MF3d/E+ via Getty Images

Investment thesis

NVIDIA Corporation’s (NASDAQ:NVDA) stock has recently suffered by facing different headwinds from a slump in sales in its Gaming segment, the announcement of a US$1.32 billion charge caused by excess inventory and a more pessimistic forecast, governmental restrictions on its exports to China and Russia and an intensification of the macroeconomic unfavorable framework, which led to lower valuations among most stocks in general, but especially in the technology sector. The market is pricing in significant negative factors and investors are even more worried about the company’s future, as the negative trend in GPU sales related to cryptocurrencies mining has been ongoing and could have longer consequences than likely previously expected. But NVIDIA is not anymore a company focusing on gaming GPUs. The market is likely underestimating the transformation NVIDIA is undergoing and its potential in the data center industry and especially the future demand for AI-based systems and applications. My analysis will show how the stock is undervalued from a long-term perspective, with a rather conservative potential price increase of 19% at $162, but could likely still fall to $106 in the short-term, if the stock doesn’t break out of its downtrend and the general market conditions continue to deteriorate.

A quick look at the recent events

NVIDIA released its Q2 FY2023 results on August 24, 2022 with a mixed image among its business segments that divided even more the actors of the already vivid discussion about the company’s valuation.

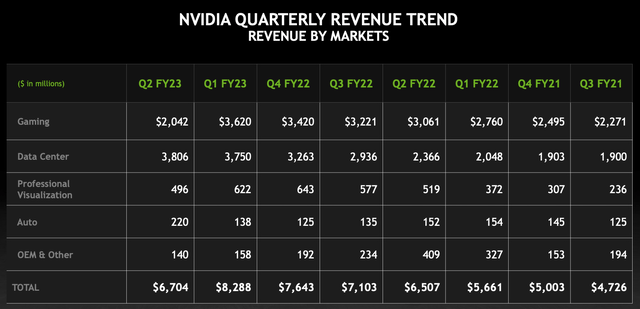

Unsurprisingly the Gaming segment experienced a decline in sales, down 33% Year-over-Year (YoY) and down 44% Quarter-over-Quarter (QoQ), mainly caused by reduced sales in Europe during the summer months, the ongoing conflict in Ukraine, strict lockdowns in China, and the drop in sales related to crypto-mining which is not quantified by the company but can be assumed to be one of the major causes, especially considering the incoming Ethereum merge, expected to happen around September 15.

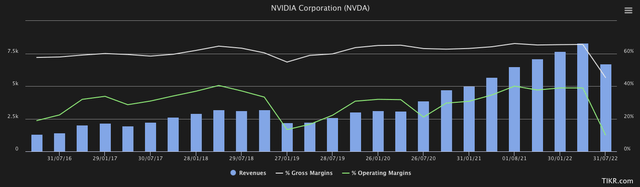

Looking at the past 5 years on a quarterly basis, it’s undeniable that NVIDIA now faces significant short-term headwinds and the management likely has chosen Q2 to be a reset quarter, by announcing charges of US$1.32B due to excess inventory and based on their expectations of future demand. A situation that reminds me of 2018-2019, when the company had to clear a backlog of older GPUs and was facing a slump in sales, mostly caused by the “crypto hangover”.

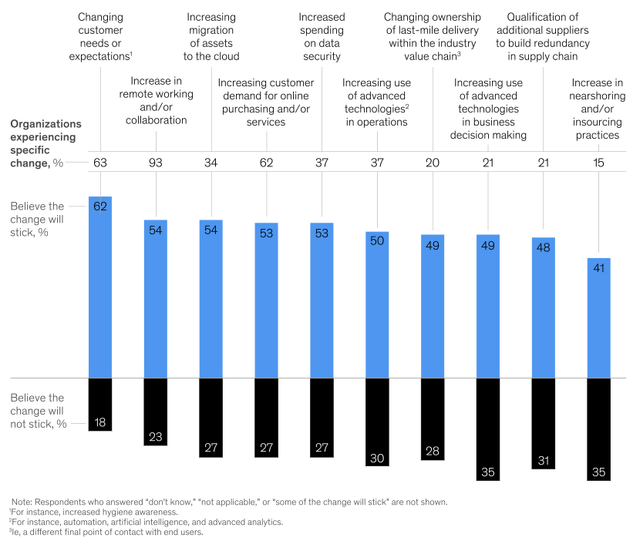

Sales in the Professional Visualization segment decelerated by 20% QoQ and were down 4% YoY, mostly impacted by lower desktop revenue. Hybrid-work is likely here to stay, in a study published by Microsoft (NASDAQ:MSFT) 66% of the global companies consider adapting their offices and processes for hybrid work; Logitech (NASDAQ:LOGI) reported that hybrid work was five times larger than the pre-pandemic level. A survey conducted by Ernst & Young with 16,264 responses from 16 countries across 23 industries, where millennials represented more than 50% of the respondents, shows that 9 out of 10 employees want flexibility in where and when they work, and on average, employees expect to work at least two to three days per week remotely after the pandemic. Despite the developments in terms of Artificial Intelligence (AI), Virtual Reality (VR) and Augmented Reality (AR) will likely continue to drive significant revenue to this business segment, the previous fast expansion is now experiencing some cyclical slowdown, impacted by a tougher macroeconomic environment.

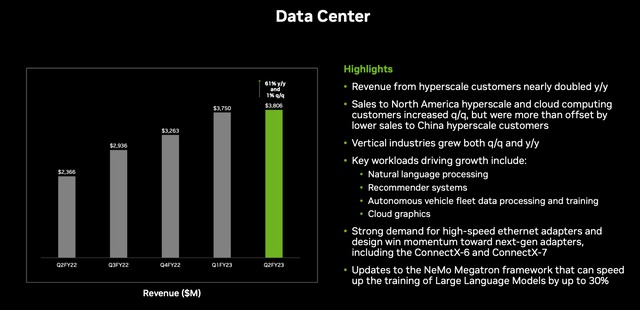

Where instead the company could report growth was in its Data Center and the Automotive segments. The latter grew 45% YoY and accelerated to 59% over the last quarter despite the automotive industry being particularly affected by a serious chip shortage and general supply chain bottlenecks over the last two years. The company offers hardware, software, and services under the brand NVIDIA DRIVE aimed to deliver state-of-the-art AI capabilities and advanced applications for Autonomous Vehicles (AVs). The company secured over $11B design wins in the past quarters and at least 25 Electric Vehicles (EVs) manufacturers already rely on NVIDIA’s DRIVE Hyperion and DRIVE Orin platforms, which act as the nervous system and the brain of their latest generation of EVs, self-driving-trucks and robotaxis.

While the Data Center segment only reported 1% growth QoQ giving obvious signs of a slowdown, it’s still up 61% YoY. In this article, I particularly want to give more insights on this business segment, which I consider to be likely the most important growth driver for the company in the coming years.

The full-stack data center computing force

Although the company is known by consumers and investors worldwide especially for its historical leadership in Discrete Graphics Processing Units (dGPUs), with a market share of 78% in Q1 2022 and more than 200M gamers using its GeForce technology, NVIDIA is no longer a company focused on gaming GPUs, as the revenue in Data Centers almost doubled its sales in its Gaming segment in the last quarter and despite the recent headwinds, cycles are part of the semiconductor industry and the company may just face its next huge growth cycle given the opportunity that data centers are offering. By diversifying its revenue streams over its biggest growth drivers, the company is now able to capture trends driving the data center industry transformation such as cloud migration and cloud scalability where large enterprises will likely rely on a hybrid model while smaller companies are more inclined to use a public cloud alone remote work and remote learning, 5G networking, Internet of Things (IoT), Automated Infrastructure Management (AIM), as well as AI and AR. As a consequence of the pandemic, the digital transformation has been accelerated through many industries and I believe that this trend is likely to continue over the next few years.

As I wrote in my article AMD Is Likely Set For Many Years Of Growth, Advanced Micro Devices, Inc. (AMD) estimates its data-center-related total addressable market (TAM) to increase from $50B to $125B in the coming 5 years. Intel Corporation (NASDAQ:INTC) and AMD dominate the market for Central Processing Units (CPU), and are aggressively expanding their efforts in the data center GPU space. Intel just announced its GPU Flex Series on August 24, optimized for OneAPI, Intel’s answer to NVIDIA’s proprietary parallel computing platform and programming model for general computing CUDA, and which allows developers to write code and AI applications for Intel’s hardware. The GPU is optimized for Android cloud gaming, media processing and delivery, and will supposedly be optimized for Virtual Desktop Infrastructure (VDI), Windows gaming, and AI Visual Inference, at a later point. Intel can leverage on its strong market positioning in server chips and tight relationships with major companies worldwide, as its GPUs will soon be available in systems built by Dell (NYSE:DELL), Lenovo (OTCPK:LNVGY) (OTCPK:LNVGF), and Hewlett Packard (NYSE:HPE), the same early adopters which are supposed to integrate NVIDIA’s newly developed data center Grace CPU. AMD just launched its new Zen 4 Ryzen 7000 processors based on two 5nm Zen 4 CPU modules and a new 6nm I/O die with integrated RDNA 2 graphics, along with DDR5 and PCIe 5.0 controllers and built-in power management. The company is expected to launch its next generation of RDNA 3-based Navi 3X this year, and the Zen 5 architecture focusing on AI and machine learning by 2024.

Why do I see NVIDIA performing better than its competitors and gaining significant market share in the data center industry? NVIDIA is not anymore a chip manufacturer, the company has grown into a full-stack computing powerhouse, transitioning from providing components to offering full-service systems and solutions. 357 out of the top 500 supercomputers are powered by NVIDIA, including 31 of 39 new systems. While today’s computing platforms can take months to train large AI models, the new Hopper GPU with Transformer Engine focusing on AI and ML is 9x faster at-scale training performance over the previous generation A100, and offers 30x large-language-model inference throughput, without loss of accuracy. But what is even more important, the scalability of the system has been significantly increased with the new generation of NVLink Switch, connecting up to 256 H100 GPUs, which can be deployed in all types of data center, including on-premises, edge, cloud and hybrid-cloud.

H100-accelerated server clusters will be able to train enormous networks that were nearly impossible to train at the speed necessary for enterprises.

Dave Salvator, Senior Product Marketing Manager NVIDIA

Without looking into more specific technical details, Hopper is also the first GPU to support PCIe Gen5 and the first to utilize HBM3, enabling 3TB/s of memory bandwidth. Combined with the upcoming Grace CPU, NVIDIA is capable of delivering an optimized system with the two processor types essential to any full-service computing platform. No other single company in the industry is capable today to offer such complete, advanced, scalable and performing solutions based on its own optimized software and hardware. Overall computational usage for AI training and ML will most likely expand exponentially in the next decade, and as I already explained in my article Nvidia Is The Stock Every Investor Should Consider, the company is likely already today the best positioned company in the industry to deliver highly innovative solutions and capture the strong growth.

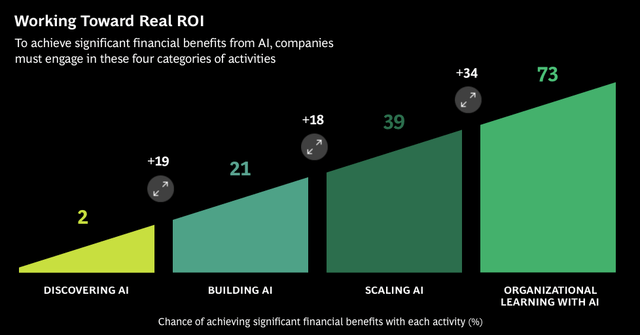

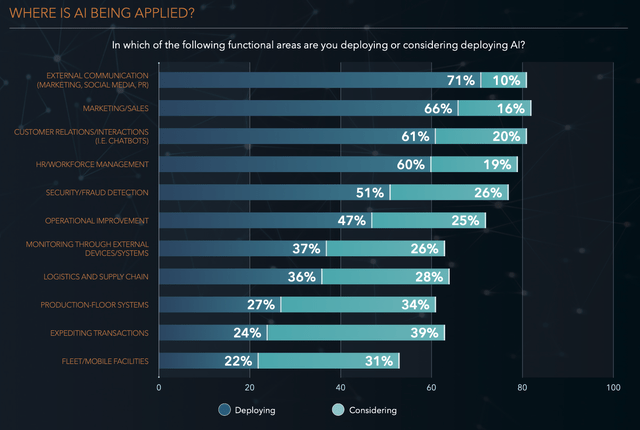

For most companies AI is still in the discovering/building phase, but this will likely change very fast in the coming years, as the financial benefits will most likely significantly outweigh the expenses and the applications through the various industries are still not entirely understood and will further increase through the ongoing digitalization, building up momentum in the coming years as companies will likely scale up on their AI capacities and deploy the technology in many more functional areas than they already do or plan today.

Risk discussion

The macroeconomic situation is one of the most uncertain and volatile in the equity market’s history. Geo-political tensions between the US and China, the ongoing and worsening conflict in Ukraine, lockdowns in China, supply-chain bottlenecks and shortages, foreign exchange rates volatility and increasing central bank rates are just some of the most impactful elements that create headwinds for NVIDIA.

The recent announcement of the US imposing an export license requirement on some strategic hardware, exported to China, Hong Kong, and Russia, includes NVIDIA’s A100, the forthcoming H100, and DGX or any other system including those chips. The license is also required for offering support or developing those products. The company declared that approximately $400M in potential sales in Q3 were affected by this restriction, if the customers refuse to buy an alternative product or if the US government will not grant the license in a timely manner. In my opinion, this will not be the last restriction for such strategic technological components and we may expect China to retaliate with similar bans or e.g. hinder the export or processing of rare earths, on which the US still relies upon, even though the country is the world largest EV manufacturer and a significant price increase of the relevant rare earths, would most likely have a negative impact on their own industry, and such restriction would likely not have the same impact as it had a in the last decade, as the US are focusing on finding alternative suppliers and building a domestic supply chain.

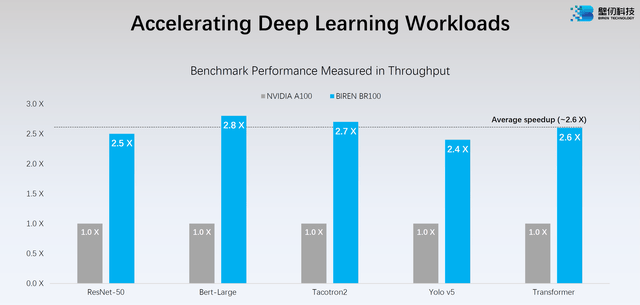

Intel’s expected Ponte Vecchio Xe-HPC GPU, which apparently outperforms the A100 by significant margins in several benchmarks, could be a potential competitor to NVIDIA’s upcoming H100 GPU. The Chinese company Biren Technology has recently launched its first GPU series to compete with its US manufacturers and address its home market, where major Chinese hyperscalers and cloud builders such as Tencent (OTCPK:TCEHY) (OTCPK:TCTZF), Alibaba (NYSE:BABA), and Baidu (NASDAQ:BIDU) are driving the demand in cloud computing. The GPU is reportedly based on a similar chiplet approach as used by AMD or Intel. Despite the company’s own benchmark tests reporting a significant speedup of approximately 2.6x compared to NVIDIA’s A100 GPU, it’s not clear on which type of workloads those tests have been performed and if NVIDIA’s chips were using the sparse matrix feature or not, which actually doubles their throughput. It’s certainly an important milestone for the industry, however I see it unlikely that Chinese GPUs will widely be used in data centers worldwide, as the situation may be comparable with the security concerns raised with Huawei’s 5G technology.

One of the consequences of the extended conflict in Ukraine is the increase in Neon gas price, which quadrupled alone between mid-2021 and February 2022 to $275 per cubic meter, and recently reached $2,500 per cubic meter, about 800 times the current price of natural gas in Europe. Russia and Ukraine provide about 50-55% of the supply of inert gasses worldwide, the Ukrainian companies Ingas and Cryoin produce approximately 50% of the global semiconductor-grade neon gas, but had to indefinitely halt their production, and more than 90% of neon gas used in the US chip industry is sourced from Ukraine. While chipmakers typically keep 3-6 months neon gas inventory, companies are quite reluctant to replace the gas with new sources, as the manufacturing process can take approximately 6 months of adjustment until the production is back at optimal levels, and moving the production facilities out of Ukraine could take approximately 9 months up to two years to ramp up the production.

Valuation

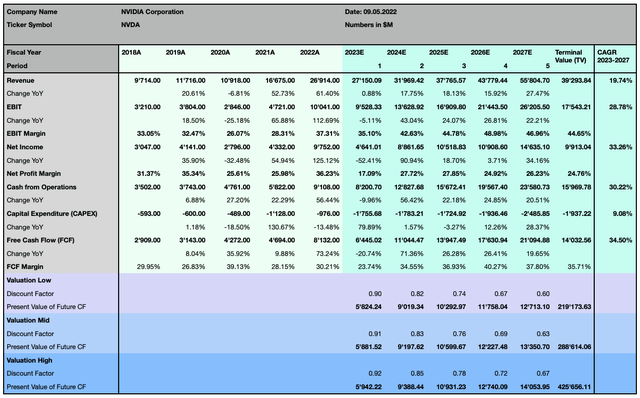

Following the recent events and based on the latest available data, I adjusted my valuation model in order to reflect the latest risks and estimations. I rely on the following Discounted Cash Flow (DCF) model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the Weighted Average Cost of Capital (WACC) and the terminal value. As forecasted by the street consensus, the current year is seen as quite thought for the company while in the coming 5 years, the company is anticipated to generate a consistent, solid 34.50% Free Cash Flow (FCF) CAGR, with substantially increased net profitability at 33.26% CAGR, while its revenue is forecasted to grow slightly slower but still at close to 20% CAGR.

Author, using data from S&P Capital IQ

The valuation takes into account an even tighter monetary policy, which will undeniably be a reality in the US as well as in many economies worldwide in the coming years and lead to a higher weighted average cost of capital.

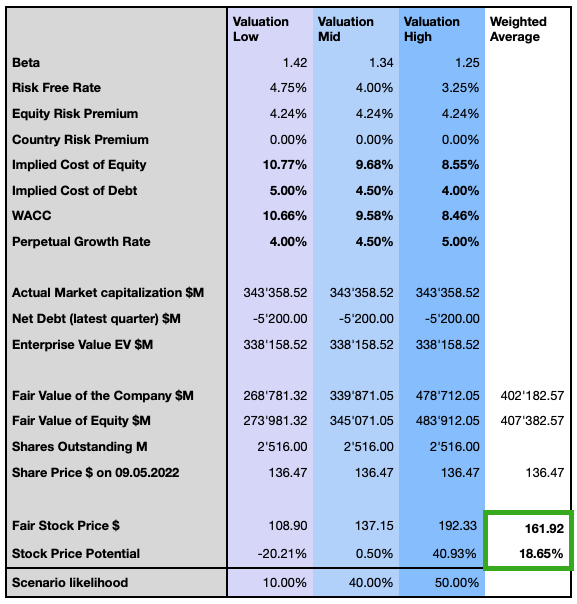

Author

I compute my opinion in terms of likelihood for the three different scenarios, adjusting slightly the likelihood from the latest valuation, and I, therefore, consider the stock to still be undervalued with a weighted average price target with 18.65% upside potential at approximately $162. Investors should consider that those forecasts are based on relatively higher discount rates and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and value the company at a higher price, but an acceleration of the inflation rate, increased cost of capital, or a greater deterioration of the company’s perspectives, could further reduce the fair value of the stock.

Market timing

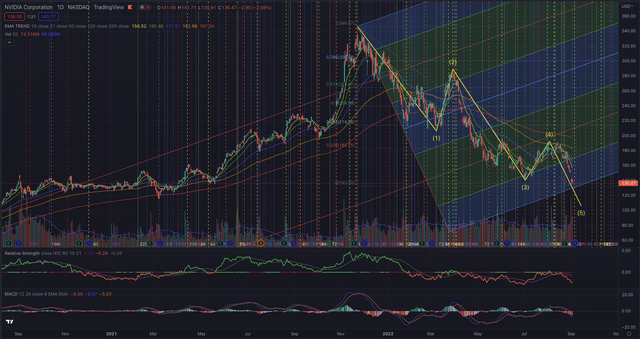

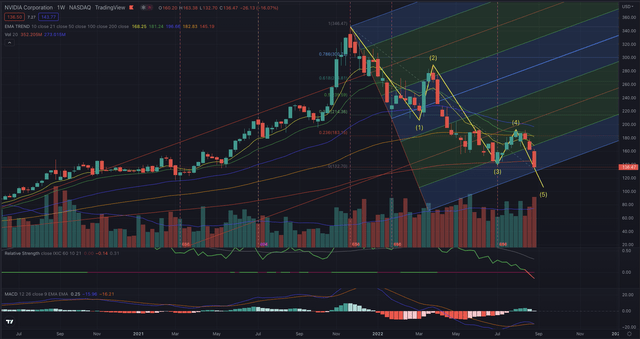

In my last article on NVIDIA I mentioned that in a short-term perspective, the stock could reach its next resistance level at $189.15, but that a breakout over that level would need even more resilience in the momentum, and that I likely saw the stock consolidating. The stock in fact topped at $192.74, or slightly over my target price, lost steam in its momentum and is now continuing in its medium-term downtrend. On September 1st, the stock hit a lower 52-weeks low on significantly higher volume, which is a quite negative signal and hints to the possible testing of the next support level at around $130 or even to further lows.

As I always analyze a stock from a long-term investor perspective and a shorter-term trading perspective, I consider the stock falling until $106 as likely scenario, if the negative trend continues to weight on the technology sector, as selling pressure is accelerating and despite possible further short rallies, the stock failed to break out from its downtrend and just broke the strong support of its EMA200 on its weekly chart. NVIDIA’s stock is also showing relative weakness compared to its reference index, which is a very important indicator of rising pressure on the stock’s price.

The street consensus given by 43 analysts prices the share on average at $212.13 with a buy rating, with the lowest estimation at $110 and the highest at $320. The Seeking Alpha Quant Rating instead qualifies the stock consistently as a hold position.

The bottom line

NVIDIA built a significant moat with its strong brand, its CUDA platform, a consistent product ecosystem with high switching costs in future oriented growth vectors, such as data centers, automotive, AI, and its optionality to grow further is one of the most promising in its industry. The shift from more consumer-oriented revenue streams to focus on B2B solutions, and the diversification away from an almost exclusively gaming GPU centered business, has already happened, yet still the market seems to not fully have priced-in those opportunities and values much more the short term headwinds. My valuation model suggests a likely potential price increase of approximately 19% at $162, compared to a more pessimist short-term estimation of a bottom around $106. I therefore rank the stock as a short term hold position, but would definitely closely follow the price action, since the long-term opportunities are still intact and in my opinion underestimated by the market at this price level. Should the stock reverse and break out of its medium-term downtrend, it’s certainly one of the most promising stocks for capturing the potential in the data center secular growth trend and generally in the semiconductor industry.

Be the first to comment