JHVEPhoto

Dear readers/followers

“Overvalued” is the adjective that I’ve been using for Marsh & McLennan Companies (NYSE:MMC) for some time. It’s a very appealing business, but every investment needs to be justified as “itself” in the context of the broader market as well. We can agree that the company does deserve a premium – the question always becomes “How much” of a premium does it warrant.

Marsh & McLennan Update – The company continues to deliver

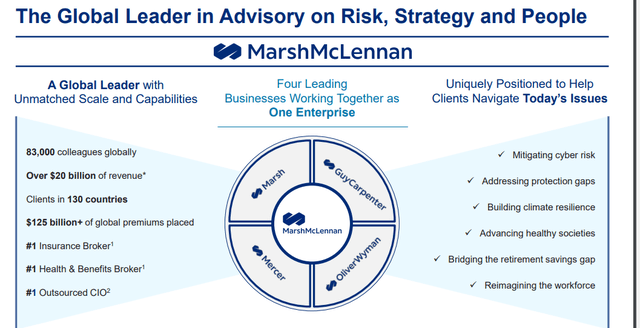

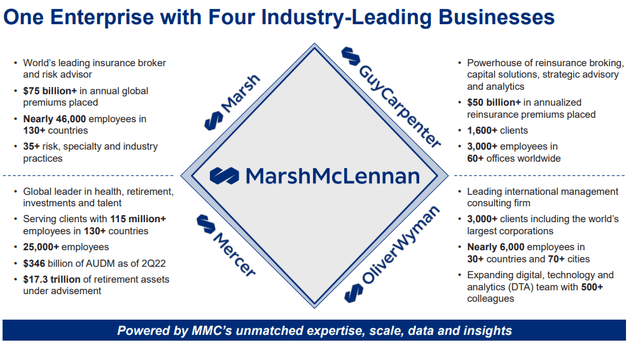

MMC is a strong company, delivering very solid recent results. MMC does professional services, and business is good. It’s one of those sectors that’s really strong, regardless of what the overall environment is. We have a new report coming out in a bit over a week or so, but I don’t expect this new report to materially change the thesis.

MMC is simply, a very good company.

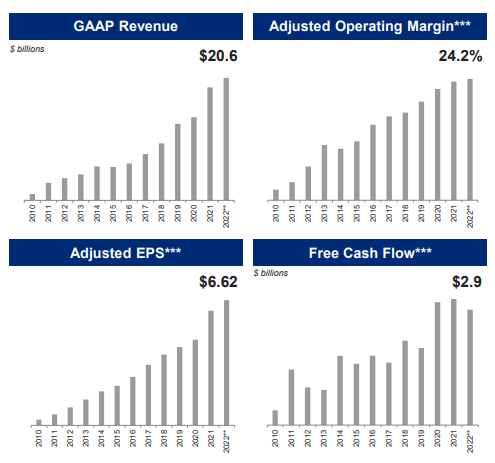

Combining insurance broking, risk management, reinsurance, health/retirement/consulting, and management consulting, the company takes the best and “leaves the rest”. As of the latest quarter, the company reported a strong underlying overall revenue growth and actual margin expansion which puts the margin expansion growth record at 14 consecutive years, with a 1500 bps increase since 2008. FCF generation is solid as well, and the CAGR FCF since the financial crisis is close to 20% – very solid.

The main challenge with MMC is really the following. Dividends will never be high. This by itself is not necessarily prohibitive in terms of investing – but it’s a complicating factor since I want dividends out of what I invest in. This is especially true in the current inflation environment.

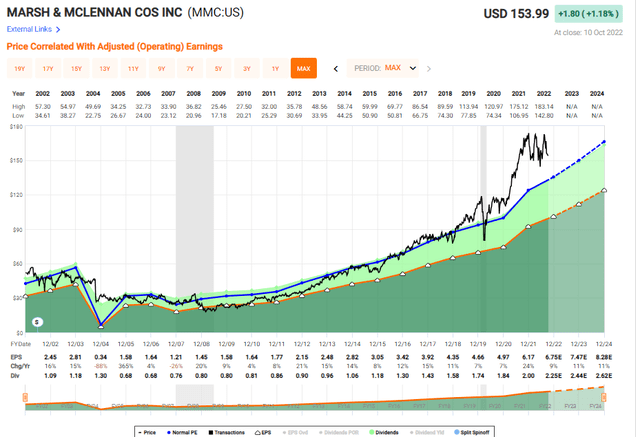

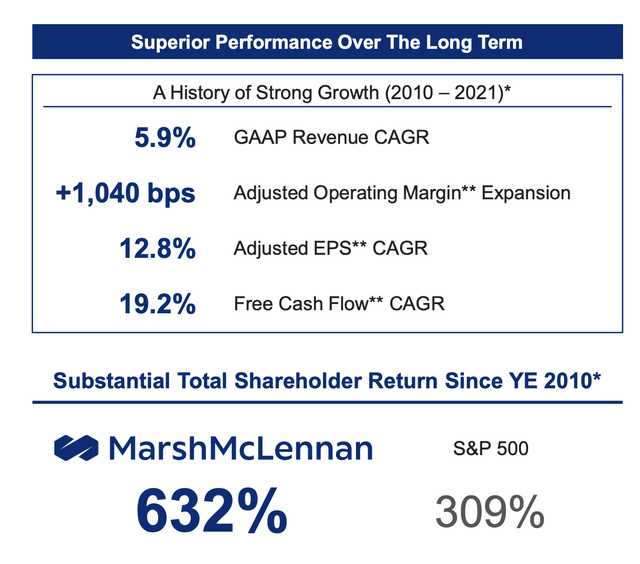

However, it’s often this way when we look at companies like this. The companies that outperform the S&P by 2x, which MMC has done…

…these companies don’t necessarily pay the greatest yields. Often times, you can have either significant capital appreciation and outperformance – or you can have income generation with either little to no, or slight outperformance over time. While I actively look for investments that combine the two factors of high yield with high capital appreciation, these are extremely rare.

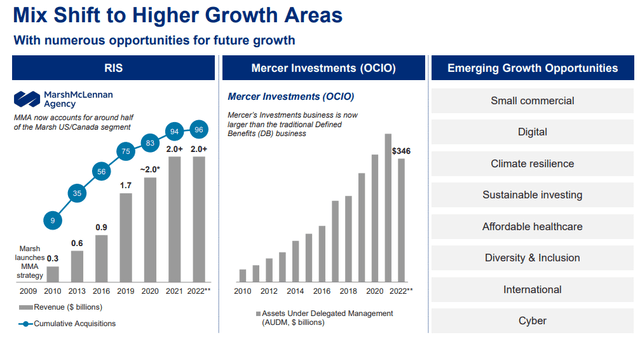

Growth isn’t at all hard to see for MMC. The company will likely see future growth from its cyber risk market, protection gap market, ESG consulting, health issues, and higher volumes of retirement insurance sales due to demographics. MMC is already shifting to a more favorable and appealing mix, and the agency is now half of the business for the NA geography.

Despite us having a long period of what was essentially “free money”, MMC was one of the companies that did not overextend its leverage or profile during this period. They instead focused on margin expansion through improving processes and managed to increase margins by 15% since the financial crisis. MMC further expects to deploy near-on $4B in the capital this year for M&As, buybacks, and some dividends.

Again, traditions here are the backbone that we work with – and these traditions are good.

MMC IR (MMC IR)

However, the main appeal of MMC is one that it shares with companies from the same segment. In a world of capital-intensive and asset-heavy businesses, MMC operate capital-light, flexible business models that have resulted in massive amounts of FCF. Even if their dividends are low, this is an appealing business.

The way the company uses its cash has been profitable over the past 10 years, including significant buybacks, good M&A, and reinvesting in its own business. MMC even outperforms a significant peer I’ve also looked at – Aon (AON). The broker-average return on the S&P has, since 2009 and the crisis, been 837%. MMC has returned 914%, which is close to twice the average of the S&P Property & Casualty insurance sector, and more than twice the S&P500.

Combine this with low capital requirements in today’s macro, as well as best-in-class management, and you might ask yourself why I, or other investors, are buying anything else except MMC.

Because, why not, right? The company bridges the retirement savings gap, which is currently estimated at approaching $4T for the US alone. It advances healthy societies – and by 2030, 20% of GPD is expected to be healthcare spending. It works with environmental, social, and other trends that are very much “in the now” – and potentially profitable as well. Cyber risk is really only one of the areas where the company can be considered to have a sort of leadership across some customer bases.

The company is also slowly shifting to focus on exactly these higher-growth areas.

For the past 14-15 years, MMC has managed to almost triple its operating margin (adjusted) through rigorous cost control and expense discipline. The next 15 years will have challenges at least as high as the one the company has already faced.

Further margin expansion?

Possible – through the following things:

- A higher degree of shared services, right-shoring and continued buildout of the company’s assets to increase efficiency

- Higher real estate efficiencies

- Overall global alignment of procurement and other standardizable processes, lending higher visibility to CapEx.

- Increased use of technology and automation to increase digitization.

- Higher investments in global platforms to increase the scalability of the company.

MMC has the history to show you that “Yes, we do things better, smoother, and more profitable than the competition”. They can prove this to you historically through results.

The question becomes, is outperformance as likely going forward?

Me, I say “yes”. The company’s position as an industry leader leading into an uncertain future typically lends customers to stick to established and proven alternatives. The more uncertain things become, the more likely customers and people are to go back to proven alternatives and “ways”. The fact that the company has a low-asset/capital-light structure only increases this appeal – as does its best-in-class (or at least close) management team with a combined expertise of dozens of years in the company, looking at the C-suite alone.

Here is what the company intends to use to drive superior returns to you over the next 5-15 years.

The valuation currently has this to say about the company, and its appeal is seen to where it is in terms of price.

Marsh & McLennan Companies – The updated valuation

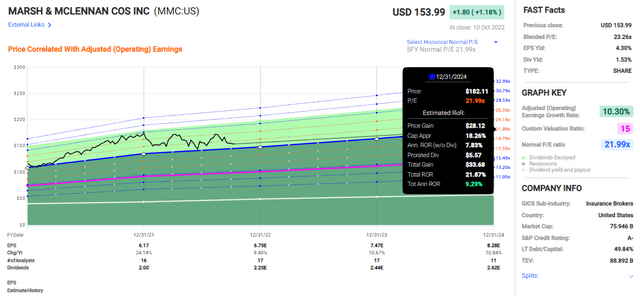

I’ve been fairly mellow on this business. It’s outperformed significantly on a 1-year basis, delivering essentially flat returns in a world market by-double-digit YTD declines. Is this justified by the company’s ESP growth?

Well, the problem for this business has been and remains the fact that we’re trading at 23-24x P/E at a yield of 1.5%. The company has A- credit and a superb market cap, but if we compare it to COVID-19 lows, well, the business is nowhere near that yet.

MMC Valuation (FAST Graphs MMC)

Even if you use the 5-year average normalized P/E of 22x, the company looks more like something we could see perhaps a year ago in terms of valuation. The upside to a 22x P/E of 2024E is around 9.29% annually, but this really comes in at a significant premium. The best that can be said for it is that the company has stayed relatively stable, all things considered, even with the rate pressures, inflation pressures, and so on.

Some analysts following the company give it a bullish thesis, considering the company a “BUY”. I can see how some can reach such a thesis. My challenge to such a stance would primarily be related to what other alternatives are available on the market today. As I mentioned, MMC needs to justify itself as an investment even contextually – to the sector and other companies. And while safe and conservative, there are companies yielding between 3-7% trading at less than half the multiple we see here, and these companies are in no way materially “unsafe”. In fact, they’re larger than MMC, oftentimes.

So, this is not me saying that I don’t “see” or understand the thesis where this could be a “BUY”. I disagree simply on a basis of valuation.

My title for this piece is about “following a thesis”. A simple one. The only problem with this business is the valuation – unfortunately, it’s not a small problem. That makes it a “simple thesis” to me.

Again, no argument against fundamentals.

A-grade credit rating, a high forecast accuracy, solid fundamentals, and every analyst and indication in the book saying that MMC will improve its earnings in 2021 and beyond. Still not enough to pay 23-24X earnings, in my book. The meager 1.5% yield which is below inflation and is a slow grower also isn’t really an argument here.

Peer comparisons continue to “show off” the overvaluation here. MMC trades at an NTM TEV to annual revenues of nearly 4.2X, with insurance peers like Aflac (AFL), Prudential (PRU), and MetLife (MET) trading around 1-2X, and P/Es that are less than half of the average weighted P/E of MMC, around 24-26X, depending on what numbers you’re comparing to. I would invest in these, or companies like Allianz (OTCPK:ALIZY) or Manulife (MFC).

S&P Global analysts give the company exuberant targets, which call for a range of $130 on the low side to $200 on the high side. Only 5 of the analysts are at a “BUY”, however, out of 16.

The average PT from analysts here is $173 implying an upside of just north of 13%.

I consider this too exuberant to what’s being offered, in context of the market.

So, with that here is my thesis – and I look forward to the 3Q22, but I don’t foresee massive changes here.

Thesis

I consider the following thesis relevant for MMC here.

- The company is a world leader in brokering insurance and policies, and with business areas of risk, strategy, and other adjacent businesses, this organization is going nowhere.

- With over 140+ years under its belt, this company is one of the largest out there in its respective businesses, and at a high valuation, this company becomes a no-nonsense “BUY” to me.

- However, at current valuations, I consider MMC no more than a “HOLD” at an overvaluation. I do not see how you can get a positive return from this company.

It’s not a business you should buy here. My 5 investment criteria are (italicized)…

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment