gguy44

A few days ago, I wrote an article titled A Big Bet Against The Big Short in which I examined three REITs that were bring shorted for various reasons.

As I explained in the article,

“while the shorts have focused on things like lack of transparency, dishonest management, faulty accounting, overblown hyperscaler domination, and the like, iREIT has concentrated on fundamentals, combined with management interaction.”

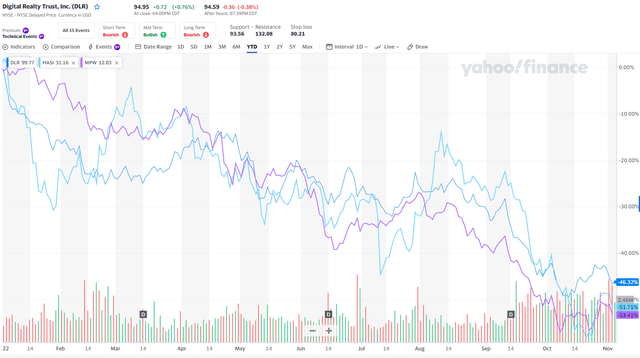

Yahoo Finance

As you can see, all three REITs are down considerably year-to-date, which creates attractive opportunities for value investors like me. As I continued in my article,

“It’s true that short sellers will oftentimes raise the bar when it comes to corporate transparency and insist that companies disclose certain facts that are relevant.

In my view, this is healthy for investors, as due diligence is perhaps one of the most important pillars to becoming an intelligent investor.

For these three REITs, we have been forced to double down on our research, to make sure that the data is accurate and that the management teams can be trusted.”

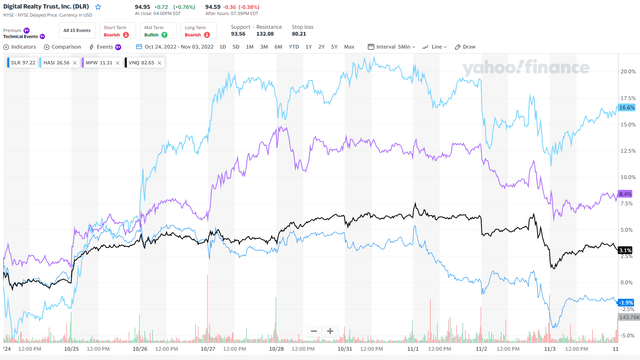

Yahoo Finance

As you can see, HASI (light blue like) and MPW (purple line) are up considerably over the last few days, while DLR (dark blue line) has continued to struggle. Yesterday HASI announced its Q3-22 earnings results,

“We’re pleased to affirm our prior guidance for annual growth in distributable EPS of 10% to 13% through 2024 and 5% to 8% annual growth in our dividend for the same period. And our Board has declared a quarterly dividend of $0.375 per share.”

MPW also delivered on a solid Q3-22 earnings report card, as the CEO, Edward Aldag, explained:

“As our operators effectively work to bring down cost and as reimbursement rates increase, we expect to continue to see coverages improving within our portfolio.”

As long-term buy-and-hold investors, we believe the earnings power for all three REITs is sound and we’re maintaining buy recommendations on all of them.

It’s hard to know whether or not the HASI and MPW short sellers are bailing, although both announced solid earnings results, in line with our forecast. Whenever the price jumps higher unexpectedly and gains momentum a short squeeze occurs.

Investopedia

A Textbook Short Squeeze

Another REIT that we have been covering that has fallen on hard times is Innovative Industrial Properties (NYSE:IIPR).

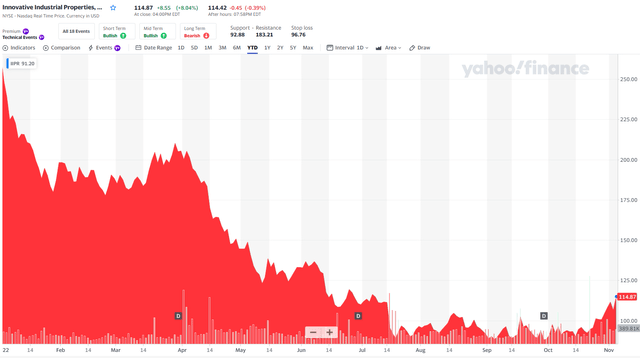

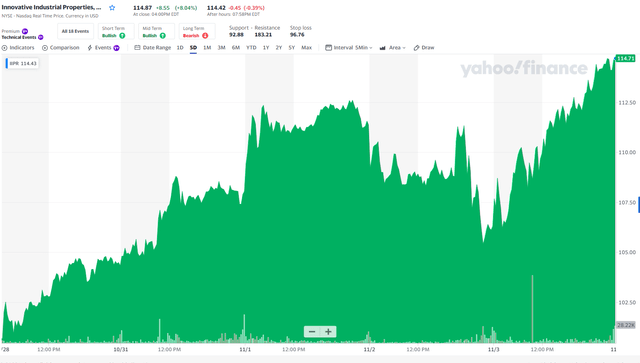

Yahoo Finance

As you can see above, shares in this cannabis-focused REIT has dropped by over 56% year-to-date. However, as you can see below, shares have jumped by over 13% during the last five days and over 8% in one day.

Yahoo Finance

Remember, it’s the combination of new buyers and panicked short sellers that creates a rapid rise in share price that can be stunning and unprecedented.

Most importantly, short sellers bet heavily on failure, and active traders typically monitor highly shorted stocks and watch for them to start rising.

If the price begins to pick up momentum (which it has for IIPR), the trader jumps in to buy, trying to catch what could be a short squeeze and a significant move higher.

Keep in mind, I’m not a trader, I’m a value investor, and over the last few months I’ve been averaging down my position in IIPR, recognizing that dollar cost averaging is an effective risk management tool.

So, let’s now take a closer look at Q3-22 earnings to see exactly what’s happening with IIPR.

Third Quarter Earnings

In Q3-22 IIPR reported AFFO/sh of $2.13 ($0.11 higher than the Street) and total revenues of $71 million, a 32% increase from Q3-21.

The increase in revenue was driven primarily by the acquisition and leasing of new properties, additional building infrastructure allowances provided to tenants at certain properties that resulted in base rent adjustments and contractual rent escalations at certain properties.

During Q3-22 IIPR did not collect contractual rents totaling $5.7 million from Kings Garden and Vertical, which includes approximately $5.3 million in base rents and property management fees and $369,000 in tenant reimbursements for property taxes and insurance.

However, IIPR did apply approximately $2.6 million from security deposits held for defaults by Kings Garden in its obligations to pay rent to partially offset this decrease.

Back in September 2022 IIPR announced a confidential settlement with Kings Garden regarding its default on contractual rent payments. The Q3-22 earnings supplemental appears to indicate that Kings Garden is still operating in its six original buildings, and has paid reimbursements to IIPR on its construction projects in Palm Springs and San Bernardino of $6.8M and $3.2M, respectively.

The reimbursements, combined with the remaining spend on the developments, total nearly $37.9M. According to BTIG analyst Thomas Catherwood,

“We suspect that IIPR could look to re-lease the 23k SF development project in Cathedral City, and may consider selling the industrial site in San Bernardino; the company’s basis in the 192k SF industrial asset is $228/SF, roughly in line with market values in the Inland Empire West.”

One other notable transaction learned from the Q3-22 earnings call was the fact that IIPR sold 575 Epsilon Drive in Pittsburgh, a 51k SF cultivation facility leased to Maitri (Private), for $23.5M ($461/SF). IIPR’s undepreciated basis in the property was $22.3M ($437/SF). According to BTIG,

“The deal provides incremental capital to reinvest with top tenants, and highlights the value of cultivation facilities in limited license states. IIPR owns nine other cultivation assets in PA with a total investment of $364.2M ($310/SF), including Parallel’s (Private) 239k SF facility, which is located only 13.1 miles from Maitri’s site. With the Maitri sale and a $10.0M repayment by Kings Garden (Private) in 3Q, we estimate that IIPR has ~$61.4M of uncommitted capital for future investment.”

Rock Solid Balance Sheet

At the end of Q3-22 IIPR had approximately $2.6 billion in total gross assets, and a total of about $306 million in debt, consisting solely of unsecured debt, with no maturities in 2022 or 2023, and $300 million of that debt not maturing until 2026.

The company’s debt to total gross assets ratio was 12% at quarter end, and the total fixed cash interest obligation on an annual basis was $16.7 million, or a little over $4 million per quarter. IIPR has maintained an investment grade credit rating and has a debt service coverage ratio in excess of 15x.

On Oct. 14 IIPR paid a quarterly dividend of $1.80 per share to common shareholder, equivalent to an annualized dividend of $7.20 per common share. The board continues to target a dividend payout ratio of 75% to 85% on AFFO on a stabilized portfolio basis. For Q3, the payout ratio was 84.5%.

Federal Legislation

As Paul Smithers, IIPR’s CEO, explains,

“in terms of recent Federal developments, while there is no substantive movement to report as it pertains to Federal legislation, we do want to touch on President Biden’s announcement to pardon prior Federal offenses for simple cannabis possession and the directive to the HHS Secretary and Attorney General to initiate review of how cannabis is scheduled under Federal law.

While this was certainly an attention grabbing announcement, the pardon for Federal offenses itself impacts a very small cohort of a few thousand as a vast majority of convictions for simple cannabis possession are made at the state level.

However, pardons constitute an action that cannot be undone by subsequent administrations. And so in a sense, this is the first permanent change to the Federal cannabis landscape in a very long time. And there have been some who postulate this action as a potential factor contributing to the argument for notification of Federal laws pertaining to cannabis, with the basis being that the Federal government has not strictly enforced cannabis laws for years, and therefore, it should be left to the states to decide.

We find this an interesting viewpoint. And ultimately, it is unclear what, if any, impact this announcement will have on the various Federal legislative efforts in process.

In terms of President Biden’s directive to the HHS secretary and AG to initiate review of current cannabis scheduling, while this does represent a potential road to rescheduling, or descheduling, we think it is a road that will take years to travel, requiring significant clinical research, and of course, time consuming litigation along the way.”

Currently there’s legalization of medical cannabis in additional states (currently 36 states and the District of Columbia have legal medical cannabis programs) and expansion of states with adult-use cannabis programs. New qualifying conditions and form factors in state medical cannabis programs should expand the patient population and product demand.

Valuation

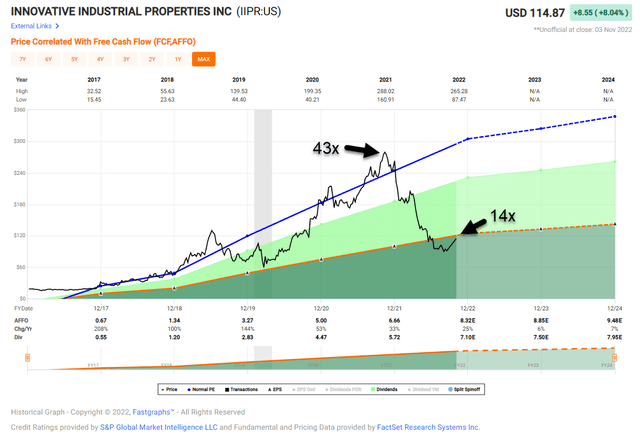

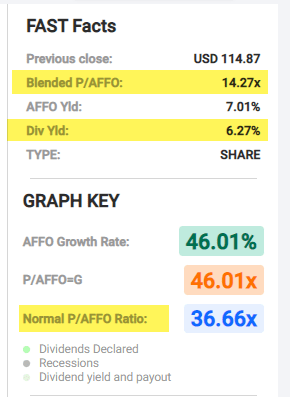

As you can see below, IIPR is a long way from 43x P/AFFO:

FAST Graphs

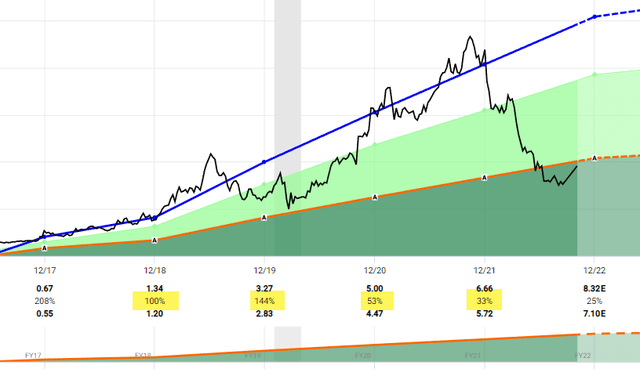

However, keep in mind that leading up to the all-time high in November 2021, IIPR was generating eye-popping growth of 100% (2018), 144% (2019), 53% (2020), and 33% (2021). In 2022 analyst are forecasting growth of 25%.

FAST Graphs

Yet, 25% is still pretty darn good for a REIT, especially when you combine the attractive 6.3% (well-covered) dividend yield.

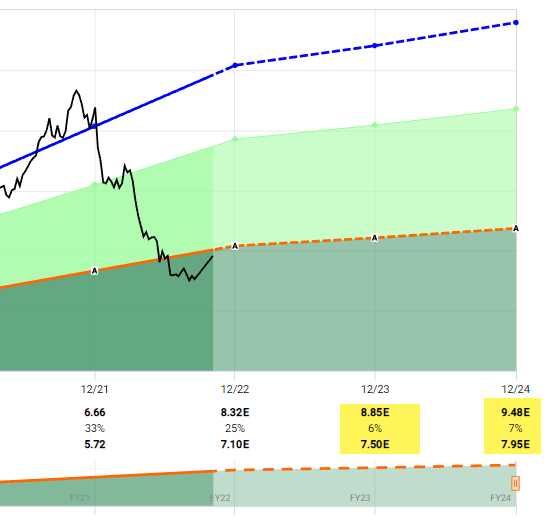

However, analysts are not so bullish with regard to 2023 and 2024:

FAST Graphs

As you can see, 6% growth in 2023 and 7% growth in 2024. On the earnings call, Alan Gold, IIPR’s founder and chairman, said,

“… we’ve gone from an acquisition program of consistent quarter-over-quarter acquisitions to a very opportunistic model. Where we’re being very judicious in deploying the capital that we do have available to us to, to the best operators that we can, and being very careful a bit as to our thoughts on future capital, even though that we do have access to capital from that our investors are, I think positively looking at the way we’re deploying the capital and being a steward of that capital, but that the general market requires us to, I think, as I said, become be more opportunistic.”

IIPR’s shares trade at 14.3x P/AFFO (11.9x based on 2023 AFFO estimates) with a dividend yield of 6.3%.

FAST Graphs

A Short Squeeze?

I guess we’ll let Mr. Market decide whether or not a short squeeze is underway…

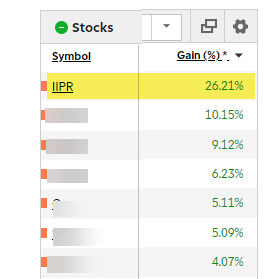

I’m long IIPR, where I have a modest position in my personal portfolio as well as my recently created family (kids’ college) portfolio – see below, IIPR is a top-performer in the college fund:

Brad Thomas

At the end of the day, earnings drive market performance, through multiple expansion and growth. The P/FFO multiple tends to be mean-reverting over the long run, and earnings growth is the primary driver of market returns.

As noted above, IIPR is not “growing like a weed anymore” and I would not expect shares to ever trade at 40x again.

However, 14x is cheap, recognizing that IIPR’s buildings are mid-quality industrial properties comparable to assets owned by STAG Industrial (STAG) – now trading at ~16x.

IIPR’s management team is being tested and I view the Kings Garden outcome as favorable, given the prompt actions taken with the rent default. Also, IIPR is showing us that the company can recycle assets and “highlights the value of cultivation facilities in limited license states.”

Given the slower growth, we’re lowering our buy below target for IIPR from $175.00 to $167.00, and our forecasted 12-month total return target to 35% (recognize that shares are up over 20% since our last purchase).

As always, thank you for reading and commenting.

Be the first to comment