Editor’s note: Seeking Alpha is proud to welcome Hindsight Investor as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Justin Sullivan/Getty Images News

Investment Thesis

Hibbett, Inc. (NASDAQ:HIBB) is a small-scale sporting goods retailer catering to rural, underserved communities. Their stock is down 38% YTD after peaking at $101.65 in November 2021. In addition to macro headwinds, investors have been concerned about Hibbett’s relationship with its wholesale partners. Management eased these concerns during the Q4 2022 earnings call, but the market has failed to take notice. With this concern behind them, Hibbett may be poised to rally once the macro environment starts to improve. At its current valuation, I believe Hibbett offers an acceptable margin of safety in relation to its intrinsic value.

Niche Market, A Natural Deterrent To Competition

Hibbett is like Dick’s Sporting Goods (DKS) except their store footprint is probably a quarter of the size. Over the years, Hibbett has been successful in growing revenue and profitability because they cater to a niche market – I can attest to this personally. I reside in the Cincinnati area now, but I am from a small town in West Virginia where Hibbett is the only game in town for sporting goods, aside from the very limited, off-brand selection available at Walmart (WMT).

Originally, I thought Hibbett would be run out of business by Amazon (AMZN) or Dick’s, but I failed to consider the communities in which they serve. Hibbett’s niche market of underserved, low to median-income communities is a deterrent to big-box retailers.

Not enough traffic or population to warrant big box expansion

This is especially true for physical stores. Think of where you might find a Dollar General (DG) – there is likely to be a Hibbett nearby. It just does not make sense to place a Dick’s Sporting Goods in small-town America, yet that is exactly where you find Hibbett.

Delivery to these communities is more expensive and can take too long

Recently, I tried ordering an item from Amazon to have it delivered to my former hometown. I ended up not placing the order because it was going to take 3 days to deliver. In Cincinnati, I am spoiled by next day or even same-day delivery from Amazon. In rural America, delivery delay is an issue no matter the retailer – Amazon, Nike, Dick’s… you name it.

I am not suggesting Amazon or others cannot steal share from Hibbett. I am suggesting there is little incentive for them to do so. Nike, Dick’s, and Amazon are not going to grow their EPS enough to satisfy shareholders by targeting Hibbett’s less than $2 billion in annual sales.

Hibbett’s Brand Partnerships Intact And Strong

Nike has been dropping retail partners like flies the past few years to focus on the D2C channel. Notable names include Dillard’s (DDS), Urban Outfitters (URBN), and Macy’s (M). On February 25, news broke that Nike added Foot Locker (FL) to the list. Foot Locker shares tumbled 30% in a single day. Nike later confirmed the rumor not to be true, but the damage had been done.

As it does, the market applied Foot Locker’s bad news to every company having a relationship with Nike – Hibbett included. Although Hibbett shares were down 55% from their high at that point, the news did not help sentiment; it has been trading sideways ever since.

Chart courtesy of Seeking Alpha

Fortunately, during Hibbett’s Q4 2022 earnings call, management reiterated a strong and mutually beneficial relationship remained intact with its brand partners. Though management did not mention them by name, it was implied Nike was the partner in question (Nike’s headquarters is in Beaverton, OR). Here’s what Jared Briskin, EVP Merchandising at Hibbett, said in response to an analyst question at the call:

And then lastly, the — can you talk about your relationship with your largest vendors, specifically the one from Beaverton, and how confident you are in what’s happening there, how they’re supporting your new store opening plans and so on and so forth? ... Samuel Poser (Williams Trading)

Yes, sure, Sam. And as we’ve said on previous calls, we’re very confident in our positioning with our strategic vendor partners. Obviously, COVID’s had a pretty dramatic impact on the supply chain. That’s led to a lot of short-term things with regard to order management issues, order changes and cancellation play, so on and so forth.

But at the same time, we’ve been able to deliver a significant amount of receipts over and above historical norms, which I think reflects the level of support and priority that we’re getting from our strategic partners.

Our strategy continues to be to focus on the underserved consumer in underserved markets, as Ben mentioned earlier, all reinforced with the premium consumer experience, and that’s highly differentiated in the marketplace and remains largely complementary to our partners.” … Jared Briskin (Hibbett – EVP Merchandising)

Additionally, I do not believe it makes sense for Nike, who is by far Hibbett’s largest merchandiser at +70% of sales, to cut ties with Hibbett. Doing so would likely cause a loss in sales for Nike, albeit a small impact overall, because Hibbett customers are likely to trade down, settling for Walmart where items are available same day in store. Thus, it would appear Nike’s relationship with Hibbett truly is mutually beneficial. At the end of the day, there are more Nike products in consumers’ hands as a result of Hibbett.

Competitive Landscape

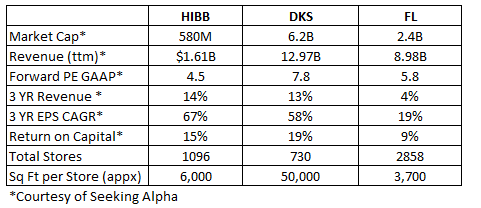

Hibbett’s closest competitor is probably Dick’s Sporting Goods, but Foot Locker also makes for a good comparison because they work with the same brand partners. Here is how Hibbett compares on key metrics:

Key metrics comparison (Author’s personal data)

HIBB Stock – Attractive Valuation

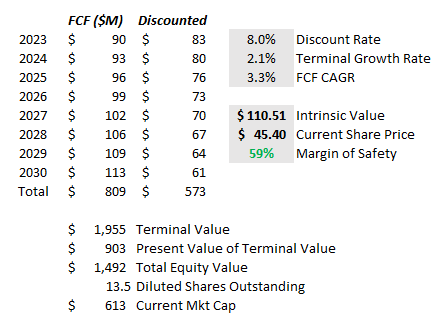

I performed a DCF analysis as well as a market multiple valuation for Hibbett. Conclusion: Hibbett’s current share price of $44.83 is cheap, no matter how I slice it.

Using the DCF, I arrive at an intrinsic value of $110.51.

DCF Analysis (Author’s personal valuation tool)

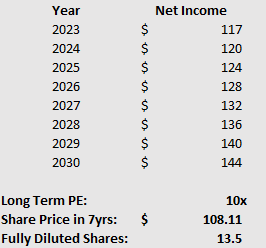

Using the market multiple approach, I arrive at a fair value of $108.11, which excludes dividends and share repurchases. I assumed revenue growth of 3%, net margins of 7%, and a long-term P/E of 10, near its 5YR average. I believe these are extremely conservative assumptions given Hibbett’s past performance and long-term objectives, which are $2 billion in sales by 2025 with 10% operating margins.

Market Multiple Valuation (Author’s personal valuation tool)

At its current share price, I believe Hibbett can beat the S&P 500 over the next several years, returning +13% annually to reach its intrinsic value of approximately $110 by 2030.

Risks

No investment is without its risks. Here are a few to consider before taking up a position in Hibbett.

Nike holds substantial influence

While I believe the probability to be low, Hibbett would take a substantial hit if Nike decided to cut ties or significantly scale back operations with the small-town retailer.

Recent inventory buildup, a concern

In their Q1 2023 earnings release, Hibbett reported inventory of $314.9 million, a 72.6% increase over the same period last year. The inventory buildup was to offset supply chain issues and ensure in-store product availability. However, in the current macro environment, I worry this may have been too ambitious. There is a risk of elevated promotional activity and merchandise write-downs if macro headwinds do not ease soon. This could hit gross margin substantially in the near term.

Company may revert to its former self

Hibbett re-baselined key financial targets, such as operating margin, post-pandemic. Indeed, operating margin improved from 3-4% pre-pandemic to 13.5% in 2022. Hibbett believes it is a different company now – I tend to believe the same – but there is risk the company reverts to its former self with lower margins and profitability.

Conclusion

Hibbett appears to be an attractive value opportunity at its current share price. The company operates in a niche market that deters big-box competition, has cleared the Nike headwind which was weighing on sentiment, and is cheap by most measures. The risk-reward profile appears favorable and may be enticing for growth-oriented value investors.

Be the first to comment