VioletaStoimenova

This modern era has come to be defined by data and how we utilize that data in order to enrich our world. This has only been made possible by significant advances in technology and data collection. It may be impossible to find a part of the economy where data is not vitally important in determining the success of market participants. Naturally, this means that there are a large number of companies, many with different areas of focus, that warrant some attention. One prospect that’s focused on data and analytics solutions, digital learning, and IT staffing that warrants some attention is Mastech Digital (NYSE:MHH). Although a fairly small company, the business continues to grow at a reasonable rate. By most measures, profit figures continue to improve as well. Add on top of this the fact that shares of the company look rather cheap at this moment, and I do think that it makes for a solid ‘buy’ prospect even though shares might be a bit lofty compared to similar businesses.

A niche data provider

According to the management team at Mastech Digital, the company offers data and analytics solutions, digital learning, and IT staffing services for both digital and mainstream technologies. Its resources include approximately 1,600 consultants that provide services across a wide variety of industries. To best understand the company though, it would be wise to break it up into the different segments that it has. The first of these is the Data and Analytics segment, which is responsible for delivering specialized data management, data engineering, customer experience consulting, data analytics and cloud services, and other related services to its customers across the globe. The end goal of this segment is to help clients accelerate their business velocity, to reduce their costs, and to improve their overall corporate operations.

The company does this by creating customized programs that include strategy, data management, business intelligence, data engineering, customer experience, and other related activities. Under this umbrella, the company provides data management and data engineering services. Under the data management category, the company helps customers identify, acquire, store, manage, and transform data for the purpose of achieving actionable business insights. Other offerings include those centered around data science by providing analytics and AI/machine learning solutions for its customers, and customer experience consulting activities, cloud services, and more. This is a fairly small portion of the company, accounting for only 17.3% of its revenue. However, it is extremely profitable, boasting 31% of the company’s profits.

The other segment that warrants attention is referred to as IT Staffing Services. Through this segment, the company provides consultants that it believes will meet the needs of its customers, needs that are usually filled by temporary contractors. For the most part, the company does focus on the IT staffing side of things. But it also offers digital transformation services, permanent placement services, and more. During its latest fiscal year, this segment accounted for 82.7% of the company’s revenue but for only 69% of its profits.

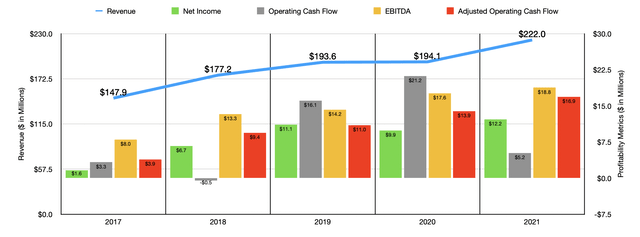

Over the past five years, Mastech Digital has done a fairly good job growing the enterprise. Revenue has risen in each year during this timeframe, climbing from $147.9 million to $222 million. The jump from $147.9 million in 2017 to $177.2 million in 2018 was driven largely by acquisition activities. The sizable increase from $194.1 million in revenue in 2020 to $222 million last year was driven by an 11% organic growth under the Data and Analytics segment and by a 12% increase in organic revenue associated with its IT Staffing Services operations.

This rise in revenue over the years has been accompanied by improved profitability. Between 2017 and 2021, net income rose almost every year, rising from $1.6 million to $12.2 million. Other profitability metrics have been a bit lumpier. For instance, operating cash flow peaked at $21.2 million in 2020 before plunging to $5.2 million in 2021. But if we adjust for changes in working capital, it would have risen consistently over the past five years, rising from $3.9 million to $16.9 million. Over that same window of time, EBITDA also increased year after year, rising from $8 million to $18.8 million.

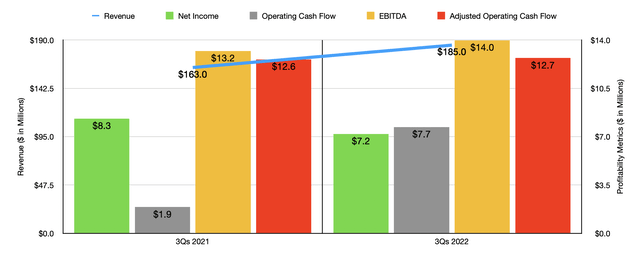

For the most part, financial performance has remained positive so far in 2022. Revenue of $185 million for the first nine months of the year beat out the $163 million reported the same time last year. Higher costs did push profitability down somewhat from $8.3 million to $7.2 million. But by all other measures, the bottom line results for the company have been positive. Operating cash flow, for instance, jumped from $1.9 million to $7.7 million. If we adjust for changes in working capital, the improvement was far more subtle, increasing from $12.6 million to $12.7 million. And over that same window of time, EBITDA for the business rose from $13.2 million to $14 million.

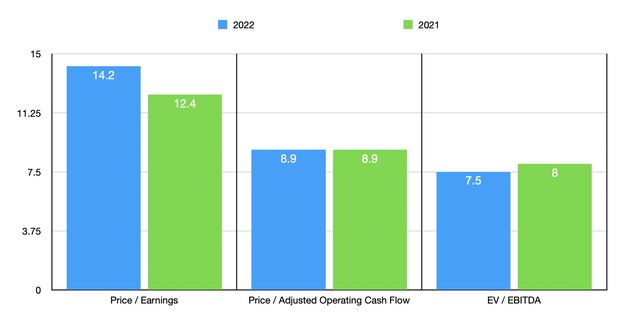

We don’t really know what to expect for the rest of the 2022 fiscal year. But if we annualize results experienced so far, we should anticipate net income of $10.6 million, adjusted operating cash flow of $17 million, and EBITDA of roughly $19.9 million. Based on these figures, the company would be trading at a forward price-to-earnings multiple of 14.2. The price to adjusted operating cash flow multiple is considerably lower at 8.9, while the EV to EBITDA multiple of the company should come in at 7.5. For context, I also put valuation figures for the company based on data from its 2021 fiscal year up in the chart above. As part of my analysis, I also compared the business to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 3.6 to a high of 8.1. In this case, Mastech Digital was the most expensive of the group. Using the price to operating cash flow approach, the range was from 7.8 to 146.5. In this scenario, three of the five companies were cheaper than our target. And when it comes to the EV to EBITDA approach, the range was from 2 to 136.3, with four of the five companies cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Mastech Digital | 14.2 | 8.9 | 7.5 |

| BGSF Inc. (BGSF) | 4.8 | 30.9 | 7.1 |

| DLH Holdings (DLHC) | 7.8 | 146.5 | 4.8 |

| Skillsoft (SKIL) | N/A | N/A | 136.3 |

| GEE Group (JOB) | 3.6 | 7.8 | 2.0 |

| Hudson Global (HSON) | 8.1 | 10.9 | 3.5 |

Takeaway

When I look at Mastech Digital, I see a company that has achieved steady growth on both its top and bottom lines. Despite being a rather small firm with a market capitalization of only $150.9 million, the business still generates attractive amounts of cash flow. Cash exceeds debt by nearly $1.3 million and the company has not demonstrated any meaningful slowdown during these difficult times. Add on top of this the fact that shares of the company look rather cheap, even though they are a bit lofty compared to similar firms, and I do believe that it makes for a solid ‘buy’ prospect at this time.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment