compared to broadcast spraying.

John Deere is also implementing the internet of things out into the field to boost the efficiency of prepping, planting, and harvesting as well as to improve per-acre crop yields. For example, Deere has developed Exactemerge planting technology, which utilizes sensors that measure the softness of the soil and pressure exerted on each seed as it is planted and uses algorithms to determine the optimal depth and spacing to maximize output and yield.

Deere will also be incorporating land topography, soil moisture, fertilizer, weed detection, crop output, and other real-time sensors into its implements to help farmers optimize irrigation, fertilizer & herbicide application, and harvest timing. This data can be combined with weather forecasts, commodity market prices, and records of the farmer’s operations to create a digital twin–a virtual model of the farming process–that enables the farmer to run in-silico simulations to minimize downtime, preempt problems, perform future planning, and maximize yield and profit. In November 2020, Deere completed the acquisition of Harvest Profit, a software provider that helps farmers forecast and measure profitability on a field-by-field basis, which I suspect can form the basis of digital twin software.

In an interview with CNet earlier this year, Deere CTO Jahmy Hindman noted that hardware pricing for the self-driving tractor has yet to be determined. The company also indicated that the subscription will likely be based on the farmer’s acreage. While I do not expect the hardware and subscription pricing to supercharge Deere’s earnings in the short term, the availability of these capabilities will almost certainly capture farmers’ attention and boost demand for new and upgrades to Deere equipment.

Quest for the holy grail–the source of truth for Ag

I believe the holy grail is the source of truth where all relevant agriculture data is aggregated in the cloud and easily accessed by all subscribing industry participants. Agriculture productivity will be greatly enhanced when stakeholders utilize this data in conjunction with seed genetic data, drone & satellite input, weather forecasts, commodity market pricing, to optimize crop decisions, seed selection, day-to-day farming operations, supply chain logistics management, crop marketing, equipment sales, capital allocation, commodity trading strategies, and regulatory decisions at the regional, national, and even international level.

I liken Deere’s sensor-loaded tractors to modern-day trojan horses that can collect large amounts of valuable real-time data on farming inputs, environmental factors, operations, and output yield. In addition to applying artificial intelligence and machine learning algorithms to assist farmers in their key decisions and daily operations, Deere can also use the data to train and enhance its AI models, which will further enhance the value of the data and widen its competitive moat.

Even though Deere has chosen to focus on agriculture, management has said that the company also working to apply some of these ideas to construction and forestry, which if successful, will provide still more upside to investors.

Financial analysis

Revenue by segment

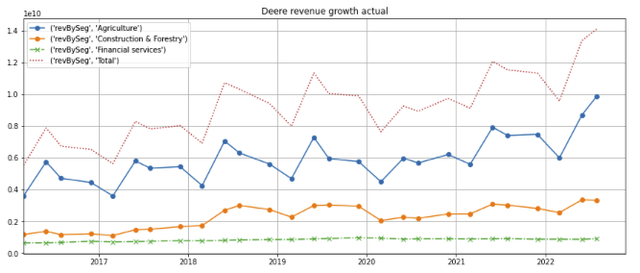

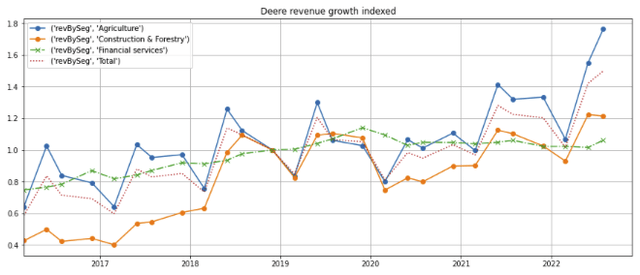

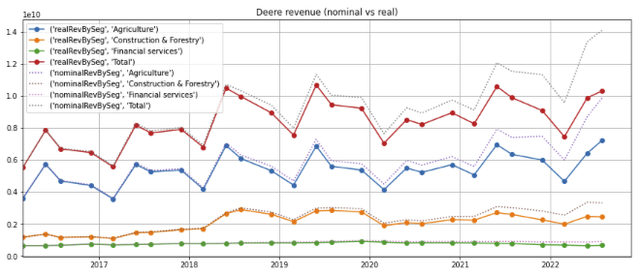

Agriculture accounts for more than two-thirds of Deere’s total revenue (figure 7, blue line). It has also delivered higher growth than construction & forestry since 2019 (figure 8, blue line vs orange line). Financial services, which provides equipment financing for John Deere dealers, makes up a relatively di minimus percentage of revenue (green dashed line).

Figure 7: Revenue by segment

Created by author using publicly available financial data

Figure 8: Revenue growth by segment, indexed to 4Q 2018

Created by author using publicly available financial data

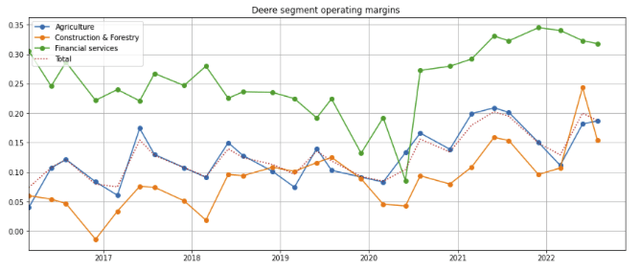

Deere’s operating margin has expanded over the last 7 years, but I am reluctant to underwrite further margin expansion into my forward projections until there is clear evidence of operating leverage from data subscription services.

Figure 9: Operating margins by segment

Created by author using publicly available financial data

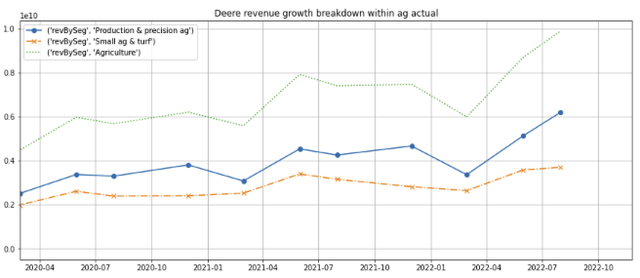

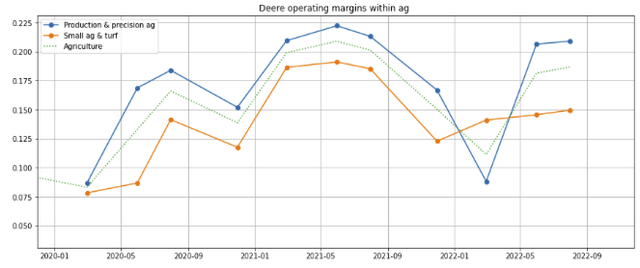

Within the agriculture segment, production and precision ag has grown faster (figure 10, blue line) and delivered higher margins (figure 11, blue line) than small consumer ag (orange line).

Figure 10: Agriculture sub-segment revenue breakdown

Created by author using publicly available financial data

Figure 11: Agriculture sub-segment operating margins

Created by author using publicly available financial data

Revenue by geography

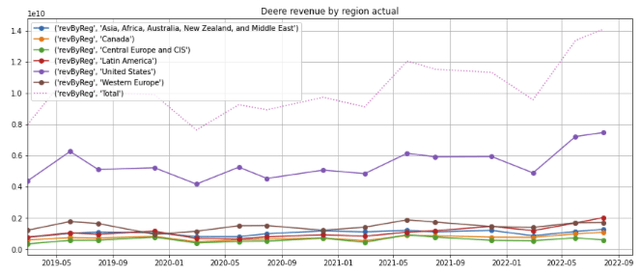

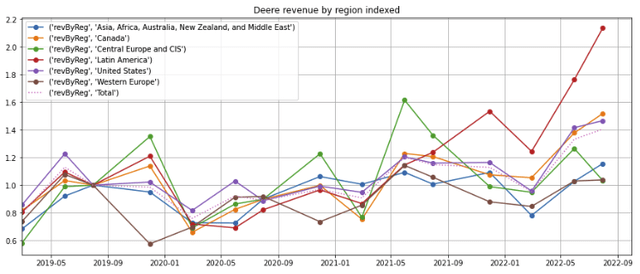

The US is the largest market and accounts of more than half of total revenue (figure 12, purple line). However, Latin America is the highest growing region, and has more than doubled revenue since 2019 (figure 13, red line)

Figure 12: Revenue by geography

Created by author using publicly available financial data

Figure 13: Revenue growth by geography, indexed to 4Q 2018

Created by author using publicly available financial data

The effect of inflation

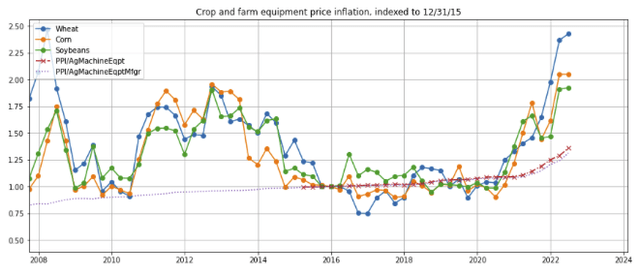

There is strong commodity price inflation since the onset of the COVID-19 pandemic (figure 14, solid lines), but the producer price index for agricultural equipment (red dashed line) has stayed ahead of manufacturing costs (purple dotted lines).

Figure 14: Crop and farm equipment price inflation

St. Louis Federal Reserve FRED

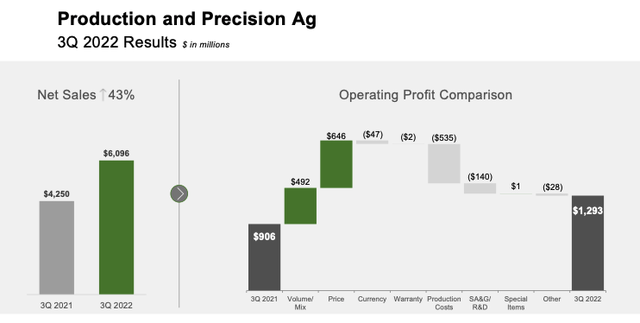

Deere’s 3Q 2022 production and precision ag segment earnings corroborates this data. For the quarter, the production cost increase of $535 million was offset by $646 million of price increases (figure 15, right chart). The remainder of the operating profit was made up by increased volume and mix, but part of the increase may have been a result of delayed sales due to work stoppages from a labor strike in fiscal year Q1 2022 that lasted almost one month.

Figure 15: 3Q 2022 earnings of Deere’s Production and Precision Ag segment

Deere and Company earnings presentation 3Q 2022

Even though Deere’s nominal revenue has grown over the last five years (figure 16, dotted lines), I note that its real, agricultural equipment-PPI adjusted revenue has been more muted (solid lines).

Figure 16: Deere segment revenue: nominal vs real, indexed to Jan 2016

Created by author using publicly available financial data and St. Louis Federal Reserve FRED

Valuation

Current price-earnings ratio

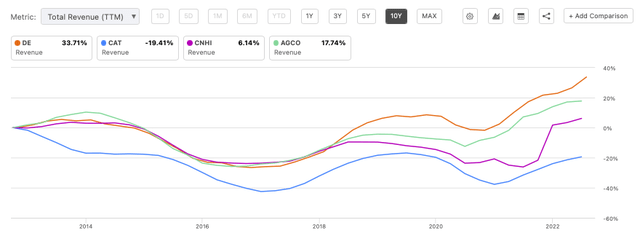

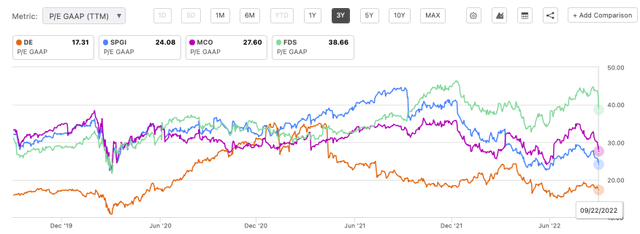

Deere’s premium price-earnings ratio of 17x, compared to Caterpillar’s (CAT) PE ratio of 14x, seems reasonable given its innovative technological edge (figure 17, orange and blue lines). With market capitalizations of $15.9 billion and $7.7 billion, CNH Industrial (CNHI) and AGCO Corporation (AGCO) (purple and green lines) are substantially smaller than Deere and Caterpillar ($105 billion and $90 billion respectively) and have grown less than Deere (figure 18). As such, I believe their lower PE ratios are justified.

Figure 17: Price-earnings valuation: Deere vs comps

Seeking Alpha Charting

Figure 18: Historical 10-year revenue growth: Deere vs comps

Seeking Alpha Charting

Potential valuation re-rating

Deere’s near-term earnings are unlikely to surge from the introduction of its self-driving tractor. However, if Deere succeeds in transforming itself into a data company, shareholders could well be rewarded with an upward revision in its valuation to a multiple closer to that of information service providers such as S&P Global (SPGI), Moody’s (MCO), and FactSet (FDS) (figure 19, blue, orange, and green lines)

Figure 19: Deere’s PE multiple compared to information service providers

Seeking Alpha Charting

Stock price

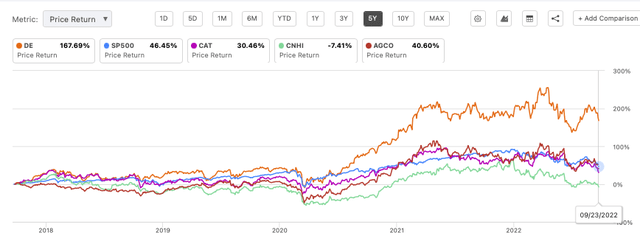

Over the last 5 years, Deere’s stock price has appreciated by 167% (figure 20, orange line), more than its heavy equipment peers and outperforming the S&P 500 index.

Figure 20: Deere stock price vs comps

Seeking Alpha Charting

Concerns

My 4 main concerns are:

1. Can Deere follow-through with the execution?

We have seen technology companies announce products with great fanfare but stumble with execution (e.g., IBM’s Watson Health, which the company was forced to sell to private equity earlier this year). I will be closely watching the progress and customer reviews of Deere’s autonomous and artificial intelligence-based products after they are delivered to customers.

2. Cybersecurity risk

Call me paranoid, but a viscous cybersecurity hack could create a real-life scene from a horror movie (think “The Attack of the Killer Deere X9 110 Zombie Harvesters”), potentially leading to serious destruction of crops, property, and life, resulting in serious reputation damage and massive liability lawsuits.

3. Can Deere’s competitors roll out similar self-driving and big data-related products, compressing profits for all players?

Deere’s two closest agriculture machinery competitors are CNH and AGCO, both of which are significantly smaller and may not have the same scale or deep pockets to invest in R&D.

Caterpillar is more focused on construction and mining and has remote operated tractors for mining; Hitachi and Komatsu also participate in heavy equipment markets, but none have announced products for agricultural applications that have the same level of technological innovation as Deere.

4. Data privacy and compliance

Farmers typically guard details of their operations carefully, and some may be reluctant to give Deere the ability to utilize their operational data. I have not seen Deere’s confidentiality agreement, but if Salesforce.com’s customer agreement is any indication of the negotiating power of SaaS (software as a service) providers, it is quite unlikely that Deere will be restricted from using customer data to train their AI models or providing customer with recommendations based on anonymized aggregated data.

Summary

- Deere & Company’s announcement of its autonomous self-driving tractor at the Consumer Electronics Show (CES) earlier this year has turned heads, generated a lot of media publicity and excitement, and earned it the “Tesla of farming” nickname.

- Deere is a leading agricultural equipment provider that is well positioned to help address the secular increase in demand for food from a growing global population and rising middle class demanding for more animal protein in their diets.

- Deere’s sensor-loaded self-driving tractor is an impressive innovation which I liken to a trojan horse that can acquire vast volumes of agricultural data, which will enable Deere to offer digital twin software to farmers and further the company’s quest to create the source of truth in agriculture.

- I do not expect a surge in near-term revenue or earnings. However, if Deere is successful in this quest, value creation should come from long-term growth and an upward revision in valuation from a heavy equipment manufacturer towards that of an information services company.

- Deere’s strong free cash flow provides some downside protection but there is still much uncertainty to this upside potential.

- On balance, I believe the stock offers a decent risk-adjusted return.

Be the first to comment