Diego Thomazini/iStock via Getty Images

Transcript

Central banks have primed markets to infer too much of a hawkish intent.

We have entered a new era shaped by production constraints. That implies a tough trade-off for central banks: squash growth or live with higher inflation. The problem: they have yet to acknowledge this. For now, this leaves the door open for markets to expect overtightening – and keeps us cautious in the near term.

1. The ECB’s rate path

The market sees the ECB hike rates well into 2023. Instead, we expect it to move quickly out of negative rates – but then pause in the face of the real recession risks that are prompted by Europe’s energy crisis.

2. The Fed’s rate path

Market pricing of Fed rate hikes has cooled a bit amid market expectations of inflation heading down. We see a short-term risk of rates snapping back because incoming data show the persistence of inflation – and the Fed continues to solve for the politics around inflation.

There is no perfect outcome here. Monetary policy alone cannot solve production-driven inflation, and the cost of trying is high. Central banks will realize this in due course.

As a result, we expect a dovish pivot in the coming months. This will be, in our view, the most muted policy response to inflation – and it has been so far.

But for now, we are tactically neutral on equities, as markets could again infer too much from the Fed’s hawkish rhetoric.

_________________

The ECB is set to confirm this week that rate increases are imminent, and markets expect it to hike well into 2023. The Fed is seen to reach peak rates at this year’s end. The sum total of rate hikes will ultimately prove to be historically low, we believe, as central banks choose to live with inflation rather than squash growth. The problem: markets have been primed to assume hawkish intent and are quick to perceive risks of overtightening. This keeps us neutral on equities in the short run.

Same high inflation, different drivers

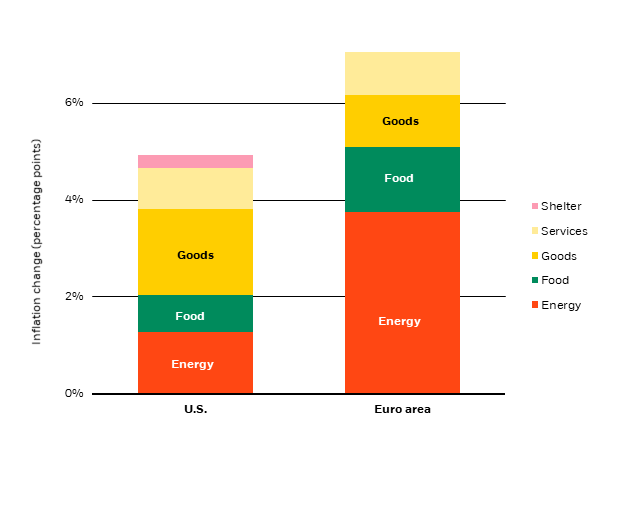

Change In US PCE And Euro Area Inflation, 2022 Vs. 2015-19 Average (BlackRock Investment Institute, with data from Haver Analytics, June 2022)

Notes: The chart shows how different categories of U.S. PCE and euro area HICP contribute to the 2022 increase in inflation compared with the 2015-2019 (pre-Covid) average. U.S. numbers are based on April 2022 data, euro area data are based on the flash inflation release for May 2022 and are subject to revision.

The ECB and the Fed both need to quickly normalize policy from the emergency settings adopted when the pandemic first hit. And they both face inflation that’s running at multi-decade highs – and are feeling pressure to rein it in. The difference: the drivers of inflation. Inflation in the euro area is driven primarily by higher energy and food bills that were exacerbated by the tragic war in Ukraine. See the red and green shaded areas in the bar chart above. This should dissipate in the medium term, in our view, as Europe finds new energy and food sources. In the U.S., inflation is more broad-based, with increases driven by goods and energy in almost equal parts (the left bar). We see U.S. inflation as persistent and expect it to settle at higher levels than pre-Covid.

We have entered an era where production constraints have become the dominant drivers of inflation. Think about bottlenecks and difficulties in producing, sourcing, transporting and staffing. Both central banks have yet to acknowledge the sharp trade-off when trying to rein in this type of inflation with rate hikes: Squash growth and jobs or live with higher inflation than before the pandemic. We don’t see a Goldilocks outcome where inflation stays near 2% while unemployment remains low and growth resumes an upward trend. This leaves the door open for markets to expect overtightening at any signs of persistent inflation, a tight labor market or economic strength – and keeps us neutral on equities in the short run.

A new inflation era

The situation is most acute in Europe. Markets expect the ECB to hike rates well into 2023 to rein in inflation that was running at an annual clip of 8.1% in May. Instead, we see it quickly raising rates out of negative territory but then pausing in the face of a recession triggered by Europe’s 1970s-style energy crisis. Last week’s decision by the European Union to ban most Russian crude oil imports is the latest example of how the West is determined to wean itself off Russian energy. This is pushing up oil prices and dragging down growth. We see a material slowdown in euro area economic activity as a result. This should do much of the ECB’s work for it. Conclusion: We believe market expectations for ECB rate hikes are overly hawkish.

Market pricing of Fed rate hikes has cooled recently on market expectations that inflation is bound to come down. This spurred a rebound in equities from 2022 lows and stopped the U.S. dollar rally in its tracks. In other words, markets have moved as if inflation is yesterday’s story. We disagree. Sure, core inflation is bound to come down from 40-year highs. But we see it as persistent and running above the Fed’s 2% target for years to come. We see short-term risk of a snap back in the market’s rate expectations as data show the persistence of inflation – and as the Fed keeps talking tough on inflation.

Where this leaves investments

What does this mean for investments? The volatile macro and market landscape is here to stay, in our view. We believe central banks will ultimately deliver a historically muted response to inflation. That underpins our core strategic view of preferring equities over government bonds. We have less conviction on a tactical horizon of six to 12 months. This is why we have gradually trimmed risk all year and downgraded DM equities to neutral last month. We are looking for signs that central banks acknowledge the trade-off of living with some inflation for the sake of preserving growth. We could see another sharp policy pivot in the coming months, this time a dovish one. This would be a catalyst to go back to overweight equities.

Bottom line

The sum total of rate hikes will prove to be historically low, we believe, as central banks choose to live with inflation. But markets are primed to perceive a risk of overtightening. This is why we are neutral on stocks in the short run.

Market backdrop

The U.S. added 390,000 jobs in May – a number that was matched by new entrants to the labor force. This shows the labor market is not as tight as is commonly thought. The data triggered a fall in stocks and rise in yields, illustrating the market is conditioned for an overly hawkish Fed. A macro landscape shaped by production constraints is volatile, we think – and more so with central banks that appear oblivious to the sharp trade-off they are facing: live with higher inflation or squash growth.

The ECB’s media briefing is this week’s key event after ECB President Christine Lagarde indicated rate hikes will kick off in July. We think the market’s pricing of the ECB rate path is too aggressive and see the ECB pausing its hiking cycle amid materially weaker growth. U.S. consumer price inflation could inform the Fed’s rate path in coming months.

Be the first to comment