nespix

Dear Friends and Investors,

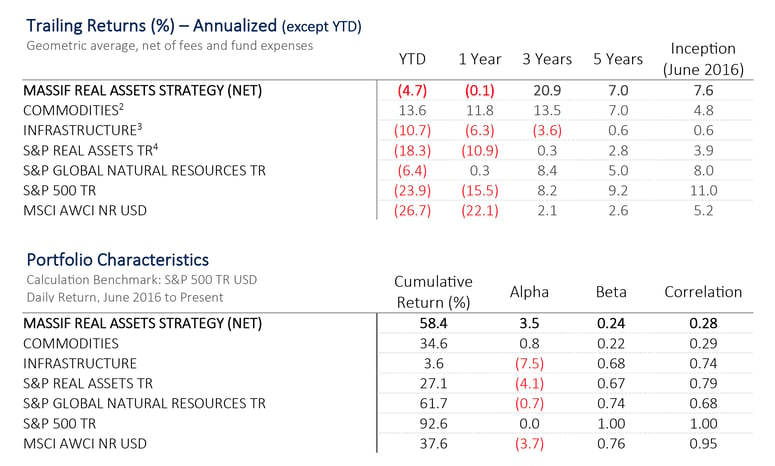

The Massif Capital Real Assets strategy returned -2.9% net of fees in the third quarter of 2022. Year-to-date, the strategy has returned -4.7%.

Returns for our long book fell just under 4.0% for the quarter, while our short book delivered a gain of just over 1.0%. We added short exposure worth 28.0% of the portfolio to the book or 34.0% on a notional basis, inclusive of a synthetic short via options. Two short positions in North American fertilizer businesses were exited for a position-level return of 22.0% and a portfolio contribution of 0.61%. Investments in South American power production and European industrial companies contributed significantly to the negative return of the long book.

We dropped our gross exposure down to 76% and our net exposure to 9%. Both those numbers will fall in the short term. We will increase gross exposure opportunistically.

A Map for Where We Are

“The zeitgeist most at risk for a rug pull is that the Fed will quickly pivot”- Massif Capital’s Q2 letter to investors.

This is as true today as it was in July. Jay Powell and the Board of Governors have been consistent, firm, and unwavering in their guidance and expectations on tightening. They have stated they have no issue raising rates in a recession. More recently, Chairman Powell has responded to a unique United Nations warning by reminding a global audience that, while mindful of the growing burden countries face from a strong dollar, they will continue to lift interest rates to bring inflation down in the United States.

If the Fed sticks to this path, which we expect it will, investors should expect a further fall in asset prices and likely disinflation in pockets of the economy. The damage will depend on the depth and duration of demand destruction.

We think it is helpful to establish and share a map to figure out where we are and where we believe we are going. Starting with the current tightening posture by the Federal Reserve:

Actions to curb inflation by reducing demand (consumption) are hurting, not helping, structural issues.

The Fed’s hiking interest rates will not solve structural underinvestment issues, particularly in the real asset ecosystem. Hiking interest rates tends to have a negative impact on economy-wide levels of investment. Future commodity supply issues, congested ports, and the sky-high utilization rates of refineries and other industrial plants are all issues resolved via investment, not further underinvestment. Rate hikes are not solving the need for investment in domestic manufacturing to reduce the dependence on foreign powers. While these initial rate hikes may dampen economic activity sufficiently to slow the current bout of inflation, the deeper economic imbalances that have created the current situation will remain unresolved. As such, investors should expect inflationary volatility in the future and invest accordingly.

Fiscal stimulus is here to stay. Any meaningful impact current economic events have on consumers will be swiftly addressed.

Direct fiscal stimulus is here to stay. The rubicon was crossed in response to COVID, and governments are now, unsurprisingly, attempting to subsidize energy amid a global energy crisis. In addition to subsidies, policymakers look increasingly willing to step in to act as primary allocators of resources. In other words, not only do we see direct subsidies being used to alleviate high prices, but we also see complete market failures where the government begins to either set prices and/or nationalize previously private enterprises. We are in a policy-driven market that is moving towards a policy-controlled market.

Greater public-sector involvement in the economy via industrial policy will be pro-growth. Monetary policy, on the other hand, is running a contra-pro-growth policy. The conflict exacerbates the cost of both pro-growth and restrictive growth policies. The cost of spending increases as economic activity pushes inflationary pressures, necessitating rate hikes. At the same time, rate hikes tamp down on economic activity, dispensing recessionary pain. The more pain, the more stimulus, the more stimulus, the more rate hikes, the more pain. The “Red Bull / Vodka” policy (a depressant on one side and a stimulant on the other) is reflexive and may run until one side blinks.

Fiscal policy may once have been reserved for infrastructure and investment, but COVID set a new precedent. As former fund manager Russell Clark recently observed, COVID proved that the multiplier effect of income transfers is much higher than either boosting asset prices via low rates or traditional fiscal policy. Under this policy umbrella, from the perspective of politicians, if nominal incomes rise faster than inflation and central banks tighten, a fall in asset prices is simply a side effect of trying to keep real wage growth strong. Fiscal and monetary regimes often swing back and forth between a policy slate that favors wealth accumulation and open markets to one that favors wealth redistribution and managed markets; the pendulum is swinging towards redistribution and management.

We are accelerating toward three shifts in the macroeconomic and geopolitical landscape.

In an internal presentation to a group of investors this quarter, we laid out three macroeconomic shifts underway:

- A shift from a stable price regime to a volatility price regime;

- A shift from abundance to scarcity;

- A shift from globalization to regionalization.

A confusing mix of depressants and stimulants feeds directly into a more volatile price regime. If underinvestment persists, periods of fiscal stimulus or an eventual pause from monetary tightening will cause prices of input goods/materials to go vertical. The magnitude and duration of extreme price moves – particularly in energy and agriculture – will not be tolerated by governments whose only option is to subsidize further or completely take over essential corners of the economy. This, in turn, fuels an already-growing trend of economic regionalization and protectionism.

Lastly, while underinvestment in industrials, materials, and energy is the thrust behind a move from abundance to scarcity, there is an essential balance of power between labor and capital that we think is beginning to shift for the first time since the 1980s. Here, scarcity refers to the scarcity of labor, a constraint that has formed the backdrop for the situation in which we find ourselves today. It also happens to be what the Fed is “trying to fix,” as the particularly pernicious form of inflation often resides in spiraling wage growth expectations and the resulting economic feedback loops. A mild or severe policy-induced recession might not eliminate the longer-term worker shortages present globally, especially in a political environment supportive of redistribution.

The post-1980s Reagan/Thatcher revolution resulted in free trade, globalized supply chains, deregulation, larger governments on more unstable financial footings (in the U.S., this manifested itself as a penchant for tax cuts on the right without equally serious consideration of spending cuts, and spending on the left, without consideration of revenue) independent central banks, and collapsing union participation in much of the western world.

The 2020s will likely represent a topping process in this economic and political outlook, what some have referred to as neoliberalism, before a shift in the 2030s. Deglobalization, which started before COVID-19, will gather pace. The pandemic underlined the vulnerabilities inherent in long, complex supply chains, while the conflict in Ukraine has caused political alliances to splinter more clearly into regional trading blocs. Since globalization reduced inflation, lowered interest rates, and destroyed worker power, it is reasonable to think regionalization will have the opposite effects.

Labor/Capital

Putting aside the longer-term implications of a shift in policy to grow real wages, the more immediate impact of labor costs is an erosion of earnings. Earnings are already threatened by a Federal Reserve hellbent on demand destruction.

This quarter, two unions representing 115,000 railroad workers, or 78% of U.S. railroad workers, were renegotiating their labor contracts and threatening to strike. The strike would also have brought important logistical arteries of the U.S. economy to a grinding halt, putting at risk the delivery of more than $2 billion of goods daily. At the last moment, the two sides came to an agreement, implementing a retroactive wage increase to 2019 of 14.1% with additional 4.0% and 4.5% wage increases in each of the next two years, as well as five $1,000 lump-sum payments. All told, the negotiated agreement exceeded what the railroad management teams initially proposed and exceeded the government’s proposals. Labor was in the driver’s seat for these negotiations. The result was the most significant wage bump for rail workers in 45 years.

The total industry EBITDA in the last 12 months, including BNSF, is roughly $46 billion. The cash bonuses represent a 1.2% drag on industry EBITDA. Compensation and benefits account for about 33% of total operating expenses at many of the Class 1 railroads. To suggest that operating expenses at the railroads have now gone up roughly 8% is an oversimplification, but it is not necessarily wide of the mark.

The idea that this wage bump could shave 8% to 10% off railroad earnings is not an outrageous claim. We suspect that is on the outer edge of what will happen, but it almost certainly translates to at least a 4%-5% increase in operating costs depending on price increases and timing factors.

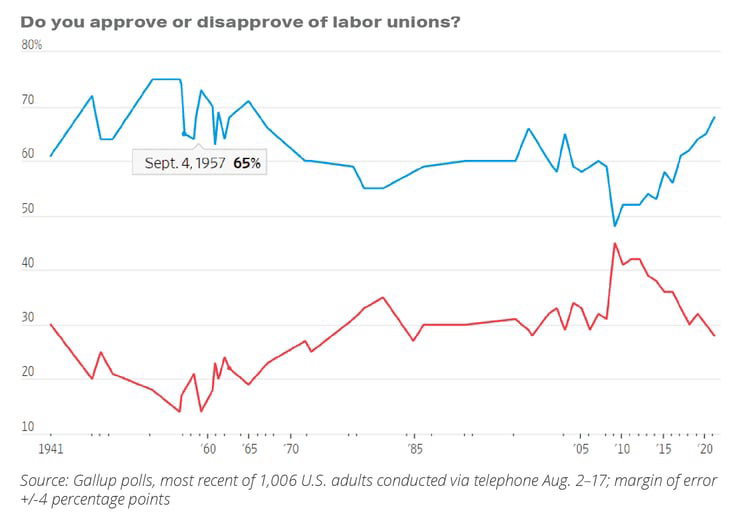

Beyond railroads, the trends are more difficult to discern. According to the WSJ, the number of workplaces with employees starting the process of trying to organize a labor union has jumped to the highest levels since we last saw YoY CPI crest 3% back between 2008 to 2010. Though these petitions represent a very small portion of the total U.S. workforce (only about 30,000 workers) it is the trend to pay attention to. This trend is further supported by Gallup polling aimed at getting a sense of the U.S. populace’s perspective on unions, which shows a widening gap between approval and disapproval hitting levels last seen in the 1970s.

Regardless of one’s opinion on the absolute level of support, the trend is significant because increased union participation at the margin is one more source of pressure in a tight labor market that appears to be approaching a point at which, given supply and demand, the marginal move could produce asymmetric moves. With inflation-straining budgets, it makes sense that individuals seek to capture more of that difference in any way they can. Furthermore, individuals will pursue this incremental improvement even if that decision creates a suboptimal outcome for society via an inflationary pulse in labor costs.

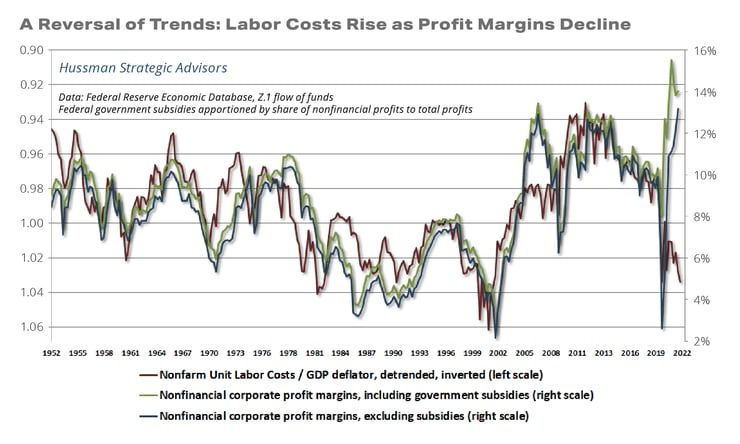

Preserving earnings margins within this mix will be a real challenge for management teams. Profit margins have been tightly linked to unit labor costs over time. In 2005-2007, corporate profits broke from labor costs, partly funded by the spike in home equity loans. This time, it has been pandemic subsidies. Following the 2008 period and the “jobless recovery” that ensued, unit labor costs were very depressed, resulting in growth in non-financial corporate profit margins. We are starting to see that reverse. Take a look at where the relationship lies today in the chart below. We anticipate that this gap will close and profit margins will fall.

What Comes Next – Asset Allocation – Short-Term Pain, Long-Term Optimism.

What does this mean for markets and investors? Most portfolios are built on lessons learned from the period between 1985 to 2020. They are high-beta portfolios split between bonds and stocks, with the idea that one will diversify the risk of the other. This may be a difficult portfolio to hold onto in the future. In the short term, swings in the inflation/deflation pendulum make owning the assets that have thrived in the recent disinflationary period challenging. Between a concentrated portfolio of disinflationary long-duration assets and inflationary assets, the latter probably outperforms. At the same time, the volatile and uncertain environment will continue to frustrate both the bulls and the bears, putting a premium on alpha allocations in a diversified portfolio instead of the beta component, which has done so well in recent years.

We have taken our net exposure in the portfolio down to 8% and will continue to add short positions in the near term, as we do not believe prices are adequately reflecting downward revisions in expected earnings. We hypothesize that productivity stagnation and systemic vulnerability to normalized interest rates will be fixed eventually. Still, current prices do not reflect the pain associated with the path to get there.

A recession almost certainly depresses demand, but on the other side, we likely remain in an environment in which:

- The posture of central banks has not necessarily changed (perhaps inflation remains stubborn at 3%-5%, primarily from wage growth and labor dynamics)

- Governments are ensuring that the consumer is subsidized on top of wages that have grown more in the last two years than any annualized rate of change in the previous 30 years

- The cost of capital is quite a bit higher than it has been in recent memory and access to that dearer capital needs to be earned

In this environment, markets will be rangebound; some companies will do quite well, but many will not survive or expectations will be severely revised. We believe strong economic growth is in the future as industrial spending grows, wage growth increases, and deglobalization unlocks efficiency and innovation along with previously inaccessible labor pools. All while having – in aggregate – flat and broadly confused markets.

This is an environment in which winners and losers need to be picked and sorted through. This is an environment in which there is amplified volatility given sudden and unexpected changes in expectations as previously hidden assumptions about asset class behaviors and correlations reveal themselves. This is an environment in which CAPEX-heavy industries see the most significant change in 30 years as there is a renewed opportunity for differentiation with shortened supply chains, a difference in the cost and utility of labor, and new materials on the horizon driven by the period of scarcity we find ourselves in today where the solution set is investment and/or material replacement.

Short Positioning

Plenty of undue optimism remains

In the U.S., equity market pricing is still in the early innings of appropriately discounting earnings erosion. This is particularly true in several industrial businesses where capital was deployed as if secular, not cyclical, changes occurred to end markets. Companies will suffer as return on invested capital gets squeezed in the coming 12 months. There is usually plenty of conversation on poorly timed buyback purchases; there is far less time spent looking at companies misreading growth trends and aggressive reinvestment. We have added several short positions to the book this quarter where the above dynamic exists, in addition to pricing multiples that reflect unsustainable margins driven by the same misread on end-market demand.

We are also encountering businesses such as Class 1 North American railroads, whose growth models predicated on efficiency maximization, asset reduction, and cheap labor are ending. The runway for a strategy focused on cost efficiency via service reduction, operationalized via employee layoffs, decommissioning hump yards, idling locomotives, etc., always had limited long-term viability. Furthermore, the strategy dubbed precision scheduling railroading has become the industry best-practice, and the ability to generate outsized returns with a strategy of industry best-practice is limited at best. As railroad strategies converged post-2015 and stock price appreciation driven by margin expansion began to fade, share buybacks and multiple expansions have driven equity returns in recent years. In 2017 and 2018, profit margin expansion accounted for roughly 52% of the stock price appreciation in railroad operators like CSX (CSX). In 2019 and 2020, P/E Multiple expansion accounted for around 70% of stock price appreciation.

Rising interest rates will continue to reset discount rates and thus drive down the multiples investors are willing to pay. Perhaps more importantly, the railroads are now looking to re-hire workers in a robust labor market who they fired during an easy labor market, while also facing the possibility that reduced volumes make the new hires redundant. Prices today would suggest neither will occur. We’re very comfortable on the opposite side of that bet.

The situation is far more precarious in Europe than in the U.S., but equity pricing generally reflects a more realistic outlook, in our opinion. The big concern is that the long-term growth model is structurally challenged. For decades, Europe/UK has relied on two sources of cheap leverage: economic leverage (low energy costs and low labor costs) and financial leverage (low-interest rates). The unwinding of this economic model will take time and will be volatile. Given this reality, UK equity market pricing appeared highly optimistic at the beginning of the third quarter. As such, we entered into a long put option position on a UK equity index with a notional value of roughly 6% of the portfolio that has performed well following an increase in sterling volatility and the rollout of conflicting monetary and fiscal policy. The puts are up 90%.

Europe/UK is experiencing a classic “negative terms of trade shock.” Import prices are rising, currencies are weak, current-account positions are deteriorating, and real incomes are under enormous pressure. The region’s central bankers are focused on the “nominal effects” of this adjustment, especially the threat of second-round effects from inflation expectations and wages. Germany’s trade surplus is now gone. It will need to draw down its fiscal space to be able to retool its growth model. We think it’s likely that structural reforms in the labor and product market will make a comeback.

Currently, we are short one European specialty chemical firm we believe is not only subject to the widespread negative economic and energy issues facing Europe but also derives a significant percentage of revenue and earnings by selling into an end-use market that will soon be swamped with cheaper Chinese substitutes. We are also short a large European cement producer that we expect will experience earnings erosion do higher input costs and a turn in the construction market, which is not yet fully priced in by the market.

We think the EU is in for more pain in the short term, but as we look beyond 24 months, the EU has been backed into a corner by Russian action in Ukraine and the excesses of the region’s growth model. The situation necessitates action. Despite the death of the EU being frequently written about in the U.S., recent crises have tended to result in tighter integration of the EU member nations and bold action. The prospect of far-right groups splintering the EU in a crisis appears as far off today as it ever has. Regarding energy, the bloc must do something about energy infrastructure and sourcing. Assuming bond markets cooperate, which is an open question given recent action in gilt markets, this need creates an opportunity for fiscal stimulus in the coming years. We anticipate the EU will be a good hunting ground for CAPEX-heavy industries over the next few years, a core reason we continue to hold Siemens Energy (OTCPK:SMEGF).

Long Positioning

Cautious and Patient

Oil and Natural Gas

We reduced oil and gas exposure from 12% in March of this year to 3% and then to 0%, with an industry short added to the book in May to hedge concerns regarding oil prices. Our concerns proved well founded over the third quarter; the risk in oil was not the widespread assertion of $150 to $200 oil; the mispriced risk was that oil would fall despite a tight/well-balanced market.

We find ample evidence to support a thesis of both continued demand long into the future, despite an ongoing transition to a low-carbon economy, and much evidence of under-investment by the industry over the last decade. This potent mix is a recipe for tight supply long into the future. At the same time, we have long been challenged to own E&Ps because of the underlying volatility of oil.

Since 2008, oil prices have made local peak-to-trough moves of more than 20% at least nine times. Prices have made a 40% downside move five times over the same period. By comparison, copper prices have only had local peak-to-trough moves greater than 20% five times during this timeframe, and only one of those moves was greater than 30%. Over the past 10 years, the annual WTI volatility has been two times higher than copper price volatility. The underlying volatility of the commodity makes oil E&Ps hard to own.

Given the underlying volatility of oil, there is, almost necessarily, a vicious downside case for every equity, and few E&Ps can be purchased at a sufficiently low price that is acceptable to us.

Unlike our mental model for investing in mining, which places a premium on junior firms to minimize commodity risk and maximize operational risk, we look towards more mature, vertically integrated E&P businesses to reduce operational risk. This allows us to comfortably hold the risk associated with the increased relative commodity price volatility of oil vs. other commodities.

We are beginning to build some cautious optimism in the space, but we’re not yet ready to allocate capital. Following the announcement of an OPEC quota production cut, oil remains easily in the top one or two upward risk factors to CPI and restrictive central bank policy. The Kingdom of Saudi Arabia (KSA) is very much in the driver’s seat here (absent exogenous shocks), and the relationship between the KSA and the U.S. looks to be deteriorating.

A key data point that we think is grossly under-discussed is the KSA’s offer-selling-price (OSP) policy, which has shown that it will guard any remaining spare capacity closely. Getting back some spare capacity gives them more control, and the October 5th OPEC cut announcement makes sense viewed through this lens. OSPs at all-time highs is quite telling, in our opinion; a good signal that the market is very tight. Our rough math suggests the actual output cut will be closer to 800,000 barrels per day, primarily born by Saudi Arabia, UAE, and Kuwait. Most other members are underproducing their quotas, such that the cut may not impact how much they are capable of producing. While ~50% of the “headline” number, this is potentially enough to offset some of the downward demand shock concerns from blunt central bank policies looking to stem inflation.

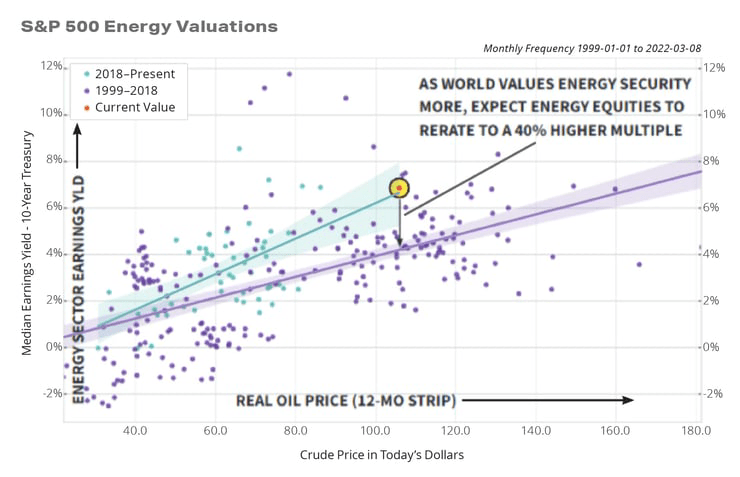

Furthermore, it is reasonable to question whether the current crisis catalyzes a new appreciation for energy security and traditional energy companies. After 5+ years of (justified) oil-adjusted multiple compression, one may expect that energy sector valuations will expand back to historical norms. The chart below illustrates this opportunity.

Before we get too eager, it is also reasonable to question whether the U.S. government will nationalize privately owned energy or logistics assets over the next 3-5 years. In times of political and economic crisis, the U.S. has not been hesitant in the past to nationalize private enterprises. The former DOE director William Becker noted in an OpEd in June: “the Federal government typically nationalizes companies to save them. In this case, it must nationalize Big Oil to save us all from a future we don’t want”. We continue to emphasize that political considerations and interests are becoming very important in major markets as governments look to secure resources. The “richness” in energy investing today can be loosely defined as the emergence of significant undercurrents that need to be considered other than the relative level and directionality of oil prices.

One region of the world we have spent considerable time studying in search of opportunities is the North Sea and the Norwegian Continental Shelf. The geostrategic importance of these assets seems evident and we believe, in the fullness of time, will result in a geopolitical premium being placed on the companies that operate them. Still, at current prices, we have found very little that interests us. A few names we have looked at include AkerBP, Lundin Energy (two independents that are in the process of merging), Harbor Energy, and Var Energi (OTCPK:VARRY). Var was by far the most interesting and, to our previous point above, the most like a major from an operations perspective. When it IPO’d earlier this year at roughly 28 NOK a share, it was not a screaming buy, but it was probably a smart buy that would not have been challenging to make a case for. Today, it looks fairly valued on a weighted spread of oil price scenarios.

We continue to like the idea of liquefied natural gas (LNG) exposure but have yet to find an opening or opportunity. We are reviewing several LNG shipping companies and firms that manage gasification infrastructure globally but have not pulled the trigger on any opportunities due to valuations. Liquefaction companies, such as Cheniere Energy (LNG), appear regularly overpriced to us, and development opportunities like Tellurian are rife with regulatory and financing concerns. On the gas side, to the degree we see softening U.S. domestic natural gas prices, we believe interesting mispricing opportunities in the Marcellus and the Utica producers might appear, but this may also be more of a long-term opportunity where we can be patient with near-term pricing.

Utilities & Electricity Producers

A rising interest rate environment is not good for these businesses, but we are maintaining our long exposure here, given the projected growth trajectories. Additionally, we find merit in holding a portion of our book that directly opposes more cyclical assets.

Roughly 11% of the portfolio is allocated to U.S. utility AES (AES) and Canadian independent power producer Polaris Renewable Energy (PIF:CA). Both positions have had modest performance this year. Polaris has been more volatile than is justified by the underlying business, putting in an all-time high this year at the beginning of August before tumbling 30.0%. AES has been far more stable and traded in a tighter range but is also down for the year by 5.4%, inclusive of reinvesting the dividends into treasury bills.

AES has continued to build its robust pipeline of energy projects and its strong backlog of signed power purchase agreements (PPAs). Currently, AES has 3.8 GW of renewables with signed PPAs under construction, 6.7 GW of signed PPAs for which building has yet to start, and a total development pipeline of 59 GW as of the start of 2022. Of note is that energy storage projects now make up 18% of that pipeline, with roughly 50% of PPA’s including some storage component.

Although we are generally cautious about build operations in today’s tight labor and materials market, AES has thoughtfully approached its purchasing by locking in hardware prices when it signed PPAs, removing a majority of current and forward price volatility. The firm’s management has maintained its targeted 7% to 9% compounded growth rate in earnings through 2025. We see little reason to question these targets based on current activities.

AES continues to lag some of its peers on a multiple basis, which offers the opportunity for relative and absolute outperformance but raises questions about what the market may be concerned by. Solar supply chain issues are the best explanation for short-term underperformance, but on a two-year basis, AES trades at a roughly 30% discount to peers as measured by P/E and a 27% discount measured on an EV/EBIT basis. Balance sheet concerns may drive the discount, but AES has enjoyed several years of steady credit improvement and notched investment grade ratings across the board in the last 24 months. Still, forward-looking leverage levels remain elevated relative to peers. This may be the wedge keeping a lid on relative performance.

Turning to Polaris, we are thrilled with management’s performance over the last 12 months. COVID threw a serious wrench into the firm’s asset acquisition and development strategy, and for much of 2021, it looked as if management was making very little progress in getting the ship back on course. This proved inaccurate, with multiple acquisitions of operating and developing renewable projects in South America announced this year. Equally important, management has increased the geographic diversity of energy-generating assets it owns and has done so while securing very high-priced, long-term power purchased agreements.

Polaris remains undersized, though, and as a result, has been unable to borrow at reasonable prices, despite a decent balance sheet that is not overly encumbered with debt. Furthermore, management does not appear to have waded into the green bond market, despite the ability to do so. In theory, Polaris should be able to secure better pricing than the LIBOR+7%, which is what it secured on the refinancing of a senior debt facility representing more than 50% of the firm’s outstanding debt in February of this year.

Given that Polaris is on a path to more than double earnings between now and 2025, with an associated doubling in returns on capital employed, we believe the company has a bright future. This future could be even brighter if management had access to more and cheaper capital. We would not like to see Polaris taken out by either a larger competitor or a private equity shop, but as a platform for building an independent power producer in South America, it has a strong start and represents a very appealing asset. We are keeping an extremely close eye on whether a lack or cost of capital will impair its working capital and ability to scale.

Precious Metals – Gold

As a first-order effect, gold has done poorly in a rising real rate environment and a strong USD (although it is at all-time highs in other currencies). The gold price adjustment to real rates appears contemporaneous. Historically, for every 1% increase in 10-year real rates, there is a reasonably predictable 10% decline in USD-denominated gold price, all else equal. If that historical relationship holds, the current rise in real rates implies a 26% decrease in gold prices, which aligns with the 22% fall from the March highs of this year. However, there is a growing differential between the selloff and sentiment of the precious metal compared to the value of a call option on a complete loss of confidence in central banks.

Equinox Gold (EQX) has been the most painful position in our portfolio, down roughly 50% since March. The fall in the stock price implies far more has gone wrong at this fast-growing gold producer than has been the case. According to our models, the current share price indicates a long-term gold price of around $1,050 at a 10% discount rate. This appears a significant mispricing. Political risk has undoubtedly been an issue, with operations at the Los Filos mine being halted multiple times and permit issues at RDM mine in Brazil. EQX is a development story and is in the high-growth stage of its corporate lifecycle, with more construction underway at one time than most mining businesses will experience in their entire operating lives.

We believe Equinox will be a strong mid-tier producer by the middle of this decade, doubling the size of its business over the next three years. We are comfortable holding this position through a price cycle and the ensuing volatility as the business matures.

We are going down to Brazil to visit several Equinox mines in October, so expect a complete commentary on the firm in the 4th quarter.

Our goal for the foreseeable future is to maintain flexibility; to retain our option to be agnostic about how events unfold. Cognizant of psychological and economic lag effects, we are focused on both the magnitude and duration of stress we may encounter. As always, we appreciate the trust and confidence you have shown in Massif Capital by investing with us. We hope that you and your families stay healthy over the coming months. Should you have any questions or concerns, please do not hesitate to reach out.

Best Regards,

Will Thomson & Chip RussellManaging Partners

Endnotes

|

| Opinions expressed herein by Massif Capital, LLC (Massif Capital) are not an investment recommendation and are not meant to be relied upon in investment decisions. Massif Capital’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is limited in scope, based on an incomplete set of information, and has limitations to its accuracy. Massif Capital recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies’ regulatory filings, public statements, and competitors. Consulting a qualified investment adviser may be prudent. The information upon which this material is based and was obtained from sources believed to be reliable but has not been independently verified. Therefore, Massif Capital cannot guarantee its accuracy. Any opinions or estimates constitute Massif Capital’s best judgment as of the date of publication and are subject to change without notice. Massif Capital explicitly disclaims any liability that may arise from the use of this material; reliance upon information in this publication is at the sole discretion of the reader. Furthermore, under no circumstances is this publication an offer to sell or a solicitation to buy securities or services discussed herein. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment