Huntsville and Highway 60 to Algonquin Park at Fall, Ontario, Canada jimfeng/E+ via Getty Images

When we last covered Algonquin Power & Utilities Corporation (NYSE:AQN) we gave it a bullish rating. This was despite the fact that we expected a far slower dividend growth rate than what the market was used to.

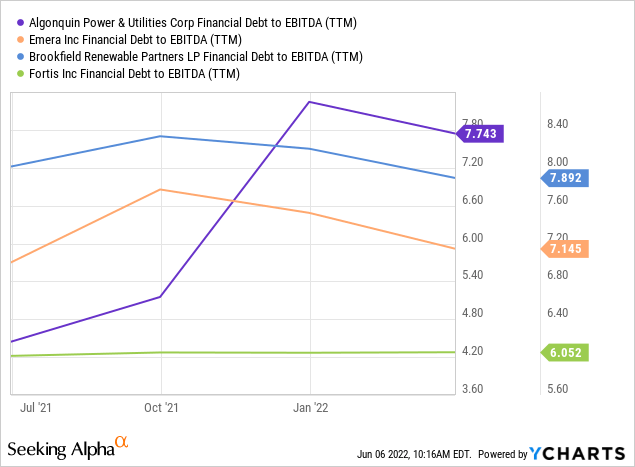

Net Debt to EBITDA which includes a lot of project specific and non-recourse debt is still near the 7.5X mark. Expect an emphasis to bring this down over time and that will likely require less growth in dividends. Our fair value here comes to about $15.50/share on the US exchange and that works out to around $20 on TSX.

Source: Expect Dividend Growth To Slow Materially

That’s about as clear as it gets.

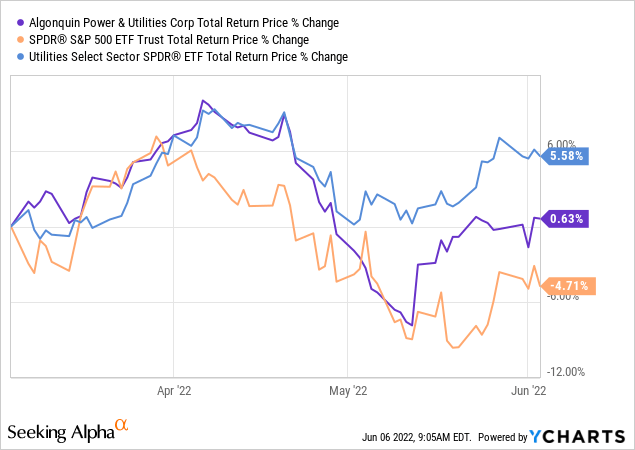

The stock is about flat since then, but has underperformed the utility sector (XLU) and outperformed the broader market.

The company did report Q1-2022 results recently and we decided to see if our thesis for a dividend slowdown was playing out as expected.

Q1-2022

The earnings came in about where analysts expected at 21 cents a share while adjusted EBITDA was a tad weaker at $330.6 million. AQN delivered solid volumes in both the regulated and renewable segments but pricing seemed a bit off and hence the numbers were a bit below expectations. The company reiterated that it expects the Kentucky Power acquisition to close shortly as the last of the pending approvals come through. These are the FERC and West Virginia approvals.

The company declared a 6% increase in dividends to an annual rate of $0.7233. This was a bit mixed compared to our expectations. On one hand, yeah, we are finally leaving the double digit growth behind as expected. On the other, we would have preferred a more dramatic slowdown to conserve cash. Since we expect about $0.73-$0.74 of earnings, the payout ratio now goes almost to 100%. There is little breathing room here.

Outlook

AQN has certainly delivered great results over the last few years and the dividend growth story has been fantastic. At this point we think AQN is slightly more ambitious than what the capital markets will allow. For example, it plans on spending almost $12.5 billion over the next 5 years.

Obviously with a payout ratio near 100% this is almost entirely capital market funded. For the Kentucky acquisition AQN went in pre-funded and it is unlikely to hit the capital markets in 2022. But beyond that, we are looking at tremendous funding requirements, every single year. Now utilities do that and so do REITs. We just think AQN’s debt to EBITDA is getting too high. We see an exit debt to EBITDA here close to 8.0X (7.7X-8.0X estimate range). A lot of it ring fenced around assets and those assets, generating renewable energy, are getting more valuable. So we are not taking an extremely bearish view here but just highlighting that this is getting risky even for the correct assets. We would have preferred a further slowdown in dividends but management likely weighed the impact on the DRIP crowd. The longer they keep them in there, the better it is for the equity funding.

Valuation & Verdict

AQN has been hard to value with its blend of assets. We have the half renewable energy generating assets and the other half with a regulated structure. It fits about midway between a company like Brookfield Renewable Energy (BEP) (BEPC) and companies like Emera Inc. (OTCPK:EMRAF) on one hand and Fortis Inc. (FTS) on the other. All of them run high debt levels unfortunately, but we still see AQN as having the least flexibility in this group. Yes BEP runs higher debt loads, but their unsecured credit rating is in a different league.

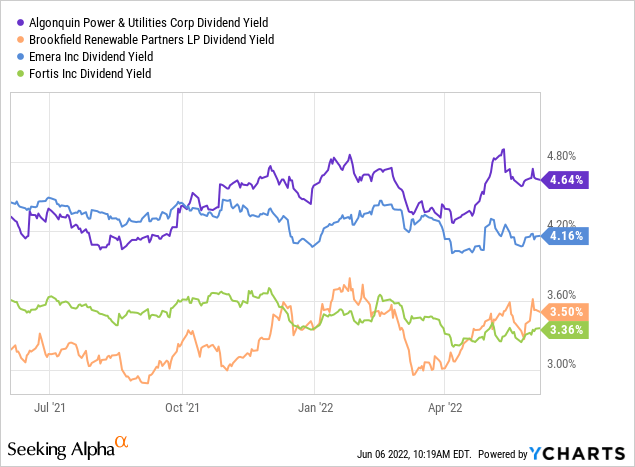

The dividend from AQN is an attractive point here, especially relative to this group.

AQN’s actual forward yield is even higher as the new data has not flowed down to Y-charts. So AQN is paying you to be involved here but it comes at the cost of dangerously high debt and payout ratios. At this point, considering the dangers we see for the utility sector, and for high yield in general, we are downgrading this to a hold/neutral. We currently own the stock, but have in-the-money calls sold against it. We expect the stock to be called away, barring a decent decline. Our preferred play in the sector comes from TransAlta Corporation (TAC) which controls TransAlta Renewables (OTCPK:TRSWF). TAC trades at almost half the EV to EBITDA multiple of AQN. The renewable generating side is very similar to that of AQN, perhaps better. But instead of a regulated utility side, it has an unregulated power generation side. We think this combination is actually better and at half the valuation and less than half the debt to EBITDA, we prefer this.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment