serts

Credit Suisse (NYSE:CS), Deutsche Bank (NYSE:DB), and Barclays (NYSE:BCS) are all large globally systemically important European banks that are trading at extremely distressed valuations currently.

CS is trading at ~0.24x tangible book value, DB is at 0.33x, and Barclays is at ~0.45x. Banks that trade at a fraction of their tangible book suggest that they are destroying capital for shareholders.

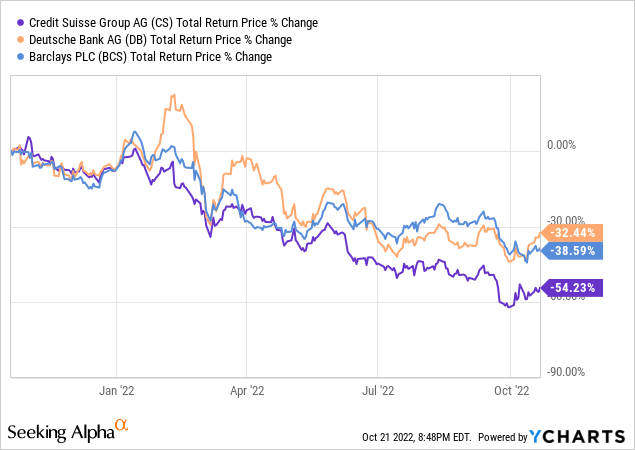

The year-to-date performance has been dismal for these banks. The strong USD compared to the Euro and GBP has exacerbated the steep decline.

Note that in local currency, DB is down YTD 17.5%, BCS decline is 19.5% and CS is 47%.

The above price chart tells the story of a turbulent 2022 so far.

DB outperformed in Q1 due to a steeper yield curve in the Eurozone (DB is exceptionally interest rates sensitive) but gave up that outperformance when the Russia-Ukraine war manifested and fears over the impact of Russian gas suspension crystallized.

CS traded with the pack in the first part of 2022 but around May commenced a precipitous decline as it became more and more apparent that it will need to restructure the investment bank and raise capital.

Whilst BCS’s fundamental performance has been strong in 2022, it was hampered by the over-issuance of securities legal issues which forced it to suspend buybacks for what amounted to be a clerical error on its side resulting in $361 million penalty. And more recently, it gave up some outperformance due to the UK mini-budget debacle.

So taking these events into account including inflation, the paradigm shift in the interest rate environment, geopolitical challenges (Russia-Ukraine conflict, China’s zero Covid policy, and Taiwan), and idiosyncratic firm-specific issues – do these valuations make sense?

In this article, I will endeavor to answer these questions as well as conclude which bank is my preferred buy currently.

Credit Suisse

On the face of it, CS is a very attractive banking franchise comprising 2/3 top-tier wealth management business and 1/3 an investment bank. In the past, some have described it as a European Morgan Stanley (MS) and suggested that with credible execution it should warrant a similar valuation (i.e. ~2x tangible book). Well, it is currently trading at ~0.24x tangible book.

So what went wrong?

CS’s investment bank (“IB”) went into a tailspin and is now on the verge of a death spiral.

It all started with colossal risk management failures in its disastrous backing of Greensill Capital and then Archegos Capital Management. In the 2021 Archegos fiasco, CS suffered a loss of over $5 billion and was forced to raise funds through the issuance of a convertible debenture to plug a capital hole. I have covered this episode in detail in this article – to recap, CS ended up holding margined stocks in the red longer than it should have and was looking to coordinate an orderly sell-down with other banks. The U.S. banks went ahead and sold the margined stock in block sales over the weekend. There is no other way to describe this other than colossal risk management and sheer naivety. Simply put (borrowing a phrase from the early 2000s), when you are in a room filled with Goldman Sachs (GS) bankers and you are not sure who is getting shafted, start worrying….it is probably you.

The medium-term impact on the business was also exceptionally material. CS had to curtail its Prime Finance unit operations which essentially meant that its Equities trading business is no longer a viable one.

But this was all back in 2021, why is that relevant in 2022?

Well, the 2022 bear market in equities is probably one of the worst macroeconomic settings for an investment bank like CS. CS investment bank is geared mostly toward credit markets and capital markets issuances. Also, in the current environment, its areas of strength in the leveraged finance, M&A, and SPAC deal activity are very much counter-productive. CS has also taken material (but yet unquantified losses) on the leveraged buyout of Citrix. On the flip side, CS has little exposure to FICC trading (unlike DB and BCS) which are more stable annuity-like trading businesses that are doing really well in this volatile environment.

Consequently, CS is bleeding losses in the IB and key senior rainmakers are deserting the ship, in increasing numbers, to peers and hedge funds.

It is clear that the IB will need to be dismantled to a great extent. It is just not able to compete with U.S. peers and once you fall out of the top #5/#6 in investment banking, the lack of scale means that it is almost impossible for the IB to earn its cost of capital. CS’s problems are also exacerbated by the heightened cost of funds currently which is reminiscent of DB’s troubled restructuring in 2017. So in short, the CS IB is going through a slow and painful death through 1000 cuts. It will need to shrink massively with the only viable parts remaining would be the ones that play a supporting role to the wealth management business.

The problem is that dismantling an IB is a complex, costly and protracted process. CS also needs to raise capital which is highly dilutive at such distressed valuations. Consequently, CS will probably need to sell parts of its crown jewels such as the US asset management business and/or Swiss domestic banking unit.

CS will unveil its restructuring plan next week. I would rather wait and see the plan (including capital raise/assets sale) before even considering a position in the stock.

Deutsche Bank

DB is already in the final innings of its restructuring and the management team led by Mr. Christian Sewing has been executing marvelously on items they can control (such as cost management and repositioning the bank). DB also benefited from a good measure of luck as the volatility in trading and higher rates in the Eurozone certainly play to its strengths.

The bank targets an ROTCE of 8% in 2022 and greater than 10% by 2025 including a capital return of $8 billion. The most significant impact on Deutsche Bank’s business is the paradigm shift in interest rates in the Eurozone from a negative rate regime to a strongly positive one. All of a sudden, DB’s deposit franchise is worth a lot more than before. This is certainly a game-changer for the stock that many investors have not quite digested yet.

The tailwinds from interest rates should translate to an incremental estimated ~EUR3 billion of pre-tax annual income by 2025 and ~EUR700 million in 2022. Considering the market cap of the stock is only EUR18 billion currently, the numbers speak for themselves.

The main concern investors express with the stock is fear around credit losses given the expected recession in the eurozone emanating from the disruption of Russian gas supplies.

That fear is completely over-blown and more than already factored in the stock price and provisioning level.

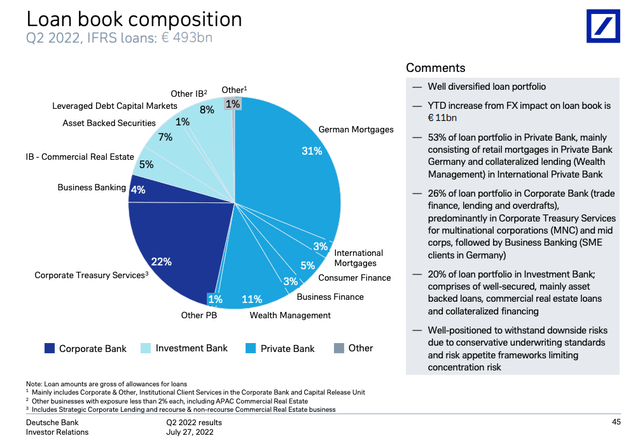

Finally, DB’s credit risk profile is super conservative and should fare well even in a deep recession scenario. The biggest part of its book comprises moderate LTV German mortgages as can be seen below:

On its part, management is guiding for very modest credit losses in 2022 due to the gas situation (less than EUR1 billion or 25 basis points) and it is already well-provided for an adverse scenario.

In short, fears over credit risk when it comes to DB are way overblown.

Barclays

Barclays is a British-domiciled transatlantic universal bank. Its share price is currently impacted by the UK mini-budget debacle that spiraled the UK Gilt market into chaos, demolished the GBP, and introduced a systemic risk premium in the UK banking system.

BCS, in contrast to CS and DB, has already completed its restructure and is now focused on execution. It is already sustainably generating ROTCE of 10% but frustratingly is still trading at a huge discount to tangible book.

It is paying a very healthy dividend of 5% that incidentally is not subject to the UK withholding tax, so is attractive for offshore investors. It is also executing a buyback program which I expect to pick up steam as it generates significant organic capital and is in a strong capital position.

Similar to DB, it enjoys the tailwinds of interest rate hikes by the Bank of England (“BOE”) and trading volatility in fixed income, currencies, and commodities trading.

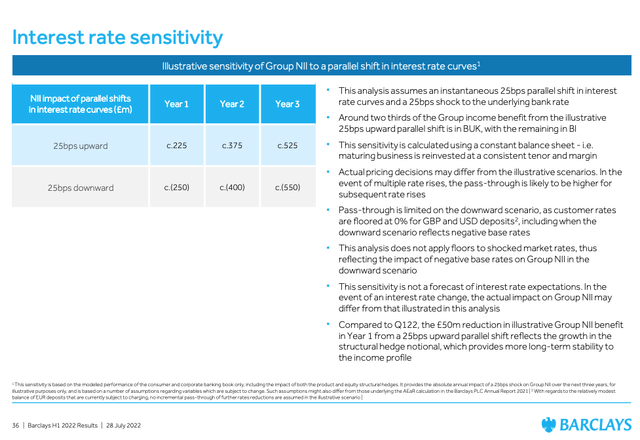

Barclays does not provide a precise projection of the tailwinds expected from the current yield curve. However, the recent Q2 earnings report disclosed a sensitivity analysis of a parallel shift up of 25 basis points:

My (conservative) back-of-the-envelope extrapolation using peers’ bank data suggests an incremental pre-tax annual income of GBP 2 to 3 billion. Keep in mind that BCS’ total market cap currently is ~GBP22 billion, so this is again, similar to DB, exceptionally material in the context of its current distressed valuation.

So the stock trades at a discount of 55% to a tangible book, pays a healthy dividend, earns above its cost of capital sustainably, and buybacks shares – so why does it trade at a distressed valuation?

Well, currently BCS is seen as a proxy leveraged trade on the UK economy. If you want to ‘short’ the UK or the GBP, a bank like Barclays is a convenient proxy. So in my view, it is not really trading in line with the fundamental strength of the underlying franchise.

BCS is also somewhat exposed to unsecured lending to UK and U.S. consumers. Even though BCS is very conservatively provisioned with coverage ratios well above its large U.S. peers, the market fears the upcoming recession and its impact on credit losses.

Conclusion and Takeaway

There will be a time to own Credit Suisse. The wealth management division is a very attractive asset indeed. The problem is that it is currently impossible to value the firm given the upcoming IB restructure and the unspecified size of the capital hole. There are too many uncertainties now and in this market, this is not a risk position I would be comfortable with. I will have greater visibility once the management team unveils the restructuring plan next week (which I will cover here in Seeking Alpha).

The choice between Barclays and Deutsche Bank is a much harder one. Both present a great and asymmetric risk/reward in my view. As always, it somewhat depends on the macroeconomic outlook.

My base case is that we are going to experience a moderate to severe recession in both the UK and the Eurozone, whereby rates are going to remain elevated for the foreseeable future and markets will remain volatile.

Given these settings, my current (slight) preference is for DB as it is not exposed to the UK and U.S. consumer credit risk which may go deep south in the next 12 to 18 months. I believe that DB’s credit book is super conservative and I expect it to outperform in a recessionary environment. This is also similar to the relative outperformance experienced by DB during the recent pandemic.

However, to reiterate, I have a strong buy rating on both firms.

I rate CS as a sell for now, but this may change after next week.

Be the first to comment