Travel Wild/iStock via Getty Images

During times of economic instability, one common trend is that spending on expensive things tends to cut back. Sometimes drastically so. Because of this, companies that deal in luxury products are not faring all that well. And in the near term, that picture could worsen. However, it’s important to note that the focus for investors should be on the long haul. And as a result of that, difficult times right now could open up the door to buying shares of companies on the cheap. A great example, in my opinion, can be seen by looking at MarineMax (NYSE:HZO). This company, which produces yachts and other seafaring vessels, is performing well from a fundamental perspective. More likely than not, the 2022 fiscal year will be quite strong for the enterprise. But even so, the market is not happy, pushing shares of the company down irrationally. Given how cheap the stock is right now and the fact that it has cash in excess of debt in the amount of $111.2 million while sporting a market capitalization of just $824 million, I cannot help but to retain my ‘strong buy’ rating on the company for now.

Sailing to profits

When I last wrote an article about MarineMax in September of 2021, I called the company an interesting player in an interesting space. I said that recent growth had been impressive and the company had succeeded in achieving significant improvements to its bottom line. I also said that shares of the company were incredibly cheap, making it a strong long-term prospect for investors to consider. Because of this, I rated the business a ‘strong buy’ to reflect my belief that its returns would drastically outperform the broader market for the foreseeable future. Since then, I have been incredibly disappointed. While the S&P 500 has dropped by 15.8%, shares of MarineMax have generated a loss for investors of 17%.

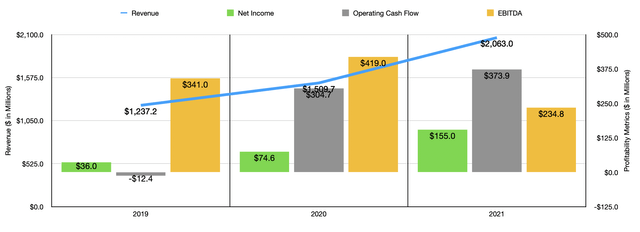

Author – SEC EDGAR Data

Judging by how far shares have fallen, you might think that the fundamental performance of the company was weakening. But that has not been the case. Consider how the company ended the 2021 fiscal year. Revenue of $2.06 billion was 36.5% higher than the $1.51 billion generated one year earlier. Net income shot up from $74.6 million to $155 million. Operating cash flow went from $304.7 million to $373.9 million. Only EBITDA for the company worsened, falling from $419 million to $234.8 million.

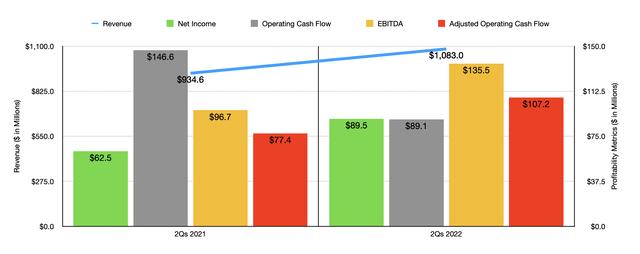

Author – SEC EDGAR Data

Strength for the company continued into the current fiscal year. Revenue in the first half of 2022 came in at $1.08 billion. That’s 15.9% above the $934.6 million generated the same time one year earlier. The company benefited from two key things here. $74.2 million of the $148.4 million increase year over year was driven by comparable store sales rising. The remaining $74 million was due to a net increase caused by stores opened, including those acquired and after factoring in those closed during the year.

This rise in revenue brought with it a further increase in profitability. Net income in the first half of 2022 came in at $89.5 million. That compares favorably to the $62.5 million reported the same time one year earlier. Operating cash flow did worsen, dropping from $146.6 million to $89.1 million. But if we adjust for changes in working capital, it would have risen from $77.4 million to $107.2 million. Meanwhile, EBITDA also improved, rising from $96.7 million to $135.5 million. For the 2022 fiscal year as a whole, management has not provided any guidance when it comes to revenue. But they do see earnings per share coming in at between $7.90 and $8.30. This is actually an upward revision compared to the prior expected range of between $7.60 and eight dollars. Given the company’s current share count, this would translate to net income of $174.4 million. Management did not offer any guidance when it came to other profitability metrics. But if we assume that those will increase at the same rate that net income should, we should anticipate operating cash flow of $420.7 million and EBITDA of $264.2 million.

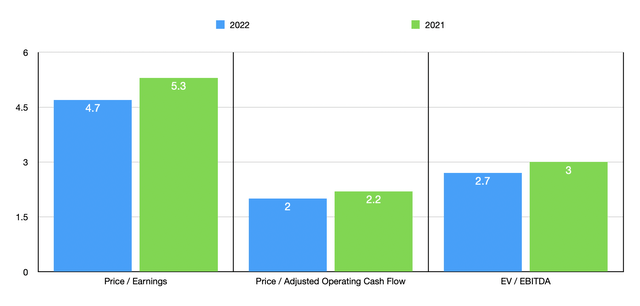

Author – SEC EDGAR Data

Given this data, we can effectively value the business. On a price-to-earnings basis, the company is trading at a forward multiple of 4.7. That’s down from the 5.3 multiple that we get if we use our 2021 results. The price to adjusted operating cash flow multiple should come in at just 2. This stacks up against the 2.2 reading that we get using our 2021 results. When it comes to the EV to EBITDA multiple, the company is similarly cheap thanks to its excess cash on hand. The multiple, using 2022 estimates, should be 2.7. This is slightly lower than the 3 handle that we get if we rely on last year’s results. As part of my analysis, I also decided to compare it to three similar firms. On a price-to-earnings basis, these companies ranged from a low of 6.5 to a high of 10.8. Using the price to operating cash flow approach, the range is from 8.3 to 852. And when we use the EV to EBITDA approach, the range is from 4.5 to 7.8. In all three scenarios, MarineMax was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| MarineMax | 5.3 | 2.2 | 3.0 |

| Brunswick Corp. (BC) | 9.2 | 13.0 | 7.2 |

| MasterCraft Boat Holdings (MCFT) | 6.5 | 8.3 |

4.5 |

| Marine Products Corporation (MPX) | 10.8 | 852.0 |

7.8 |

Takeaway

Fundamentally speaking, MarineMax seems to be in a great spot right now. Even if financial performance were to weaken significantly, the company would still likely be trading at a low price on both an absolute basis and relative to similar firms. It helps that the company has cash in excess of debt, a fact that drastically reduces its risk exposure. I acknowledge that an unfavorable economic development could hit the company to some degree. But even in that scenario, I cannot help but to find this to be a highly bullish prospect. And as a result, I have decided to retain my ‘strong buy’ rating on the company for now.

Be the first to comment