tylim

(Editor’s Note: This is a follow-up to the contributor’s September 26, 2022 article)

On October 4, 2022, Connect Biopharma (NASDAQ:CNTB) announced topline results for CBP-201’s atopic dermatitis (or AD) study in China. The primary endpoint and key secondary endpoints were all met with high statistical significance (Table 1). CBP-201 turned in Dupixent-level numbers and more, but the stock was punished on a day the iShares Biotechnology ETF (IBB) and SPDR S&P Biotech ETF (XBI) rose 2.86% and 3.78%, respectively. This may be a prime opportunity for long-term investors looking for value to buy the dip.

Table 1. Efficacy results of CN002

|

CBP-201 |

Placebo |

P-value |

|

|

Primary endpoint: IGA 0 or 11 |

30.3 |

7.5 |

<0.001 |

|

EASI-502 |

83.1 |

41.1 |

<0.001 |

|

EASI-753 |

62.9 |

23.4 |

<0.001 |

|

EASI-904 |

35.8 |

6.3 |

<0.001 |

|

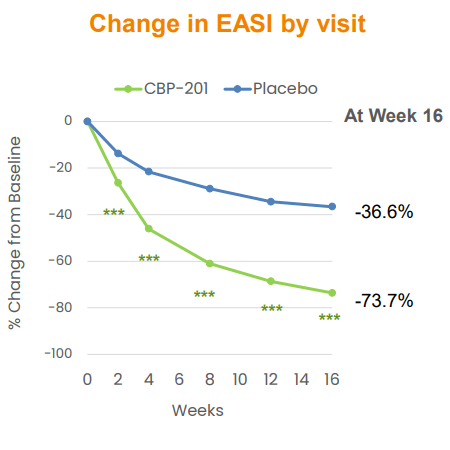

% change in EASI5 |

-73.7 |

-36.6 |

<0.001 |

|

PP-NRS [4+]6 |

35 |

9.6 |

<0.001 |

|

PP-NRS [3+]7 |

46.7 |

16.7 |

<0.001 |

|

% change in PP-NRS8 |

-38.1 |

-12.3 |

<0.001 |

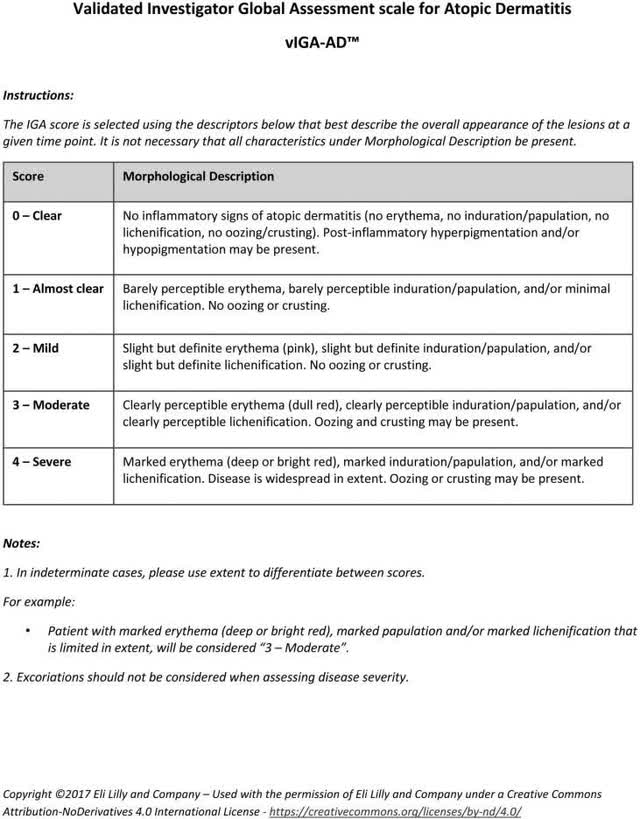

1 % of patients with 0 or 1 point (“clear” or “almost clear”) on validated Investigator Global Assessment for Atopic Dermatitis (vIGA-AD) scale and ≥2-point reduction in IGA from baseline at Week 16

2 % of patients with ≥50% improvement in Eczema Area and Severity Index (EASI) score from baseline to Week 16

3 % of patients with ≥75% improvement in EASI score from baseline at Week 16

4 % of patients with ≥90% improvement in EASI score from baseline at Week 16

5 % improvement in EASI at Week 16

6 % of patients with ≥4-point reduction on Peak Pruritus-Numerical Rating Scale (PP-NRS) from baseline at Week 16

7 % of patients with ≥3-point reduction on PP-NRS from baseline at Week 16

8 % change in PP-NRS at Week 16

CN002 is a randomized, double-blind, multi-center, controlled trial in Chinese subjects aged 12 to 75 with moderate to severe AD. At the screening and baseline visit, patients had to have, among other things, a) IGA score of ≥3 out of 4 (see Figure 1), b) EASI score ≥16 out of 72 and c) average daily score on the PP-NRS of ≥4 out of 10.

Figure 1.

The FDA has recommended an IGA as the primary endpoint for new drug approval trials in AD since the days of Elidel cream, while the global Harmonising Outcome Measures for Eczema (or HOME) initiative prefers the EASI. HOME also endorses PP-NRS to measure itch intensity, a core symptom of AD, based on the question: ‘On a scale of 0 to 10, with 0 being “no itch” and 10 being “worst itch imaginable”, how would you rate your itch at the worst moment during the previous 24 hours?’ Thus, China’s Center for Drug Evaluation of the National Medical Products Administration (or CDE) deemed that a positive primary analysis on a subset of 255 adult patients who had completed the initial 16-week period (Stage 1) of this well-designed study would support a New Drug Application (or NDA).

CBP-201 delivered, with efficacy results comparable to Dupixent, the only interleukin-4 receptor alpha (IL-4Rα) on the market and jointly sold by Sanofi (SNY) and Regeneron (REGN). Table 2 shows additional data aligning with the CN002 topline results. So why did the market react so negatively? It might be a case of too little, too late.

Table 2. Efficacy results of Dupixent in major trials of adult subjects with moderate-to-severe AD, using the current recommended initial dose of 600 mg, followed by 300 mg given every other week (Q2W)

|

Dupixent |

Placebo |

Dupixent |

Placebo |

Dupixent |

Placebo |

Dupixent |

Placebo |

|

|

IGA 0 or 1 |

37.9 |

10.3 |

36.1 |

8.5 |

38.7 |

12.4 |

26.8 |

4.8 |

|

EASI-50 |

68.8 |

24.6 |

65.2 |

22.0 |

80.2 |

37.5 |

70.7 |

28.9 |

|

EASI-75 |

51.3 |

14.7 |

44.2 |

11.9 |

68.9 |

23.2 |

57.3 |

14.5 |

|

EASI-90 |

35.7 |

7.6 |

30.0 |

7.2 |

39.6 |

11.1 |

40.2 |

6.0 |

|

% change in EASI |

-72.3 |

-37.6 |

-67.1 |

-30.9 |

-76.7 |

-43.2 |

-75.23 |

-39.4 |

|

PP-NRS [4+] |

40.8 |

12.3 |

36.0 |

9.5 |

58.8 |

19.7 |

39.0 |

4.8 |

|

PP-NRS [3+] |

46.8 |

17.2 |

50.6 |

12.8 |

65.7 |

27.8 |

52.4 |

9.6 |

|

% change in PP-NRS |

-51.0 |

-26.1 |

-44.3 |

-15.4 |

-56.2 |

-28.6 |

-48.59 |

-21.13 |

Connect Bio did not release data among the topline results that clearly maintained a quicker onset by CBP-201 over Dupixent. Yes, improvements in EASI at Week 2 (26.3% change with CBP-201 vs 13.8% for placebo, p < 0.001) were significant and clinically meaningful. Baseline EASI score was 29.6, so the average improvement was approximately 7.8 points, which is higher than minimal clinically important difference of 6.6 points and also correlates to at least a 1-point improvement in the IGA. It was a good start, but not better than Dupixent. Now, management is angling for a positive showing for the more convenient Q4W dosing, as well as increased efficacy post-16 weeks (Figure 2), as potential areas of differentiation.

Figure 2. CBP-201 Secondary Endpoint

CNTB October 2022 Corporate Presentation, p. 14

Now the waiting begins for the Stage 2 36-week readout. If the last Stage 1 patient was dosed in June, their 36-week visit would occur by May of next year. Stage 2 will more likely than not show statistical significance for both active regimens. This will also include 52-week safety data, which so far has been exemplary. By that time, data from additional adult and adolescent Stage 1 patients outside the primary analysis population could also be available. Connect Bio will next be requesting a pre-biologics license application with the CDE to determine the next steps for a potential NDA filing.

Risks and Takeaways

Some of the key points from our article from a few weeks ago remain:

CNTB is a risky biotechnology stock. Investors in a bear market prefer companies with stable earnings, even in the defensive health sector, so might pass over biotech, especially microcaps. So long as CNTB is below $5, the threshold will also preclude most institutions and mutual funds from buying. ETFs such as IBB and XBI may be safer means of exposure to the sector.

CNTB shares could again spend an extended time under $1 like last year. But that was with the spate of bad trial results, so there is even less danger now of not regaining Nasdaq compliance. The dreaded reverse-split will not happen.

The company ended the week with a $59.5 million cap and is trading way below their cash level, which currently should be around $190 million and is projected to last until 2024. Thus, traders who believe in the stock’s cash and pipeline value and think the market is wrong may continue to accumulate more shares even if the price keeps dipping.

The financial outlook stays the same as discussed in the previous article. So should the projected sales of CBP-201 if the previously given timeline holds, where CEO Wei had anticipated filing the NDA in 2024 for a potential approval in 2025. In 2020, Dupixent was approved after a review period of only 25 days from NDA acceptance.

Between now and 2025, there may be increased competition. The first JAK inhibitor for treating AD, Rinvoq from AbbVie (ABBV) was approved in February, and others in the class are on the way. However, use of JAK inhibitors may lead to many serious adverse effects including increased mortality, malignancies, cardiovascular events, thrombosis, and serious infections leading to hospitalization or death. Therefore their place in AD therapy would likely be behind IL-4Rα antagonists. That said, there may be other rival agents in advanced trials that CEO Wei hasn’t disclosed or isn’t aware of.

As with the primary analysis, further readouts may be negatively received by the market even when positive. Outside of the CN002 events, there are few clear catalysts on the horizon. One is the Phase 3 initiating by year end, the first of four controlled clinical trials in the global AD registrational program. Another is the CBP-201 asthma Phase 2b trial in H2 2023. CBP-174 and CBP-307 have been put on hold.

Finally, there are at least 2 possible upshots for CNTB, and both are speculative. The company might be able to secure partnerships for any of their 3 clinical drug candidates. An up-front cash infusion would allow so much flexibility, including looking for more deals in the immunology space. The second is that the CN002 results have a very small chance to persuade the CDE to grant breakthrough therapy designation to CBP-201 so that Connect Bio would be prioritized by the CDE in communications and in receiving guidance to advance its drug development progress.

Be the first to comment