koto_feja/E+ via Getty Images

I don’t mind weak openings when they are followed by a strong close. We did not have an exceptionally strong close yesterday, but the steady recovery throughout the day from what was a more than a 2% drop in the major market averages at the open is very encouraging. The mega-cap technology names led the rebound, as long-term interest rates declined due to growth concerns.

Finviz

As oil was making its meteoric rise in March to $130 per barrel, I asserted that the most important commodity in the world was exhibiting the same speculative fervor that we saw in meme stocks the year before. The same could be said for several commodities impacted by Russia’s invasion of Ukraine. I also surmised that the reversal back down in the months that followed would be just as fierce, which is what we had a glimpse of yesterday. Crude oil collapsed $10 per barrel to close under $100 for the first time since May, as investment flows into the futures market reversed over concerns about global growth. Yesterday I pointed out a similar collapse in price for wheat, which had nearly doubled following the invasion. Food and energy prices can move with the same speed and range as speculative stocks because most were financialized more than 20 years ago through the passage of the Commodity Futures Modernization Act of 2000.

Bloomberg

This is why I claimed we were seeing the peak rate of inflation back in April, which is now becoming more evident to the consensus. Granted, we have replaced inflation fears with recession fears, but that’s not surprising considering the rapid tightening in financial conditions that is accompanying the drop in prices for food and energy.

Bloomberg

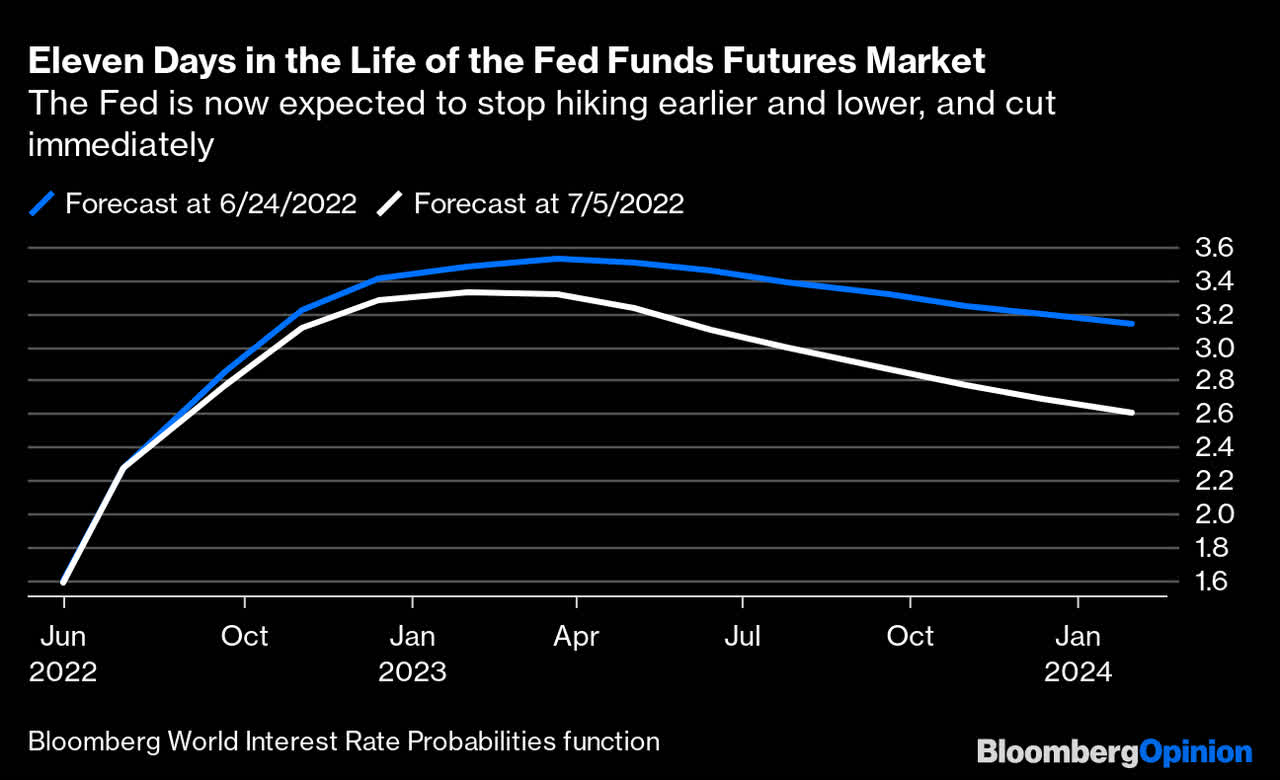

My base case has been that the rate of inflation will fall this year much faster than the consensus expects, due largely to a drop in food and energy prices. As a result, the Fed will be unlikely to raise short-term interest rates as high or as aggressively as the market expects. That is also starting to play out, as markets now expect the Fed to stop tightening sooner at a lower peak rate, which is now followed by rate cuts in 2023.

Bloomberg

The rate cut expectations are linked to the recession concerns, but I don’t see those as likely because I think any recession would be shallow and short lived should the Fed not be able to execute a soft landing.

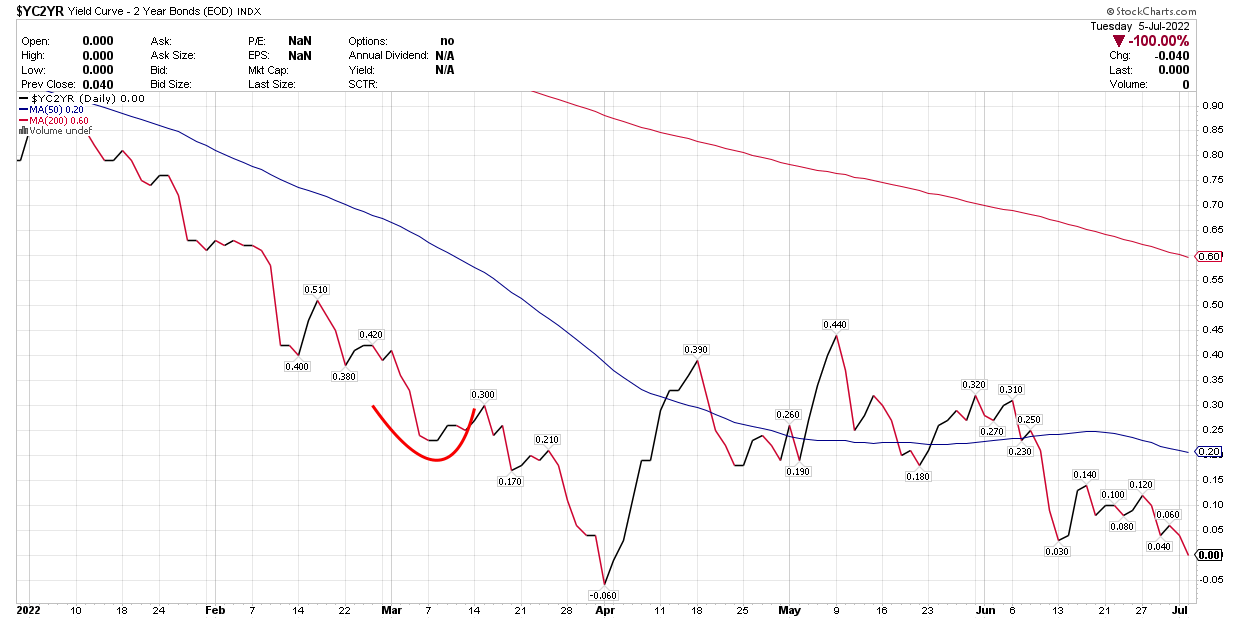

One reason recession fears keep building is that the Atlanta Fed’s GDPNow model is estimating that the economy contracted 2.1% in the second quarter. That model based on the incoming economic data during the quarter. I think it is off base, due to factors related to the pandemic that are skewing the data. Still, the fear of a recession is driving down long-term interest rates, as measured by the 10-year Treasury yield. The yield has fallen from a high of 3.5% in June to 2.82% yesterday, which is equal to the 2-year Treasury yield, resulting in a completely flat yield curve.

Stockcharts

The curve will invert, as it did very briefly in April, if the 10-year yield falls below the 2-year yield. Investors consider the 10-year yield to be the neutral rate of interest, which means that it represents a level for short-term rate (Fed funds rate) that is neither stimulative nor restrictive. The 2-year yield is the market’s estimate of where the Fed funds rate will be over the coming 12 months. That rate has also fallen from a June high of 3.45% to 2.82%. If the 10-year yield falls below the 2-year yield, it tells investors that the Fed is expected to tighten monetary policy to the extent that a recession is very likely to result.

While inversions have preceded recessions in the past, that has only been the case when they lasted several months and not days or a few weeks. I don’t see that happening. Nothing moves in a straight line, which gives bulls and bears fodder to make their respective cases day by day, depending on which direction inflation, interest rates, and stock prices are swinging. The bottom line is that the rates of change are starting to move in a more favorable direction, which strengthens my resolve that the worst is over for risk assets and the overall economy. Again, the second half of this year should be much better than the first.

Be the first to comment