Robert Way

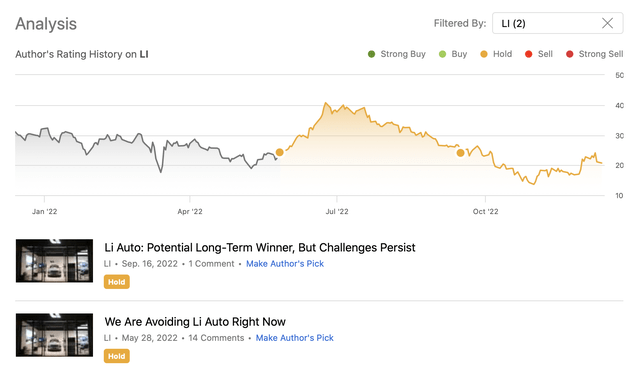

Li Auto Inc. (NASDAQ:LI), through its subsidiaries, designs, develops, manufactures, and sells new energy vehicles in the People’s Republic of China. This year, we have published two articles on LI, rating the company’s stock as “hold” both times.

These articles were:

Li Auto: Potential Long-Term Winner, But Challenges Persist

We Are Avoiding Li Auto Right Now

Past analysis (Author)

The primary reasons for our “hold” ratings were:

- Increasing revenue and increasing deliveries compared to the quarters in the previous year.

- Material tailwinds are likely to be created by the continued consumer adoption of NEVs in China.

- On the other hand, concerns related to chip supplies and COVID-19 related restrictions can create substantial headwinds for the firm.

- Uncertain macroeconomic environment, competition, and regulatory landscape in the near term.

Today, we are going to take a look at the Q3 results, and analyse if the previously established “hold” rating is still valid.

Q3 results

Deliveries

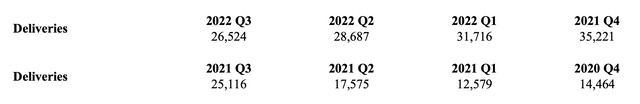

LI has managed to increase its total vehicle deliveries year-over-year, reaching 26,524 units, representing a 5.6% year-over-year increase. Important to mention that while delivery numbers have increased year-over-year, the figure has declined quarter-over-quarter, as it has been doing so in the previous two quarters.

Deliveries (LI)

We would like to highlight two factors that can potentially impact the delivery figures:

1.) Accessibility of chips in China

2.) Covid-19 related lockdowns in China

While the uncertainty related to the chips remains, the development around the Covid-19 restrictions is definitely positive. The Chinese government has substantially relaxed the restrictions related to Covid-19 cases, which could potentially fuel not only LI’s growth in the near term, but also the growth of many Chinese firms.

This positive development is likely to be already incorporated in the firm’s Q4 outlook, in which they expect a substantial increase in the number of vehicles delivered:

Deliveries of vehicles to be between 45,000 and 48,000 vehicles, representing an increase of 27.8% to 36.3% from the fourth quarter of 2021.

Sales

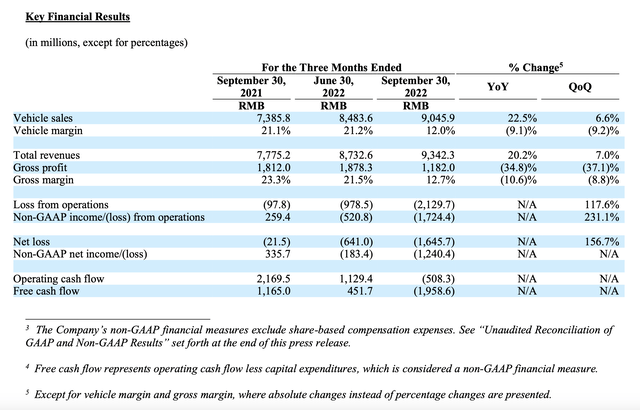

Along with the increase in the number of vehicles delivered, both vehicle sales and total sales have increased year-over-year. Vehicle sales have risen by as much as 22.5% YoY, while total sales by 20.2%.

Key financial results (LI)

The higher average selling price due to the delivery of Li L9 has been a significant contributor to the increasing vehicle sales. This has been partially offset by the decrease in revenue from other sales and services, as the sales of automotive regulatory credits in the third quarter of 2021 did not reoccur in Q3 2022.

In our opinion, the sales are likely to continue growing in the coming quarters, primarily due to the easing Covid-19 restrictions, the growing number of LI retail store and servicing centres and the wider and wider adoption of NEVs in China.

The firm expects the year-over-year growth in Q4 to be substantial:

Total revenues to be between RMB16.51 billion (US$2.32 billion) and RMB17.61 billion (US$2.47 billion), representing an increase of 55.4% to 65.8% from the fourth quarter of 2021.

While the increasing sales and the growing market are both promising signs, this is only one side of the story.

Costs have substantially increased compared to the same period in the previous year, margins have contracted and both operating- and free cash flow have dramatically declined.

Costs

Cost of sales have increased by more than 36% in the third quarter. There are two key factors contributing to this increase:

- higher average cost of sales due to the delivery of Li L9

- an inventory provision and losses on purchase commitments related to Li ONE as the company has lowered their order forecast for Li ONE, accounting for the stronger-than-expected demand for Li L9 and the firm’s plan to accelerate the launch of Li L8

The inventory provision and losses on purchase commitments have also led to a substantial contraction of the vehicle margin year-over-year, however we believe that this contraction is not likely to continue in the coming quarters.

On top of that, operating expenses have also skyrocketed, increasing by 73.4% compared to the third quarter in the prior year.

Contributors to the operating expense increase have been:

- Research and development expenses, which have grown 103.1% YoY, driven by the elevated costs associated with future models, as well as increased employee compensation as a result of the growing number of R&D staff.

- SG&A expenses, which have grown 47.6% YoY, fuelled by the elevated employee compensation as a result of the growing number of staff, along with the increased rental expenses related to with the expansion of the LI’s sales network.

In our opinion, as long as the company is in the growth phase (rapid expansion of its network and manufacturing capacities) the costs are likely to keep increasing. The R&D related cost increases are also inevitable. In a very competitive landscape, with players like Tesla (TSLA), NIO (NIO) or XPeng (XPEV), LI has to make sure that their products remain relevant. The competition is also likely to put downward pressure on the margins in the longer term.

Going forward, the firm is planning to manage costs more responsibly, however, we would like to see the execution before we would consider upgrading the stock to “buy”. CTO Tie Li made the following comments:

Looking ahead, we are optimistic that with rapid production ramp-up, rigorous execution, and responsible cost management, we will realize greater economies of scale and further drive down costs, putting us back on track to hit our profitability inflection point, […] As always, we believe that our ability to deliver best-in-class products will keep Li Auto at the forefront of the NEV transformation.

To sum up

The macroeconomic landscape has somewhat improved since our last writing. The easing of the zero-Covid policy in China can be a catalyst to fuel both delivery and sales growth in the quarters to come. This may have a positive impact on the stock price in the near term.

On the other hand, the Q3 results have been somewhat mixed. While delivery and sales figures have increased YoY, despite missing analyst estimates, operating income and net income have both declined, due to the increasing costs.

For these reasons, we remain cautious and maintain our “hold” rating.

Be the first to comment