YinYang/iStock via Getty Images

Introduction

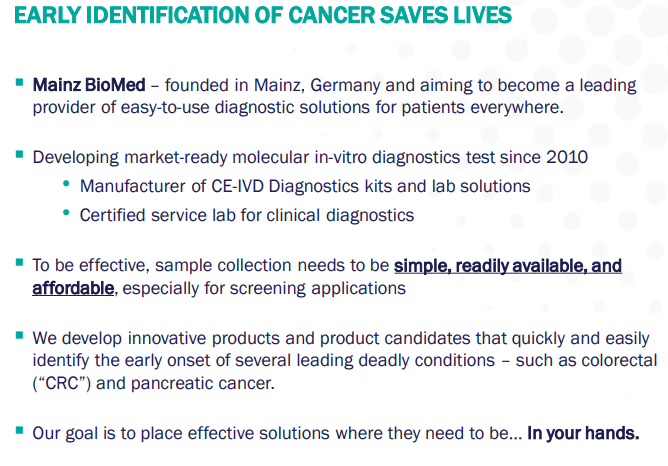

Mainz Biomed (NASDAQ:MYNZ) offers investors an opportunity to invest in an up-and-coming genetic testing company that focuses on disease detection. Their primary test kit is for the deadly, expensive, and a hard to detect group of colorectal cancers. This would allow patients to have an easier way to regularly check for the early signs of these diseases without the need for more invasive and costly procedures such as colonoscopies. Along with the ColoAlert test kit, the company is a frequent collaborator and service lab for other diagnostics companies, allowing Mainz to develop fruitful partnerships down the road that other entry level companies may not have.

Considering that the colorectal test market is large, early data suggests that Mainz’s current product offers accuracy advantages over other genetic tests of the same indication, and the company is already working on other diagnostic areas, I believe that the current $100 million USD valuation is worth a thought for investors that are willing to wait for commercialization to truly scale up. However, there are a few bumps in the road moving forward that will have to be considered and the risk and reward may not be enticing to some. I hope to lay out the strengths and weaknesses of the thesis in the article.

For the coming quarters, the investment is speculative, and the best chance for upside relies on not just ColoAlert, but many other tests.

The ColoAlert Test

For diagnostics companies, while there may be fewer hurdles to jump through for success compared to therapies (costly development process, strict approval standards, etc.), good diagnostics kits can save lives and be profitable products for developers. However, this also means that there is usually increased competition as other companies are also able to fund tests in the same areas. The ability to target markets with significant total available market (TAM) or opportunity is just as important as offering the most accurate kits.

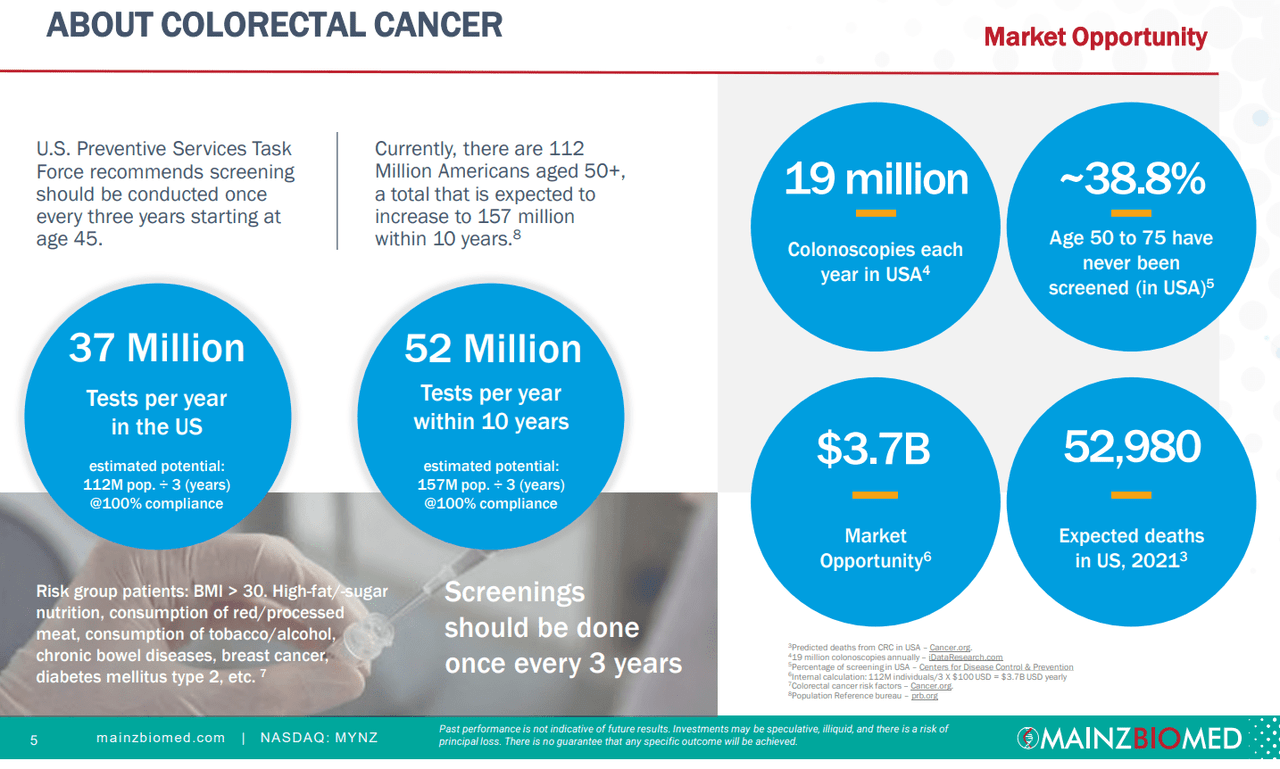

For MYNZ, they check off both boxes. First, colorectal cancer is unfortunately a common disease that can affect nearly all populations. For this reason, preventive screening is widespread and as long as populations age, there will be more risk for colorectal cancer. Most important for diagnostics companies is the fact that healthcare professionals recommend frequent testing, about once every three years starting at age 45, and this would account for a potential issuance of over 35 million tests per year in the US alone. At $100 per test, that would account for $3.5 billion in revenues per year.

The TAM can also be assessed in other ways, whether looking at persons over the age of 45 who choose not to get screened at all, or ~39% of those between 50-75 in the US, or with the 20 million colonoscopies that can be replaced per year. Both of these groups may be looking to either begin non-invasive detection, or replace regular colonoscopies, increasing the compliance for those above 45. However, this still lowers the $3.5 million in potential revenues by over 50% as we remove high-risk populations and non-compliance. With time and increased accuracy of the test kit, it may be likely that the TAM will gradually increase, especially with our aging societies.

3Q22 Investor Presentation

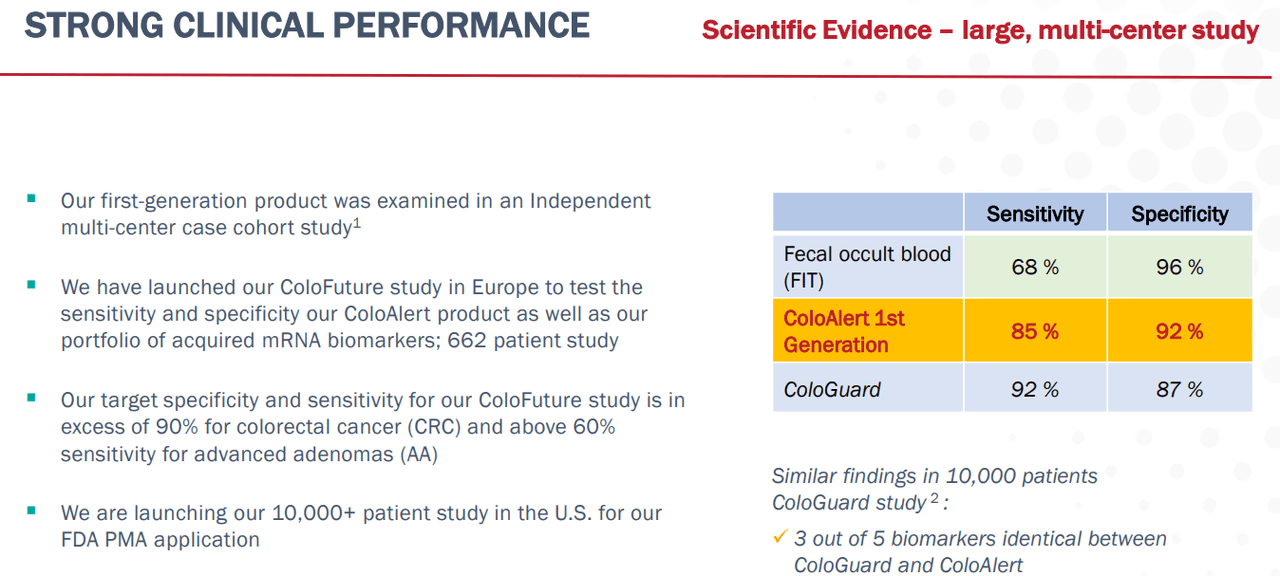

Another risk to consider is the fact that there is competition in the colorectal cancer field, and Mainz will have to develop an advantageous test. The legacy way to test outside of a colonoscopy is with a fecal occult blood test (FIT version) that provides a higher proportion of false negatives due to low sensitivity, but offers few false positives. Then, there is Exact Sciences’ (EXAS) ColoGuard, a test that is quite accurate and will be the primary competition for MYNZ. Both companies’ products and data are quite recent, and so it will be important to assess the advantages of both moving forward. At the moment, I would say it is too soon to tell how competition will influence Mainz, but at over $500, ColoGuard seems to be the more expensive option.

3Q22 Investor Presentation

Current Valuation

Mainz Biomed currently trades at a $100.1 billion USD market cap and I find that the valuation is quite low. Some of this is due to the 20%+ appreciation of the USD over the past year compared to the Euro, and some of it is the higher discount rates that must be applied because of the fed. However, considering that the market is currently implying that the $3.5 billion TAM has between a 10 and 15% probability of success (or proportion of TAM met), the current is quite favorable for those willing to establish a long-term position. The table below highlights the current valuation on a 15% discount rate basis over 10 years, along with potential annualized stock price performance at a 2.5x P/S (EXAS trades at 3.15x but is more diversified).

|

PoS or Proportion of TAM Met (%) |

Potential Revenues (millions USD) |

Present Value (million USD) |

Discount or (Premium) (%) |

10 Year CAGR (%, at 2.5x P/S @ Potential Revenues) |

|

10 |

$350 |

$86 |

(14%) |

24.2 |

|

15 |

$525 |

$130 |

30 |

29.4 |

|

20 |

$700 |

$173 |

73 |

33.1 |

3Q22 Investor Presentation

Burn Rate Considerations

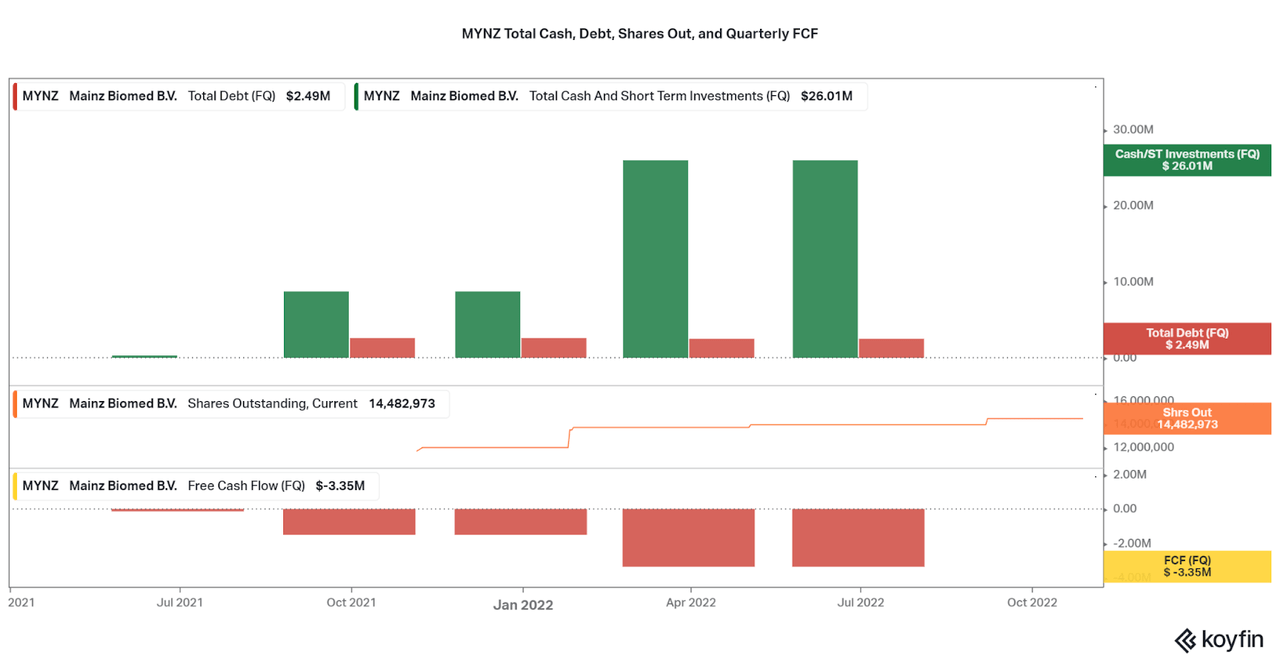

To further highlight the long-term capabilities of the investment, Mainz offers a strong balance sheet with multiple years of operations available with current cash on hand. At $23 million in net cash as of the first half of 2022 compared to quarterly FCF losses averaging around $3 million, Mainz can support operations for approximately 2 years. With the current valuation extremely low, I do not expect that MYNZ will dilute to a high degree over the next few years, but issuances of debt are uncertain. We may hear management discuss increasing the cash balance with the next few earnings reports.

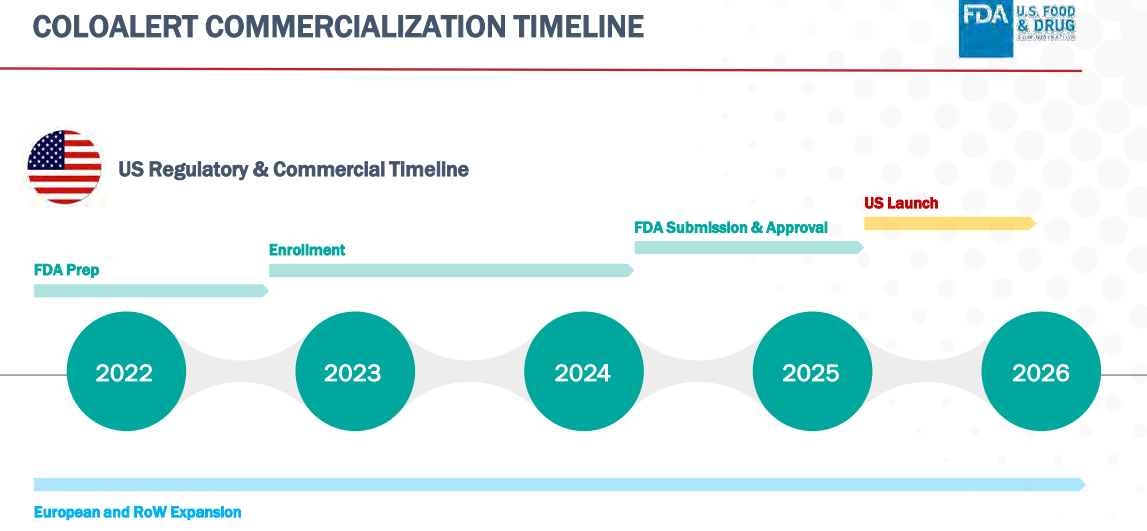

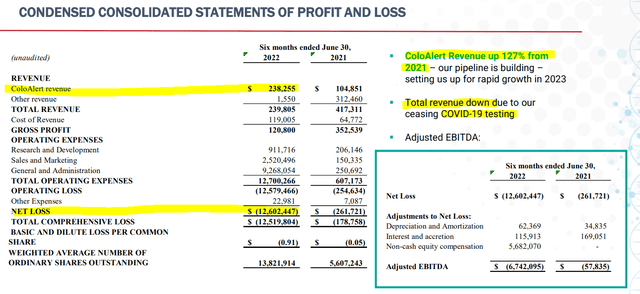

While the burn rate seems short on the surface, initial sales of the CE/IVD approved ColoAlert in Europe will increase cash flows over the next two years while Mainz works on FDA approval. Sales are currently growing at over 100% per year, and so I expect that Mainz may even become cash flow positive with just European revenues by the time of the US approval. However, it will be important to keep an eye on progress on a regular basis.

Koyfin 3Q22 Investor Presentation

Conclusion

As shown, the current valuation looks quite pessimistic regardless of what proportion of the market they meet. While the fact of the matter is that Mainz needs to first expand approvals in the US and Europe, the current data suggest that the approvals should occur. As such, I expect the share price to jump significantly. Upon maturation, further consideration of profitability, expanded indications, and competition will be necessary to bolster the cause, but for at least the next decade it seems that upside looks quite favorable for investors. Perhaps revenues from regions outside of the US will provide surprise upside, especially with distribution partnerships already underway.

For the moment, I will be patiently accumulating shares and will see how development plays out. If there is any spike due to positive news, I will most likely sell the jump and try to get back in at a lower price. Investors should also keep in mind that this is a volatile, low-volume microcap company, and this investment is not suited for those who want a lower risk investment. However, I will keep the long-term opportunity in mind and believe that Mainz may mature into a multi-billion genetic test company at some point down the road. Until then, I will be keeping an eye on the developments and will provide an update as necessary. Thanks for reading.

Be the first to comment