Eva-Katalin/E+ via Getty Images

I love a good bargain, and call them as I see them. With so many stocks being sold, it pays to be choosy. That’s why I like industry giants with economies of scale and strong balance sheets, which makes it unlikely that they will go the way of the dinosaur any time soon. This brings me to Cisco Systems (NASDAQ:CSCO), which has gotten rather cheap after the recent sell-off. In this article, I highlight what makes CSCO an ideal buy at the current price, so let’s get started.

Why CSCO?

Cisco is the world’s leading networking company, supplying businesses of all sizes with switches, routers, cybersecurity, and complementary networking products. It benefits from its comprehensive suite of networking gear, and from the institutional knowledge base that it’s built up over decades.

In many ways, Cisco is an 800 lb. gorilla in the networking space, with an equity market cap of $177 billion, far surpassing that of its closest peers. This serves as a competitive advantage for the company, giving it the flexibility to make key acquisitions, such as ThousandEyes and AppDynamics in recent years.

Moreover, Cisco’s moat is derived by high level of industry standards that it’s set, the institutional knowledge from the high number of Cisco Certified professionals, and by its installed base, which reinforces its incumbency, especially with large enterprises. Such a base gives Cisco significant bargaining power with its suppliers and also creates a switching cost barrier for customers.

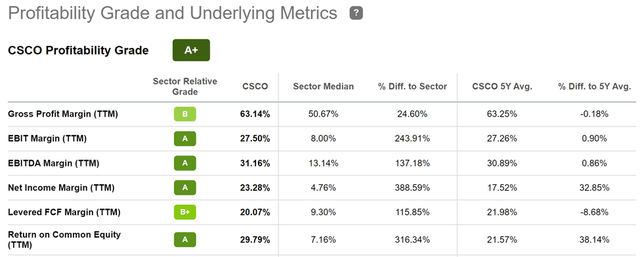

As shown below, these advantages are reflected by Cisco’s strong A+ profitability grade, with industry EBITDA and Net Income Margins of 31% and 23%, respectively.

CSCO Profitability (Seeking Alpha)

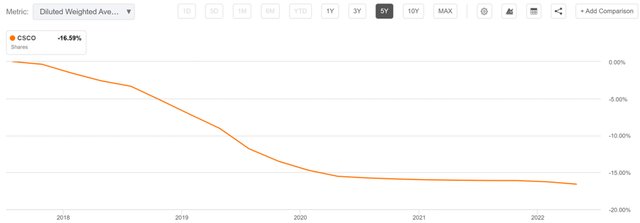

Cisco has also been a serial repurchaser of its shares, which is why it has a rather high return on equity of 29.8%. As shown below, CSCO retired an impressive 16.6% of its outstanding float over the past 5 years, with the bulk of the purchases being made prior to 2020.

CSCO Outstanding Shares (Seeking Alpha)

Cisco continues to transform itself into more of a subscription and services-based model. While revenue was flat YoY at $12.8 billion in the third fiscal quarter (ended in April), it’s seen robust ARR (annual recurring revenue) growth of 11% to $22.4 billion (annual run rate). Moreover, CSCO was able to grow its EPS by 7% due to margin improvements that led to higher operating income.

This is not to say that the company doesn’t have headwinds, as supply chain issues in China have resulted in the company guiding for a 1-5.5% revenue decline in its fiscal fourth quarter (but still 2-3% growth for the full fiscal year). Moreover, like many other American companies, the war in Ukraine has resulted in exiting of its Russian and Belarus operations. While the Russia exit would just be a one-time write-off, supply chain issues may persist in the near term.

Nonetheless, I see the long-term growth thesis as being intact, and Cisco’s comprehensive product portfolio is another key advantage. The company offers an end-to-end solution for its customers, from network infrastructure to software, which helps it land large enterprise contracts. Also, as 5G wireless technology starts to roll out, Cisco is well-positioned to benefit, as 5G will require a massive upgrade in network infrastructure. Cisco also has multiple levers to grow, as highlighted by Morningstar in its recent analyst report:

Alongside changing its product offerings, Cisco is moving product sales toward subscription-based offerings, which we believe is the preferred method of consumption for cloud-based resources. We are encouraged that Cisco is rolling this sales model to additional products and that customers look to purchase bundles with analytics and security.

In our view, Cisco is evolving its portfolio at a more rapid rate to stay ahead of trends in areas such as switching, communications, cybersecurity management, software-defined wide area networking, and analytics. We expect Cisco to continue looking to acquisitions to bolster its capabilities in these areas to offset pressure in maturing market segments.

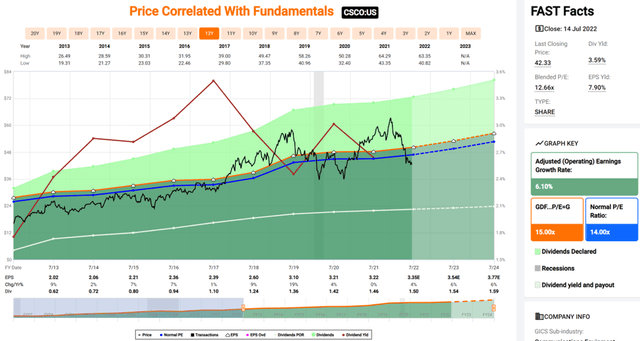

Meanwhile, Cisco sports a very strong AA- rated balance sheet, and the recent share price weakness has driven up the dividend yield to 3.6%. The dividend is well-protected by a 44% payout ratio and comes with 11 years of consecutive growth with a 6.4% 5-year CAGR.

Turning to valuation, CSCO appears to be undervalued at the current price of $42.33, with a forward PE of just 12.6, sitting below its normal PE of 14.0 over the past decade. Morningstar has a $54 fair value estimate, and sell-side analysts have an average price target of $53. This implies a potential one-year 29% total return including dividends.

Investor Takeaway

Cisco is a high-quality tech company with a strong balance sheet, market-leading positions, and multiple levers for growth. While it has near-term headwinds, I see the long-term growth thesis as being intact. As such, the recent share price weakness presents an attractive buying opportunity for long-term investors who prize safe and growing income.

Be the first to comment