Marco_Bonfanti/iStock Editorial via Getty Images

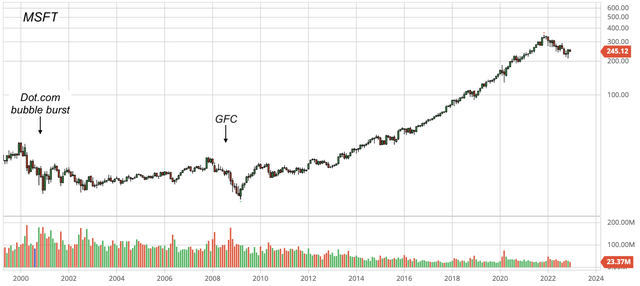

I was recently asked about whether Microsoft Corp. (NASDAQ:MSFT) is a great dividend growth investing idea at this time, especially given the stock has declined by some 25% in the last 12 months or so (Fig. 1).

Fig. 1. Stock chart of Microsoft, shown with major bear markets, dividend back-adjusted (modified from Barchart and Seeking Alpha)

Below, let’s analyze Microsoft in light of dividend growth investing.

Dividend growth

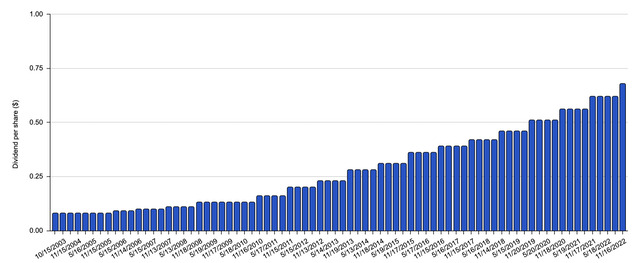

Microsoft paid its first quarterly dividend in February 2003. Since then, the company has continued to raise dividends for some 20 consecutive years. Should the tech giant keep the dividend growth momentum, it would join the elite group of dividend champions in 5 years.

- From 2003 to 2022, Microsoft raised dividends at a CAGR of 11.44%. In the first 10 years (2003-2012), the company grew dividends at a CAGR of 10.72%, while in the second 10 years (2013-2022), it grew dividends at a CAGR of 12.06%. Microsoft was able to maintain a more or less steady pace of dividend growth (Fig. 2).

Fig. 2. Quarterly dividend per share of Microsoft (compiled by Laurentian Research based on Seeking Alpha data)

In view of the excellent track record in raising dividends, the following question arises naturally: Can an entry be justified at this time for a dividend growth investor?

As of December 6, 2022, Microsoft had a dividend yield of 1.11%, implying a total rate of return of 13.17%. That fails our first criterion for a dividend growth investing target; at The Natural Resources Hub, we require a total rate of return of no less than 15%.

We also require a >15% dividend yield on cost in 10 years. Supposing the company maintains a dividend growth rate of 12.06% in the next 10 years, Microsoft’s dividend yield on cost will expand to a paltry 3.46% by 2032, which appears to be underwhelming for someone who purchases a stock today with the hoping of reaping high dividend yield on his cost basis in 10 years or so.

Risks

For a dividend growth investor, the greatest risks to buy Microsoft at this time are two-fold.

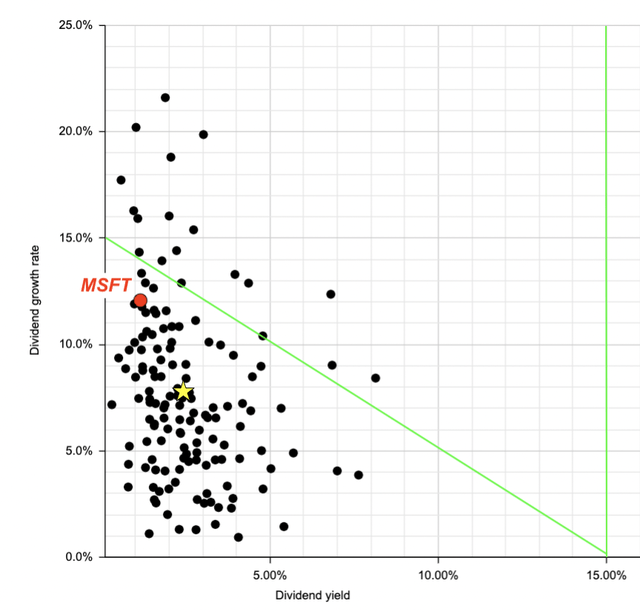

Firstly, Microsoft seems to be underpaying shareholders with regard to dividends, as can be shown using two metrics, namely, the dividend yield and dividend growth rate:

- Microsoft only pays out 26.58% of EPS to yield a paltry 1.11%, which is substantially lower than the average yield of the dividend champions (Fig. 3).

- Microsoft can attain the maximum growth rate of 20.92% as supported by after-dividend cash flow, estimated from inserting its 28.50% ROIC and 26.58% payout rate into ROIC X ( 1 – Payout Ratio). Out of such an extraordinary profit growth, dividends have been raised at only 12.06% per year.

Fig. 3. Scatter plot of the dividend champions in terms of dividend yield and dividend growth rate, with Microsoft (MSFT, red dot) and dividend champion average (gold star) shown (Laurentian Research for The Natural Resources Hub based on data sourced from Seeking Alpha and company financial filings)

Secondly, dividend growth investor may be paying too high a share price today. According to my estimate, to satisfy both criteria as given above, both a higher payout ratio and a discount to the current price have to be present. For example, assuming dividends grow at the same rate as the maximum EPS growth rate as supported by after-dividend cash flow, an additional 45% drop in the share price in combination with a dividend payout ratio of 40% can result in a 20% total rate of return and a 15% dividend yield on cost by 2032, thus satisfying both criteria for dividend growth investing.

- It is perhaps worth noting that an additional 45% decline in share price after the 25% drop in the last 12 months may not be so unreasonable as it seems. As a reference, Microsoft share price dropped 59% during the Global Financial Crisis (or GFC) and 66% during the dot.com bubble burst (Fig. 1).

Investor takeaways

Microsoft has been raising dividends steadily in the last 20 years. At this rate, the bluechip tech giant may end up joining the celebrated group of dividend champions in 5 years. It is thus natural for investors to begin to evaluate the stock from a vantage point of dividend growth investing.

It is my opinion, however, Microsoft is not an attractive dividend growth investing target yet. For the stock to become appealing to dividend growth investors, not only does the company have to offer a sweeter dividend policy (including a higher payout ratio and a dividend growth apace with its EPS expansion), a discount to the current share price is in order.

If that is too much to ask, I’d be happy to continue to allocate capital to the dividend growth investing ideas presented in a series of recent articles, e.g., this one.

Be the first to comment