Luis Alvarez/DigitalVision via Getty Images

A Quick Take On WalkMe

WalkMe (NASDAQ:WKME) went public in June 2021, raising approximately $287 million in gross proceeds from an IPO that priced at $31.00 per share.

The firm enables enterprises to monitor and analyze online customer engagement via its SaaS Digital Adoption Platform.

Until WKME begins to make meaningful progress toward operating breakeven, in the current market environment, I don’t see a lot of upside to the stock.

I’m on Hold for WKME in the near term.

WalkMe Overview

Tel Aviv, Israel-based WalkMe was founded to develop a SaaS platform for enterprises to maximize their insight into and ability to increase customer engagement across various aspects of their online business.

Management is headed by co-founder and CEO Dan Adika, who was previously a software engineer at Hewlett-Packard Company and computer programmer in the IDF.

The company’s primary offerings include:

-

Unified visibility & insights

-

Consistent user experience

-

Self-service onboarding, feature engagement, support

WalkMe’s Market & Competition

According to a 2018 market research report by Research and Markets, the global customer experience management market is projected to grow to $21.3 billion by 2024.

This represents a forecast CAGR of 22% from 2018 to 2024.

The main driver for this expected growth is the increasing need for personalized customer experience.

Also, as IT infrastructure becomes more complex, organizations continue to seek more unified views into the online activities of their prospects and customers for decision-making purposes.

Major competitive or other industry participants include:

-

SAP

-

Microsoft

-

Oracle

-

Salesforce

-

Software for specific in-app guidance

WalkMe’s Recent Financial Performance

-

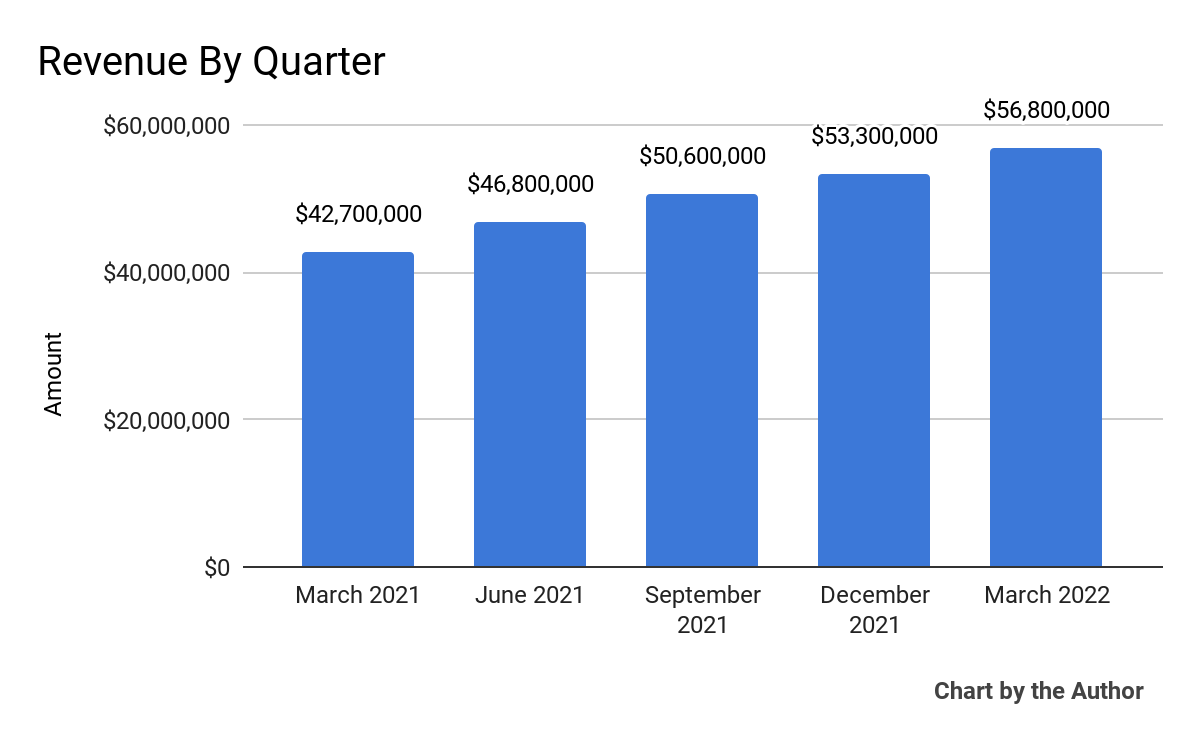

Total revenue by quarter has grown steadily over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

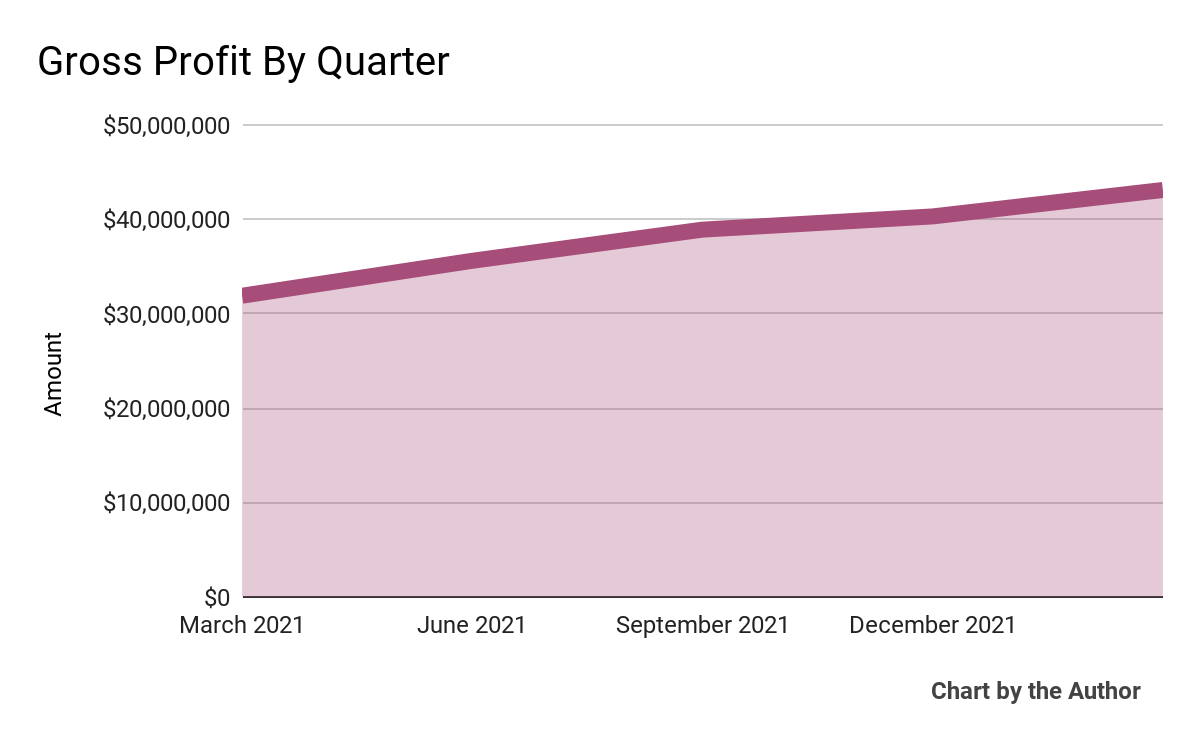

Gross profit by quarter has followed roughly the same trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

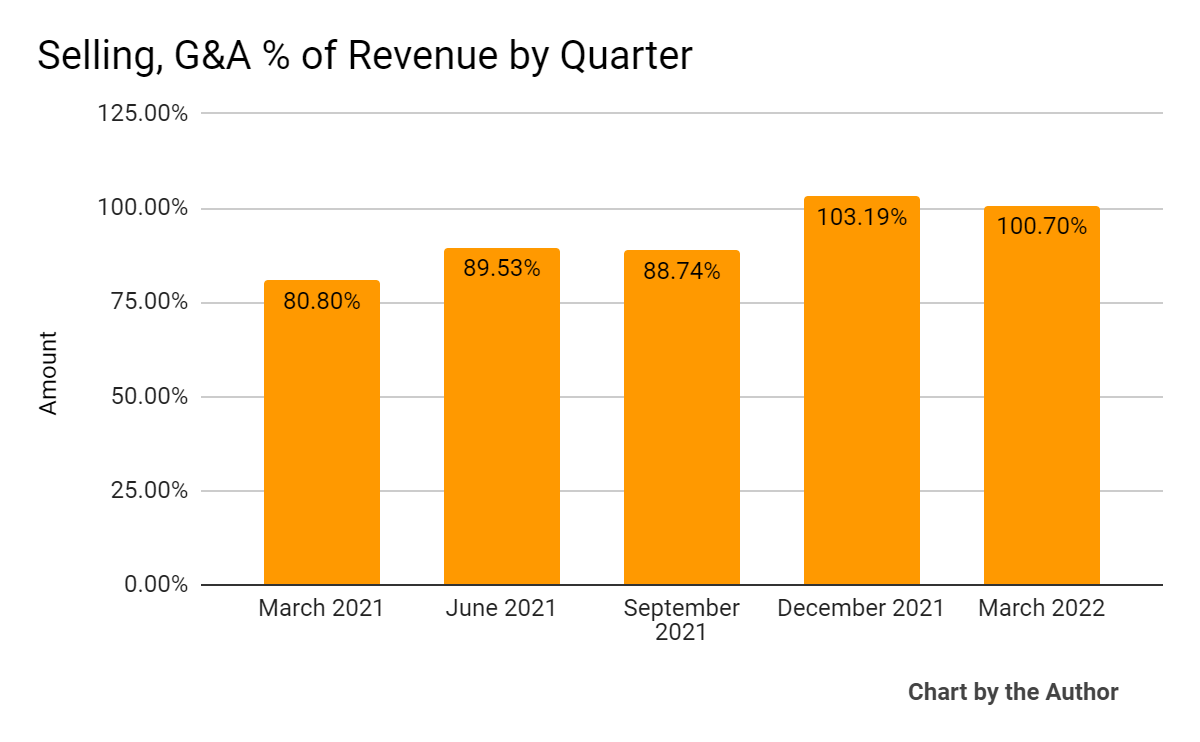

Selling, G&A expenses as a percentage of total revenue by quarter have remained quite high:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

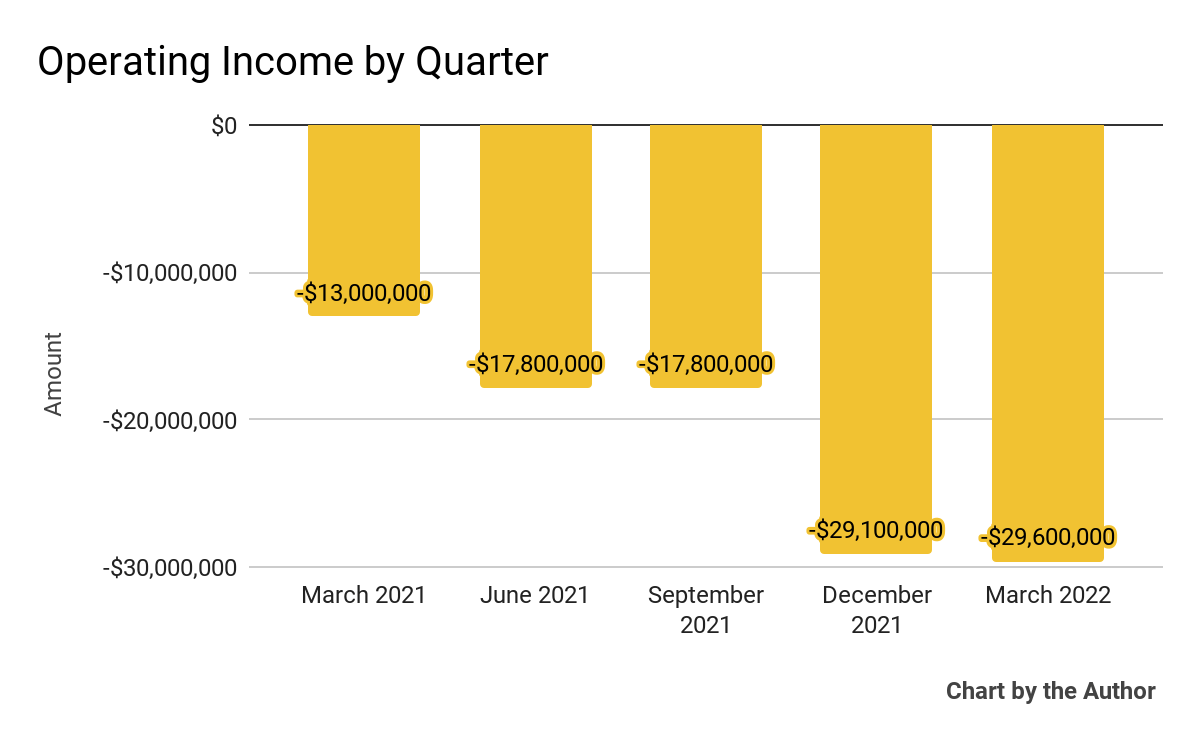

Operating losses by quarter have worsened markedly in recent quarters:

5 Quarter Operating Income (Seeking Alpha)

-

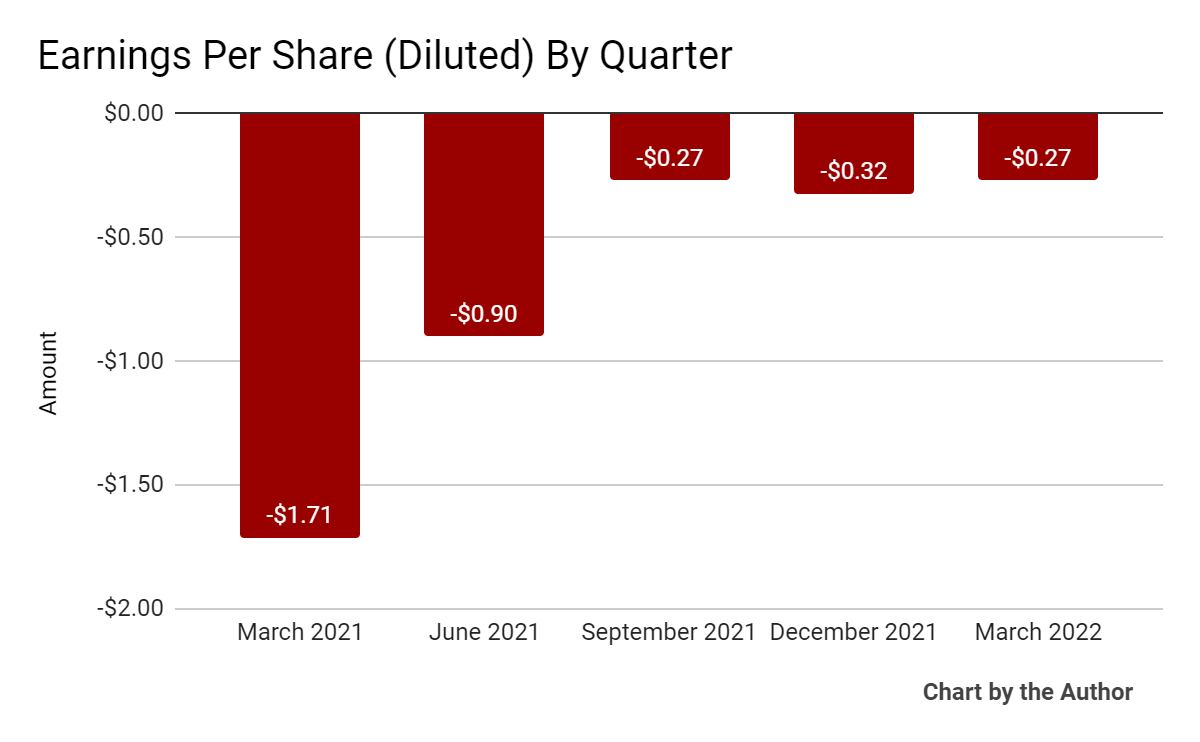

Earnings per share (Diluted) have also remained considerably negative in recent periods:

5 Quarter Earnings Per Share (Seeking Alpha)

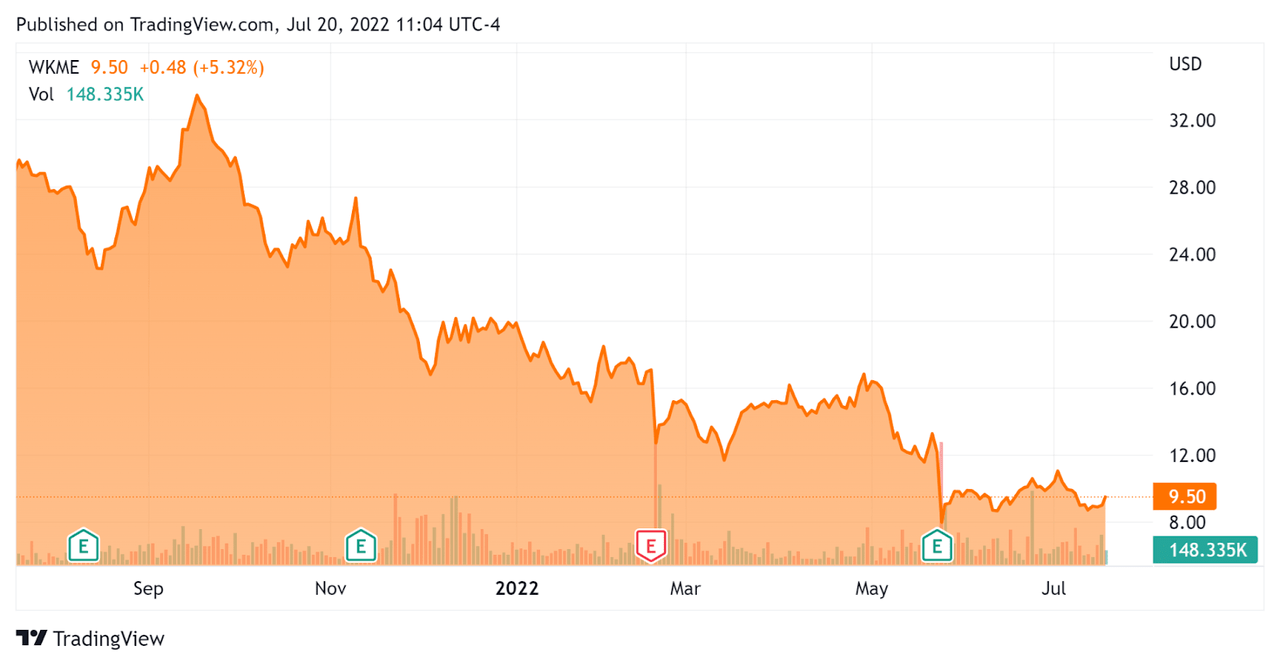

In the past 12 months, WKME’s stock price has fallen 67.4 percent vs. the U.S. S&P 500 index’ drop of around 8.2 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For WalkMe

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$452,520,000 |

|

Market Capitalization |

$762,250,000 |

|

Enterprise Value / Sales [TTM] |

2.18 |

|

Price / Sales [TTM] |

3.01 |

|

Revenue Growth Rate [TTM] |

32.38% |

|

Operating Cash Flow [TTM] |

-$49,630,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.76 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

WKME’s most recent GAAP Rule of 40 calculation was negative (11%) as of Q1 2022, so the firm needs significant improvement in this regard, per the table below:

|

GAAP Rule of 40 |

Calculation |

|

Recent Rev. Growth % |

32% |

|

GAAP EBITDA % |

-43% |

|

Total |

-11% |

(Source – Seeking Alpha)

Commentary On WalkMe

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the growth in customer use of its Digital Adoption Platform, with average ARR per customer of $650,000.

The company recently launched its Digital Transformation Intelligence product, to enable organizations to monitor their digital transformation initiatives.

Also, WKME added a new Chief Revenue Officer to focus on scaling and improving its enterprise sales efforts, notably its U.S Federal and international expansion initiatives.

As to its financial results, the firm grew subscription revenue 34% year-over-year.

WKME sees strength in its large enterprise and commercial customers with over 500 employees while the firm is experiencing higher than normal churn from its smaller customers.

Looking ahead, management said it ‘remains confident in our pipeline for the rest of the year,’ and sees the potential to ‘grow more than 30% for the next three to five years.’

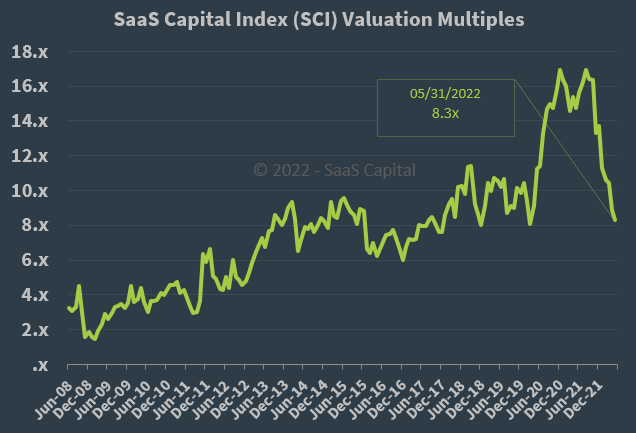

Regarding valuation, the market is valuing WKME at an EV/Sales multiple of around 2.2x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 8.3x at May 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, WKME is currently valued by the market at a significant discount to the SaaS Capital Index, at least as of May 31, 2022.

The primary risk to the company’s stock price is its continued heavy operating losses which have been severely punished in the current rising interest rate market environment.

A potential upside catalyst to the stock could include a slowing or pause in interest rate hikes, potentially reducing cost of capital concerns for money losing companies like WalkMe.

While the firm is transitioning to a focus on greater than 500 employee enterprise customers, larger customers typically require longer sales cycles, which may slow its revenue ramp.

But, until WKME begins to make meaningful progress toward operating breakeven, in the current market environment, I don’t see a lot of upside to the stock.

I’m on Hold for WKME in the near term.

Be the first to comment