Ethan Miller/Getty Images News

Only a few years ago, Qualcomm (NASDAQ:QCOM) didn’t have much of a business beyond smartphones. Now, the wireless chip giant hosted an Auto Investor Day due to surging demand and a growing order book. My investment thesis is ultra-Bullish on the stock due to the cheap valuation on the dip to $120 and the growth opportunities outside of handsets.

Exploding Pipeline

In a few short months, Qualcomm has added an incredible $11 billion to the Auto design-win pipeline. The wireless giant now has a massive $30 billion design-win pipeline after reporting an impressive $19 billion total when reporting FQ3’22 earnings back in July.

Only a few short years ago, the Auto business appeared more like a long shot for Qualcomm to gain much market share. Chip companies like Intel (INTC) have long struggled to move beyond core competencies, making the concept of Qualcomm moving successfully into Auto and IoT as major long shots.

Now, the previous corporate goal of $3 billion in Auto revenues by FY26 has been supplanted with a new $4 billion goal based on the surge in design wins. The wireless giant has $44 billion in annual revenues, led by over 60% of revenues from the handsets market, so auto will still be a small part of the business. The goal of reaching $9 billion in revenue by FY31 becomes a massive business in the next decade.

The key here is that in combination with IoT, such as chips for Meta (META) headsets, the company has a combined non-handset business capable of pushing forward growth. The IoT category has already reached $1.8 billion in quarterly sales, with a goal of reaching $9 billion for FY24. Qualcomm will have a combined book of business for IoT and Auto quickly approaching the handset business in the next few years.

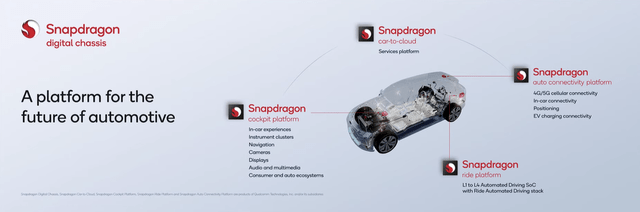

Qualcomm is focused on the below technology solutions to build the digital cockpit of the future including infotainment, wireless connections, driver assistance and cybersecurity protections, amongst others. The Snapdragon Ride platform continues to evolve further and further into the automated driving landscape.

Source: Qualcomm Auto Investor Day

The Arriver acquisition was completed back in April and delivered Qualcomm with open, fully integrated, and competitive Advanced Driver Assistance System (ADAS) solutions to automakers and Tier-1 suppliers at scale. The company quickly went from an infotainment and connectivity solutions provider to a fully technology provider, advancing the Qualcomm Ride platform to a legitimate technology leader.

The total Auto TAM surges to $100 billion by 2030 led by the ADAS/AD market at $59 billion. A lot of the near-term business will focus on connectivity and the digital cockpit. The amazing part is that the premium vehicle will have up to $3,000 in technology content by 2030.

Source: Qualcomm Auto Investor Day

Amazingly, Qualcomm forecasts a $5 licensing fee for 5G connected vehicles. The global vehicle market is at a nearly 80 million annual production rate, which provides a $400 million annual royalty rate.

Stock Disconnect

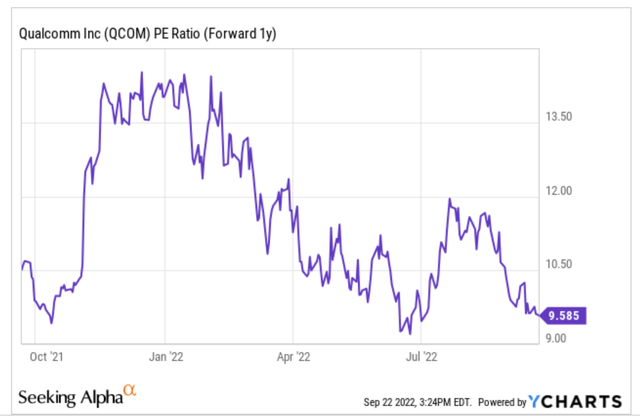

The stock is very disconnected with the opportunity ahead for Qualcomm. The wireless company has recently reported recorded results, yet the stock trades down $73 from the recent high above $193.

Qualcomm trades down at a remarkably low 9.6x forward EPS target of nearly $13 for FY23. The company faces struggles in the handset market, but premium customers such as Apple (AAPL) haven’t seen the same setbacks as high-end manufacturers, where the wireless giant participates less.

The key though is the opportunity in the years ahead. Qualcomm hasn’t reached any peak earnings level with the ability to stack Auto and IoT revenues on top of a huge earnings stream from the handset business. Over the next decade, the Auto business will surge from $1 billion annually now to $9 billion providing a massive boost to the revenue base ensuring the current peak EPS will only continue to grow.

Takeaway

The key investor takeaway is that Qualcomm is too cheap trading below 10x forward EPS targets, even if the current numbers are under pressure. The massive Auto and IoT markets ensure the current earnings stream will only grow in the decade ahead.

Be the first to comment