jewhyte

All values are in CAD unless noted otherwise.

RioCan Real Estate Investment Trust (OTCPK:RIOCF) (TSX: REI.UN) left us impressed with its clear plans and execution of its strategy to reduce exposure to non-essential retail properties. The name of the multi-year game was to edge out pure retail with mixed-use properties, where grocery anchored centers co-exist with office and residential buildings in prime, high-density transit oriented areas. Majority of this strategy was/is to be executed on property already owned by RioCan.

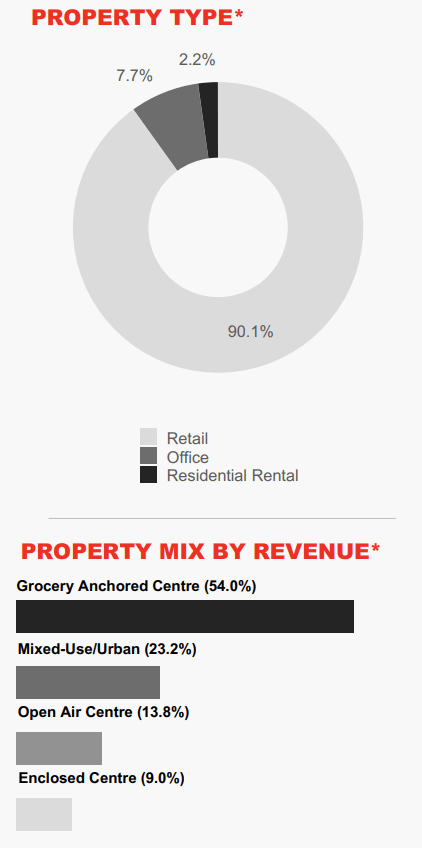

Bringing our focus back to the now, this primarily Toronto-based REIT had the following property mix in its portfolio at the end of Q1 2022.

RioCan Q1 2022 Report

The last time we wrote on it we issued a Mea Culpa as we had given this one a pass in 2021, preferring another REIT instead. Our choice underperformed RioCan and we had come back to the table to see if we could identify a buy point to get in on the REIT’s diversification bandwagon. Aforementioned admission of error non withstanding, we chose to stay out once again and summarized our reasoning in the conclusion:

The valuation, overall, is on the expensive side for us. Yes, we get the move to the residential side but 17X AFFO is still a bit high. Even after their 5-year plan, residential NOI will be under 10%. Last time we covered this, we were close to moving this to a sell. The execution and clear plans that we have seen though, still keep us neutral, despite the big share price gains. We remain sidelined here and this has been also influenced by the sheer abundance of opportunities we are seeing in REITs. Those looking for a redevelopment story should consider H&R REIT (OTCPK:HRUFF) in our opinion.

Source: RioCan: Proving Us Wrong, One Residential Building At A Time

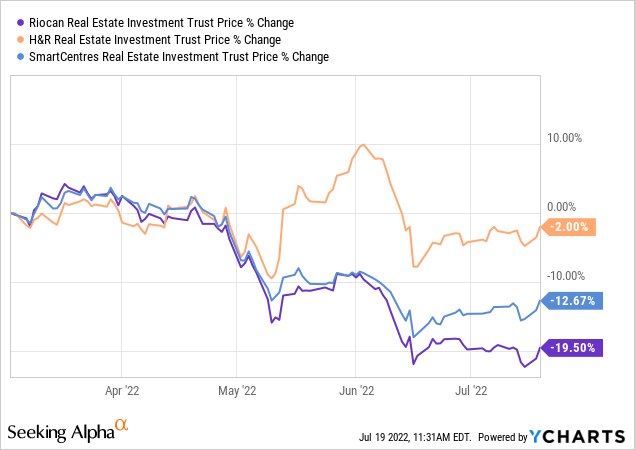

Appears we got the call right the last time around.

Is this a case of even a broken clock (us) being right twice a day? Or have the interest rate and inflation headwinds started eroding some of their well laid diversification plans? Finally, what makes us bullish now?

Q1-2022

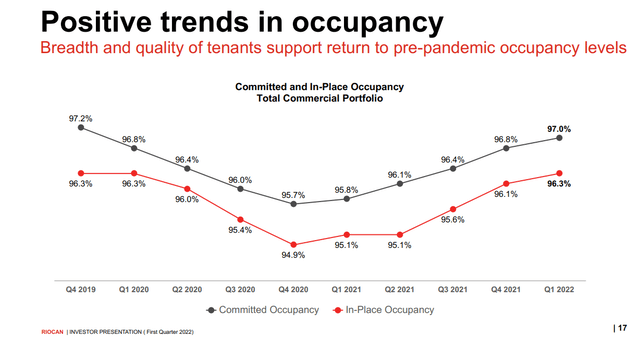

Q1-2022 FFO came in blazing hot at $0.42 and was about 5% ahead of consensus. RioCan’s rent collection moved above 99% and there was no bad debt expense. Net operating income or NOI, for properties that existed last year (SPNOI) was up 4.1%. The REIT showed gains in both its current (96.3%) and committed occupancy rates (97%).

Notable were the leasing spreads on renewals at almost 7%. RioCan completed 145,000 Sq. Ft of developments in Q1-2022. All in all, it was a solid report and management reiterated its growth view.

Why Does The Market Hate The Stock?

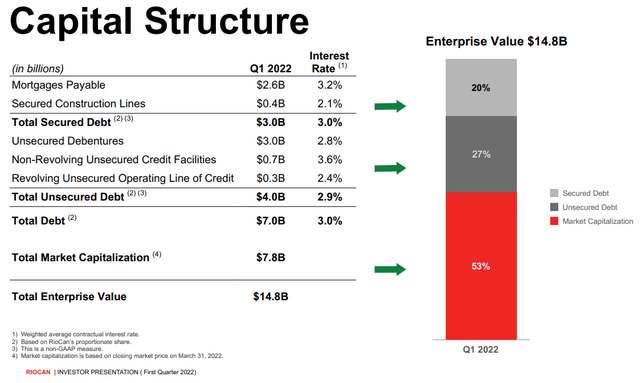

That 20% drop shown above was pretty brisk and in line with the steepest falls in the Canadian REIT space. The primary issue remains that of debt and RioCan is flirting with a 9.5X debt to EBITDA. Debt to Asset ratio is far better at 40% and clearly the market is paying more attention to the former metric. Which is more important though? The latter ratio assumes that there is a nice smooth market for asset sales and RioCan will be able to sell properties at its sub 6% cap rates. We think that is currently the case but don’t assume that will always be the way things shape up. Debt to EBITDA is in the driving seat because it is front and center destroying RioCan’s hard won FFO growth. What we mean by that is from 2022 to 2023 the expected growth in NOI is about $40 million, while interest expenses are now expected to move up by $34 million! So RioCan’s growth plans will result in a FFO that stays flat between 2022 and 2023. That is a lot of capex and a lot of flailing around for a flat FFO. The company is aware of how this looks to even the casual observer and the latest report had a paragraph dedicated to the cause.

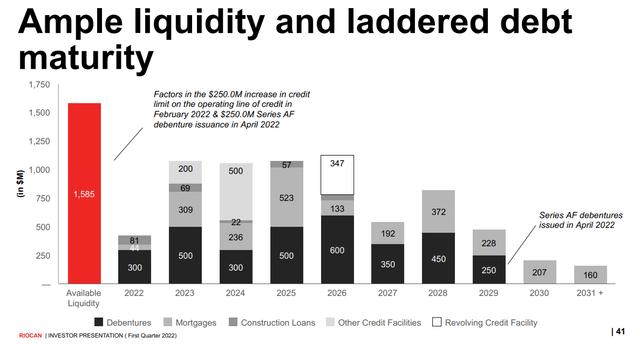

For our next wave of projects, we will be developing on lands that we already own with in-place income, which affords us with the ability to maintain discipline. To protect against rising interest rates, RioCan has employed a variety of tactics, namely maintaining a low proportion of floating rate debt, locking in long-term fixed rate debt and maintaining a well-distributed debt maturity profile. Ample liquidity of $1.3 billion and unencumbered assets of $9.2 billion, provide additional flexibility to the Trust in the current interest rate environment.

Source: RioCan Q1-2022 Report

That sounds nice, but counterpoint here is that the 2023 rise will only be the first wave in the video game. RioCan has $7.0 billion of total debt and only $1.0 billion renewing in 2023.

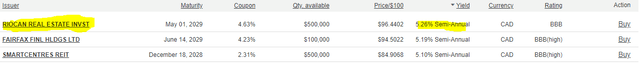

Current implied rates for RioCan issuing 7 year bonds are at 5.26%.

Investors can envision what a 2% move on that $7.0 billion of debt from 3% to 5% will do. Granted that it will be spread out over a few years, but RioCan has little room for error here, if it wants to achieve its transformation plan.

Let’s also keep in mind that this debt load is as things stand. There is no way that RioCan’s capex plan will not require additional debt raising, even assuming that it can recycle some properties at attractive rates.

Verdict

At 12X FFO, things are certainly more interesting than they have been in the past. While inflation hurts in terms of rising costs for redevelopment, you have to give some credit for zoned land values and replacement cost of retail properties moving up. You are seeing this in the rents that they are getting. The implied cap rate is also at 6.75%, which discounts some risks. Residential property values are likely to be supported based on how strong rents have been. We still think this merits a small position as the occupancy gains and leasing spreads have been terrific. To buy, you have to believe in the NAV and have to believe that interest rates are unlikely to move up a lot more. If you don’t, this is not for you. At $20.00 CAD, we are putting a buy rating here, with a 2 year target of $23.00 CAD. The 15% gain alongside the hefty 5% annual dividend creates a good return in this market.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment