wildpixel/iStock via Getty Images

Market Overview

International equities were faced with numerous risks in the first quarter, ranging from resurging COVID-19 cases in large geographies like China to inflation and potential monetary tightening globally, before Russia’s invasion of Ukraine on February 24 overshadowed all else. Europe was most directly impacted by the conflict as crude oil and natural gas prices spiked and already-challenged supply chains were further pressured. The benchmark MSCI EAFE Index declined 5.91% while the MSCI Emerging Markets Index fell 6.97%. Large cap equities held up better than small caps with the MSCI EAFE Small Cap Index giving back 8.53%. More importantly, value outperformed growth by substantial margins with the MSCI EAFE Value Index gaining 0.33% for the period while the MSCI EAFE Growth Index declined 11.94%.

One of the key drivers of the rotation from growth to value stocks was action in the bond market. A significant rise in long-term bond yields reflected heightened inflationary pressures in the global economy and the outlook for tighter monetary policy. Higher rates are typically a short-term headwind to long-duration assets such as growth stocks. And while, in the longer run, high-quality growth stocks can typically pass on inflation, the sudden and sharp spike in bond yields puts pressure on near-term valuations.

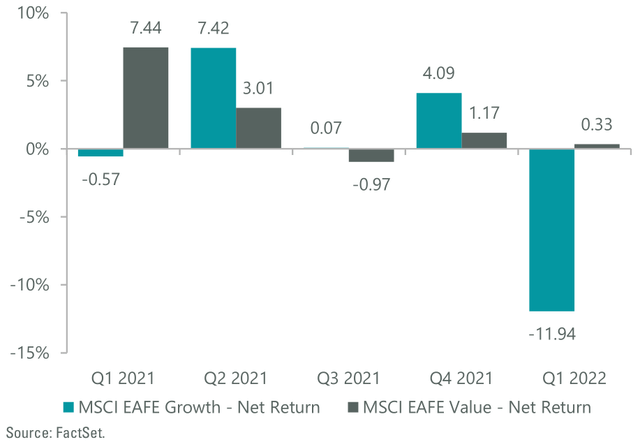

Exhibit 1: MSCI Growth vs. Value Performance

There has been a lot of debate about whether inflation is as permanent post-COVID. A certain amount of inventory restocking was needed to cure supply chain disruptions impacted by frictional costs and labor shortages. Manufacturing finally seemed to have found its footing and ports were reopening. China, the world’s largest consumer of commodity goods, has been easing economic policies for some time to tackle a broad real estate problem and navigate further COVID-19 lockdowns continuing to slow its economy. These actions should have ameliorated significant commodity pressures — until war broke out. Coupled with the potential for Russia to now control significant parts of the food supply output and other key materials and minerals, the calculus shifted overnight.

Under these conditions, the ClearBridge International Growth ADR Strategy underperformed its core MSCI EAFE Index benchmark. This is to be expected but doesn’t mean we are satisfied with the results. Our observation is that in these types of markets, the Strategy tends to underperform until more balance is achieved in the market between growth and value. Simplistically, the index is a blend of both value and growth stocks. However, similar to the first quarter of 2021 (Exhibit 1) — when the value component outperformed so meaningfully — it remains tilted to whatever is doing the best, and this quarter it was value. In virtually every sector, the stocks we identify most as value did the best.

On a sector and industry basis, energy (+16.98%), materials (+3.30%) and defense (+4.63%), given the invasion impact, did well. We evaluate and own these types of stocks within our structural bucket if we believe they will see a step change in forward returns at attractive valuations. We began to buy energy last year and that has worked well for the portfolio more recently. While the structural bucket is a component of our diversified approach to growth, the portfolio also remains invested in growth companies with a significant overweight to information technology (IT); these names underperformed in a narrow, one- sided value market.

Europe and the U.K., which represent the Strategy’s largest regional exposures, were a microcosm of these cross currents. Early in the first quarter, economies were still influenced by COVID-19, but a peak in cases was in sight and reopening was underway. Markets played the improvements, rates moved moderately, consumer spending picked up and services like travel recovered from depressed levels. War in Ukraine changed the picture dramatically. Inflation picked up even further, driven by higher natural gas, oil and agricultural commodity prices, which will be passed on to the consumer. Germany’s inflation passed the 7% level last seen after the 1990 reunification. The war has caused manufacturing and consumer sentiment to plunge.

While natural gas is still flowing from Russia to Europe, there are discussions that could change this. Germany, a massive importer of oil and gas, is currently in Stage 1 monitoring of energy usage and asking customers to monitor usage. A serious reduction or complete shut off of Russian gas could lead to a recession in Europe, which is the growing consensus view. We don’t agree, however, as we believe Europe has the support structures and spending capacity to keep the incipient post-COVID-19 recovery intact. The telltale signs of recession, such as European credit spreads widening, have not happened.

Positively, the urgency of energy security has accelerated spending on renewable energy. The EU commission has proposed a new measure regarding energy security and plans to reduce European dependence on Russian natural gas. REPowerEU emphasizes two pillars in order to reduce reliance on Russian gas and drive resilience: diversifying gas supplies, mostly via higher liquified natural gas imports; and more rapidly reducing fossil fuel use by boosting energy efficiency while increasing renewables and electrification. Many wind and solar projects will accelerate with easier permitting and financing.

The Strategy is well-exposed to this secular shift and to accelerated spending on alternative energy sourcing and generation. Growth in renewables should benefit EDP (OTCMKTS:EDRVF), an operator of wind farms for power generation, and SolarEdge (SEDG), a company we repurchased on weakness in the first quarter that develops electronics for solar installations and should take advantage of greater incentives for solar installations in many geographies. The company has expanded its products offering to address larger markets in commercial and utility solar on top of its traditional residential solar market. The acceleration in electrification of transport should support electric vehicle-related stocks like TE Connectivity (TEL) and Nidec (OTCMKTS:NJDCY). In addition, industrial manufacturers Legrand (OTCMKTS:LGRDY) and Atlas Copco (OTCMKTS:ATLCY) should benefit from demand for greater efficiency in mid-voltage applications such as energy-efficient compressors.

The conflict could also boost the trend toward reshoring or near- shoring supply chains and production. Market worries about China’s intentions toward Taiwan, which could alter the global balance of power in semiconductors, have hastened the near- shoring of semi production globally. Such growing risks are hastening the need to build new capacity in Eastern Europe, Canada and Mexico, and they should result in a positive, multiyear, capex-heavy trend for Western companies. Such a transition would most directly benefit the Strategy’s structural growth companies, a bucket we have been increasing (and that now accounts for more than 40% of portfolio assets) to better manage the volatile risk/reward environment in international markets.

Portfolio Positioning

We initiated a position in exchange operator Deutsche Boerse (OTCMKTS:DBOEY), a company with higher rate sensitivity and a higher orientation toward financial data. It operates a fund administration business with recurring revenues that have allowed these non-transaction divisions to do well.

The purchase complements our financials exposure in Europe. While sensitive to the macro environment, European banks have already taken a serious hit and trade at levels implying stagflation or a technical recession. Higher rates will help the banks and their capital levels are high across the entire sector. Provisioning reserve releases are unlikely from here and perhaps faster buildup is needed again for future losses in the years to come, but we believe these headwinds are already priced in.

Also within the structural bucket, we added to our commodity exposure with the purchase of Suncor Energy (SU). Suncor, a past holding, is a Canadian integrated oil company where we capitalized on attractive valuation due to a COVID-19-induced slowdown. We expect recovery in oil demand and strong pricing will result in faster than expected free cash flow growth and financial deleveraging.

The structural bucket has the shortest investment horizon across the spectrum of growth companies we target in the Strategy. We closely monitor the macro impacts and turnaround progress of these companies and will be disciplined sellers when the thesis for a holding plays out.

Most of our selling over the last several quarters has occurred among emerging growth companies, where we have reduced our exposure to under 5% to better manage risk. Exits from the emerging growth bucket in the quarter included Sea Ltd. (SE) after the company issued below-consensus guidance due to a slowdown in its gaming business coupled with a second miss in its e-commerce business due to the pull-forward effects of the pandemic and continued difficult comps. We also trimmed back workflow software maker Atlassian (TEAM) after a strong runup in its shares in 2021.

Most of our reductions in emerging growth have involved IT or related companies where innovation is a key to their business model. That said, we remain positive on the IT sector and have largely maintained holdings in our highest-conviction ideas.

During the quarter, we reduced our semiconductor exposure through the sale of Tokyo Electron (OTCMKTS:TOELY) and a trim of ASML (ASML) to manage concerns of a slowdown due to the risk of double ordering and potential softness in some consumer end markets. We increased our position in IT services with the purchase of Accenture as we remain optimistic about the long-term growth potential these companies provide, which is underpinned by the compressed digital transformation cycle, rising cloud adoption and growth in data-driven insights.

Despite the market volatility and hyper focus on rising rates, chief information officer surveys continue to forecast resilience in IT budgets this year. Growth in IT spending for 2022 is expected to remain above the 10-year pre-COVID-19 average, according to Morgan Stanley. We believe this is a result of the strong secular underpinnings brought on by digital transformation and businesses focusing on increasing efficiencies through technology.

New addition Olympus (OTCMKTS:OCPNY), a Japanese precision equipment and medical device maker, is a good example. The company is the number one player in gastrointestinal endoscopy with 70% market share with an entrenched moat. Its therapeutic solutions division should continue to scale with new product investments in high-growth areas, coupled with improvement in procedural volumes from COVID-19 recovery. We are also seeing progress in a restructuring plan that will create a streamlined global medical technology company with improving profitability and a reliable governance structure.

Outlook

We continue to invest for the long term and are willing to endure volatility as long as our secular thesis for owning a company has not been impacted. The post-COVID-19 hangover for our emerging growth bucket has been very tough, but we understand the risks, have culled the portfolio of several challenged stocks and see a way back for disruptive growth names.

From a regional standpoint, we continue to see promise in Europe and are increasing our exposure to regions like Canada through companies well-suited for developing trends around energy security and supply chains. While headline inflation remains high across Europe, the region does not face the same wage pressures as the U.S., which could temper the increasing hawkish stance of policymakers once the Ukraine situation becomes more settled. Without question, higher energy and agricultural commodity prices creates new challenges for emerging markets, where we greatly reduced exposure in 2021. We expect continued volatility around both economic performance and political change to remain a feature of these markets.

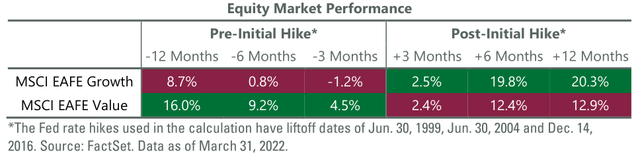

Heightened levels of uncertainty remain across international markets. In Asia, COVID-19 has become a significant risk again, not only in mainland China but also markets where Chinese tourists drive retail spending like Japan and Europe. Currencies are also in flux, with the yen, typically a port in the storm, the worst-performing developed market currency for the quarter. We believe our risk-aware approach to growth investing, emphasizing quality companies with pricing power, can provide balance as the global economy continues to work through these myriad uncertainties. It has been well-documented how tightening cycles hurt long-duration growth assets. As the Bank of England moves ahead with further tightening similar to the U.S. Fed and the ECB contemplates its own monetary actions, it is also worth noting that growth equities tend to outperform value once a tightening cycle is underway (Exhibit 2).

Exhibit 2: Growth Leads Out of Tightening Cycles

Portfolio Highlights

During the first quarter, the ClearBridge International Growth ADR Strategy underperformed its MSCI EAFE Index benchmark. The Strategy had losses across nine of the 10 sectors in which it was invested (out of 11 total), driven by the subsector and stock- specific allocations toward growth areas versus the benchmark.

The IT, industrials, health care and consumer discretionary sectors were the primary detractors while the energy sector was the sole contributor.

On a relative basis, overall stock selection and sector allocation detracted from performance. An overweight to the IT sector was the primary detractor, and we continue to work down this overweight.

Stock selection in the materials sector, hurt by our lack of metals and mining stocks, also had a negative impact on results, as did selection in health care, where an underweight to large cap pharma names and overweight in life science/tools company and more consistently growing medtech names proved detrimental. Stock selection in industrials was hurt by an overweight to machinery and underweight to defense. Within financials, our underweight to banks was a primary detractor with markets such as Japan and Australia outperforming Europe. On the positive side, stock selection in energy aided performance.

On a regional basis, stock selection in Europe Ex U.K., Japan and the U.K. and an underweight to Asia Ex Japan, primarily Australia with its large components of both mining and bank stocks, detracted the most from performance.

On an individual stock basis, the largest contributors to absolute returns in the quarter included Schlumberger (SLB), Canadian Pacific Railway (CP), London Stock Exchange (OTCMKTS:LDNXF), MonotaRO (OTCMKTS:MONOY) and Novo Nordisk (NVO). The greatest detractors from absolute returns included positions in Recruit Holdings (OTCMKTS:RCRUY), ICON (ICLR), Atlas Copco, Hoya (OTCMKTS:HOCPY) and TE Connectivity.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment