Justin Paget/DigitalVision via Getty Images

For a business, transitioning can be difficult. When a firm recognizes the need or advantage of changing its business model, the time and cost necessary can be significant. So to undergo such a transition while still posting stronger revenue and profit figures year after year is a truly remarkable feat. One business that plays in the trucking industry that achieved just this is Marten Transport (NASDAQ:MRTN). And despite concerns over the broader economy today, management revealed some financial results that were rather impressive in the latest quarter. Moving forward, this indicates that the company will likely continue to fare well. Though shares of the company are pricey relative to similar firms, the business is priced cheaply enough that it could warrant some nice upside for long-term, value-oriented investors.

Things are going well for Marten Transport

Over the past few years, Marten Transport has worked hard to strategically transition its operations from focusing on being a refrigerated long-haul carrier into becoming an enterprise that focused on both refrigerated and dry truck-based transportation capabilities. Today, it boasts operation across five different business platforms across four operating segments. The primary source of the company’s revenue is its Truckload segment. Through this unit, the company offers regional short-haul and medium to long haul full load transportation services. These services often involve the transportation of food and other consumer packaged goods that are temperature sensitive by nature. During the company’s 2021 fiscal year, this segment accounted for 40.7% of the firm’s revenue and 45.7% of its profits.

The next segment to pay attention to is the Dedicated segment. Through this, the company provides customized transportation solutions that meet individual customer requirements. It does this using all sorts of equipment, including temperature-controlled trailers, dry vans, and other equipment that it has access to. While contracts under the Truckload segment are generally for about one year, contracts under this segment tender last for between three and five years. In 2021, this segment accounted for 33.8% of the company’s revenue and 32.6% of its profits. Next, we have the Intermodal segment, which transports their customers’ freight on journeys that involve railroad flatcars for some portion of the trip. This segment was responsible for 10.5% of the company’s sales and 8.5% of its profits last year. And finally, we have the Brokerage segment, through which the company arranges for third-party carriers for the transportation of customer goods. This unit was responsible for 14.9% of revenue last year and 13.2% of profits.

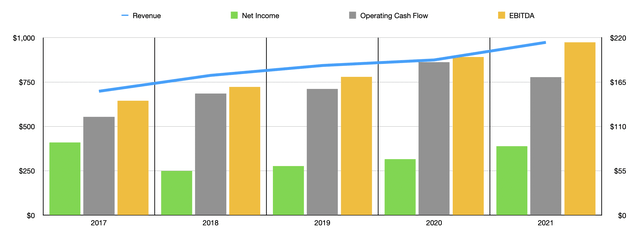

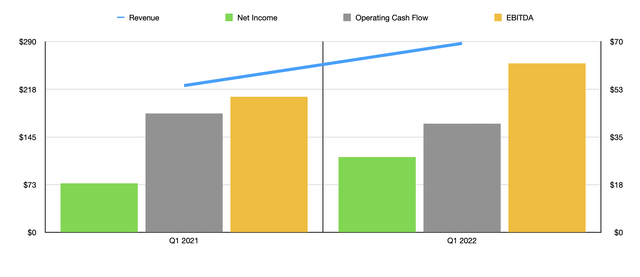

Over the past few years, management has done well to grow the business. Revenue expanded each of the past five years, climbing from $698.1 million in 2017 to $973.6 million last year. The growth in revenue from 2020 to 2021 was an impressive 11.3%, driven by a mixture of higher charges the company was able to place on customers across three of its segments, as well as by a surge in brokerage revenue as a result of the number of loads transported rising by 12.8%. Interestingly, the business has continued that strong growth into the 2022 fiscal year. During the first quarter, which management just reported, sales came in at $287.28 million. That represents an increase of 28.8% over the $223.05 million reported one year earlier. Not only that, it’s also higher than the $262.17 million analysts anticipated. In addition to seeing average revenue per tractor per week, excluding fuel surcharges, increase year over year, the company also saw the total number of miles transported under its Dedicated segment. This rise was 2.4%, while the Truckload segment saw the total miles drop by 7.6% year over year. Meanwhile, the number of loads transported under the Brokerage segment grew by 35.1%, while the number of loads under the Intermodal segment inched up by 3.9%.

As revenue has risen in recent years, so too has profitability. After seeing that income drop from $90.3 million in 2017 to $55 million in 2018, it then began a steady and consistent decline year after year. By 2021, net profits came in at $85.4 million. A similar trend could be seen with operating cash flow. Between 2017 and 2021, this metric grew from $121.9 million to $171.2 million. And EBITDA for the company expanded during this time frame from $142 million to $214.3 million. When it comes to the latest quarter, the business reported a profit per share of $0.33. That translated to a net profit of $27.53 million. By comparison, the company generated a profit one year earlier of $0.22 per share, or $18.01 million. Analysts, meanwhile, expected the company to generate a profit of just $0.26 for the quarter, which would have translated to net income of $21.31 million. Other profitability metrics for the company were rather mixed. While EBITDA increased from $49.69 million in the first quarter of the company’s 2021 fiscal year to $62 million this year, operating cash flow declined from $43.57 million to $39.94 million.

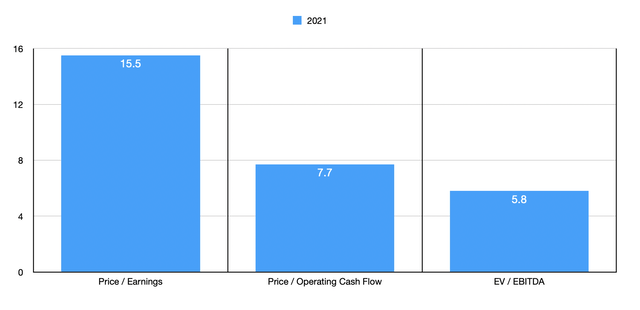

When it comes to valuing the company, we do not have enough information to realistically forecast what the 2022 fiscal year will look like. So instead, I would prefer to be more conservative on the matter and rely on 2021 results. When I say conservative, I mean that, if results achieved in the first quarter of this year are any indication, results will likely end up stronger for 2022 as a whole than they were in 2021. It’s better to be surprised in a positive way than a negative way. Using the company’s 2021 results, I calculated that it is trading at a price to earnings multiple of 15.5. The price to operating cash flow multiple is 7.7, and the EV to EBITDA multiple of the firm should be 5.8. To put this all in perspective, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 5.6 to a high of 14.8. Our prospect was the most expensive of the group. Meanwhile, using the price to operating cash flow approach, the range was from 3.8 to 20.4. And using the EV to EBITDA approach, the range was from 2.8 to 9.6. In both of these cases, four of the five companies were cheaper than Marten Transport.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Marten Transport | 15.5 | 7.7 | 5.8 |

| P.A.M. Transportation Services (PTSI) | 8.2 | 6.2 | 4.5 |

| USA Truck (USAK) | 5.6 | 4.4 | 2.8 |

| Daseke (DSKE) | 10.8 | 3.8 | 4.8 |

| Landstar System (LSTR) | 14.8 | 20.4 | 9.6 |

| Knight-Swift Transportation Holdings (KNX) | 10.7 | 6.7 | 5.5 |

Takeaway

At this moment, Marten Transport is doing quite well for itself. I am pleased with the company’s performance and the most recent data provided by management indicates that business is stronger than previously anticipated. Long term, I fully suspect the company will do well for shareholders. Even if current supply chain issues are temporary and pricing pulls back for the business, its long-term trajectory has cemented itself as a quality operator in this market. Because of that, I think that it could make for an attractive play moving forward. Though while shares of the company are cheap on an absolute basis, it is also true that other players are more attractive from a pricing perspective at this time. So for somebody who wants to do a deep dive into undervalued waters, that may yield even greater results than buying into this firm now.

Be the first to comment