courtneyk

Ally Financial (NYSE:ALLY) has been doing everything it can and everything it should to position itself as best it could in a somewhat volatile environment. They’ve tackled their long-term debts, they lowered interest expense, lowered operational expenses, and diversified their portfolios to lower exposure.

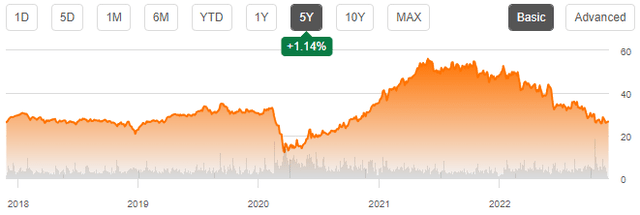

Even so, the company’s share price performance is quite puzzling, given that it surged after the COVID-19 pandemic to a high of almost $60.00 per share in late 2021 but has since come down over 50%. This is, I believe, on the back of the news on inflation, as the company still does a considerable amount of its operating in the automobile financing market, which is nearly first to get hit when prices go up, historically speaking.

ALLY Share Performance (Seeking Alpha Chart)

There are certainly still risks, but I’ll focus on what I see as the positive catalysts. I’ll discuss the risks briefly at the end of the article, but if you want to get a deeper dive, you can read Harrison Schwartz’s piece, Ally Financial: Bankruptcy Risk Grows As Auto Market Declines.

Driving Customers: Promotions & Checking

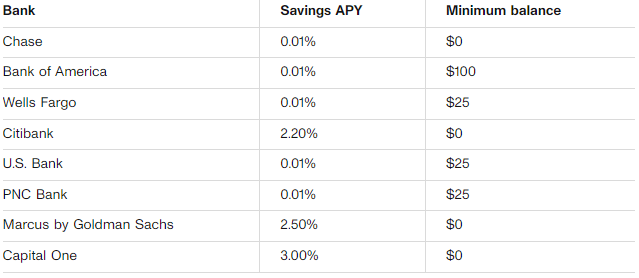

The main thing the company is banking on, pun intended, is to drive customers to its checking accounts and various other tools using promotions, primarily by offering higher interest rates on their deposits. This is something that most other banks are doing, but Ally Financial has done a little more to market these offers for customers of other banks. Their offered savings account rate is anywhere from 3% to 4.1%, and that’s compared to other banks who offer around the average 0.19% nationally.

Even though the big banks have increased some of their savings and checking account interest rate, they remain low relative to what Ally Financial is offering and the financial institution has been working on marketing and promoting their offering to customers who increasingly want higher yields.

Average Savings APY (CNET Complication)

This is driving the company’s onboarding of new customers and it should help their sales growth to remain quite healthy as they gain market share after moving more aggressively to build up their traditional checking banking to diversify away from offering loans as their main source of business.

Fundamentals Driving Margins

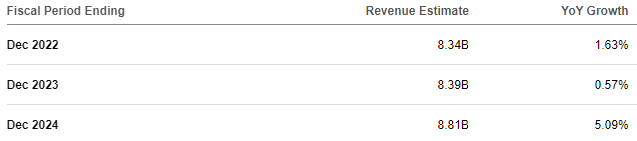

It’s not just that the company is doing good work with growing their sales, which are currently projected to grow at an accelerating rate over the next 36 months as they expect more customers to come for their banking and loan needs as well as their existing customers making more deposits and taking out more loans and other paid services.

ALLY Sales Projections (Seeking Alpha Aggregator)

When it comes to the company’s current expectations – analysts and market experts project that the company will continue to report higher provisions for loan losses as the automotive loan sectors faces tough times due to spiking used and new car prices and lower appetite for trading in or upgrading cars by those who see their financial future in question with regards to employment.

What’s behind the numbers?

This means that, currently, analysts expect the company’s net income to remain subdued. Let’s take the company’s most recent reporting quarter as an example of what this means:

Interest income rose from $1.8 billion to $2.4 billion in the most recent quarter compared to the same time a year ago and ‘other non interest income’ rose from $767 million to $822 million on back of an increased customer base.

But the company faced higher interest expense due to their long-term debt faces higher interest rates and interest-bearing deposits make up most of their total deposits. This means that although interest income was higher by almost $600 million, their net interest income (interest income minus interest expense) only rose by $220 million.

Furthermore, the company reported a profit from sales of investment securities in the reporting quarter last year but reported a loss of over $189 million in the most recent quarter this year – leading to a net loss in net of more than $200 million relative to the same period last year.

Short Term Bad, Long Term Good

While these factors I just mentioned are bad for the company, and they’re expected to continue and report these loan losses as default rates on car loans increase, the long-term trajectory is quite healthy for the company.

There are several parts to this long-term trend I see being encouraging.

Debt & Interest

The company worked to lower their overall leverage by paying off their long-term debt which reached quite high levels a few years back. The company reported over $50 billion in long term debt, which it has reduced to just over $10 billion.

This doesn’t just deleverage the company’s balance sheet by lowering their debt, it also saves them a lot of cash by lowering their own non-consumer interest expense on their debt load. Back when their debt load was near $50 billion, the company paid almost $3 billion annually in interest expense (not on borrowings or anything that goes to consumer accounts), and that figure has now decreased to just $820 million and is continuing to fall as they pay back more of their long term debt and restructure some other parts from variable interest rates as interest rates remain high.

Occupancy Expenses

One of the benefits of digitalization of the financial system is that most banks have been closing down their branches as more and more people bank online and don’t need to go into their bank branch to do basic transactions.

For Ally Financial that has been no different, but they managed to overperform the other banks and have lowered their occupancy expense (think branches, buildings, kiosks, leases, etc.) from $2.3 billion annually back in 2015 to just $570 million in their last full reporting year and up a little since to a little over $870 million as they refocus on consumer banking and open some new stores.

I believe that in order to introduce themselves, they need to make a presence for the time being, which may push occupancy expenses up. This, coupled with the higher rent and leasing payments that most large and middle-sized cities are experiencing now, should cause occupancy expenses to head a bit higher over the next few quarters but present a good cost-cutting measure later on.

Another Bigly Benefit: Yield

Although this is mostly due to the company’s share price falling so much over the past few quarters, the company currently pays out a cash dividend of $1.15 annually, which yields around 4.5% annually.

This is quite a bit better than other big banks like JPMorgan Chase’s (JPM) 2.93%, Bank of America’s (BAC) 2.3% and just a tad bit lower than Citigroup’s (C) 4.22% yield. However, there’s a catch about these comparisons.

With Citigroup paying out a bit more in annual dividend, their payout ratio (the amount of cash dividend per share they pay out relative to what they earn per share) varies from 24% to 32% over the past 18 months. This is compared to Ally Financial, with those payout ratio numbers at 13% to 24%.

This doesn’t mean much for the dividend sustainability since the payout ratio is low and both of these companies are not in any danger of bankruptcy, but it does mean that Ally Financial has, potentially, more room to increase this dividend or share buybacks in order to attract more investors and reward ’em.

Conclusion: Time To Buy

Ally Financial has been heading down as a reaction to auto loan exposure, which it certainly has, but it also presents a solid long-term opportunity.

This is because it has positioned itself well to take advantage of their increasing market share in the retail and consumer banking arena and are able to offer higher savings accounts rates due to their long-term margin expansion goals by lowering debt and operational expenses.

Due to these factors, I am increasingly bullish on Ally Financial and am likely to re-initiate my long position through share purchases in the coming week.

Be the first to comment