niphon

Investment Thesis

Martin Marietta Materials (NYSE:MLM) is experiencing good demand for its products and services despite the uncertainty in market conditions. The company’s revenue benefited from the multiple pricing actions taken over the last few quarters. Looking forward, it plans to implement further price increases in the fourth quarter of FY22 and FY23. This should drive both revenue and margin growth. Apart from this, the company plans to improve its capacity in the Texas cement market given the favorable business dynamics. Despite the slowdown in the residential market, the company should benefit from the healthy demand in the infrastructure and non-residential end markets. I believe the stock is a good buy given its growth prospects and reasonable valuation.

MLM Q3 FY22 Earnings

MLM reported better-than-expected financial results for the third quarter of 2022. The revenue in the quarter grew 16.8% Y/Y to ~$1.81 bn which was better than consensus estimates by ~$50 mn. The adjusted EPS was up ~10.4% Y/Y to $4.69 (vs. the consensus estimate of $4.63). The increase in product and service revenue was due to sales growth in the aggregates and cement businesses, partially offset by the sales declines in the ready-mixed concrete and magnesia specialties businesses. The adjusted EBITDA margin in the quarter declined 310 bps Y/Y to 28.3% due to elevated energy, internal freight, and repair and maintenance costs, partially offset by pricing actions. However, adjusted EPS improved in the quarter due to increases in adjusted EBITDA and revenue.

Revenue Outlook

Despite the current macroeconomic uncertainty, MLM has improved its sales in the third quarter of 2022. The revenue of the Building Materials business increased 16% Y/Y to $1.61 bn, driven by acquisitions and double-digit pricing growth across all product lines. The Building Materials business accounts for ~96% of the company’s sales and includes the sale of aggregates, cement, as well as asphalt, and ready-mixed concrete (downstream businesses). The demand across the aggregates remains healthy. The total shipments, including acquisitions, increased 5.6% Y/Y to 60.2 mn tons. Organic aggregate shipments were largely flat as the strong demand was offset by supply chain disruptions, inclement weather in certain key markets, logistics constraints, and cement shortages. However, the pricing for aggregates remains strong and increased by 11.9% Y/Y as the cumulative effect of multiple pricing actions continued to build in the third quarter.

In the cement business, the Texas market continued to experience robust demand and tight supply, resulting in sold-out conditions. The healthy Texas cement market, along with strong execution, led to shipments of 1.1 mn tons, a 2.3% Y/Y increase, and a record third-quarter level. Additionally, the pricing increased by 21.4% Y/Y driven by continued strong demand and the impact of a second price increase of $12 per ton on July 1. In the downstream businesses, shipments of organic ready-mix concrete decreased 16.8% Y/Y primarily due to the wet August in North Texas and the completion of certain large projects in the quarter. The organic pricing, however, went up 20.3% Y/Y as a result of multiple pricing actions, such as fuel surcharges required to pass through raw material costs and other inflationary cost pressures.

The organic asphalt shipments increased by 4.3% Y/Y driven primarily by the strong demand in Colorado, and the organic pricing improved by 22% Y/Y to offset the increase in raw material costs, mainly liquid asphalt (bitumen). Including the contributions from the acquired operations on the West Coast, asphalt shipments and pricing increased 31.3% Y/Y and 26.1% Y/Y.

The aggregates business should see a further price increase in the fourth quarter of 2022 and in FY23 thanks to the current demand environment and overall customer confidence level. The Texas cement industry should benefit from the favorable market dynamics in the commercial sector and the recently announced $20 per tonne price increase starting January 1, 2023. The company is also making two noteworthy moves to increase production capacity in the Texas cement market. The first is to convert its Midlothian and Hunter plants to produce a less carbon-intensive Portland-Limestone Cement (PLC), also known as Type 1L cement. Once this transition is complete, the cement production capacity is expected to increase by 10%. Second, the company is installing a new finish mill at its Midlothian plant, which is expected to be completed by the end of 2023. This mill should provide 450,000 tons of incremental production capacity to the Texas marketplace.

Looking forward, the demand from expanded federal and state-level infrastructure investment coupled with large industrial projects of scale should offset the near-term headwinds in the residential sector. The customer backlogs in the aggregates business were up 7% Y/Y and in the cement business were flat Y/Y.

The shipments in the infrastructure end market contributed ~36% to the total volume. This end market is poised for growth as the Department of Transportation (DoT) receives incremental funding from the Infrastructure Investment and Jobs Act (IIJA) through the allocation for FY23, which began on July 1, 2022.

The aggregate shipments for the non-residential end market accounted for 35% of the total volumes in Q3 FY22. The project backlog in non-residential construction remained strong mainly due to the demand from heavy side of the business which includes energy, critical product manufacturing, and data centers of scale. The heavy side of the business accounts for 55% of the total non-residential volumes. While the post-pandemic recovery in the light commercial, retail, and hospitality sectors is continuing, it is expected to moderate going forward as these markets generally follow single-family residential development. The light side of the business accounts for 45% of the total non-residential volumes.

The residential market accounted for 23% of the total volume of shipments in Q3 FY22. The shipment volume has begun to slow down in single-family housing starts, partially offset by continued strength in multi-family construction. I expect this slowdown to continue until mortgage rates and home prices find equilibrium.

I believe the aggregates shipment volumes in FY23 should be flat to slightly up as increased infrastructure investment, along with heavy non-residential projects of scale should offset the product shipments slowdown in the single-family residential sector. However, the sales growth should be much better given the planned price hikes in the fourth quarter of 2022 and in 2023.

Margins

The adjusted consolidated gross margin declined 200 bps Y/Y to 27% due to higher inflationary costs. However, these costs moderated sequentially as the margins improved compared to Q2 FY22. The building materials business’s adjusted gross margin declined 130 bps Y/Y due to inflationary impacts of higher energy, internal freight, repairs, and maintenance costs, partially offset by pricing growth.

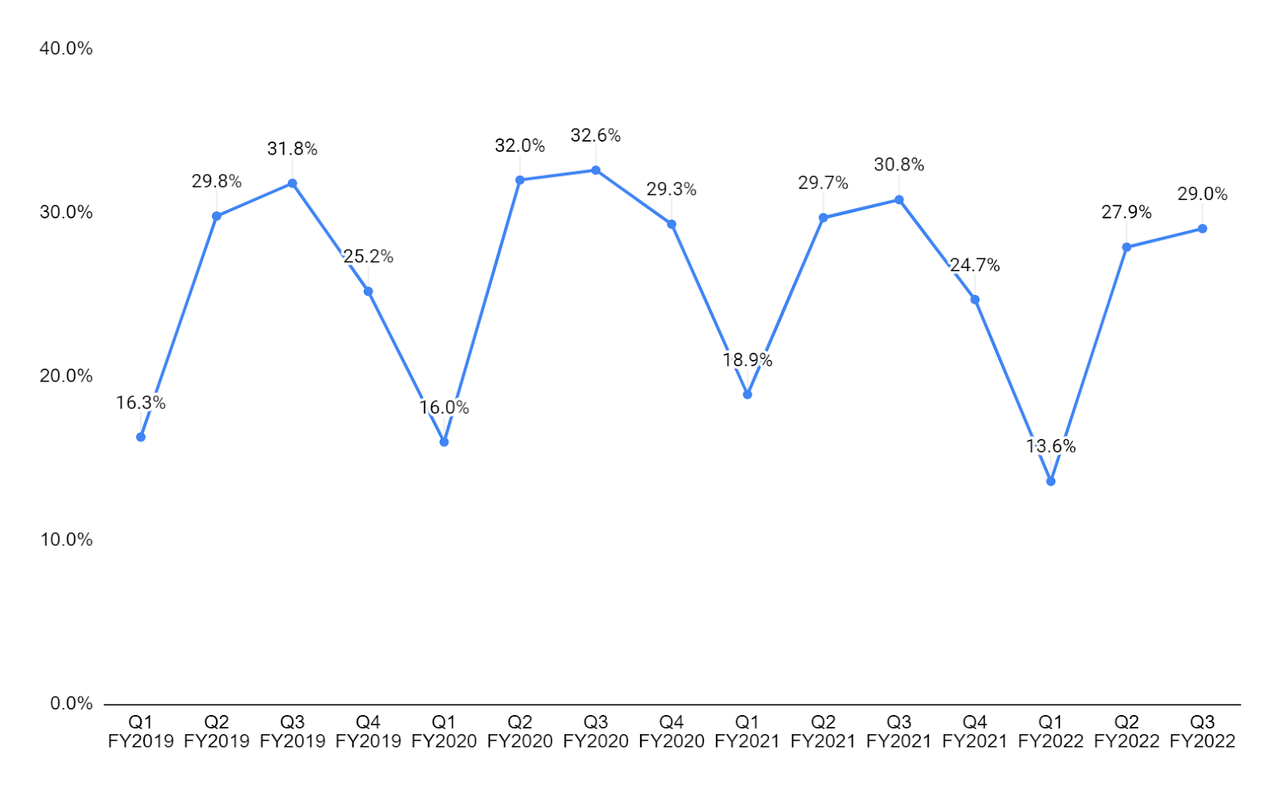

MLM Building Materials Business adjusted gross margin (Company’s data, GS Analytics Research)

Looking forward, the company has notified its customers of a price increase in the fourth quarter of 2022 in some markets and a broad-based price hike in 2023. These pricing actions, along with other inflation containment actions, position MLM to expand margins in Q4 FY22 and in FY23. Additionally, the diesel costs are expected to stabilize in the quarter, further benefiting the margin. Inflation supports a constructive pricing environment for upstream materials as the benefits of pricing actions endure long after inflationary pressures abate. So, I am optimistic about the company’s long-term margin prospects.

Valuation & Conclusion

The stock is currently trading at a 23.65x P/E on FY23 consensus EPS estimates of $15.20, which is lower than its five-year average forward P/E of 25.69x. The company’s sales growth should benefit from the healthy demand in the infrastructure and non-residential end markets along with the planned price hikes in Q4 FY22 and FY23. The company’s margin should improve due to these pricing actions as well as additional inflation containment actions. According to the consensus sell-side estimates, the company’s EPS is expected to grow 21.06% in FY23 and 14.35% in FY24 helped by the strong revenue and margin growth. I believe the company’s fundamentals are attractive and valuations are reasonable. Hence, I have a buy rating on MLM stock.

Be the first to comment