Deagreez

Canadian Utilities Limited (OTCPK:CDUAF), which offers electricity among other energy services, recently signed a transaction to increase its exposure to the renewable industry. Besides, with expertise targeting both consumers and industrial groups, management intends to enter new markets outside North America. With my own forecasts about future free cash flow generation, I obtained a valuation of close to $43, which is larger than the current price mark.

Canadian Utilities

With global assets valued at approximately $21 billion, Canadian Utilities Limited provides energy services to businesses, industries, and homes.

The company belongs to the ATCO group, and is based in Canada. It also has plans and projects in other parts of the world, including Chile, Australia, Mexico, and some areas of the Central American Caribbean. I believe that international expansion could bring significant stock demand because the target market would likely grow.

Canadian Utilities is divided into its three main branches of the business model: power generation, utilities (transmission and distribution of electric power and natural gas), and global initiatives (technology, logistics, and services related to energy). I believe that the level of diversification is significant.

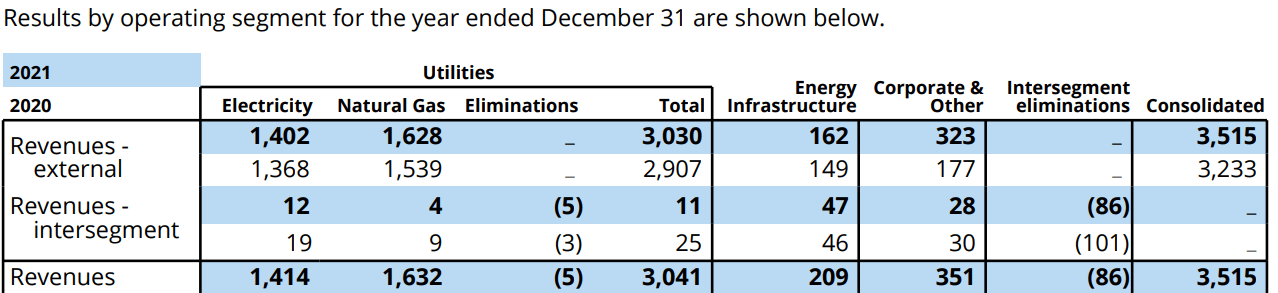

Source: Annual Report

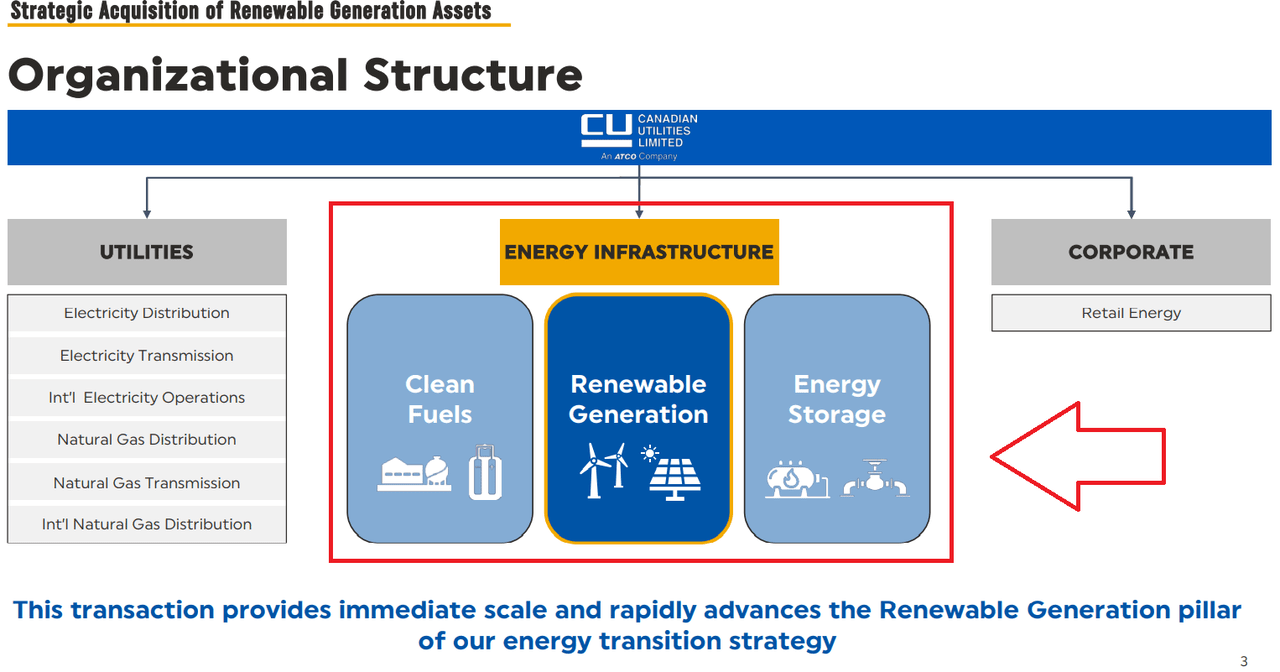

Canadian Utilities has an investment area made up of experts that also allows it to invest in long-term assets outside the company’s usual target market, expanding its profit margin as well as economic sustainability. The most recent announcement of acquisition of renewable generation assets appears a clear example of the company’s strategy.

Source: Acquisition Of Renewable Generation Assets

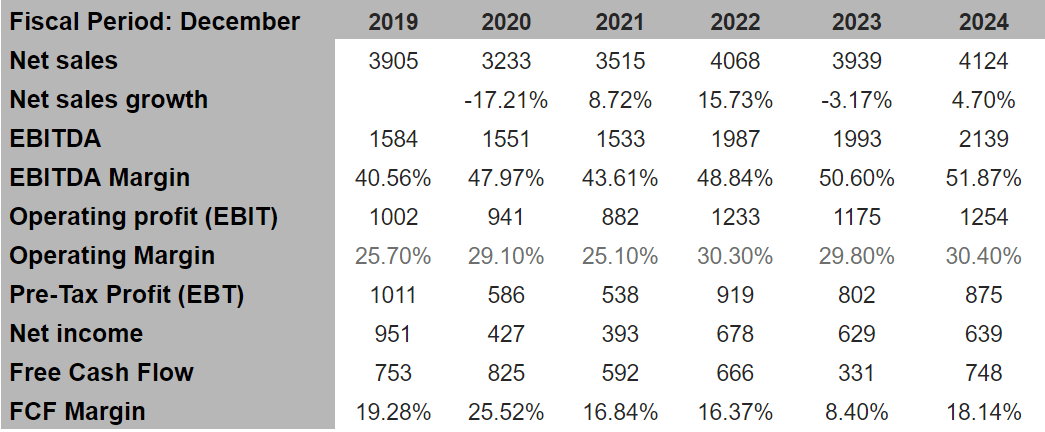

Market Expectations Include 2024 FCF Margin Close To 18% And 2024 Positive Sales Growth

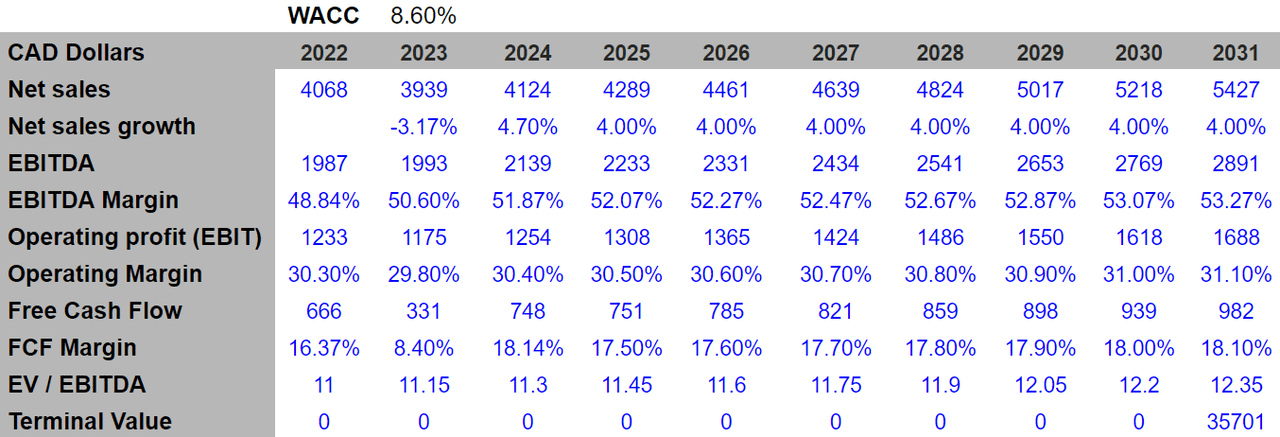

Analysts expect net sales of CAD4.124 million by 2024 together with a net sales growth of 4.70%. 2024 EBITDA would likely stand at CAD2.139 million with an EBITDA margin of 51.87%. 2024 operating profit would be CAD1.25 billion with an operating margin of 30.40%. Besides, pre-tax profit will likely be close to CAD875 million, which would lead us to 2024 net income of CAD639 million. Finally, 2024 free cash flow would stand at CAD748 million with a FCF margin of 18.14%.

Source: Marketscreener.com

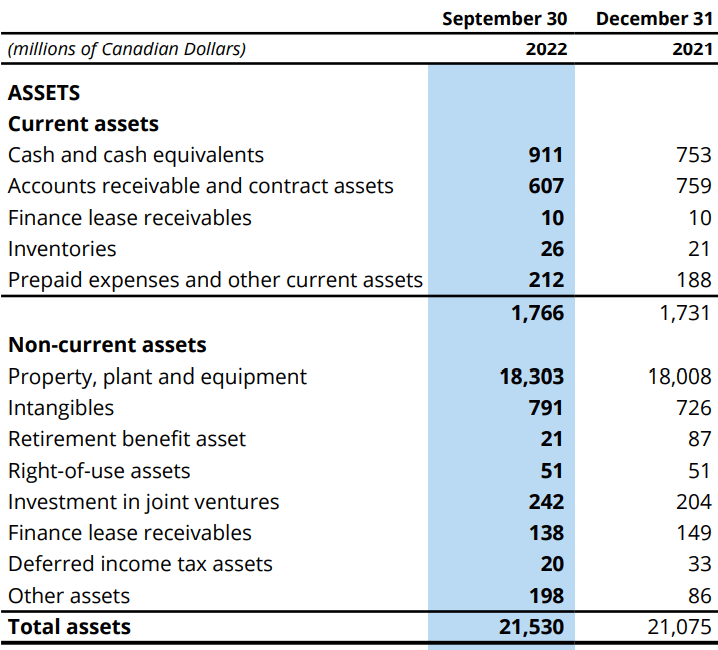

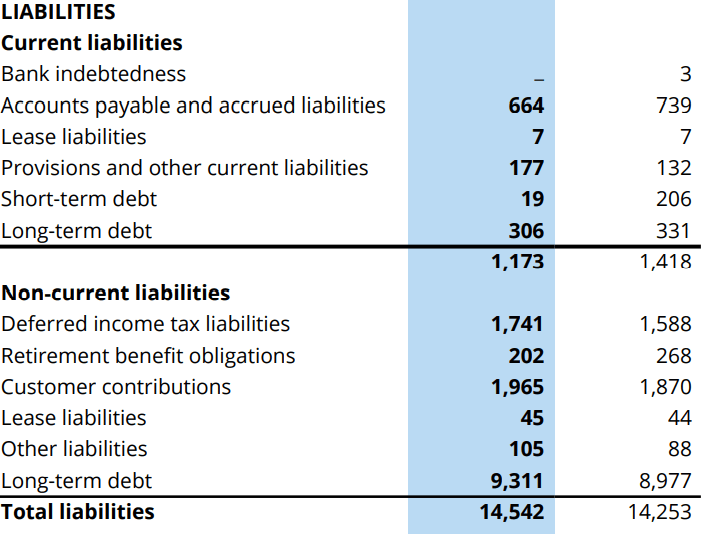

Balance Sheet

As of September 30, 2022, management reported cash of CAD911 million, with accounts receivable worth CAD607 million and prepaid expense of CAD212 million. Current assets stand at more than CAD1.766 billion, which is significantly larger than the total amount of current liabilities. Liquidity does not seem to be an issue for Canadian Utilities.

Non-current assets include property of CAD18.303 billion and intangible assets of CAD791 million. Total assets are equal to CAD21.530 billion, close to 1x-2x the total amount of liabilities. With these numbers in mind, I believe that the balance sheet appears in good shape.

Source: Quarterly Report

The list of liabilities include accounts payable worth CAD664 million with provisions and other current liabilities worth CAD177 million. Non-current liabilities include deferred income tax worth CAD1.741 million and customer contributions worth CAD1.965 billion. Finally, long term debt stands at CAD9.311 billion, and total liabilities are worth CAD14.542 million. The total amount of debt does not seem small. However, considering that Canadian Utilities delivers stable free cash flow, and it is a mature business model, I wouldn’t be worried about the company’s financial obligations.

Source: Quarterly Report

Conservative Assumptions, The Net Zero Plan, And More Clients Could Lead To A Valuation Of CAD43 Per Share

It is known that in recent years the global agenda in relation to the exploitation, generation, and supply of energy for corporations, industrial plants, and homes has undergone profound transformations in terms of the acceleration of climate change and the lack of predictability.

Without going any further, one of the great conflicts of the coming winter in Europe along with a large part of the Western world is the supply of gas to the population, complicated by the war situation that Russia and Ukraine are currently going through. For this reason, it is of vital importance that companies with years of experience can adapt to the requirements of the future and serve as a guide for those responsible for preparing energy supply and extraction plans. With all this in mind, under this case scenario, I assumed that Canadian Utilities will receive significant visibility from the investment community.

Among its different services, Canadian Utilities brings together the preparation of an energy development plan and the management of establishments built by third parties. This means that its business model works perfectly at any stage of the elaboration of a project for energy supply, be it for entire cities, as well as the industrial centers or individual homes. Under this scenario, I believe that the company’s expertise of working with very different clients will enhance future sales growth.

In addition to its electricity and natural gas energy services and adapting to the evident transformation needs not only in the way of generating energy but also in the way of understanding humanity’s relationship with the use and reuse of resources, the company has developed renewable energy or technologies to reduce the environmental damage of its work. An example of this is the production of high-quality solar panels as well as compliance with the requirements of the Canadian government in relation to the trade and use of resources from petroleum.

For the year 2050, the company has prepared the Net Zero plan, through which it commits to reduce its greenhouse gas emissions to zero by the year 2050. I assumed that the Net Zero plan will bring more customers looking to invest in green energy. More demand for Canadian Utilities’ equity could lower the cost of capital, which would bring a larger fair valuation.

Under the previous conditions, I assumed 2031 net sales of CAD5.427 billion and 2031 net sales growth of 4%. 2031 EBITDA would stand at CAD2.891 billion with an EBITDA margin of 53.27%. 2031 operating profit would be CAD1.688 billion with an operating margin of 31.10%. 2031 free cash flow would stand at CAD982 million, and 2031 FCF margin would be 18.10%.

Source: Author’s Work

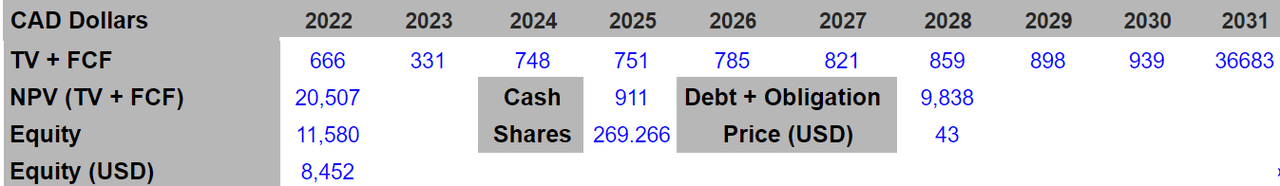

Considering an EV/EBITDA of 12.35x, the sum of the terminal value and the discounted cash flow stands at CAD20.507 billion. The equity valuation would be CAD11.580 billion. If we assume cash of CAD911 million and debt and obligations worth CAD9.838 million, the final price would be $43 per share.

Source: Author’s Work

Regulatory Changes, Changes In The Interest Rates, Or Energy Asset Price Changes Could Lead To A Valuation Of $14.15

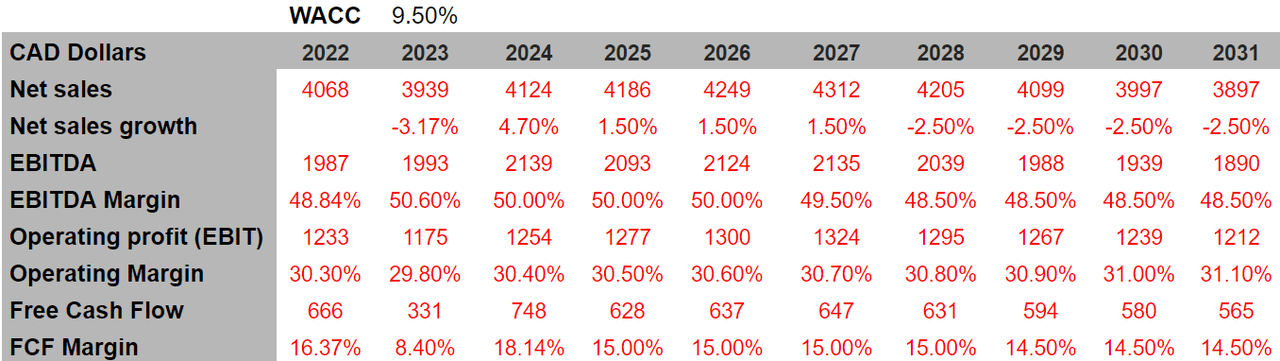

One of the risks of Canadian Utilities is restrictions and modifications in the regulations promoted by national and regional governments regarding the energy industry, mainly electricity and natural gas. If the company has to invest more in capex to respect the new regulations, free cash flow expectations would lower.

Besides, interest rate changes, energy asset price changes, or foreign currency exchange rate variations could be detrimental for Canadian Utilities. In this regard, management may have to make consistent projections for the future, counting on the security of the action to be carried out based on a previous and extensive study on financial conditions and the specificities of the market. In my view, wrong forecasts would lead to free cash flow declines.

Under this scenario, I assumed 2031 net sales of CAD3.897 billion together with 2031 net sales growth of -2.50%. In addition, I assumed 2031 EBITDA of CAD1.89 billion, an EBITDA margin of 48.50%, operating profit of CAD1.212 billion, and an operating margin of 31.10%. Finally, 2031 free cash flow would be CAD565 million with a FCF margin of 14.50%.

Source: Author’s Work

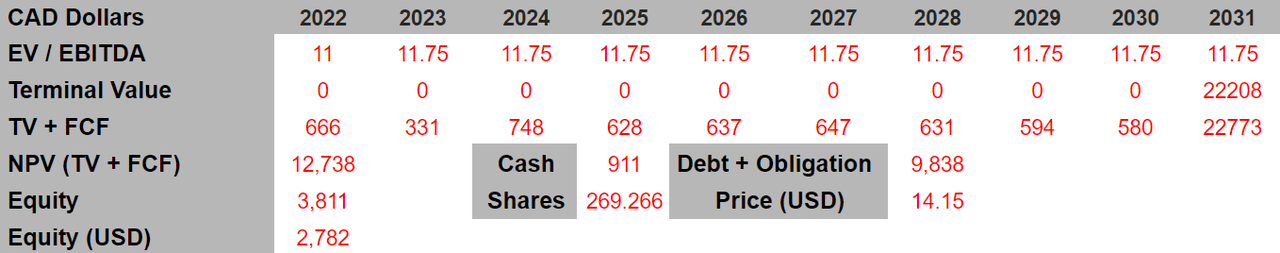

Under this bearish case scenario, I used an EV/EBITDA multiple of 11.75x and a WACC of 9.5%, which implied an enterprise value close to CAD12.5 billion. The equity valuation would stand at CAD3.811 billion. If we add cash for CAD911 million, and subtract debt and obligations of CAD9.838 billion, the fair price would stand at $14.15 per share.

Source: Author’s Work

Conclusion

Canadian Utilities envisions projects outside North America, and targets both industrial clients and homes. The company has recently signed transactions to increase its exposure to the renewable energy industry. In my view, with the new Net Zero Plan and the free cash flow stream expected by most market analysts, the implied valuation could be close to $43. I do see risks from changes in energy regulations and relationships with governments. With that, I believe that the upside potential appears much more significant than the downside risk in the stock price.

Be the first to comment