cemagraphics

I consider Main Street Capital (NYSE:MAIN) a “best-of-breed” internally managed BDC. I’m not alone on this assertion. The BDC trades at a premium to NAV of approximately 1.4%, even though the stock is down 19% from its recent 52-week high. It’s relatively undervalued based on traditional valuation metrics with a forward P/E of 10.47. This is not a “buy at the point of maximum pessimism” pick. This is “buy the top performing solid dividend paying stock” opportunity. Therefore, you can expect to pay somewhat of a premium for a winner. MAIN has always traded for a premium to its peers. I will list of the reasons why.

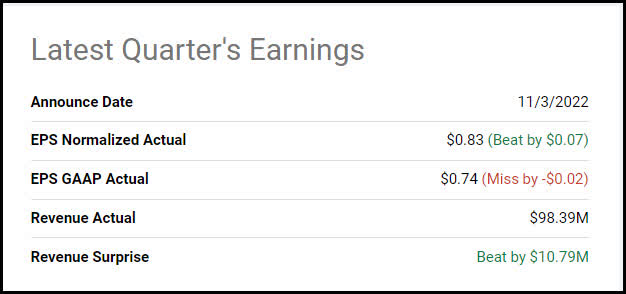

Main just beat earnings again

According to Seeking Alpha news:

“Main Street Capital Non-GAAP EPS of $0.88 beats by $0.12, total investment income of $98.39M beats by $10.79M.

Main Street Capital stock drifted up 1.3% in Thursday after-hours trading after the business development company’s Q3 earnings and revenue came in better than expected given continued strength in its lower middle market portfolio companies and private loan investment strategies.

“These positive results included contributions from each of our core investment strategies, and as a result of our strong performance, distributable net investment income per share exceeded our regular monthly dividends by over 36%,” said CEO Dwayne L. Hyzak.

Q3 distributable net investment income of $0.88 a share, topping the average analyst estimate of $0.76, rose from $0.76 at Sept. 30, 2021.

Total investment income of $98.4M, exceeding the $87.6M consensus, increased from $76.8M a year earlier.

Interest income was $75.02M compared with $50.47M in Q3 of last year.

Net asset value of $25.94 per share gained from $25.29 at Dec. 31, 2021.

Net increase in net assets resulting from operations was $55.34M, down from $83.96M in Q3 2021.

Total cash expenses accelerated to $32.6M from $24.6M a year ago due to a $6.5M increase in interest expense, a $1.1M increase in cash compensation expenses and a $1.0M increase in general and administrative expense, partly offset by a $0.6M increase in expenses allocated to its External Investment Manager.”

Beat on top and bottom lines

Seeking Alpha

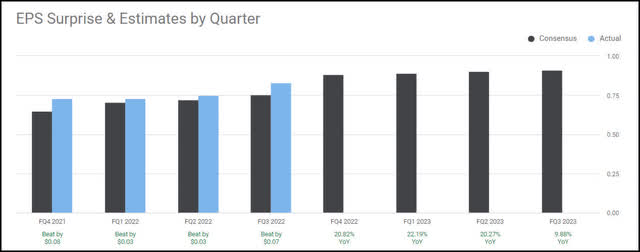

Main has beat earnings estimate for the last four quarters and earnings are expected to continue to grow going forward.

Seeking Alpha

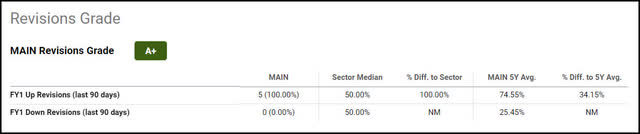

Main scores an A+ on Seeking Alpha’s earnings revisions scorecard with five recent upward revisions.

Seeking Alpha

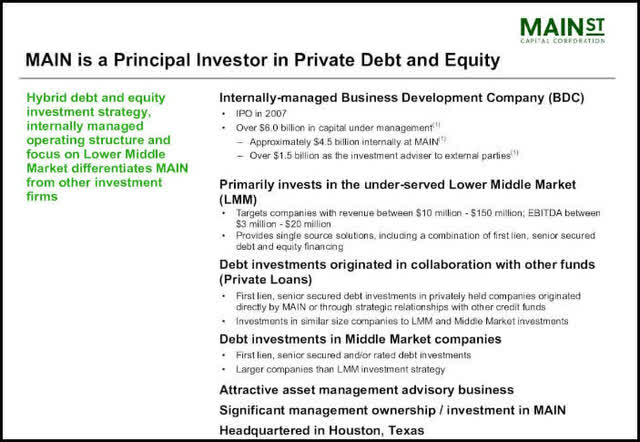

The company has numerous streams of revenue and from highly diversified sources.

Main assets overview

Main

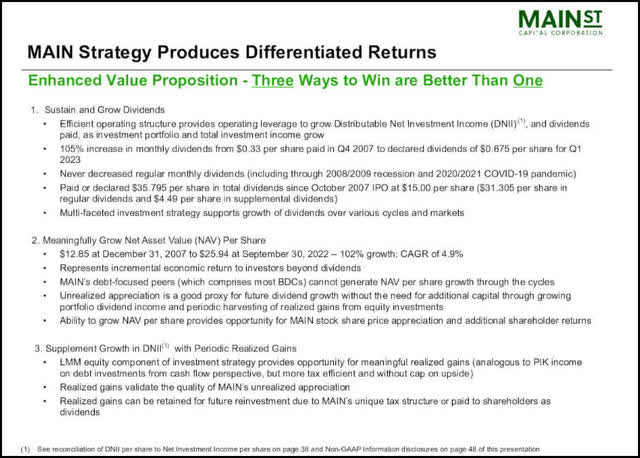

The company has amassed a highly diversified set of income producing assets that adds considerably to the margin of safety regarding the dividend. They have three primary ways to make money.

Main

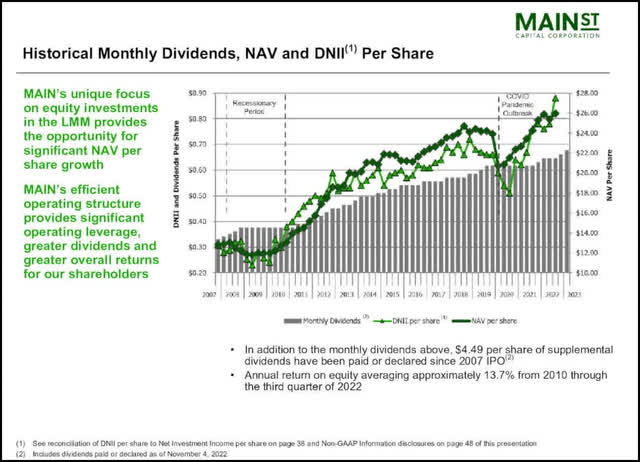

Main’s superior internal operating structure and equity investments has provided the opportunity for substantial NAV and dividend growth throughout the years as well.

Main

Below is a key statement by the CEO on the most recent conference call regarding improving outlook and dividend increases for 2023.

From CEO Dwayne Hysak on latest earnings conference call:

“Based upon our results for the third quarter, combined with our favorable outlook in each of our primary investment strategies and for our asset management business and the benefits of our efficient operating structure, earlier this week, our Board declared a supplemental dividend of $0.10 per share payable in December and an increase in monthly dividends for the first quarter of 2023 to $0.225 per share payable in each of January, February and March. These monthly dividends represent a 4.7% increase from the first quarter of 2022 and a 2.3% increase from the fourth quarter of 2022.

Supplemental dividend for December is due to our strong performance in the third quarter, which resulted in DNII per share that was $0.235 or 36% greater than our monthly dividends paid during the quarter. The fourth quarter represents our fifth consecutive quarter of paying a supplemental dividend and will result in total supplemental dividends paid during 2022 of $0.35 per share, representing an additional 13.5% paid in excess of our monthly dividends.”

Add to this the fact the company pays the 7% yielding dividend monthly and often declares a special dividend as a cherry on top, and you have the formula for entry into to a SWAN income portfolio.

The wrap up

As the old saying goes, “the dividend that has just been raised is the safest.” Add to that Main did not cut the dividend since 2007 surviving the Great Financial Crisis. GFC and the COVID crash says a lot. Not just about the strength of their business, but about the integrity of management. It would have been very easy to hit the brakes like a majority of companies did and cut, pause, or even eliminate the dividend during the last two major downturns. On top of this, the company has been performing extremely well over the last year when others are reporting huge losses due to inflation and recessionary factors. All these factors taken as a whole is what led me to choose Main at this time for the SWAN income portfolio. The stock is current down 19% from its 52-week high.

Finviz

Nonetheless, it has bounced substantially off the bottom of the downtrend channel and broken through strong resistance at the 50 day sma. I see this as a strong sign of a trend reversal and decided to start a new 1/2 2% position in the stock. Major support is at $32 and my 12 month price target is $44 implying an approximate 18% upside from current levels.

Join the #1 fastest growing NEW dividend/retirement income service! Our core 5.97% Yield SWAN and 11.64% Quality High Yield portfolios are substantially outperforming the market currently.

We have opened up an addition 50 heavily discounted Charter memberships and they are going fast! We have 10 FIVE STAR reviews in the first two months!

Four Portfolios

~ Quality High Yield Income – Current Yield – 11.64%

~ SWAN Quality Income – Current Yield – 5.97%

~ High Quality Growth

~ Ultra-High Growth

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds are donated to the DAV (Disabled American Veterans).

Be the first to comment