Cavan Images/iStock via Getty Images

The Q4 Earnings Season for the Silver Miners Index (SIL) came to an end last month, and the last company to release its results was Excellon Resources (NYSE:EXN). As usual, the best is rarely saved for last, and the company reported another year of above-average costs, net losses, and minimal progress on its non-producing assets. With Excellon’s market cap below $40 million, one might conclude that the stock might be worth buying. However, while Excellon is reasonably valued after a 70% decline, I see a risk of share dilution and I see few redeeming qualities, suggesting there are dozens of better ways to bet on higher silver prices.

Silver City Project Mineralization (Company Presentation)

Over a year ago, I wrote on Excellon Resources (“Excellon”), noting that while it appeared undervalued at first glance, several risks justified its discount relative to peers. Since then, the stock has tumbled 70% in a period where the silver price has increased, and I still don’t see a value proposition for the stock. In fact, with inflationary pressures likely to put a further dent in Excellon’s already razor-thin margins, I don’t see how the company will generate any free cash flow without an average silver price above $28.00/oz. Let’s take a closer look at the recent annual results:

Production & Grades

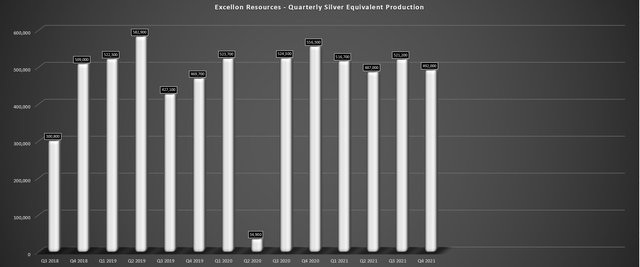

Excellon Resources released its Q4 and FY2021 results last month, reporting increased production of ~2.02 million silver-equivalent ounces [SEOs], but this increase was mainly due to the benefit of being up against easy year-over-year comps. The easy year-over-year comps were related to the COVID-19-related temporary shutdowns in 2020 which impacted production levels. This is shown by the below chart, where we can see the production of just ~34,900 SEOs in Q2 2020.

Excellon – Quarterly Silver-Equivalent Production (Company Filings, Author’s Chart)

If we adjust for this weak quarter due to COVID-19 and assume a ~450,000 SEO production rate, FY2020 production would have come in at ~2.05 million SEOs, and Excellon would have reported a decline in annual production in 2021. Hence, the higher production was nothing to write home about. In fact, the company had to mill substantially more material (~86,000 tonnes) in 2021 to increase production and still saw only a slight increase in production from FY2020 levels (~1.64 million SEOs). This was related to much lower grades, with silver grades dipping 5% to 494 grams per tonne silver, while lead grades also fell (5.01% vs. 5.37%).

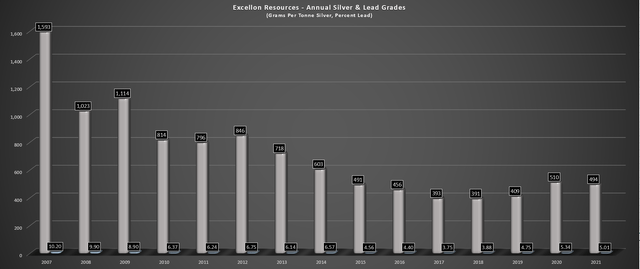

Excellon – Annual Silver & Lead Grades (Company Filings, Author’s Chart)

As the chart above shows, the brief uptrend in declining grades ended in 2021, continuing a long history of declining grades at the Platosa Mine. While this trend isn’t a huge surprise, given that grades have been declining sector-wide and it’s not easy to replace high-grade ounces consistently, it is an issue for Excellon. This is because Platosa is a relatively small-scale operation, and when an asset is processing a mere ~80,000 tonnes per annum, grades are key to keeping costs under control.

Costs & Margins

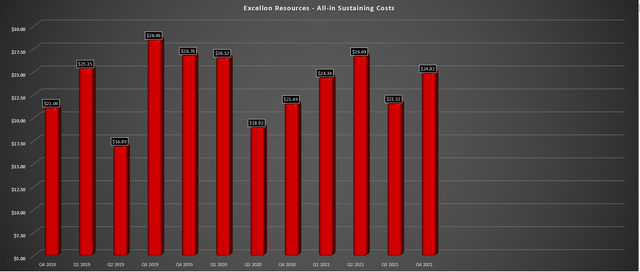

Speaking of costs, all-in sustaining costs did not trend in the right direction either in 2021, with Excellon’s all-in sustaining costs coming in at $24.82/oz in Q4 2021 and $24.78/oz for the year. This cost figure was just $0.34 shy of the company’s average realized silver price, and it’s difficult to generate any meaningful free cash flow when working with a 2% AISC margin ($24.78/oz vs. $25.12/oz).

Excellon – All-in Sustaining Costs Per Ounce (Company Filings, Author’s Chart)

The higher costs are no surprise, with inflationary pressures putting a dent in margins sector-wide, and I would not be surprised to see costs stay above $24.00/oz in FY2022, making it very difficult for Excellon to turn a profit. In previous updates on Endeavour Silver (EXK), I have warned against paying up for the stock above US$5.30, given that it has razor-thin margins with all-in sustaining costs of ~$20.00/oz. However, at least Endeavour has a path to lower costs if it can bring Terronera online in 2024. In Excellon’s case, it actually makes Endeavour look like a high-margin producer relative to its bleak margin profile.

Financial Results

Moving to Excellon’s financial results, there wasn’t much to write home about here either, with annual revenue of ~$38.0 million and an adjusted loss of $14.3 million. While this was an improvement from FY2020’s adjusted loss of $16.0 million, it was a significant increase from pre-COVID-19 levels (~$10.1 million), and this was despite a much higher silver price. With silver up more than 40% from FY2019 levels last year and Excellon still unable to turn a profit, I think it’s generous to call the company a producer, given that one should only own a producer vs. an explorer is if it’s generating free cash flow.

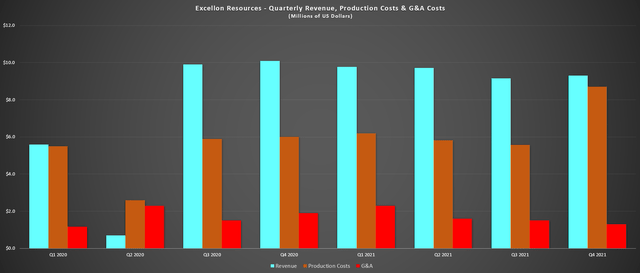

Excellon – Financial Results (Company Filings, Author’s Chart)

Looking at the above chart, we can see that production costs and G&A costs make up more than 80% of quarterly revenue, with average quarterly combined G&A and production costs of ~$8.0 million on a trailing twelve-month basis. After subtracting out ~$1.7 million in quarterly depletion and amortization, and exploration/holding expenses of ~$1.5 million per quarter, I don’t see any hope in Platosa generating consistent free cash flow without at least a $28.50/oz silver price. In fact, I’m surprised the company is still operating the asset.

What About Kilgore?

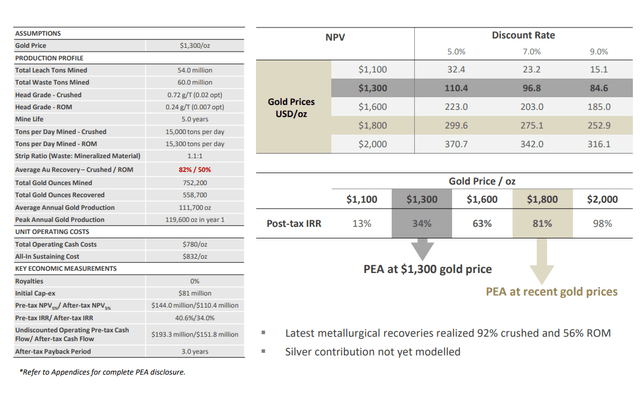

While Platosa will struggle to make money at current silver prices, or even at $28.00/oz, and its future looks bleak, the company continuously highlights the multi-million-ounce potential at its Kilgore Project in Idaho. If we look at the tables below, one might conclude that this is an incredible opportunity for Excellon and easily justifies its current fully diluted market cap of ~$35 million. However, there are several issues with valuing this project at anywhere near the levels that Excellon seems to be implying it is worth in its recent presentation.

Kilgore Project – Idaho (Company Presentation)

For starters, the company uses the benefit of much higher gold prices in its calculations, which swings in the project’s favor, but is not adjusting for potential inflationary pressures. With many projects seeing 40% plus increases in upfront capex, and others seeing capex blowouts of 60% or more since 2020 levels (not 2019, like the PEA), the company is dreaming if they think they can build this project for $81 million. In fact, I would be surprised if the project showed an upfront capex bill of less than $140 million at the Feasibility level using Q2 2022 pricing.

Previously, I didn’t see any hope of this asset heading into production under Excellon, but inflationary pressures have squashed any glimmer of hope. This is because the upfront capex to build this project has likely risen at least 50% from the 2019 PEA, while Excellon’s market cap has slid more than 70%. So, with a market cap to upfront capex ratio of what I would estimate to be 0.20 to 1.0 (~$35 million / ~$140 million) and no free cash flow generation from Platosa, there’s no path forward for this project to be built without significant share dilution.

Besides, even if the company could build the project, it’s at least five years away from its first gold pour, and considerable money would need to be spent on permitting feasibility level work and drilling to upgrade the current resource. Some investors might see some opportunity in divesting the asset, but the problem with this move is that it strips the company of its best project (which is not saying much), with Excellon now back to relying on its other projects, which are even further away from production (Silver City).

Another option might be partnering on Kilgore, with a joint-venture to move it forward with an option for the better-capitalized partner to earn up to 70%. However, I think there are far more attractive opportunities elsewhere. Besides, with a ~5-year mine life, I still don’t see Kilgore as a potential mine given the degradation in the project economics following increases in materials and labor costs which will push capex higher. To summarize, I don’t think there’s any use in assigning more than $15 million in value to this project.

Valuation

Based on ~38 million fully diluted shares and a share price of US$0.90, Excellon trades at a market cap of ~$35 million, which means that it’s being valued at ~$20 million if we assign $15 million in value for Kilgore. While I think this is a reasonable valuation for a company with two other exploration projects (Oakley, Silver City), the problem is that Excellon is in no position to advance these projects with its weak balance sheet and continuous net losses at Platosa. This means that we cannot rely on the current share count, with share dilution looking highly likely before year-end, and a lot of it, given that Excellon may need to raise capital at multi-year lows.

Besides, even if the company does raise capital to fund more aggressive drill programs, the investment thesis isn’t all that attractive. This is because there is no shortage of exploration stories in the silver space. So, while one could argue that Excellon is cheap, I don’t see the catalyst for a re-rating, and with several names paying dividends and returning capital to shareholders, I think there are dozens of better places to park one’s money if they believe in higher precious metals prices.

Summary

Excellon may be cheap, but it’s cheap for a reason, and I see an elevated risk of share dilution given that the company is entering the year with a net working capital position of less than $1.0 million. Generally, I avoid companies where additional share dilution looks likely in the next six months and exploration stories where I don’t have any confidence in production in the next five years. With Excellon losing money as a producer, I think it’s generous to call it an explorer, and none of its projects are overly impressive. Even if they were, though, there’s no aggressive exploration budget to fast-track them along the development curve. In summary, I continue to see the stock as an Avoid.

Be the first to comment