kanawatvector

Investing has not been easy this year with stocks finishing their worst first half since 1970. The debate about whether or not we are heading for recession is frenzied. Back in June I wrote that recession had already begun and forecasted a negative real GDP print for Q2 2022. That prediction came true on July 28 when the Q2 real GDP printed at -0.9%. The U.S. now has two consecutive quarters of negative real GDP growth, after Q1 was -1.6%, which is a traditional measure of recession.

My investment perspective always begins with macro because macro is paramount to the underlying performance of each asset. Recession and tightener monetary policy necessitate greater care in investment decisions. That’s why I’m avoiding entire sectors such as consumer discretionary at this time.

Instead, I’ve been on the hunt for smart opportunities and meaningful income. Healthcare has been a preferential sector for me over the past year. This is because valuations have been attractive and healthcare has some resiliency to recession.

Bristol Myers Squibb (NYSE:BMY) is one of those healthcare equities that I have been watching. The company has demonstrated consistency and remarkable strength in the face of momentous sell offs. I especially prefer their product portfolio of cancer, hematology, and cardiovascular medications that are required for life threatening and life debilitating diseases. These qualities confer priority to these drugs for patients that may need to tighten up budgets due to inflation.

Q2 Earnings Performance

Bristol Myers Squibb released their Q2 2022 earnings in July. The results were solid with non-GAAP EPS beating estimates at $1.93 and revenues up 1.7% YoY. Non-GAAP earnings per share increased by 18.4% YoY. However, both Q2 2022 and Q2 2021 suffered from in-process R&D charges. Excluding those charges non-GAAP EPS only increased by 7%.

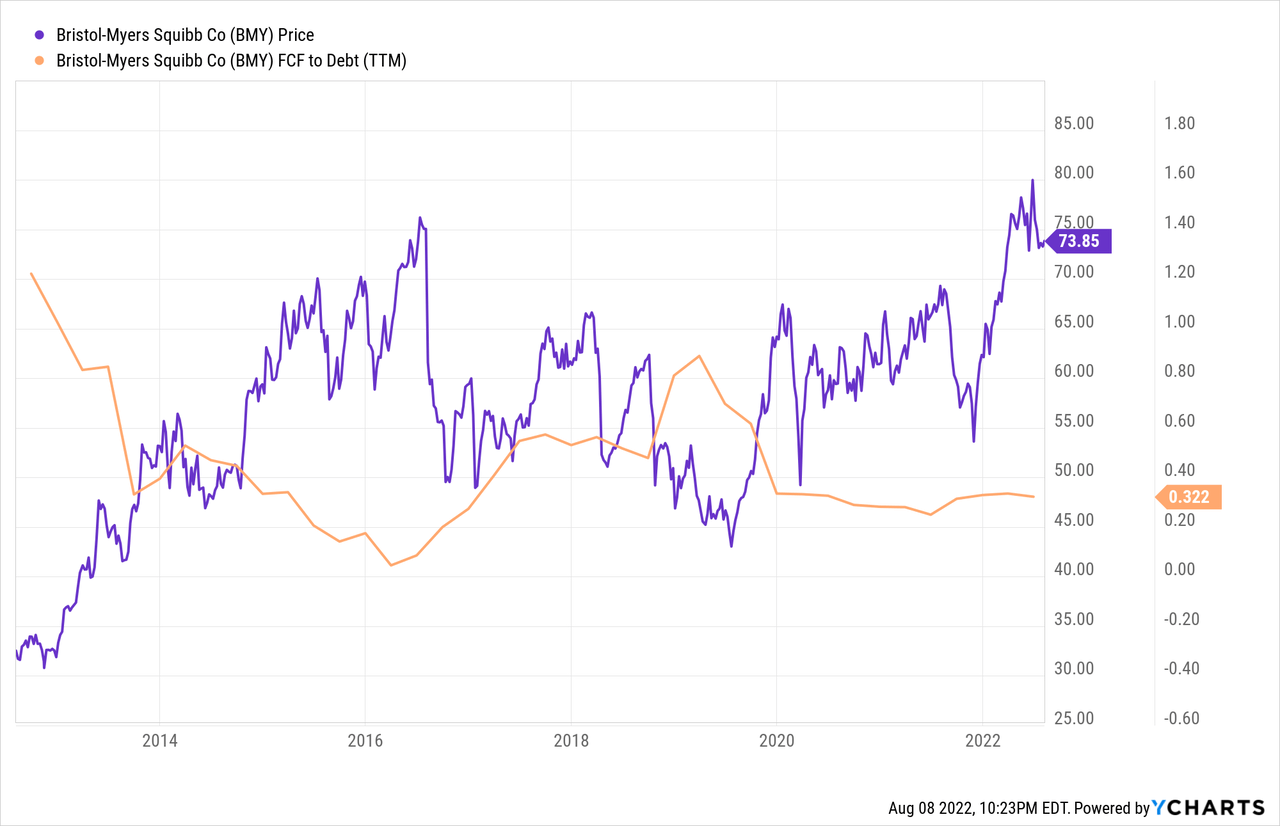

BMY has $10.2 billion in remaining share repurchases authorized, equal to 6.6% of market cap. The company ended the quarter with a respectable long term debt to capital ratio of 50.13. With $0.93 of free cash flow per share in Q2, BMY is operating a FCF to debt ratio of 0.322. Therefore, I think the debt obligations are manageable.

Sluggish Growth

Updates to the company’s pharmaceutical portfolio were provided during the quarterly earnings call. I noted several positive developments that will contribute to growth:

- Received U.S. FDA approval for Breyanzi

- Phase 2 data for Milvexian was positive

- Reached agreement to acquire Turning Point Therapeutics

- Expected approval of Deucravacitinib next month

- Launch of Camzyos with free trial prescriptions ending soon

- Approval of Deucravacitinib in September and ready for launch

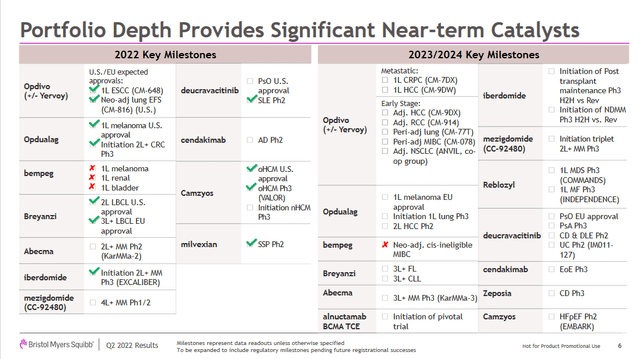

Below is a progress update of the near term catalysts in the portfolio. Negative developments have been experienced for bempeg. Clinical development for bempeg has now ceased which caused Nektar, BMY’s partner on the trial, to receive a downgrade from JPMorgan. Other pharmaceuticals are experiencing positive progress.

Seeking Alpha (company Q2 2022 earnings call presentation)

When discussing drugs that are currently in production, Chief Financial Officer David Elkins said this during the teleconference:

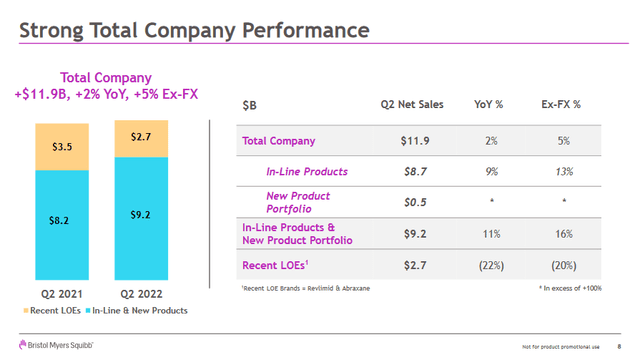

Second quarter revenues were approximately $11.9 billion, growing 5% year-over-year. This performance was driven by robust growth of our in line and new product portfolio of 16%, more than offsetting our recent LOEs.

Loss of exclusivity (LOE) drugs are a primary concern for R&D companies like BMY. Similar to the way that oil and gas or mining companies operate, BMY needs to replace pharmaceutical “reserves” as drug patents expire and generics appropriate market share. Recent LOEs accounted for 22.7% of Q2 revenues and that segment experienced a 22% YoY decline.

Seeking Alpha (company Q2 2022 earnings call presentation)

One of my top concerns is the decline in Revlimid. This product experienced a revenues decline of 22% YoY due to increased competition from generic alternatives. Revlimid accounted for 21% of Q2 revenues and management is guiding for $9-9.5 billion in revenues from Revlimid in 2022. This means that they expect revenues of $1.851-2.101 billion in Q3 and Q4 from the drug. That would represent a 24-33% decrease in revenues during 2022. In total, estimates suggest that BMY is going to endure a $10 billion loss in revenues due to generics this year.

| Q1 | Q2 | Q3 & Q4 (estimate) |

| $2.797B | $2.501B | $1.851-2.101B |

This is what Elkins said about Revlimid during the call:

Sales in the quarter were approximately $2.5 billion. Sales were primarily impacted by generic entry, particularly in international markets. In the US, while we did experience demand softness from the volume generic entry in the quarter, we understand that specialty pharmacies are mainly utilizing the current generic for new patients to ensure continuity of treatment.

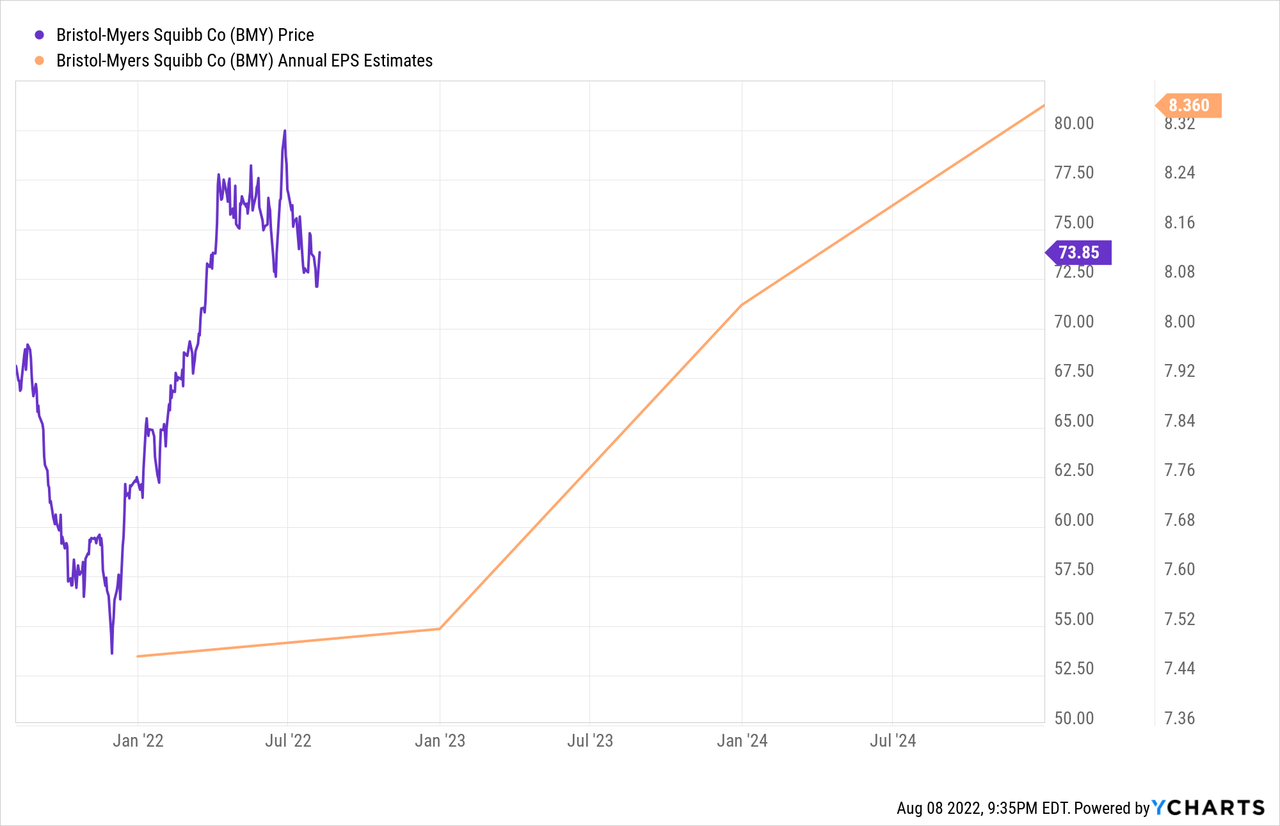

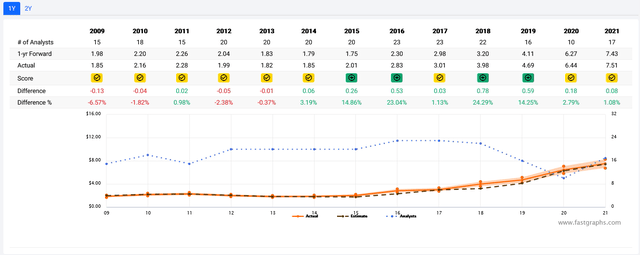

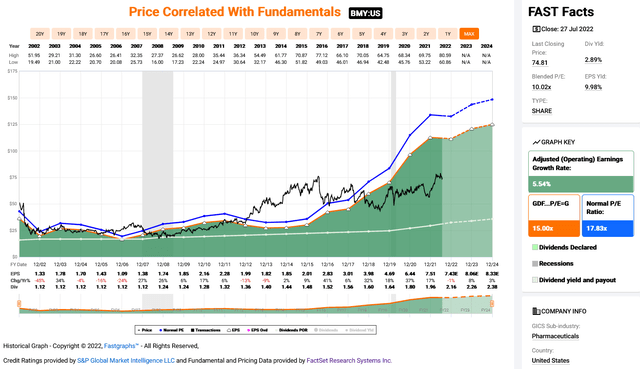

Fortunately, management did reaffirm 2022 guidance of $7.44-7.74 non-GAAP diluted EPS. Analysts continue to expect annual increases in EPS through 2024, as shown below. Although estimates are only expecting an 11.1% increase in EPS over the next two years.

BMY analysts on FAST Graphs have a good track record of 1 year forward through 2009 which includes two recessions. Analysts were most wrong in 2009 when they missed earnings by 6.5%, a minor miss. Those analysts are expecting no growth to earnings in 2022, 7% growth in 2023, and 4% growth in 2024.

Track record of analyst estimates (FAST Graphs)

The Price is Right

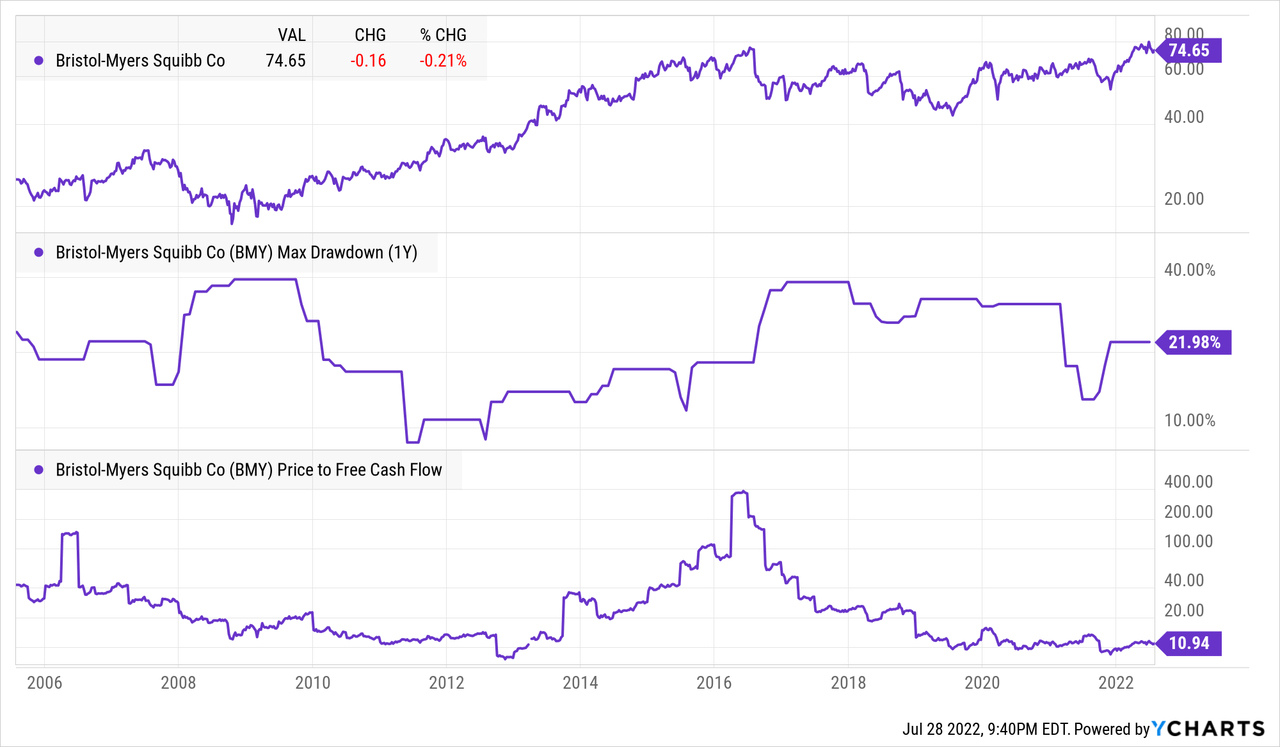

What I can’t complain about is the price for the company’s current performance. BMY is trading at an adjusted P/E of 9.62. This is nearly half of the 10-year normal adjusted P/E of 18.22.

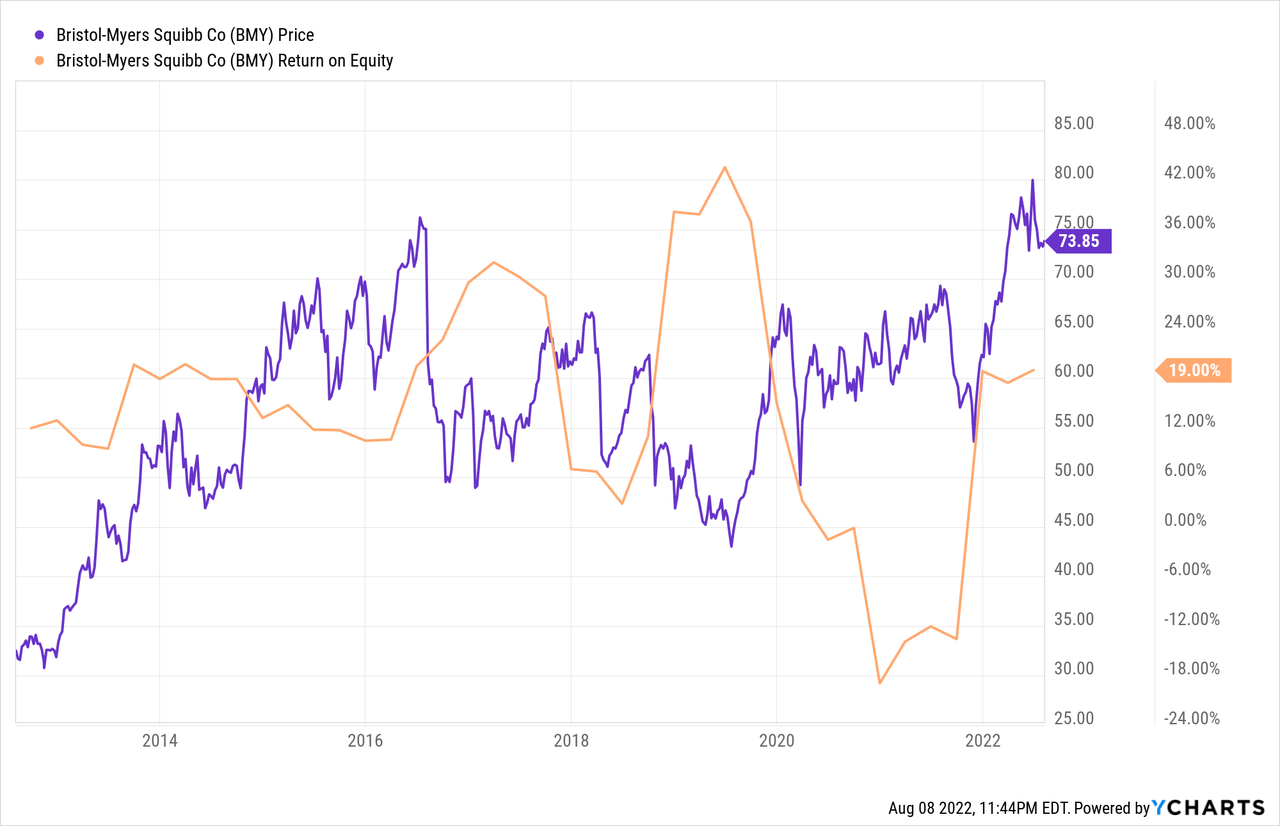

The current Free Cash Flow yield of 9.1% is near the highest in company history while the return on equity stands at 19%, also attractive. The DCF model from Alpha Spread estimates the fair value per share of $59.08 under the worst case scenario.

Earning 10% Annualized with Covered Calls

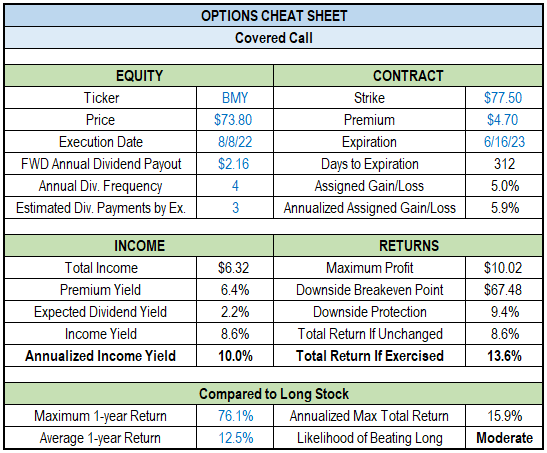

BMY offers a solid 3% FWD dividend yield at a 27.3% payout ratio. Given the slow growth projections and nature of the business I would expect the shares to exhibit relativity low volatility. Given these conditions, I am interested in taking advantage of the dividend with a covered call option trade. One advantage of using this strategy is that part of the potential profits is returned when the trade is executed, freeing up the capital for other trades.

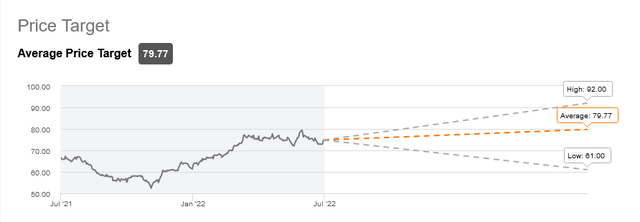

Wall Street Analysts have an average price target of $79.77 and a low target of $61.00 per share. I think these targets may be generous but it provides a good starting place for determining strike price.

Analyst Price Targets (Seeking Alpha)

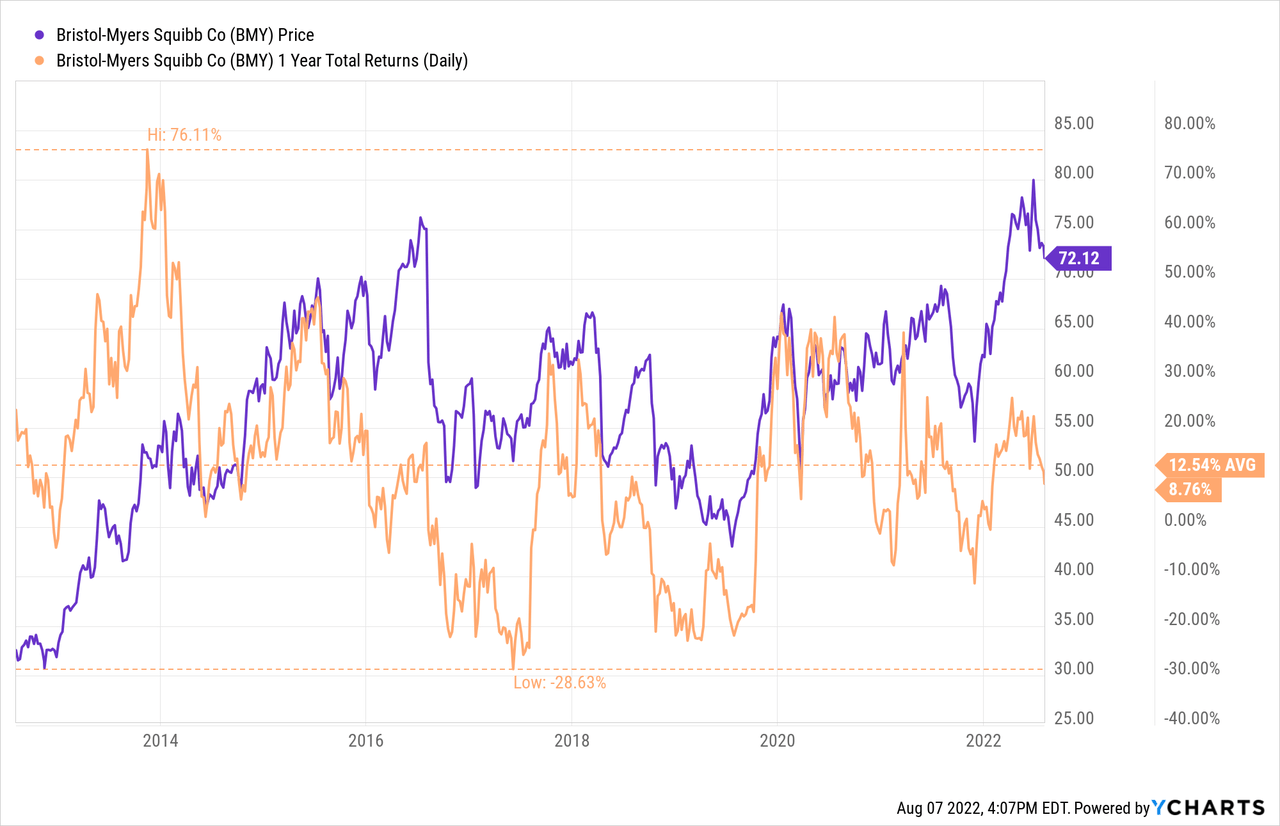

In the past, BMY has experienced 1 year total returns as high as 76.1% and as low as -28.6% with an average of 12.5%. Therefore, I’m going to look for a covered call that results in annualized total returns above 12.5%.

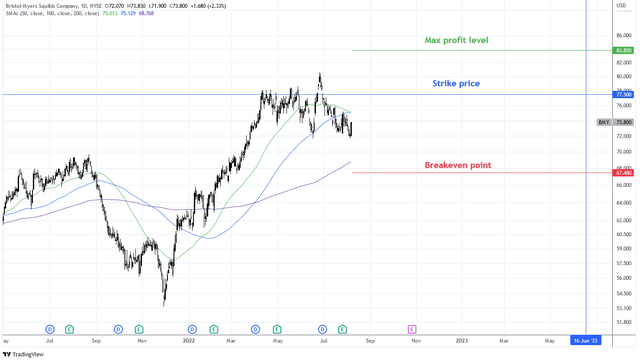

I have selected the June 16, 2023 call contracts with a strike price of $77.50 per share for my trade. This strike conservatively fits with analyst price targets and delivers call premium of $4.70 per share which is 6.4% of cost basis. Over the next 11 months the trade will produce dividend and premium income equal to 8.6% which is 10% annualized. If the contract is assigned I will profit a total of 13.6%, 15.9% annualized. The breakeven is at $67.48, a drop of 9.4%.

BMY Options Cheat Sheet (Image by author (data from Seeking Alpha))

Visually, the trade looks like this:

Charts by TradingView (adapted by author)

Summary

BMY is a solid company with products that people need. The company has demonstrated to be recession-resilient and that’s what I’m looking for right now. While valuations are fair and financial performance is solid, the company is lacking in growth.

I think that share price will probably underperform against analyst price targets. Still, I expect volatility to be mild over the near term due to the nature of the company and financial strength. I want to capture that dividend and I think the best way is with covered calls. I have executed a covered write trade on BMY by going short the June 16, 2023 $77.50 strike call contract. I expect to yield 10% annualized income and, if assigned, will profit a total of 13.6%.

Be the first to comment