shulz

Desktop Metal (NYSE:DM) is a stock that has been crushed in 2022, but has quietly nearly tripled off the lows this spring. For our many followers who may be unaware, Desktop Metal is a company involved in 3D printing that we have traded long and short several times. The crazy thing here is that even after the massive retracement in the stock to the $3 range, the stock is still somewhat expensive, even with all of the revenue growth it has seen. It has however made tremendous moves to expand its business. While the company is exciting, the stock has been a flop since it came public and it is very speculative. But this recent rally may have some legs. Consider buying in for a swing trade when momentum turns back positive in the next few sessions. We especially like it if you can get the stock under $3.00. Long-term investors are obviously way underwater here, but this stock can be traded. We can see the case for new money coming in for a multi-year investment at these levels. Overall the Street has liked the stock for a few months, though the market, and tech in particular, has been strong since June so that is playing a large role. We like what the company is doing, but this is a very speculative buy.

Why consider this specialty tech name?

So, why should investors, or traders for that matter, even consider this name for possible exposure and gains? Before focusing on the trading side of things, we want to tell you why we like the company generally speaking. They are really striving toward improving the efficiency of 3D printing with the idea of bringing it to scale. If it can be demonstrated as effective, reliable, and efficient, it is likely this approach will experience massive growth over the course of the decade. Recently, the company teased a new solution called FreeFoam, a new expandable 3D printable foam for mass production. This is a cool solutions for the industrial 3D printing market and for foam manufacturing, which is a $120 billion market. With this new launch when it fully rolls out gives Desktop Metal increased total addressable market opportunities. They also have good automotive, aerospace, and defense solutions.

Operationally, the company is working to move toward its goals, but the growth path has been in question. There are no earnings, only revenues. But this is a speculative name.

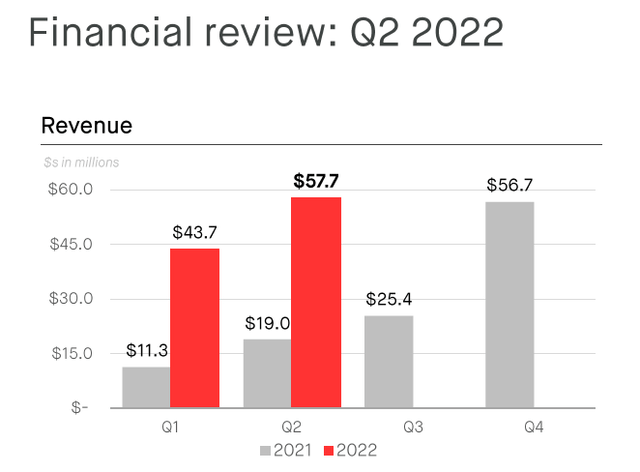

Top line setting records

A lot of the moves the company has made has led to record top line growth. This is definitely welcomed news for the bulls. The massive year-over-year revenue growth is impressive. The just reported quarter was a top and bottom line beat versus consensus estimates. The company reported yet another quarter of top line strength with the highest quarterly revenue ever for the company. Revenue was $57.7 million, which is crazy year-over-year growth of over 200% and sequential growth of 32% from Q1 2022. Organic growth and acquisitions led to the strong quarterly revenues. Revenue was $58 million.

Because the stock is expensive (though much cheaper than it was a year ago), even in the single digits, the company had to deliver beats to get some momentum back, which it did. The beats on both lines were strong. The revenue of $58 million was a substantial $3.5 million beat. Of course, the company does not make money, so this keeps the stock pinned somewhat

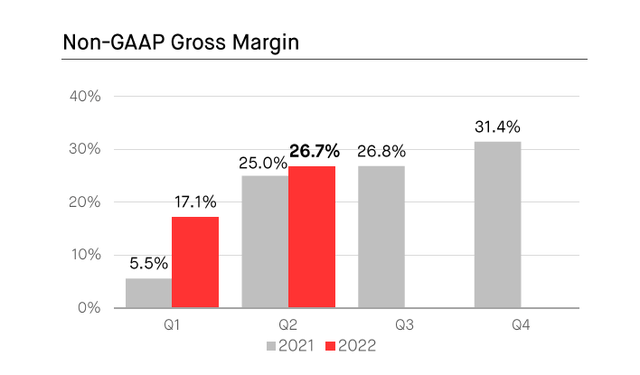

Margins and earnings

While the business developments are strong, and revenues are growing tremendously, this company does not make a profit. But margins are strong. Desktop Metal did register a 170 basis point increase in its gross margins from last year to 26.7% on an adjusted basis.

This is a plus. But losses are mounting. The company had a net loss of $297.3 million, primarily due to a non-cash goodwill impairment charge of $229.5 million as a result of the company’s stock price declines and a $2.4 million of restructuring charges. On top of that, adjusted EBITDA was negative $27.5 million. Ouch. This was a larger adjusted EBITDA loss of $24.5 million a year ago. That is a problem. The company lost $0.10 per share this quarter, which was not horrible, and beat by $0.03. The Street was fine with the results but really liked the guidance being reaffirmed.

Outlook

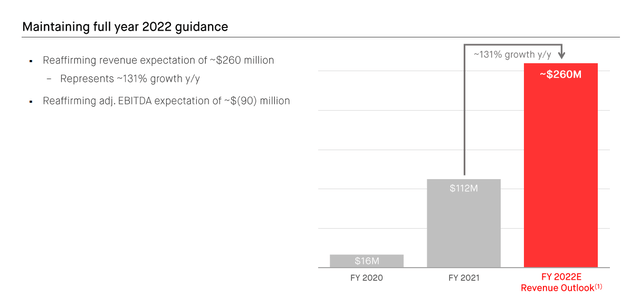

After a stock gets crushed sometimes a company has a decent report and does enough to keep the Street happy. In this case, the company reaffirmed annual guidance and it really made the Street happy, continuing some momentum. For the full year, the company issued guidance for revenues of $260 million which is more than double last year (growth of 131%).

On top of that company sees an adjusted EBITDA loss of $90 million. It is tough that they lose money like this, but this is common for companies when they ramp up revenues and customers for a few years. How is their balance sheet?

Cash position

The cash position makes us feel like now is a good time to buy, despite the company losing money. Now, if the company can continue to expand dramatically, grow its revenue base, and then control costs to grind toward a profit, a buy at or under $3.00 will be solid.

However, if losses widen, and break-even is farther down the road, the company could need to raise more money, diluting shareholders further, and the stock will continue to suffer. With rates higher, borrowing money is more expensive, so they need a path to profit. Of course, back in May the company did a $115 million notes offering, so cash is good right now.

Desktop Metal ended the quarter with $255.7 million in cash, cash equivalents, and short-term investments. Cash will be sufficient to keep operations going well into 2023. The company has strong liquidity.

Take home on Desktop Metal

In the short run, this quarterly report was strong. The stock had been falling for months and months and months. It was looking like it was going to head to a sub $1 stock. It was rough. Compared to the IPO, it’s been a horrific disaster here. Just far below expectations. But we are seeing extreme growth. We are seeing records being set. We do not like ongoing costs, and losses, but this company is in expansion mode. Buying the stock is speculative, but could provide huge returns in a short time period, and even more long term. All things considered, traders can leverage the momentum and earn some rapid returns here, especially if the stock pulls back for a better entry.

Be the first to comment