Daria Nipot

Thesis

On October 6th, Amazon (NASDAQ:AMZN) announced an unprecedented second Prime Shopping Day, which I view as a clear warning signal that the e-commerce giant is fighting against disappointing analyst’s and investor’s revenue expectations.

Amazon shares are down about 33% YTD, versus a loss of almost 25% for the S&P 500 (SPX). But the stock is still trading expensive — at a one year forward EV/EBIT of x83.

Seeking Alpha

In my opinion, what protects AMZN shares from further downside, is the market’s hope and believe that Amazon may take more wallet share of consumer’s spending in a recession. This believe must not be allowed to fade. And the additional prime day should be designed to prop up this believe with an extra $4.1bn of sales.

Declining E-Commerce Sales

Amazon’s e-commerce sales have stealthy declined for the past 2 quarters, as Q2 results indicated a 4.3% year over decrease — falling to $50.9 billion. But given a strong performance from AWS, as well as a revenue push supported by a nearly 40% price increase from Prime subscriptions, markets did not really take note.

But still, Amazon’s decreasing e-commerce sales contrast sharply with the dominant market narrative that Amazon’s consumer-centric business model would be ‘recession proof’. But the narrative has predominantly been built in a time when Covid-19 lockdowns pushed customers to increasingly rely on online shopping. Thus, the dynamics of the next recession’s impact on Amazon might very well be different.

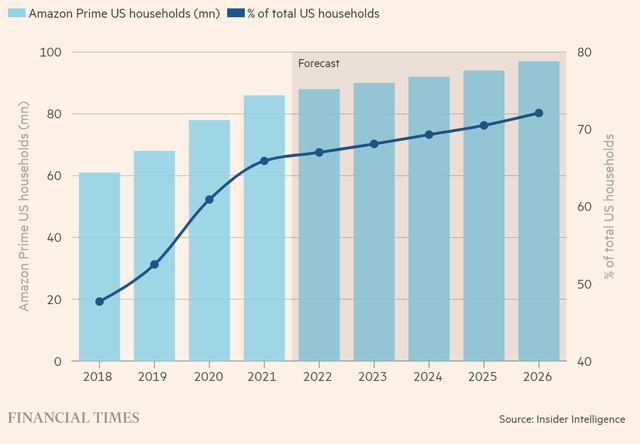

Amazon retains a strong market share of the global e-commerce market, and especially in the U.S, where the company claims nearly 40% of e-commerce sales. but the problem is that additional upside becomes more difficult to capture. As of 2022, nearly 85% of U.S.’ households are already subscribers of Amazon Prime Services.

Financial Times

While Amazon’s consumer business feels the impact of a slowing economy, due to rising interest rates and inflation, Amazon’s operating expenses jumped by 11.9% year over year, to $117.9 billion.

As Amazon’s margins are squeezed, the company has scaled back on hiring, as well as on infrastructure expansion. According to analyst Marc Wulfraat, Amazon has so far scaled back operations and/or expansion on 66 U.S. facilities.

Watch Out For Sales Promotions

To fight slowing e-commerce sales, Amazon has announced an unprecedented second Prime Shopping Day, which will span over 2 days starting on Tuesday October 11th. The promotion will cover the US, Canada and 13 European countries. Notably, Amazon’s second Prime Day will be celebrated only three months after this year’s first Prime Day.

During my time as an equity analyst, I learned that the best way to judge if a consumer company is struggling to meet revenue and earnings guidance, is to watch the frequency and aggression of sales promotions. On October 6th, Amazon announced that: (emphasis added)

Prime members can start checking off their holiday gift list with the largest savings ever of 80% off select Fire TV smart TVs; and up to 50% off select JBL, Sony, and Bose ear buds, speakers, and headphones …

I am not surprised to see that together with Amazon, also other (struggling) consumer centric brands join the sales promotion to boost revenues — Hello, Peloton (PLTON).

For the first time ever, Peloton will offer exclusive deals of 15% off the Peloton Bike with delivery available to select locations and up to 25% off select accessories and apparel

In a note to clients, Jefferies analyst Brent Thill has argued that the Prime Day event could add an extra $4.1bn in sales to Amazon’s topline, and thus help the e-commerce giant to push the annual year over year revenue increase to about 14% — but still the lowest growth rate on record.

All that said, for me it is very hard to find any bullish implications from Amazon’s additional Prime Day event.

Reiterate ‘Hold’ Recommendation

I don’t like the implications of a second Prime Shopping Day, as I believe it is a desperate effort to boost already slowing e-commerce sales. But arguably, the problem is in the economy, not in Amazon’s business model — as inflation, higher interest rates and fading consumer confidence is slowly taking out even the most resilient businesses, including FedEx (FDX), Walmart (WMT) and Apple (AAPL).

Moreover, I also do not like the odds of betting against Amazon, which is in my opinion one of the world’s best managed companies. And given an exceptional platform of trust, the e-commerce giant remains well positioned to grow and prosper long-term.

But I would like to point out that this is not the environment to take on risks. And trading at a valuation of x83 EV/EBIT, the risk/reward for Amazon is skewed to the downside, in my opinion. Accordingly, I advise to remain on the sidelines and reiterate a ‘Hold’ recommendation.

Be the first to comment