Chip Somodevilla/Getty Images News

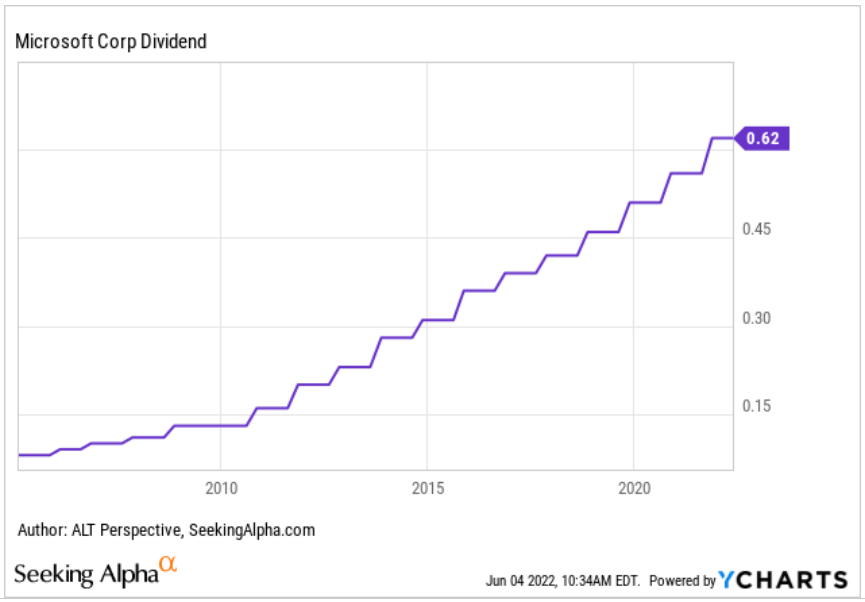

Microsoft Corp. (NASDAQ:MSFT) has been a household name for decades and long-term shareholders are aplenty on this steady revenue growth generator. MSFT stock is also a must-have for many dividend investors. Since it started paying out a dividend in 2003, it has increased the payout annually.

YCharts

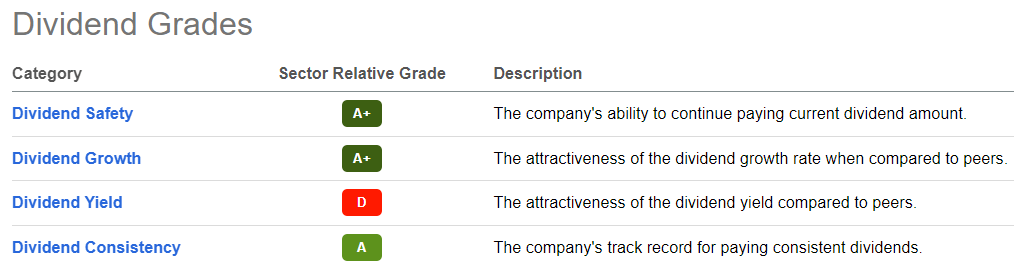

Yet, the dividend growth hasn’t been able to make MSFT a high dividend yield stock because of the faster rise in the share price. Thus, it has a D grade for dividend yield relative to the Information Technology sector where it belongs. Nonetheless, MSFT scored an A for dividend consistency as well as A+ for dividend growth and dividend safety.

Seeking Alpha Premium

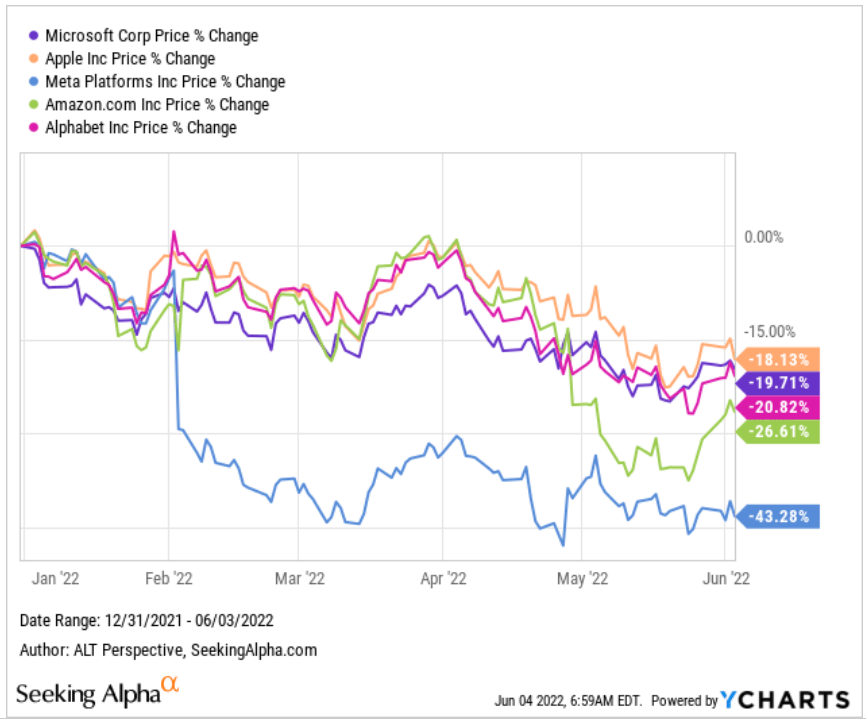

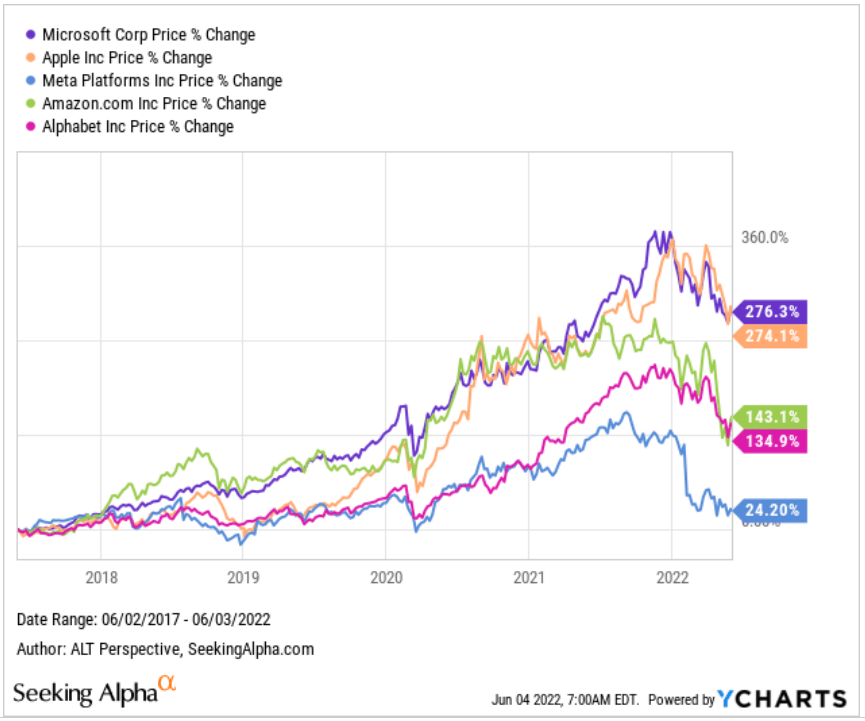

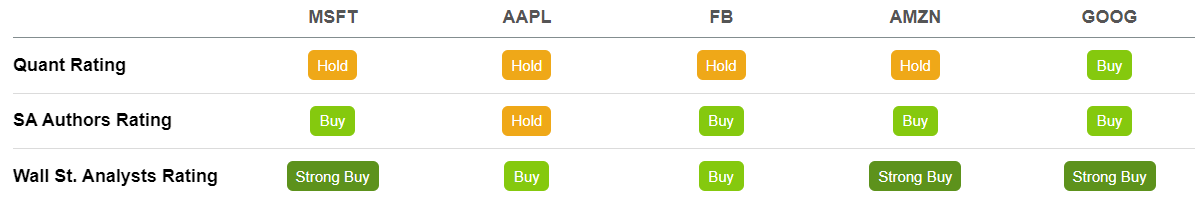

Some Microsoft shareholders may also have been attracted by MSFT being the only dividend stock of the beloved MAMAA, an acronym coined by CNBC’s Jim Cramer for Microsoft, Apple Inc. (AAPL), Meta Platforms Inc. (FB), Amazon.com Inc. (AMZN), and Alphabet Inc. (GOOG)(GOOGL), besides AAPL. Coincidentally or otherwise, both dividend paying stocks MSFT and AAPL have fallen the least among the MAMAA group year-to-date, down 19.7% and 18.1% respectively.

YCharts

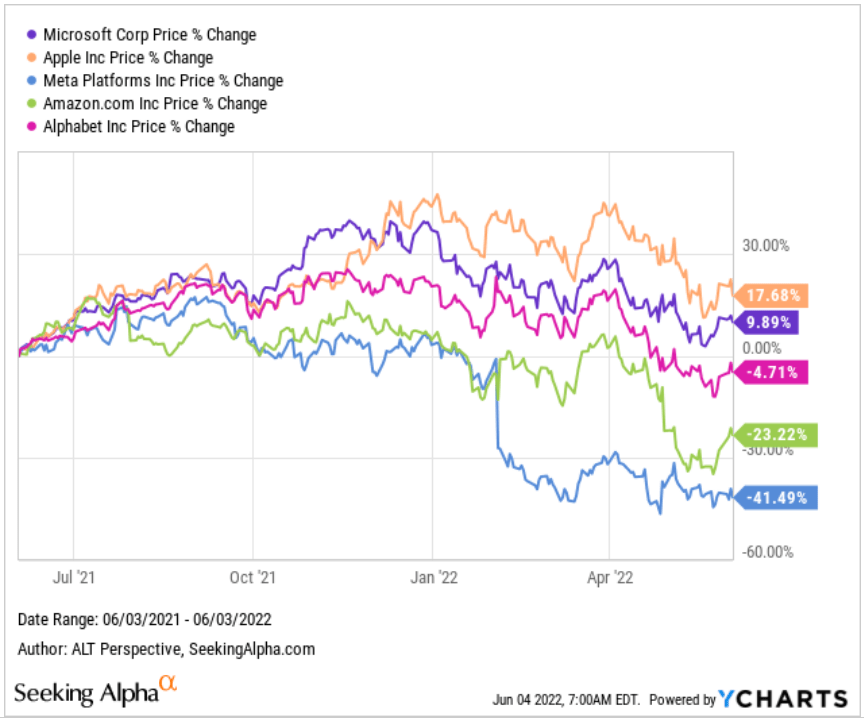

In the past year, MSFT and AAPL are the only two among the MAMAA group to be above water, up 9.9% and 17.7% respectively.

YCharts

Over the past five years, MSFT and AAPL are the outperformers again, appreciating 276% and 274% respectively, while FB stock is up only 24%.

YCharts

MSFT Stock Key Metrics

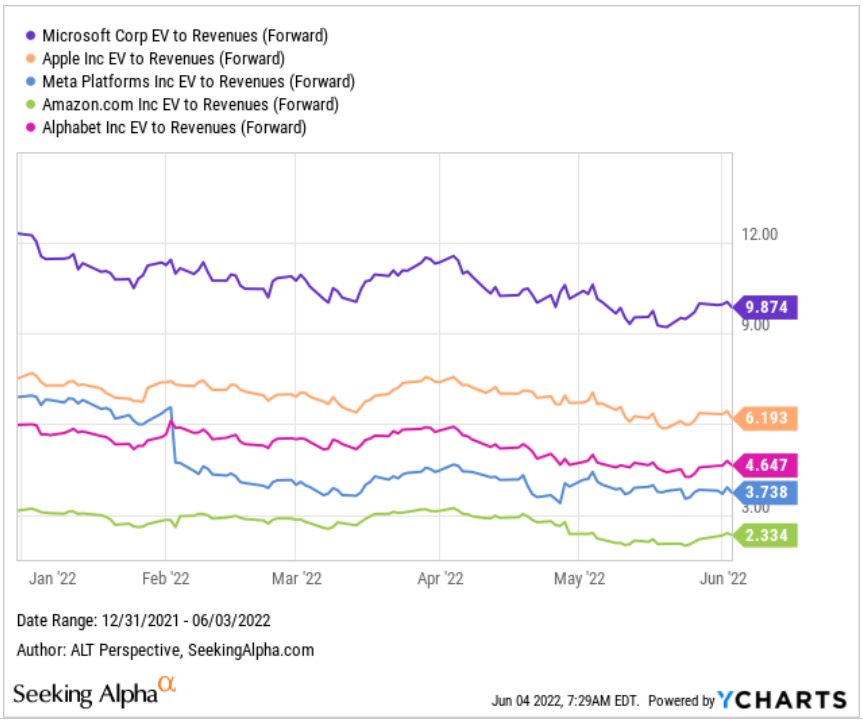

With the share prices of Microsoft and Apple performing better than the other MAMAA members, it shouldn’t be surprising that the duo has higher enterprise value [EV] to revenues. On a forward basis, MSFT stock’s EV to sales ratio is 9.9 times, the highest of the lot.

YCharts

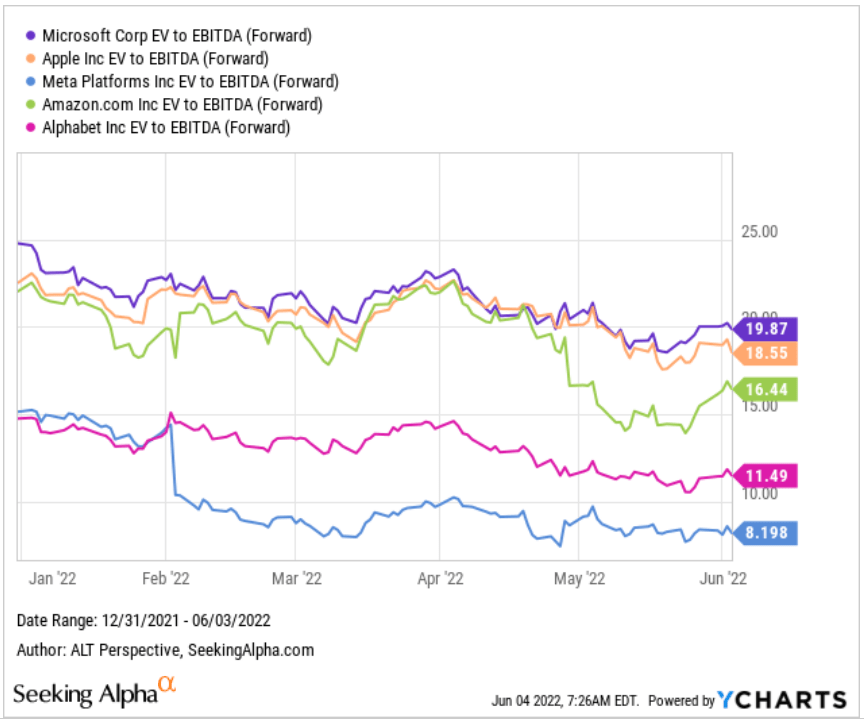

In a rising interest rate environment, as we are in currently, market players are not that keen on stock metrics related to sales. However, Microsoft is also leading the MAMAA stocks on the EV to EBITDA ratio at 19.9 times, more than double that of FB stock’s EV to EBITDA ratio of 8.2 times.

YCharts

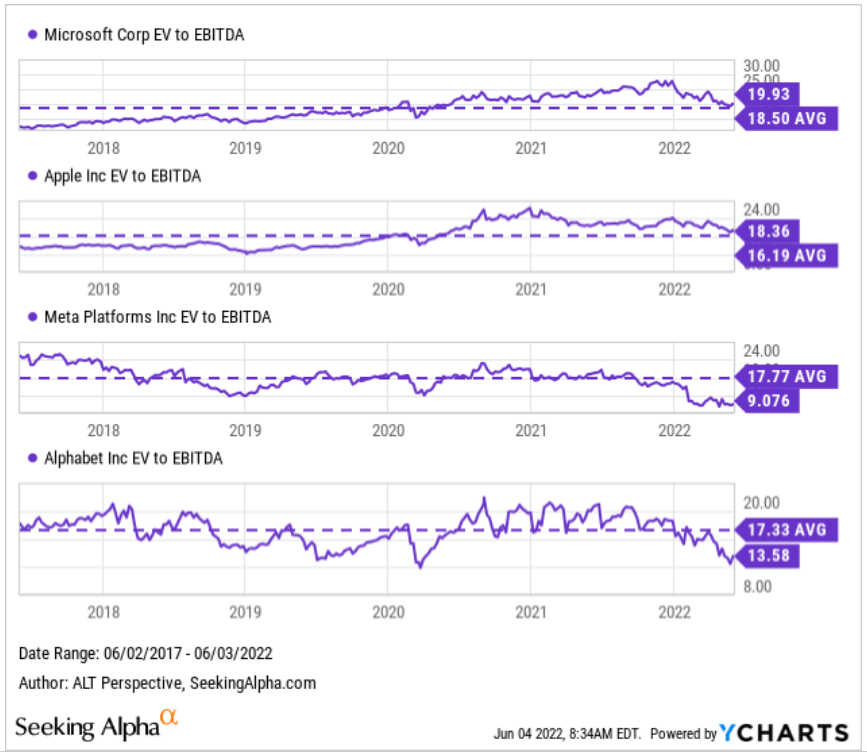

Yet, the current EV to EBITDA ratio of MSFT is only slightly above its five-year average. Microsoft has also given up its pandemic premium, making it a challenging argument to say MSFT stock is expensive. Meta Platforms and Alphabet are trading at lower than average EV to EBITDA but the pressures faced by their ad-dependent businesses are well known.

YCharts

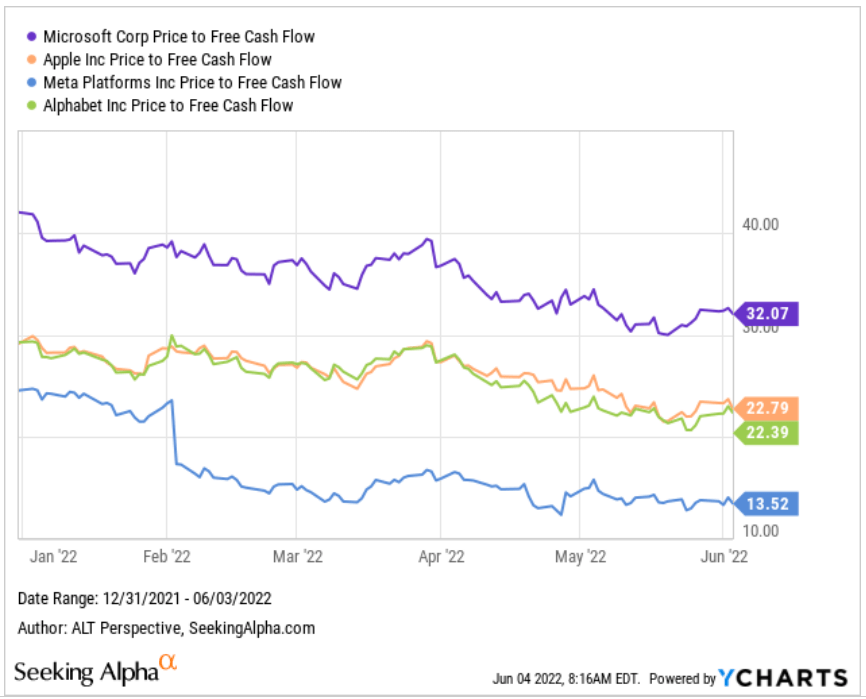

On a price-to-free cash flow [FCF] ratio, MSFT stock is leading the MAMAA pack again at 32.1 times. The second-most “expensive” MAMAA stock is AAPL at 22.8 times, a significant discount over MSFT.

YCharts

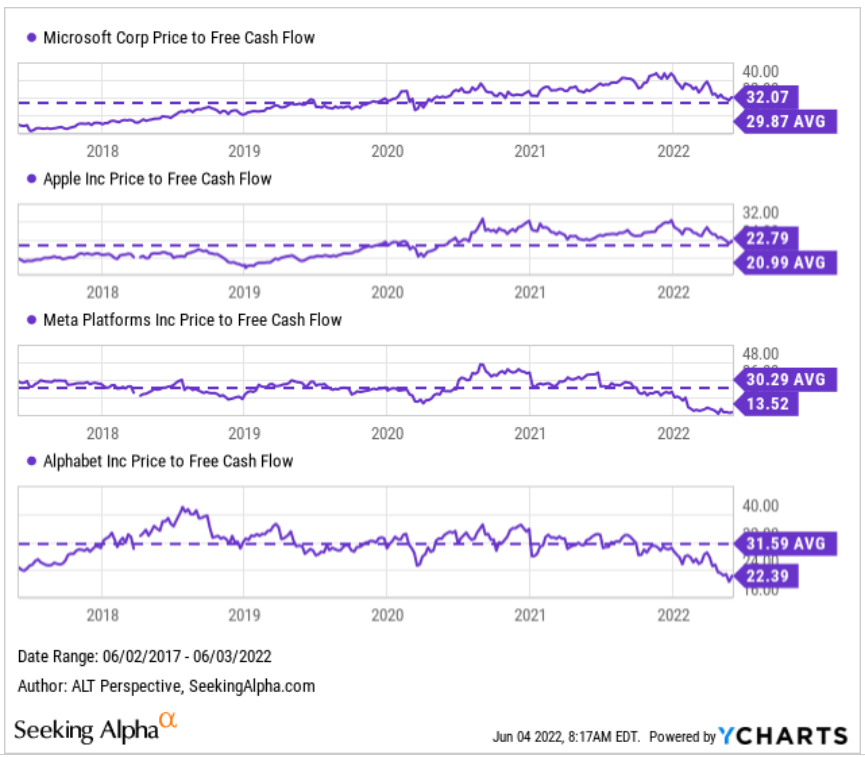

On a five-year basis, Microsoft’s price-to-FCF is trading near its pre-pandemic multiples.

YCharts

Microsoft Business Overview And Margin Discussion

MSFT may be a buy-and-hold or even a buy-and-forget stock for many. Nonetheless, it remains a highly traded stock for others, with the daily trading volume in the tens of millions of shares on a typical day and hundreds of millions of shares on more active days. We also have fresh batches of investors all the time, and likely accelerated by the rise of user-friendly trading apps such as Robinhood, operated by Robinhood Markets, Inc. (HOOD), that may also offer fractional share trading.

Thus, I would like to provide a brief overview of Microsoft’s businesses to hopefully aid new investors in your research and a refresher for others. Microsoft is currently structured into three main divisions:

- Productivity and Business Processes holding the Office products (both commercial and consumer) and cloud services, professional networking platform LinkedIn, and Dynamics (enterprise resource planning and customer relationship management software applications).

- Intelligent Cloud comprises server products and cloud services, including Azure.

- More Personal Computing, housing the Windows operating system, gaming unit Xbox, search and news advertising [BING], as well as the Surface tablets.

In the fiscal year 2022 third quarter, the last reported quarter, Productivity and Business Processes contributed 32.0% of the total revenue. Intelligent Cloud contributed 38.6% of the total revenue and More Personal Computing contributed the remaining 29.4%.

While there may be seasonal fluctuations in the revenue contribution proportion, long-time shareholders should be comforted that the division with the traditional business of operating system is the smallest or second smallest at times as it has become the one with the slowest growth at 11% in FY2022 Q3. With the upheaval in the supply chain and inflation crimping consumer spending, as well as lower engagement following the post-pandemic reopening, revenues from the Xbox unit would be negatively impacted. Indeed, Amy Hood, Microsoft’s Executive Vice President and Chief Financial Officer, had said during the FY2022 Q3 earnings call that “constraints from the shutdowns in China” had disrupted the current quarter’s supply for OEM, Surface, and Xbox consoles.

The Productivity and Business Processes division is bringing in comparable revenues as More Personal Computing, but reported higher growth at 17% in FY2022 Q3. Intelligent Cloud, which has become the largest division, is also the fastest growing division, posting a 26% year-on-year increase in FY2022 Q3.

Interestingly, Microsoft also offers the categorization of Microsoft Cloud to distinguish the commercial revenues. The category includes Azure and other cloud services, Office 365 Commercial, the commercial portion of LinkedIn, Dynamics 365, and other cloud properties. Microsoft Cloud posted 28% year-on-year revenue growth in FY2022 Q3 on a GAAP basis and 35% on a constant currency basis, larger than any of the three divisions in the total revenue breakdown.

Shareholders would be hoping that in the oft-touted upcoming recession, commercial bookings would prove to be more resilient and capable of offsetting consumer slowdown. In a response to an analyst question on possible business impacts on Microsoft from the volatile macroeconomics backdrop, Satya Nadella, the CEO of Microsoft, had soothing words. He replied that the company possessed price leadership and could offer “more value for less price.”

Furthermore, based on “the conversations we are having with our customers,” Nadella claimed businesses are not cutting “their IT budgets or digital transformation projects,” rather “some of these projects are the way they’re going to accelerate their transformation or for that matter automation for example.” He explained that “in an inflationary environment, the only deflationary force is software.”

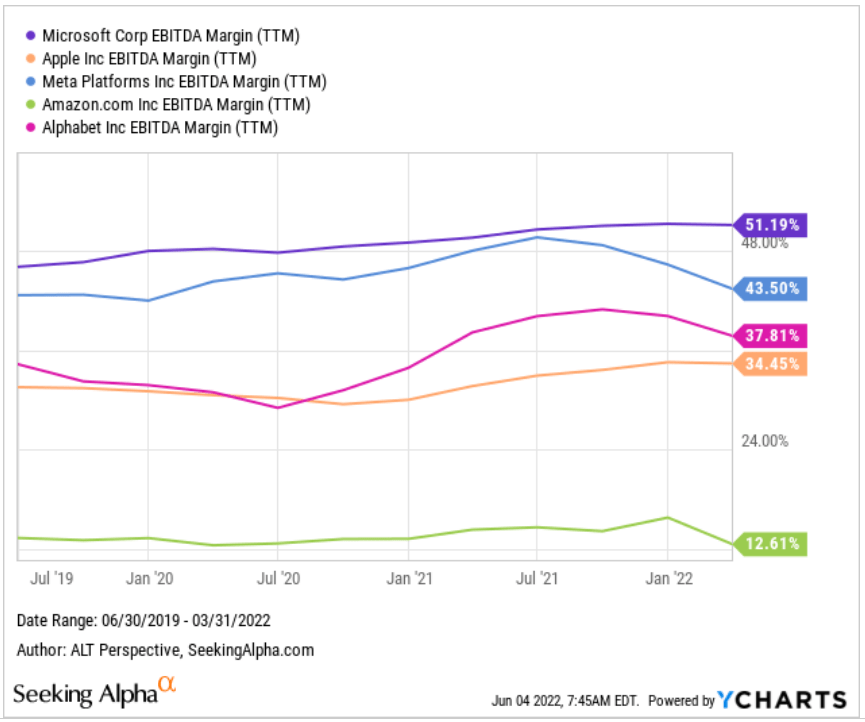

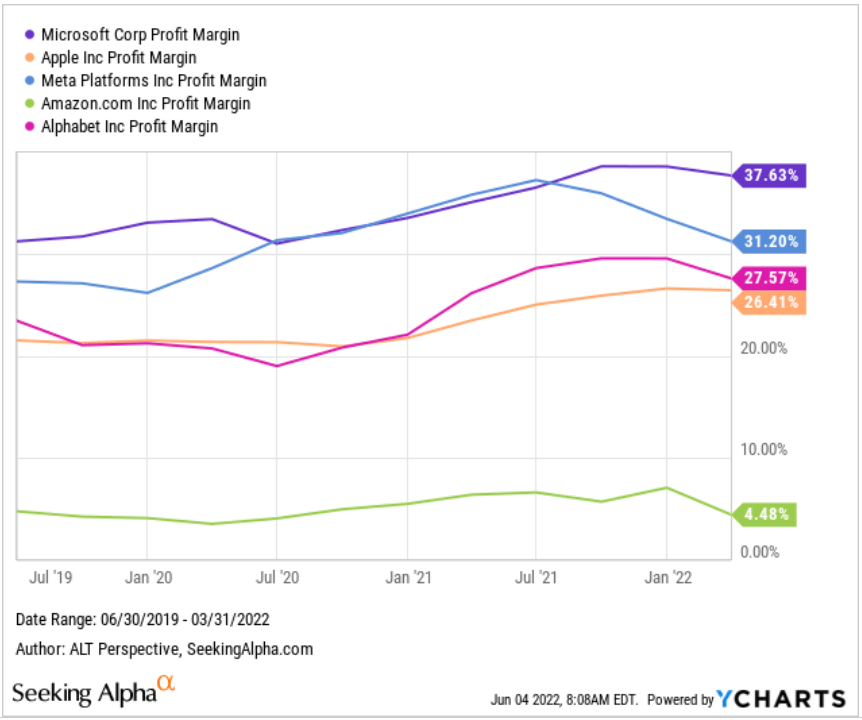

Jeff Bezos, the founder of Amazon, famously said “your margin is my opportunity.” Microsoft has the highest EBITDA margin and net profit margin among the MAMAA stocks at 51% and 38% respectively. The Microsoft Cloud category boasts a fat gross margin of around 70% in the past several quarters, higher than the overall company margin. Would Nadella be able to hold its favorable margins, insisting on its rich profits at the expense of its enterprise customers, amid an economic slowdown?

YCharts

YCHARTS

What Is Microsoft Stock’s Price Target?

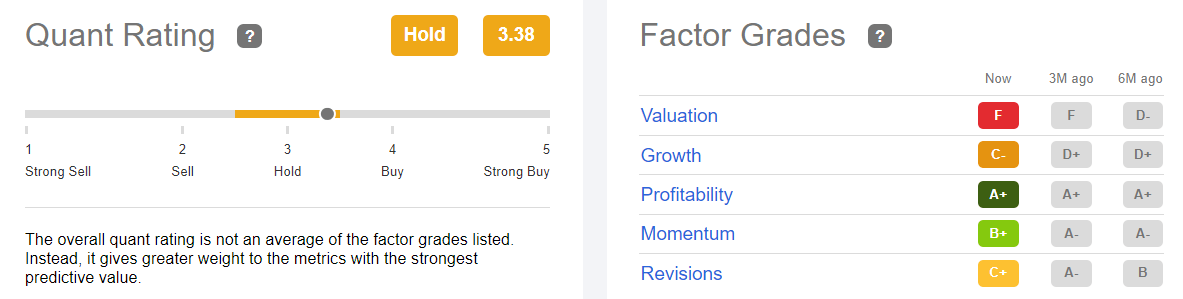

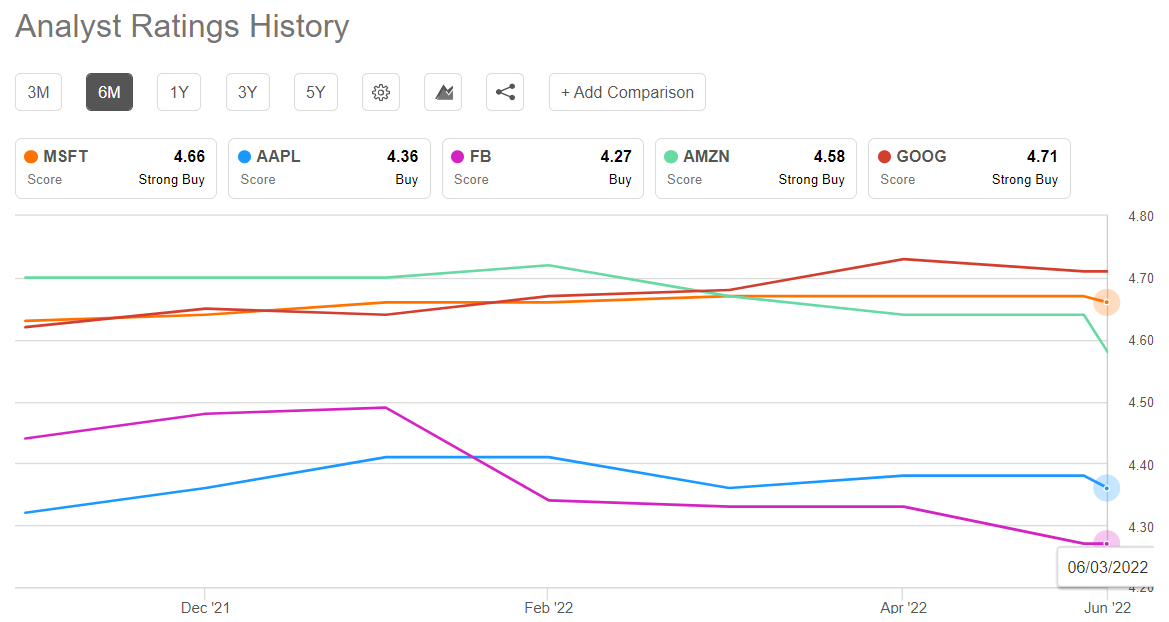

MSFT has the coveted Strong Buy rating from Wall Street analysts. Even the “no-brainer” AAPL stock only earned a Buy. MSFT, however, has a Hold quant rating, the same as the other MAMAA stocks, except GOOG/GOOGL.

Seeking Alpha Premium

Looking at the factor grades contributing to the quant rating, MSFT has scored poorly on valuation. As discussed earlier, MSFT stock has held up fairly well among the MAMAA group and the overall tech space. Hence, the F factor grade it received for valuation is understandable. Similarly, its high A+ score for profitability is also expected.

Seeking Alpha Premium

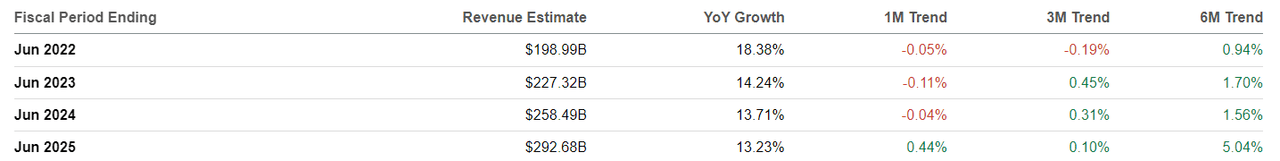

The C+ grade MSFT received for revisions may be concerning as it is a deterioration from A- three months ago. The last time MSFT had a worse than B- score for revisions was as far back as October 2020 and that was only for three days. However, looking into the details, we see that analysts have lowered their revenue estimates for the current fiscal year by a mere 0.05% over the past month, 0.11% for the fiscal period ending June 2023, and 0.04% for the following fiscal year.

Seeking Alpha Premium

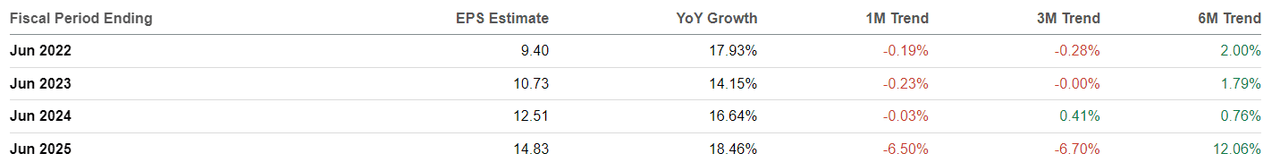

The earnings per share [EPS] estimate downward revisions have also been negligible at 0.03% to 0.23% for the fiscal years till June 2024. The decline in EPS estimate for the fiscal year ending June 2025 of 6.5% in just the past month seems worrying. However, it is a long way to go and analysts may revise the 2025 estimates upwards when there is more clarity. Furthermore, it is unfathomable that shareholders have been selling off their holdings in MSFT because of this sharp drop in EPS estimate for 2025.

Seeking Alpha Premium

While there may be some slight downwards revisions by analysts in Microsoft Corporation’s upcoming revenues and EPS, the high 4.66 analyst rating score MSFT received, second to GOOG/GOOGL in the MAMAA group, is a testament to Wall Street’s love for the software titan.

Seeking Alpha Premium

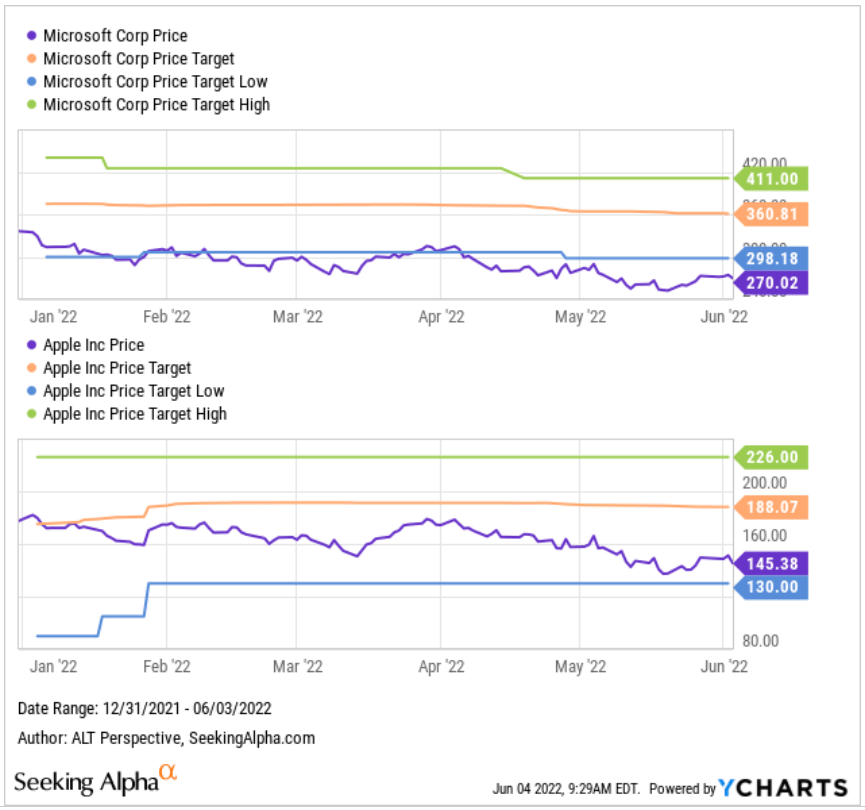

Furthermore, the consensus price target for MSFT remains high at $360.81, a 33.6% upside from the last closing price. This offers greater upside potential than AAPL if the analysts are correct on both stocks. MSFT is even trading below the most bearish price target of $298.18, while AAPL remains $15.38 higher than the most bearish price target on it.

YCharts

Is Microsoft Stock Near A Buy Opportunity?

Microsoft shares took a tumble on Thursday after the software giant shaved its revenue and earnings outlook for the fourth quarter of its fiscal year 2022, attributing the move to the impact of foreign exchange headwinds. The company factored in a $460 million impact from foreign exchange and guided earnings to be between $2.24 and $2.32 per share, compared to a previous outlook of $2.28 and $2.35 per share. It also updated its revenue outlook for the period, with sales expected to be between $51.94 billion and $52.74 billion, a slight decline from the previous outlook of $52.4 billion and $53.2 billion.

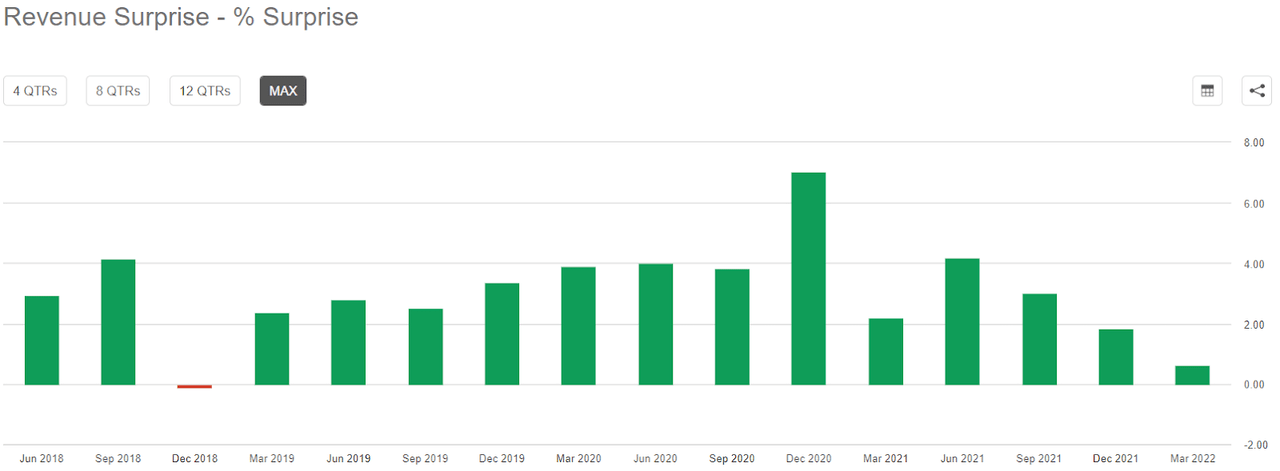

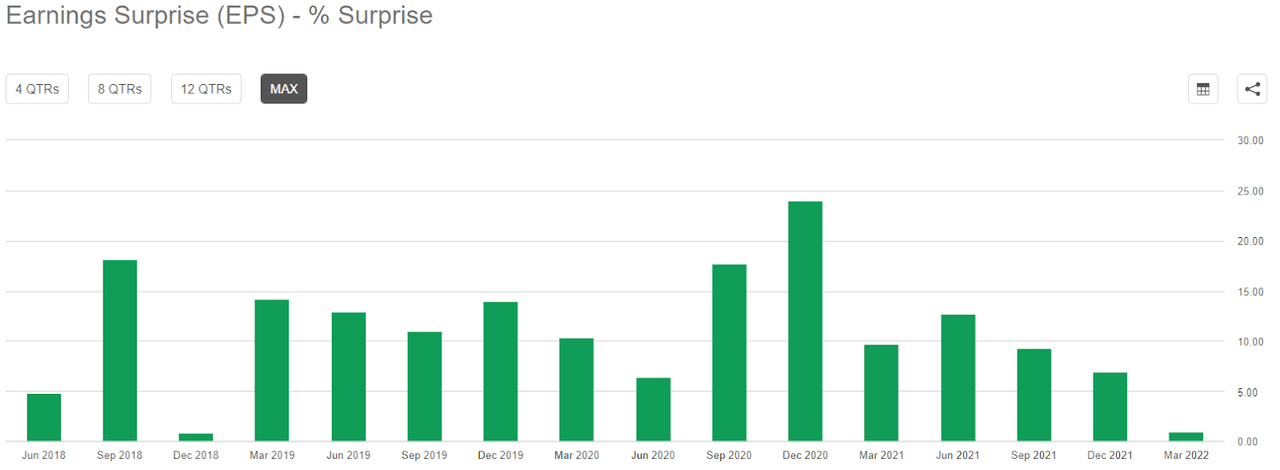

The revised guidance may spur analysts to dampen their estimates on Microsoft. If they do not do so more conservatively, Microsoft may find it tough to beat the consensus estimates when it next reports its quarterly earnings. For the quarter ending March 2022, Microsoft has already reported its lowest revenue and earnings surprise since December 2018. It was also the fourth consecutive quarter of lower revenue and EPS surprise. In this jittery investment climate, market players may not be so kind to the shares if it reports a miss or revises its guidance again subsequently, as the shareholders of Snap Inc. (SNAP) know very well.

Seeking Alpha Premium

Seeking Alpha Premium

Furthermore, as discussed earlier, Nadella has been very confident about the outlook for Microsoft. Apart from the foreign currency impact, Nadella doesn’t expect a recession to affect Microsoft. What if he is wrong? Bloomberg recently reported that Microsoft is slowing down on adding new employees in its Windows, Office, and Teams groups. However, there has not been news about any layoffs, unlike other software companies.

On the harsher regulatory landscape and a wave of unionization affecting the large caps, Microsoft seems less impacted by both issues. The Information recently wrote on “Microsoft’s Exceptionalism on Unions,” highlighting how it is more receptive to labor unions than the other tech giants. The article also noted Microsoft “isn’t facing the same level of antitrust scrutiny as its peers,” suggesting that it may find better luck with regulators on its M&A deals, such as its $68.7 billion acquisition of video game publisher Activision Blizzard (ATVI). This would mean Microsoft is more capable of expanding by inorganic growth than the other MAMAA stocks.

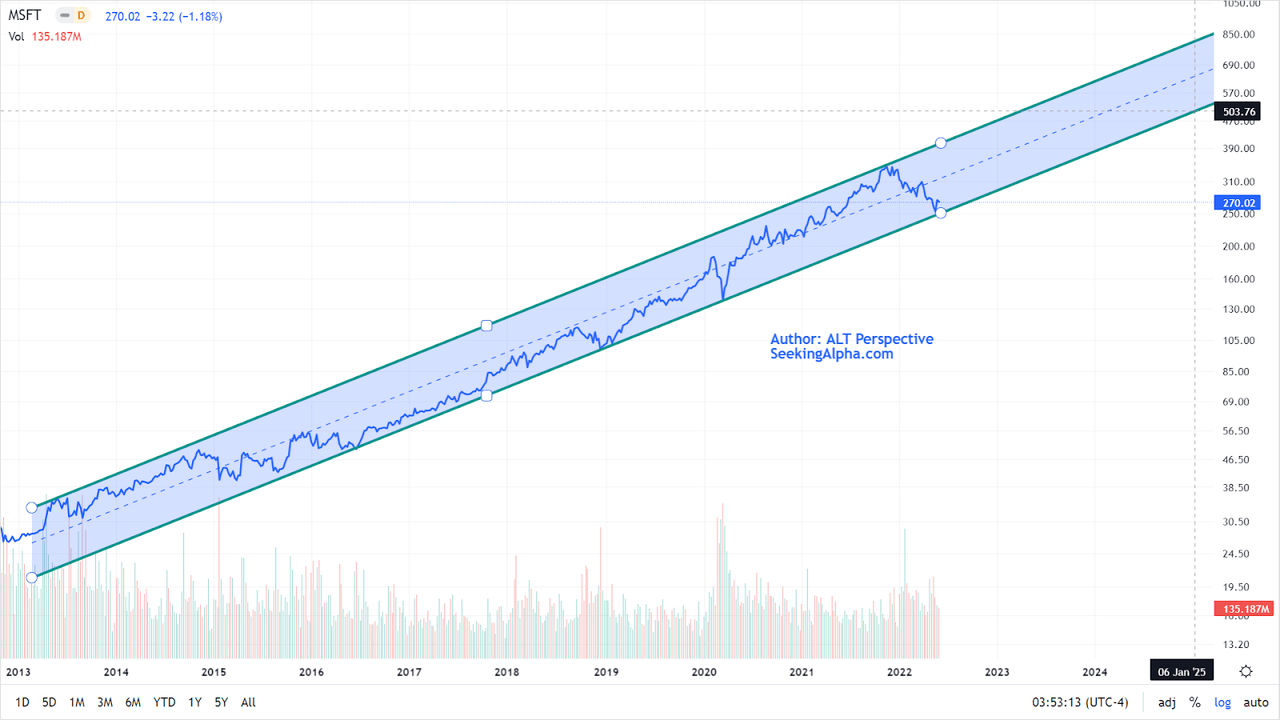

Chart-wise, MSFT stock appears to have bounced off its multi-year support in mid-May. There doesn’t seem to be an imminent danger of the share price dipping below this well-tested support. However, all bets are off if the broader market weakens further, dragging MSFT down with it. Yet, if the price channel holds, MSFT may reach $500 in two and a half years or even climb above $800, a very attractive return from share price appreciation alone, without having to factor in the dividends.

Seeking Alpha

For investors who have been waiting for a buying opportunity to enter or add to positions, now seems to be a good time. There may be further downside and MSFT stock may breach its multi-year support. However, MSFT may also continue to move within its price channel and investors would have missed the current price to get on board this stalwart of the tech industry.

Be the first to comment