Tevarak

Core Scientific (NASDAQ:CORZ) is a leading operator in the Bitcoin (BTC-USD) mining space. The company became known for its aggressive approach to developing and deploying its Bitcoin mining fleet. Core, like most Bitcoin mining companies, has seen dramatic selling activity since its IPO in early 2022 due to the crypto bear market. This aggressive selling has now presented investors with an interesting opportunity. Core scientific is dominating production figures across the mining industry but has a market cap of roughly $1 billion at current prices. Today we will take a look at Core Scientific’s recent events and discuss what investors can expect going forward from the company.

Before we get started, I have made a crypto ‘cheat sheet’ that documents the important terms for newbie crypto investors. The sheet can be found here.

Production Update

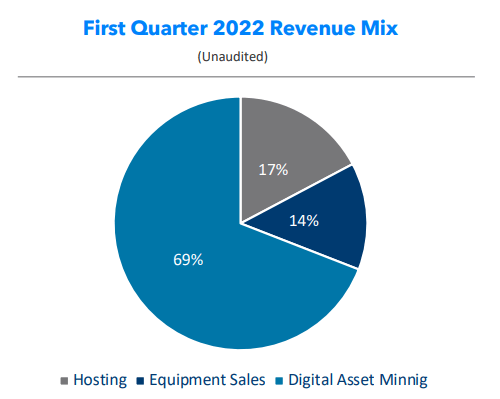

Core’s main product is Bitcoin which accounts for roughly 69% of its revenue. It also provides hosting services that accounted for 17% of revenue in the last quarter, with the remainder being equipment sales that should only provide a temporary windfall.

Core Scientific

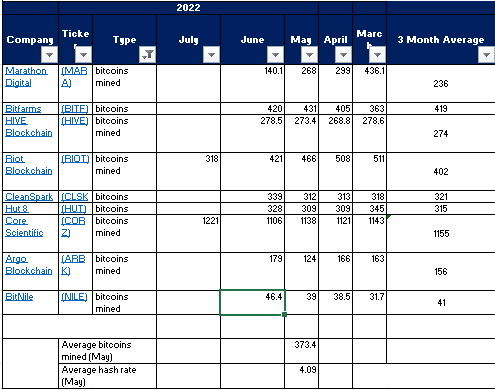

In the first quarter, they reported revenue of $192.5 million, which is 255% higher than the previous year. They also report a net loss of $466.2 million in that period. The loss was primarily attributable to non-cash mark to market adjustments due to accounting rules. The company mined 3,202 Bitcoins in the first quarter, which is more than the second and third largest miners combined. It has since continued its major outperformance relative to its peers and, from a production standpoint, looks set to make the calendar year 2022 a record year.

Author adapted from Seeking Alpha

Thanks to the stellar production figures, Core now holds more than 10,000 self-mined Bitcoins on its balance sheet. This is a significant outperformance when compared to other mining companies.

Earnings Download and Outlook

With the heavy dependence on Bitcoin for revenue, the current crypto winter is definitely unwelcome for focused mining companies like core. Bitcoin mining companies operate very similarly to rare metal mining companies in that they choose to stockpile their key resources and wait for advantageous prices where they tend to liquidate heavily. Like regular miners, there may be instances where the actual cost of production will exceed the market rate for the resource at that point in time, and this is incumbent on the company to maintain liquidity via earned income or financing until they can get to the right conditions. This is sort of where Core is. They have a stellar business model and an aggressive approach to growth but, unfortunately, cannot control the market rates for their main assets. The company doesn’t typically disclose its actual cost per coin, but it did claim to be profitable in may in bitcoin was hovering around $30,000. At the time of the writing of this article, Bitcoin has slumped to $23,000 a coin, and with earnings coming up on August 11th, 2022, there are a few key things investors should look out for. The first thing is if there’s any forced selling. As I mentioned earlier, Bitcoin miners prefer to sell tokens at advantageous levels and rely on alternative financing to help them get to the other side of bad prices. Core recently secured $100 million in financing to do just that. This is at a time when borrowing for many big part crypto miners is becoming difficult, and there are signs that smaller players could become victims of attrition and get worked out of the market. Core’s leadership team has so far decided to take a measured approach, demonstrating their sound understanding of the market, even pausing on ordering new machines until the uncertainty subsides. While the company has been selling its tokens, much of it seems to be precautionary rather than panic selling which is fine. It is prudent for the company to raise cash and lower risk in the current climate, and though the extremely low valuation of the company’s stock makes it prohibitive to raise funds via a secondary offering, which seems to be the preferred method in the mining industry. This puts the company in the position to acquire assets or companies in the space at discounts strategically should the low pricing force smaller players into insolvency.

The other thing we want to look out for in the upcoming earnings report is any clarity on the cost per coin of production. There are methods to estimate the total cost, but the direct cost is a popular figure to rely on as it provides guidance as to whether the company should continue to manufacture tokens or take a pause on production.

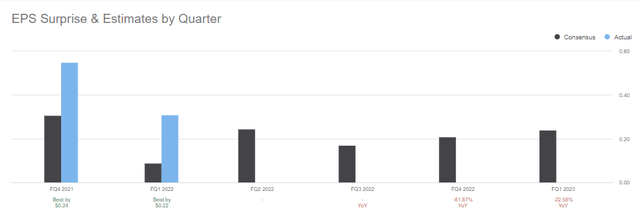

I have no great expectations for profitability outside of greater-than-expected token sales due to the sharp sell-off. This will likely drive another EPS beat, but it’s important to see the effect the sell-off has had on the company’s valuation of its Bitcoin treasury. The sell-off has slowed, but we are still much lower than last quarter. The company has been doing a great job of beating EPS since the IPO, but the stock has not performed. I wouldn’t place much stock in EPS beats until Bitcoin starts to recover.

What is more important is the management teams plan to manage costs throughout the crypto winter and make sure that the company still has heavy exposure to Bitcoin at the right time. This will most likely be a balancing act, and investors should be reminded that it is better to sell the token too soon than too late in a crypto bear market.

The Takeaway

Core Scientific has been putting out massive production figures for some time now, and the valuation is tiny. There are reasons for the low valuation, but the important thing is that a big Bitcoin move in the right direction will fix all concerns. Bitcoin prices may well wash out further, but Bitcoin mining stocks can sustain short stints at disadvantageous prices. Core’s stock will likely outperform on a crypto recovery. I do believe there are better mining companies in the space from my investment standpoint, but Core Scientific is worth a speculative buy on the excellent production history. I will revisit the stock and provide price targets at Bitcoin price levels once the story around selling becomes clear and we get some information regarding the direct cost of production.

Be the first to comment