Duncan_Andison/iStock via Getty Images

By Robert Hughes

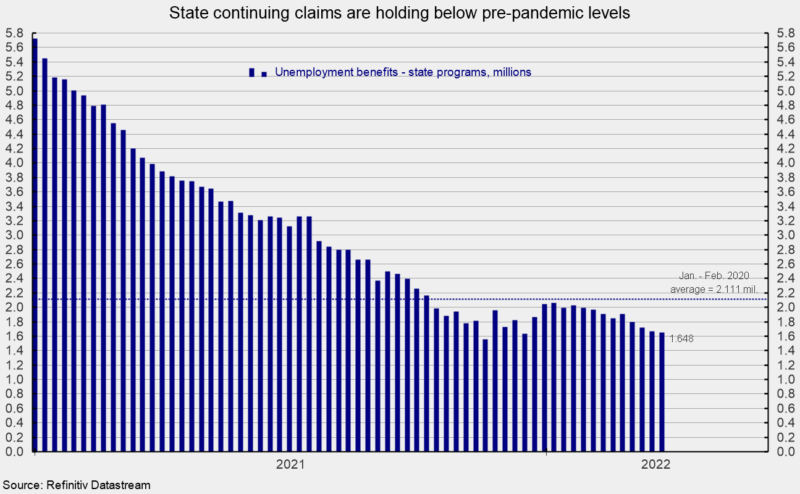

Initial claims for regular state unemployment insurance rose slightly, increasing 18,000 for the week ending April 9, coming in at 185,000, above the prior week’s multidecade low (see first chart). Claims continue to bounce around week to week but have posted declines in eight of the last twelve weeks. Despite the uptick, claims remain below the January – February 2020 average of 212,000 prior to the lockdowns. By long-term historical comparison, initial claims remain extremely low.

The four-week average rose slightly in the latest week, coming in at 172,250, up 2,000 from the prior week but just the second increase in the last 11 weeks. Weekly initial claims data continue to suggest the labor market remains very tight. However, disruptions to the global economy due to the Russian invasion of Ukraine and the start of a Fed tightening cycle may cause volatility to economic activity in coming months.

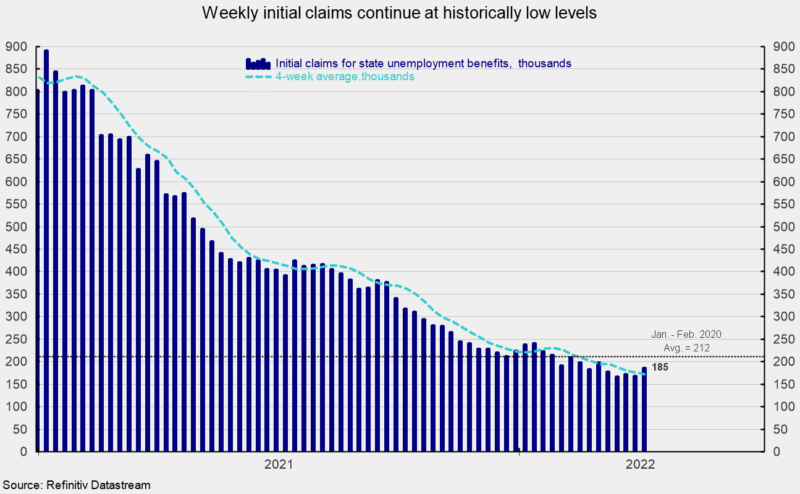

The number of ongoing claims for state unemployment programs totaled 1.648 million for the week ending March 26, a drop of 19,735 from the prior week (see second chart). State continuing claims have declined in nine of the past eleven weeks and have been below their pre-pandemic level of 2.111 million since October 2021 (see second chart).

The latest results for the combined Federal and state programs put the total number of people claiming benefits in all unemployment programs at 1.703 million for the week ended March 26, a decrease of 19,733 from the prior week. The latest result is the seventh week in a row below 2 million.

Despite some volatility, initial claims have trended lower in recent weeks and remain at an extremely low level by historical comparison. The overall low level of claims combined with the high number of open jobs suggest the labor market remains very tight. Continuing labor shortages, along with materials shortages and logistical issues, are likely to continue to slow the recovery in production across the economy and sustain upward pressure on prices. In addition, geopolitical and global economic turmoil as a result of the Russian invasion of Ukraine has had a dramatic impact on capital and commodity markets, launching a new wave of disruptions to businesses. Furthermore, the start of a new Fed tightening cycle will likely weigh on future economic activity. The outlook remains highly uncertain.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment