onurdongel

Matterport (NASDAQ:MTTR) continues to struggle to grow as expected. The company focused on spatial data completed an acquisition to help boost guidance, but the business is still struggling to onboard new customers. My investment thesis is now Neutral after the big stock jump, though the surging subscriber base and potential for data management of spaces is intriguing.

Struggling, But Promising

The company continues to build a strong subscription business despite the macro headwinds. Revenues were down 4% from last year as Product and License revenues fall with the shift in the business and supply chain constraints.

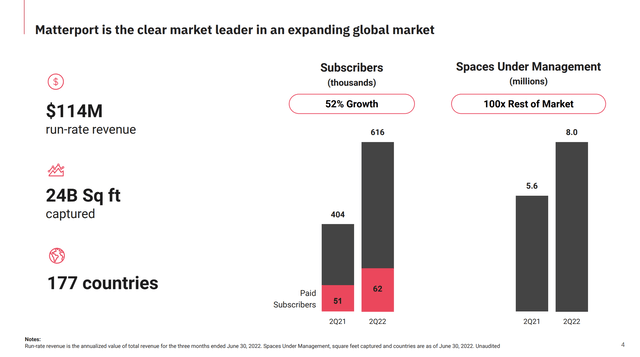

Matterport reported key subscription revenues grew 20% YoY to reach $18.4 million. Along with Services revenue of $5.0 million, the company grew the run-rate revenues to $114 million. Also, subscribers surged 52% to reach 616K, up 10% sequentially.

Source: Matterport Q2’22 presentation

These key metrics focused on subscribers and spaces under management show a very healthy demand for the product offerings of Matterport. The biggest issue remains the ability of the company to offer the cameras or services to get large enterprise customers on the platform with their digital twins.

The Product revenue dipped $4.2 million YoY and would’ve been relatively flat, if not for the issues with camera supplies. Regardless, this metric isn’t meaningful to the business over the long term as the company shifts customers to either Capture Services to onboard digital twins or enterprises expand uses of smartphone apps and bypass the need for fancy cameras.

The inability to ship ordered cameras continues to delay the start of subscriptions crimping future revenues. The backup in orders amounted to $3+ million in delayed product revenue for the quarter and a substantial impact on the reduction in potential subscriptions. Matterport suggests the backlog should improve in the 2H of the year with supply issues resolving.

Misleading Guidance

The stock soared over 35% in initial trading following earnings due in part to confusion over what appears to be strong guidance for the year. Matterport increased guidance for the year primarily due to the additional revenues added with the acquisition of VHT Studios.

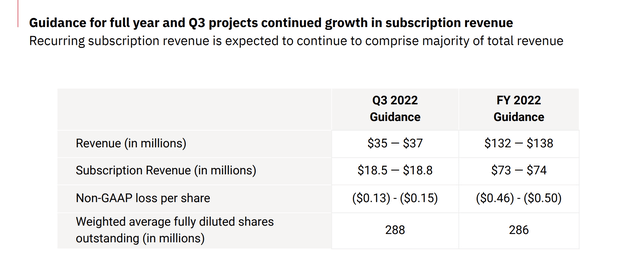

Source: Matterport Q2’22 presentation

The digital spaces leader guided to Q3 revenues of $36 million and 2022 revenue of $135 million. Previously, Matterport had guided to annual revenues of $130 million.

After reporting a quarter where revenues missed analyst estimates by $1.9 million, the market is getting carried away with guidance for a $7.5 million sequential increase. For perspective, the subscription revenue guidance for the year was cut from $81.0 million to only $73.5 million now.

What the company did add to guidance is around $3.5 million for the Pro2 Camera, with backlog recovered in Q3 and ~$4.0 million for the VHT Studios business added in Q3 with the deal closing July 7. On the Q2’22 earnings call, CFO JD Fay provided the following estimates for the business:

So the VHT acquisition should contribute about $4 million in the third quarter, and it’s a seasonal business because it’s us residential real estate base. So, it’ll be a bit less in fourth quarter. And then, the balance then of course would be that recovery in the product revenue line item that we talked about. The backlog itself, we expect to ship through all of the backlog in Q3, and then Q4 would be organic returns base business with respect to product revenue then.

The VHT business will help Matterport capture more digital twins and build marketing capabilities to help brokerages and agents promote and sell properties via those digital spaces. Most of the VHT business is recurring, helping the company build on the recurring revenue theme and shift away from selling hardware products with low margins.

The key here is that Matterport is adding up to $8.0 million worth of revenues from VHT Services to the 2022 guidance and the annual revenue guidance hike was only $5 million. The stock shouldn’t be rallying on this news.

Matterport is now worth over $1.8 billion trading at $6.50 on this big rally while annual recurring revenues are around $110 million after adding VHT Studios to the business. The company has a cash balance of $562 million pushing the enterprise value down to $1.25 billion.

With the large losses, one has to be careful using the EV. The cash balance will shrink appreciably over the next few years as the company guided to an annual loss of ~$140 million.

Takeaway

The key investor takeaway is that Matterport continues to build an interesting digital spaces management suite. As supply chain issues resolve, the company should start growing subscriptions on a more consistent basis. For now though, the stock has rallied too far on subpar subscription guidance.

Be the first to comment